Wv Sales Tax

In the state of West Virginia, sales tax is an important revenue source for the government, contributing significantly to the state's economy and funding various public services. Understanding the intricacies of West Virginia's sales tax system is crucial for businesses and consumers alike, as it impacts their financial obligations and planning. This comprehensive guide aims to provide an in-depth analysis of West Virginia's sales tax, exploring its rates, exemptions, collection methods, and the latest developments in this dynamic tax landscape.

West Virginia Sales Tax Fundamentals

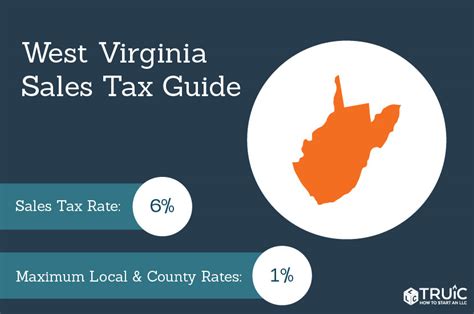

West Virginia imposes a sales and use tax on the sale, lease, or rental of tangible personal property, as well as certain services. The tax is collected by businesses and is remitted to the West Virginia State Tax Department. The standard sales tax rate in West Virginia is 6%, which is applied to most retail sales, with some specific exemptions and additional local taxes in certain jurisdictions.

Taxable Goods and Services

The sales tax in West Virginia applies to a wide range of goods and services, including:

- Clothing and footwear.

- Electronics and appliances.

- Furniture and home goods.

- Automotive sales and repairs.

- Restaurant meals and prepared foods.

- Entertainment services (e.g., movie tickets, amusement parks).

Exemptions and Special Considerations

While the majority of goods and services are subject to sales tax, West Virginia provides exemptions for certain items and situations. These include:

- Groceries: Food items intended for consumption at home are exempt from sales tax, making groceries a tax-free necessity for West Virginians.

- Prescription Drugs: Sales of prescription medications are exempt, ensuring essential healthcare items are not burdened with additional costs.

- Educational Materials: Textbooks, school supplies, and certain educational resources are tax-free, supporting the state’s commitment to education.

- Manufacturing: Sales to manufacturers for use in production are often exempt, encouraging industrial growth.

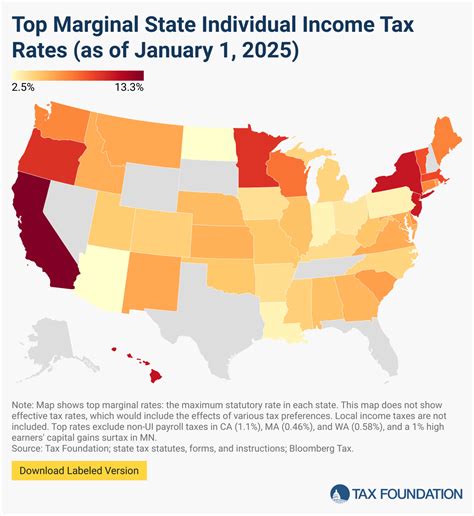

Local Sales Tax Rates

In addition to the state sales tax, West Virginia allows local governments to impose their own sales taxes. These local taxes vary by jurisdiction and can increase the overall tax rate for consumers. For instance, the city of Charleston has a local sales tax of 1%, bringing the total sales tax rate to 7% within city limits.

| Jurisdiction | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Charleston | 1% | 7% |

| Morgantown | 0.5% | 6.5% |

| Huntington | 1% | 7% |

Sales Tax Collection and Remittance

Businesses in West Virginia are responsible for collecting sales tax from customers at the point of sale and remitting these taxes to the state. The process involves several key steps:

Registration and Licensing

Any business engaged in taxable sales or services in West Virginia must register with the State Tax Department and obtain a Seller’s Permit. This permit authorizes the business to collect and remit sales tax.

Tax Calculation and Billing

Businesses calculate the sales tax on each transaction by multiplying the taxable amount by the applicable tax rate (state and local). This tax is then added to the sale price and billed to the customer.

Remittance

Sales tax collected by businesses must be remitted to the West Virginia State Tax Department on a regular basis, typically monthly or quarterly. The tax is paid using the appropriate forms and payment methods, which can include electronic filing and payment systems.

