Property Tax Refund Mn

The state of Minnesota, affectionately known as the "Land of 10,000 Lakes," offers its residents a range of programs and initiatives aimed at providing relief and assistance with property taxes. One such program is the Property Tax Refund, which has become a crucial support system for many Minnesotans, helping them manage their financial obligations and maintain their homes.

In this comprehensive guide, we will delve into the intricacies of the Property Tax Refund program in Minnesota, exploring its history, eligibility criteria, application process, and the impact it has on the lives of residents. By understanding this program, we can appreciate the efforts made by the state to support its citizens and ensure a more equitable distribution of the tax burden.

A Brief History of the Property Tax Refund Program

The Property Tax Refund program in Minnesota has its roots in the late 20th century, emerging as a response to the rising concerns over the impact of property taxes on the state’s residents. As property values increased, so did the tax bills, posing a significant challenge for many homeowners, especially those on fixed incomes or with limited financial means.

In 1971, the Minnesota Legislature took a bold step by introducing the Property Tax Refund program, aiming to provide relief to eligible homeowners and renters. This initiative was part of a broader effort to ensure that the benefits of homeownership were accessible to a wider range of citizens and to prevent property taxes from becoming an unaffordable burden.

Over the years, the program has evolved and expanded, adapting to the changing needs of Minnesotans. The eligibility criteria have been refined, and the refund amounts have been adjusted to keep pace with inflation and rising living costs. Today, the Property Tax Refund program stands as a cornerstone of Minnesota's commitment to supporting its residents and fostering a sense of community.

Understanding Eligibility: Who Qualifies for the Property Tax Refund?

The Property Tax Refund program in Minnesota is designed to benefit a wide range of residents, including homeowners, renters, and even those who pay property taxes on agricultural land. However, to qualify for this program, individuals must meet specific criteria set forth by the state.

Income Requirements

One of the primary eligibility factors is income. The state sets income limits based on the applicant’s filing status (single, married, or head of household) and the number of dependents they claim. These income limits are adjusted annually to account for inflation and changing economic conditions. For example, in 2023, the income limits for a single filer without dependents ranged from 39,500 to 53,500, depending on the county of residence.

It's important to note that income is not the sole determining factor. The state also considers the applicant's age, disability status, and whether they are a veteran or a surviving spouse of a veteran. These additional factors can enhance eligibility and potentially increase the refund amount.

Property Value and Taxes

The program is primarily aimed at providing relief for those with lower-value properties. As such, the value of the property being taxed is a crucial eligibility criterion. In general, the program favors homeowners and renters with properties valued at or below the median home value in their county. For instance, in Hennepin County, the median home value was approximately $300,000 in 2022, and properties valued at or below this amount are more likely to qualify for the refund.

The amount of property taxes paid is another important consideration. The program is designed to benefit those who pay a significant portion of their income towards property taxes. As a result, applicants with higher property tax bills relative to their income are more likely to qualify for a larger refund.

Residency and Ownership Requirements

To be eligible for the Property Tax Refund, applicants must be legal residents of Minnesota and have owned or rented their property for the entire taxable year. This residency requirement ensures that the program benefits those who are actively contributing to the state’s economy and community.

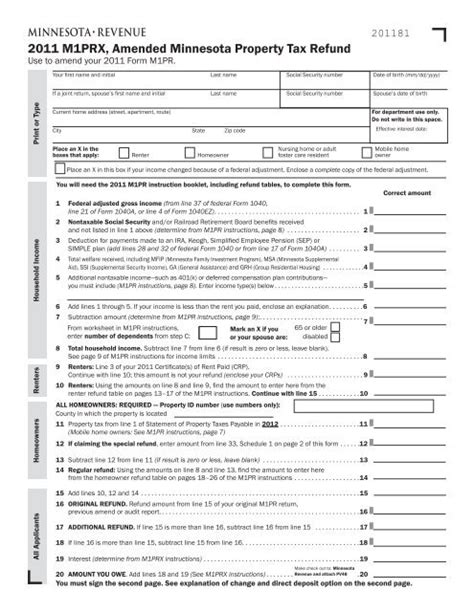

Applying for the Property Tax Refund: A Step-by-Step Guide

The application process for the Property Tax Refund program is designed to be straightforward and accessible to all eligible Minnesotans. Here’s a detailed guide to help you navigate the process seamlessly:

Step 1: Gather the Necessary Documentation

Before you begin the application, ensure you have the following documents ready:

- Your most recent Minnesota state income tax return (Form M1)

- Proof of your income, such as W-2 forms, 1099s, or Social Security benefit statements

- A copy of your most recent property tax statement or rent certificate

- If you are a veteran or a surviving spouse of a veteran, have your DD-214 or veteran ID card ready

- For those with disabilities, provide documentation from the Social Security Administration or a qualified medical professional

Step 2: Choose Your Application Method

Minnesota offers several convenient ways to apply for the Property Tax Refund:

- Online Application: Visit the Minnesota Department of Revenue’s website and complete the online application form. This method is secure, efficient, and allows you to track the status of your application.

- Paper Application: If you prefer a traditional approach, you can download and print the application form from the Department of Revenue’s website. Fill it out, attach the required documents, and mail it to the address provided.

- In-Person Application: Visit your local county revenue office or a Minnesota State University campus to receive assistance with your application. This option is ideal for those who need help or prefer a more personal touch.

Step 3: Complete the Application Form

Whether you choose to apply online or by paper, ensure that you provide accurate and complete information. Double-check your income, property value, and tax amounts to ensure they match the documents you’ve submitted. Incomplete or inaccurate applications may result in delays or even denial of your refund.

Step 4: Submit Your Application

Once you’ve completed the application form and gathered all the necessary documents, it’s time to submit your application. If you’re applying online, simply click the submit button, and your application will be processed immediately. For paper applications, ensure you include all the required documents and mail them to the address provided by the Department of Revenue.

Step 5: Track Your Application Status

After submitting your application, you can track its progress through the Department of Revenue’s website. This feature allows you to stay informed about the status of your refund and provides peace of mind. Typically, it takes around 6-8 weeks for applications to be processed, but this timeline can vary based on the volume of applications received.

Maximizing Your Property Tax Refund: Tips and Strategies

While the Property Tax Refund program provides a valuable source of relief, there are strategies you can employ to maximize your refund and make the most of this opportunity:

Stay Informed About Eligibility Changes

The eligibility criteria and income limits for the Property Tax Refund program are subject to change annually. Stay updated on these changes by visiting the Minnesota Department of Revenue’s website or signing up for their newsletter. By staying informed, you can ensure that you continue to meet the eligibility requirements and take advantage of any enhancements to the program.

Explore Additional Benefits

Minnesota offers a range of other programs and initiatives that can further reduce your property tax burden. These include the Property Tax Work Credit, the Homestead Credit, and the Circuit Breaker Program. Each of these programs has its own eligibility criteria and refund amounts. By exploring these additional benefits, you may be able to qualify for multiple forms of relief, potentially reducing your property tax burden even further.

Consider Renting Instead of Owning

If you’re currently a homeowner but are struggling to keep up with property taxes, it may be worth considering renting instead. While renting doesn’t provide the same long-term financial benefits as homeownership, it can offer immediate relief from the burden of property taxes. In Minnesota, renters are eligible for the Property Tax Refund program, and they may find it easier to qualify for a refund due to lower income requirements.

Seek Professional Assistance

If you’re unsure about your eligibility or have questions about the application process, don’t hesitate to seek professional assistance. The Minnesota Department of Revenue provides a wealth of resources and guidance on their website. Additionally, you can reach out to your local county revenue office or a tax professional who specializes in property tax relief programs. These experts can provide personalized advice and ensure that you’re taking full advantage of the benefits available to you.

The Impact of the Property Tax Refund Program: Real-Life Stories

The Property Tax Refund program has had a profound impact on the lives of countless Minnesotans, providing much-needed financial relief and peace of mind. Here are a few real-life stories that showcase the program’s positive influence:

Story 1: The Retired Couple

“John and Mary, a retired couple in their 70s, had always dreamed of spending their golden years in their beloved home in rural Minnesota. However, as property values rose, so did their tax bills, putting a strain on their fixed income. The Property Tax Refund program came as a blessing, providing them with a substantial refund each year. This refund allowed them to continue living in their home comfortably, knowing that their hard-earned savings were protected.”

