7 Essential Tips to Manage Your San Bernardino Tax Expectations

In a town where the sun is perpetually shining and the federal tax code feels like it was drafted during a particularly cryptic game of Sudoku, managing expectations around San Bernardino taxes can be akin to trying to predict the weather using a medium-sized psychic rodent. Yet, amidst the dust-blown streets and the soaring obesity rates of tax deadlines, a handful of tips can help you navigate the treacherous sands of tax season with all the grace of a tightrope walker on a windy day.

Understanding the Fiscal Landscape of San Bernardino

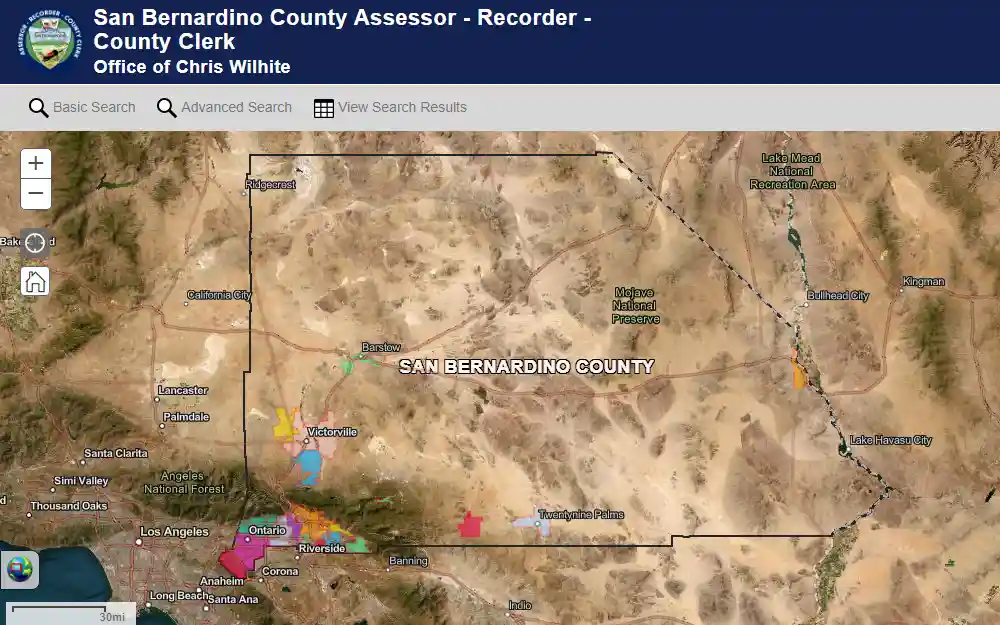

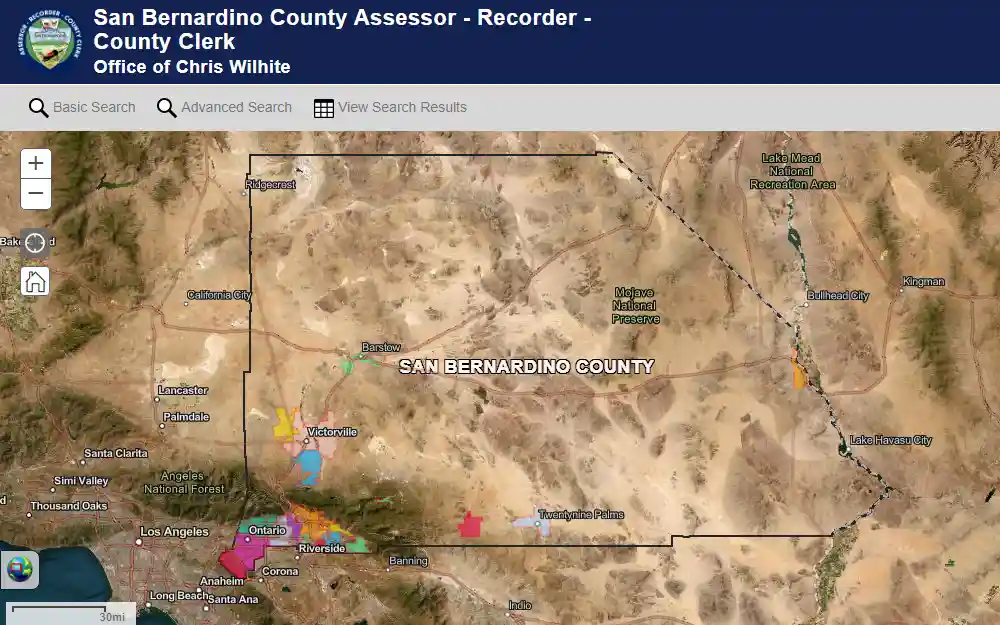

Before diving into tips, it's vital to recognize that San Bernardino County has a unique tax ecosystem that combines state mandates with local levies, sometimes making you wish you’d paid more attention in civics class—if only to better grasp the labyrinthine tax structure. The county's income and sales taxes, property assessments, and special district levies form a complex mosaic that demands strategic planning. As of 2023, residents face an effective property tax rate hovering around 0.74%, slightly above the California average, thanks to local measures funding everything from public parks to the notoriously underfunded emergency services.