Compliance and Audits

The State Tax Department conducts audits to ensure businesses are correctly calculating and remitting sales tax. Non-compliance can result in penalties, interest, and legal repercussions. It is essential for businesses to maintain accurate records and ensure their tax calculations are up-to-date with any changes in tax rates or regulations.

Impact of Sales Tax on West Virginia’s Economy

West Virginia’s sales tax system plays a significant role in shaping the state’s economic landscape. It is a key source of revenue for the state government, funding essential services such as education, healthcare, infrastructure, and public safety.

Revenue Generation

In the fiscal year 2022, West Virginia’s sales and use tax generated $1.39 billion in revenue, a 3.7% increase from the previous year. This revenue stream is vital for maintaining the state’s fiscal health and supporting its public sector.

Economic Stimulus

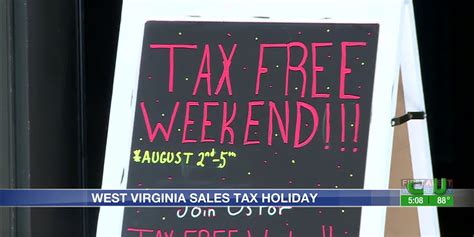

Sales tax exemptions and incentives can stimulate the economy by encouraging consumer spending and business investment. For instance, West Virginia’s exemption on groceries and prescription drugs helps alleviate the tax burden on essential goods, potentially increasing purchasing power and economic activity.

Regional Disparities

The presence of local sales taxes can create regional disparities in tax rates, which may influence consumer behavior and business strategies. Areas with higher tax rates may see consumers cross jurisdictional boundaries to make purchases in lower-tax regions, impacting local businesses and tax revenues.

Future Developments and Challenges

West Virginia’s sales tax system is subject to ongoing changes and developments, driven by economic shifts, technological advancements, and policy decisions. Staying informed about these changes is crucial for businesses and consumers to ensure compliance and optimize their financial strategies.

Online Sales Tax

With the rise of e-commerce, the collection of sales tax on online purchases has become a critical issue. West Virginia, like many states, is working to ensure that online retailers collect and remit sales tax on transactions with in-state customers. This includes the implementation of laws and regulations to address the unique challenges of taxing online sales.

Tax Reform Initiatives

West Virginia has periodically undertaken tax reform efforts to streamline its tax system and address budgetary needs. These initiatives may involve changes to sales tax rates, exemptions, or the structure of the tax system. Staying updated on these reforms is essential for businesses to adapt their tax strategies accordingly.

Compliance and Technology

Advancements in technology, such as tax automation software, are transforming the sales tax landscape. These tools can help businesses accurately calculate and remit sales tax, ensuring compliance and reducing the risk of penalties. Staying abreast of these technological advancements can significantly benefit businesses operating in West Virginia.

Conclusion

West Virginia’s sales tax system is a dynamic and ever-evolving component of the state’s economic framework. From understanding the fundamentals of tax rates and exemptions to navigating the complexities of collection and remittance, businesses and consumers alike must stay informed to make the most of this tax landscape. By staying updated on sales tax developments, West Virginians can ensure compliance, optimize their financial strategies, and contribute to the state’s vibrant economy.

What is the current sales tax rate in West Virginia for the year 2023?

+The standard sales tax rate in West Virginia for 2023 remains at 6%. This rate is applied to most retail sales, unless specific exemptions apply.

Are there any upcoming changes to West Virginia’s sales tax structure for the year 2024?

+As of the time of this writing, there are no official announcements regarding significant changes to West Virginia’s sales tax structure for 2024. However, it is always advisable to stay updated with the West Virginia State Tax Department for any potential future developments or legislative changes.

How can I calculate the total sales tax for a purchase in West Virginia, considering both state and local taxes?

+To calculate the total sales tax for a purchase in West Virginia, you need to consider both the state tax rate (6%) and any applicable local tax rates. You can use the following formula: Total Sales Tax = (State Tax Rate + Local Tax Rate) x Purchase Amount. For example, if you’re in an area with a 1% local tax rate, the total sales tax would be 7% (6% state tax + 1% local tax) of the purchase amount.