Jackson County Real Estate Taxes

In the realm of property ownership, understanding the intricacies of real estate taxes is paramount. This article delves into the specifics of Jackson County's real estate tax system, offering a comprehensive guide to homeowners, investors, and anyone interested in the economic landscape of this region.

Unraveling Jackson County’s Real Estate Tax Structure

Jackson County, known for its vibrant communities and diverse real estate market, employs a nuanced approach to property taxation. The county’s tax system is designed to support local services, infrastructure, and community development while ensuring fairness and transparency for property owners.

At the heart of this system is the annual property tax assessment, a process that determines the taxable value of each property within the county. This value, often referred to as the assessed value, is crucial as it forms the basis for calculating the real estate taxes owed by property owners.

The Assessment Process

The journey towards determining the assessed value begins with a thorough evaluation of each property by the Jackson County Assessor’s Office. This office employs a team of professionals who inspect and analyze various aspects of a property, including its physical characteristics, location, and recent sales data.

One of the key methods used in the assessment process is the sales comparison approach. This technique involves comparing the subject property to similar properties that have recently sold in the same area. By analyzing these sales, assessors can determine a fair market value for the property, which forms the basis for its assessed value.

| Assessment Year | Average Assessed Value Increase |

|---|---|

| 2022 | 3.2% |

| 2021 | 2.8% |

| 2020 | 4.1% |

Tax Rates and Calculations

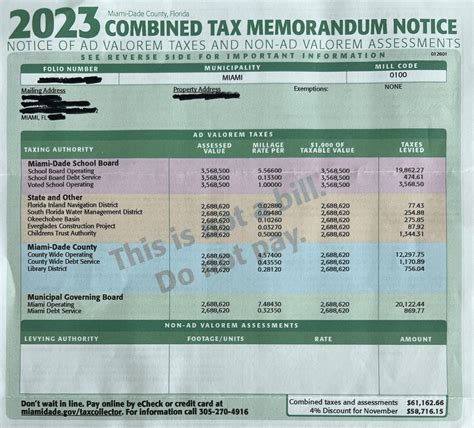

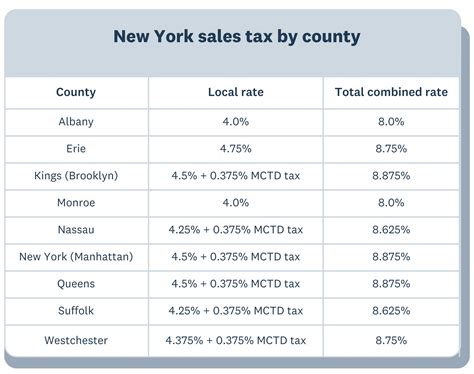

Once the assessed value is determined, it is multiplied by the applicable millage rate to calculate the annual real estate tax bill. Millage rates, expressed in mills (where one mill equals 1 of tax for every 1,000 of assessed value), are set by various taxing authorities within the county, including the county government, school districts, and special taxing districts.

For instance, consider a residential property with an assessed value of $200,000. If the combined millage rate for the property's location is 50 mills, the annual real estate tax bill would be calculated as follows:

$200,000 (assessed value) x 0.050 (millage rate) = $10,000

So, in this scenario, the property owner would owe $10,000 in real estate taxes for the year.

Tax Relief and Exemptions

Jackson County recognizes the financial burden that real estate taxes can place on certain property owners, and as such, offers a range of tax relief programs and exemptions. These include:

- Homestead Exemption: Available to homeowners who use their property as their primary residence, this exemption reduces the taxable value of the property by a set amount, typically $20,000.

- Senior Citizen Exemption: Designed to assist older homeowners, this exemption provides a reduction in taxable value based on age and income. For instance, homeowners aged 65 or older with an annual income below a certain threshold may qualify for a significant reduction.

- Veteran's Exemption: As a token of appreciation for their service, Jackson County offers an exemption to qualifying veterans, reducing their taxable value by a certain percentage.