The Critical Role of Local Tax Agencies

San Bernardino County's tax agencies, including the County Assessor and the State Franchise Tax Board, play a starring role in setting expectations. They often resemble a combination of overenthusiastic game show hosts and cryptic cryptographers—broadcasting mixed messages that can leave even seasoned accountants questioning the meaning of life, or at least their latest IRS letter.

| Relevant Category | Substantive Data |

|---|---|

| Property Tax Rate | 0.74% effective rate, with some districts reaching as high as 1.25% |

| Sales Tax | 7.75% combined state and local rate, among the highest in California |

| Income Tax Brackets | Varies, but top marginal rates reach 13.3%, applicable to high earners |

7 Sharp Tips to Master Your San Bernardino Tax Expectations

1. Embrace the Power of Accurate Record-Keeping

An ancient adage among tax professionals is that meticulous records aren’t just a good idea—they’re your armor in the armorless arena of tax audits. From receipts of that questionable crossword puzzle subscription to proof of home office expenses, organizing everything into a cloud-based filing system can turn an intimidating mountain of paperwork into a manageable molehill. For San Bernardino residents, document everything that could possibly be construed as deductible—because the county’s tax collectors are perhaps more attuned to high-stakes poker than you’ve ever been.

2. Know Your Local Tax Deadlines—And Respect Them

While federal deadlines are widely publicized, Californians might overlook local filing dates, which can differ slightly for property taxes or business licenses. San Bernardino’s property tax bills typically arrive in early November, with deadlines in December—giving you ample time to prepare or panic. Missing these deadlines results in penalties that are as predictable as a California wildfire: costly and unavoidable, unless you’re adept at wielding the magic wand of an extension or a payment plan.

3. Leverage Local Tax Incentives and Credits

San Bernardino County offers a variety of incentives targeting small businesses, renewable energy projects, and certain residential improvements. These incentives are designed to make your tax expectations less burdensome, provided you do your homework. For instance, the Clean Energy Incentive Program can provide substantial tax credits if you upgrade your home to solar power—a move that, humorously, might also reduce your reliance on the county’s unreliable power grid.

4. Keep an Eye on Tax Rate Fluctuations—Yes, They Change

The local sales tax rate, for instance, can fluctuate based on what measure the voters pass—or fail to pass. In recent years, ballot measures have aimed to hike taxes for funding infrastructure or schools, often passing amidst a wave of voter apathy or confusion. Staying informed via county board meetings and public notices ensures your expectations align with reality—because nothing kills morale faster than discovering a new tax levy just after your budget planning.

5. Consult Professional Help—Even When You Think You Don’t Need It

While the temptation to do your taxes “yourself” might be as strong as resisting the siren call of that double cheeseburger, experts—especially those with local experience—can reveal hidden deductions and avoid costly mistakes. A reputable CPA familiar with San Bernardino’s nuances might seem an indulgence, but in the long run, they’re your best allies against the IRS and local tax surges.

6. Use Technology to Your Advantage

Tax preparation software tailored for Californians, combined with local tax rate calculators, can automate some of the guesswork. But beware: these tools are only as good as the data fed into them. For San Bernardino specifics, employing apps that track local sales tax rates or property assessments can ensure your expectations aren’t shattered when an unexpected levy appears on your bill.

7. Anticipate, Don’t React—Plan Strategically

Budget for taxes as if they were a guest who overstays their welcome—predictable but sometimes uninvited. Incorporate quarterly estimated payments if you’re self-employed or have income streams that aren’t subject to withholding. Advance planning grants you the power to control your fiscal narrative, transforming what would be panic into a sense of mastery—at least until the next tax season rolls around with its new quirks.

Key Points

- Deep understanding of local tax codes is indispensable to avoiding surprises.

- Proactive documentation turns audit fears into mere distant echoes.

- Leveraging incentives can significantly lessen your tax burden.

- Monitoring rate changes keeps expectations realistic and planable.

- Expert advice often offers the edge in a complex tax environment.

How does San Bernardino’s property tax compare nationally?

+San Bernardino’s effective property tax rate of 0.74% sits slightly above California’s average but is considerably lower than many eastern states, making it a relatively moderate contributor. Nonetheless, local assessments and special district levies can add up, turning a seemingly benign rate into a potential surprise bill.

What pitfalls should I avoid when estimating my local sales tax liability?

+Avoid assuming statewide rates apply uniformly to all transactions. San Bernardino’s sales tax can vary by jurisdiction and even neighborhood, so relying solely on general rates without consulting local calculators may lead to underestimation and shocked faces at checkout or tax time alike.

Are there any local tax exemptions I should be aware of?

+Yes, certain residential upgrades, renewable energy installations, and small business credits are exempt or partially exempt. Checking with the San Bernardino County Assessor’s office or certified tax professional can reveal exemptions pertinent to your specific situation, turning expectations into monetary savings.