Story 2: The Young Family

“Sarah and David, a young family with two small children, faced a challenging situation when they bought their first home. With rising property taxes, they struggled to make ends meet. The Property Tax Refund program offered them a much-needed financial boost. The refund they received helped cover the cost of their children’s education and extracurricular activities, ensuring that their family could thrive and grow in their new home.”

Story 3: The Veteran

“Mike, a veteran who served his country proudly, faced unique challenges when it came to property taxes. As a result of his service-related disabilities, he found it difficult to work and had a limited income. The Property Tax Refund program, combined with the additional benefits available to veterans, provided him with the financial support he needed. The refund he received each year allowed him to maintain his independence and continue living in the home he loved.”

The Future of Property Tax Relief in Minnesota

As Minnesota continues to evolve and adapt to the changing needs of its residents, the Property Tax Refund program is likely to play an even more significant role in providing financial relief and stability. Here are some potential future developments and their implications:

Expanding Eligibility Criteria

In recent years, there has been growing recognition of the diverse financial circumstances faced by Minnesotans. As a result, there may be a push to expand the eligibility criteria for the Property Tax Refund program. This could include increasing income limits, especially for families with multiple dependents, or extending eligibility to those with higher property values but lower incomes. By making the program more inclusive, even more Minnesotans could benefit from this crucial support.

Enhanced Refund Amounts

To keep pace with rising living costs and inflation, the state may consider increasing the maximum refund amounts available through the program. This would provide greater financial relief to eligible applicants, ensuring that their property taxes remain a manageable expense. Additionally, the state could explore options for providing larger refunds to those with the greatest financial need, further reducing the tax burden for vulnerable populations.

Streamlined Application Process

In an effort to make the Property Tax Refund program more accessible and user-friendly, the state may invest in modernizing the application process. This could involve further developing the online application platform, making it more intuitive and user-friendly. Additionally, the state could explore partnerships with community organizations and financial institutions to provide assistance and guidance to those who may have difficulty accessing the program.

Integration with Other Support Programs

Minnesota’s commitment to supporting its residents goes beyond the Property Tax Refund program. To provide a more comprehensive safety net, the state may explore opportunities to integrate this program with other initiatives, such as the Circuit Breaker Program and the Property Tax Work Credit. By combining these programs, eligible applicants could receive a more significant overall benefit, reducing their tax burden and improving their financial well-being.

Conclusion

The Property Tax Refund program in Minnesota stands as a testament to the state’s dedication to its residents and its commitment to ensuring that homeownership and property ownership remain accessible to all. By providing financial relief to those who need it most, this program not only helps individuals and families but also strengthens the fabric of communities across the state.

As we look to the future, it's clear that the Property Tax Refund program will continue to evolve, adapting to the changing needs of Minnesotans. With potential expansions in eligibility, enhanced refund amounts, and a more streamlined application process, this program is poised to make an even greater impact on the lives of those it serves.

How often can I apply for the Property Tax Refund program in Minnesota?

+You can apply for the Property Tax Refund program annually. The application period typically opens in the spring and closes in the summer, allowing residents to claim their refund for the previous tax year. It’s important to note that you must apply each year to be considered for the refund.

Are there any income limits for renters to qualify for the Property Tax Refund program?

+Yes, income limits apply to renters as well. The income limits for renters are generally lower than those for homeowners. For example, in 2023, the income limits for renters ranged from 25,000 to 35,000, depending on the county of residence. These limits are subject to change annually, so it’s important to check the current guidelines.

Can I apply for the Property Tax Refund program if I own multiple properties in Minnesota?

+Yes, you can apply for the Property Tax Refund program for each property you own in Minnesota, provided you meet the eligibility criteria for each property. However, the refund amount is calculated separately for each property, and the total refund you receive may be subject to certain limits.

What happens if I move within Minnesota during the tax year? Am I still eligible for the Property Tax Refund program?

+If you move within Minnesota during the tax year, you may still be eligible for the Property Tax Refund program. However, the eligibility and refund amount may be prorated based on the time you spent at each residence. It’s important to carefully review the guidelines and provide accurate information about your residency status when applying.

Can I receive the Property Tax Refund if I’m a full-time student in Minnesota?

+Yes, full-time students in Minnesota who meet the eligibility criteria can receive the Property Tax Refund. However, the income limits for students are generally lower than those for other applicants. Additionally, students must provide proof of their full-time student status, such as a valid student ID or a letter from their educational institution.