The Role of Real Estate Taxes in Jackson County

Real estate taxes play a vital role in the economic ecosystem of Jackson County. These taxes fund a myriad of essential services and infrastructure projects that benefit the entire community.

Funding Local Services

A significant portion of real estate tax revenue is allocated to fund local government operations. This includes the maintenance and improvement of roads, parks, and other public spaces, as well as the provision of emergency services such as fire and police departments.

Additionally, real estate taxes support the county's education system. A large part of the tax revenue goes towards funding public schools, ensuring that students have access to quality education and necessary resources.

Infrastructure Development

Real estate taxes also contribute to the county’s infrastructure development plans. This includes the construction and maintenance of water and sewer systems, as well as the development of new housing projects and commercial spaces.

For instance, a recent infrastructure project funded by real estate taxes in Jackson County involved the expansion of the local wastewater treatment plant, ensuring the continued efficient management of wastewater for the growing population.

Community Support and Economic Growth

Beyond the immediate benefits of funding local services and infrastructure, real estate taxes also contribute to the overall economic growth and stability of Jackson County.

By supporting local businesses and residents through the provision of essential services and a well-maintained infrastructure, real estate taxes create an environment conducive to economic development. This, in turn, attracts new businesses and investors, further boosting the county's economy.

Staying Informed and Resources

For property owners in Jackson County, staying informed about real estate tax matters is essential. The county provides various resources to help residents understand their tax obligations and explore potential tax relief opportunities.

The Jackson County Treasurer's Office offers an online property tax lookup tool, allowing residents to check their current tax bills, payment history, and assess any outstanding balances. This tool also provides information on tax due dates and payment options.

Additionally, the Jackson County Assessor's Office provides an online property record lookup, which allows property owners to access detailed information about their property, including its assessed value, sales history, and any applicable exemptions.

Conclusion

Understanding the nuances of Jackson County’s real estate tax system is an important aspect of responsible property ownership. From the assessment process to tax relief opportunities, each component plays a crucial role in ensuring the financial stability and prosperity of the community.

By staying informed and leveraging the resources provided by the county, property owners can navigate the real estate tax landscape with confidence, contributing to the vibrant and thriving community of Jackson County.

How often are properties reassessed for real estate taxes in Jackson County?

+

Properties in Jackson County are typically reassessed every odd-numbered year. This reassessment process ensures that the taxable value of properties remains up-to-date and reflects any changes or improvements made to the property.

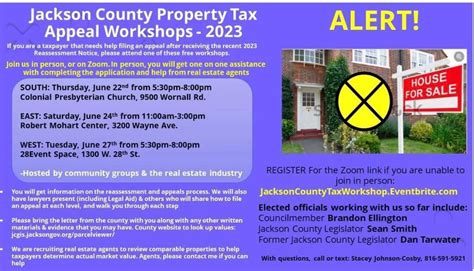

Can I appeal my property’s assessed value if I believe it is inaccurate?

+

Absolutely! Jackson County provides a process for property owners to appeal their assessed value. This process typically involves submitting an appeal with supporting documentation to the Assessor’s Office within a specified timeframe. It’s important to review the county’s guidelines and deadlines for appeals to ensure a successful outcome.

What happens if I don’t pay my real estate taxes on time in Jackson County?

+

Unpaid real estate taxes in Jackson County can result in significant penalties and interest charges. If taxes remain unpaid for an extended period, the county may initiate a tax foreclosure process, which could ultimately lead to the loss of the property. It’s crucial to stay on top of tax payments to avoid these consequences.

Are there any online resources to help me estimate my real estate taxes in Jackson County before purchasing a property?

+

Yes, the Jackson County Treasurer’s Office provides an online property tax estimator tool. This tool allows prospective property buyers to estimate their annual real estate taxes based on the property’s assessed value and the current millage rate. It’s a useful resource for budgeting and financial planning.

How does Jackson County determine the millage rate for real estate taxes?

+

The millage rate in Jackson County is determined by various taxing authorities, including the county government, school districts, and special taxing districts. These entities set their millage rates based on their budget needs and the services they provide to the community. The combined millage rate for a specific property is the sum of these individual rates.