Ga Sales Tax

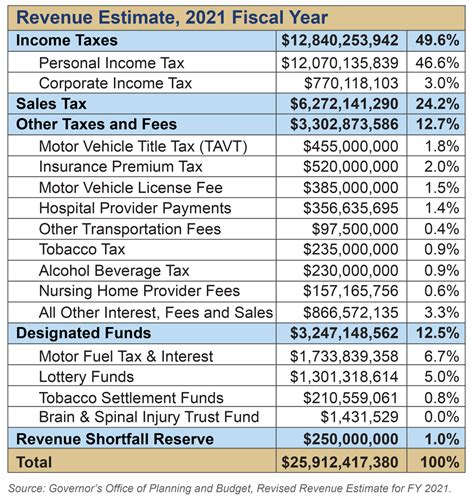

The concept of sales tax is an integral part of many economies worldwide, impacting consumers and businesses alike. In the United States, sales tax is a vital revenue source for state and local governments, funding essential services and infrastructure. This article will delve into the intricacies of Georgia's sales tax, offering a comprehensive guide to its rates, exemptions, and implications for businesses and consumers.

Understanding Georgia’s Sales Tax Structure

Georgia, often referred to as the “Peach State,” boasts a unique sales tax system with a robust framework that influences the state’s economy and consumer behavior. The state’s sales tax is a consumption tax, levied on the sale or lease of tangible personal property and certain services.

The Georgia Department of Revenue is responsible for administering and enforcing the state's sales tax laws, ensuring compliance and fairness across all sectors. The tax is collected by registered businesses, known as sellers, and remitted to the state on a periodic basis, typically monthly or quarterly.

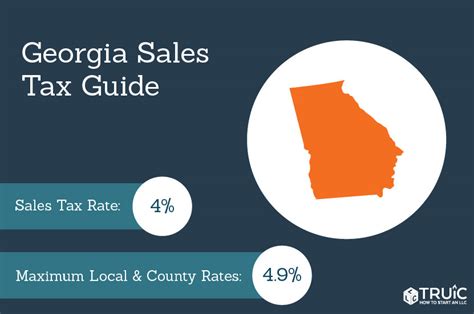

Sales Tax Rates

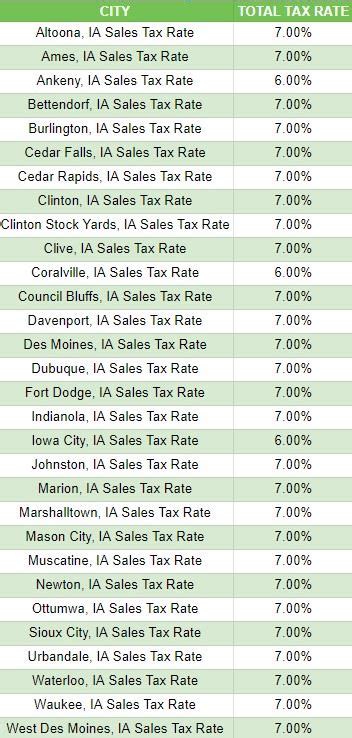

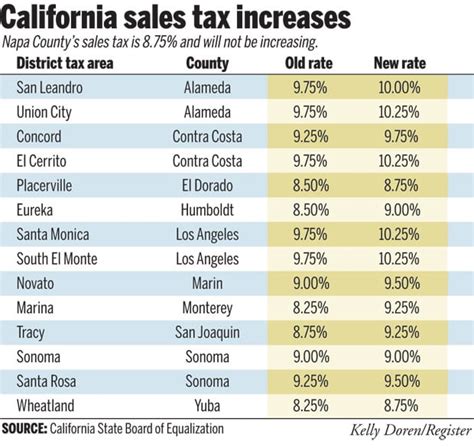

Georgia’s sales tax system is characterized by a state-wide base rate of 4%, which is applied uniformly across the state. However, the state’s unique feature lies in its local option sales taxes, allowing counties and municipalities to levy additional taxes to fund specific projects or initiatives.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| Statewide Base Rate | 4% |

| Atlanta | 1% |

| Athens-Clarke County | 1% |

| Gwinnett County | 1% |

| Savannah | 2% |

These local option sales taxes can be as high as 3%, making the total sales tax rate in certain areas up to 7%, significantly impacting the cost of goods and services for consumers.

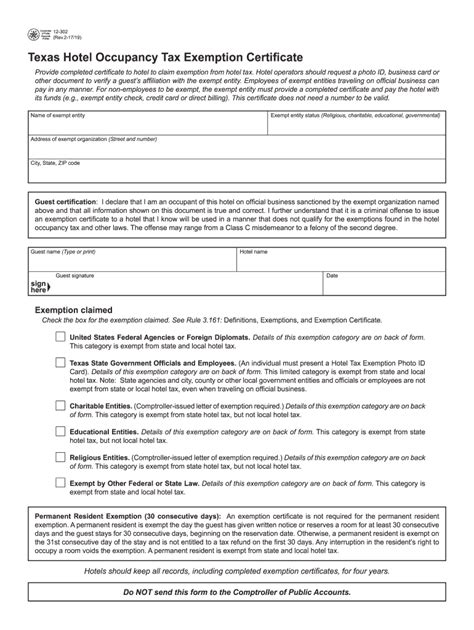

Exemptions and Special Considerations

Georgia’s sales tax system is not applied universally. Certain goods and services are exempt from sales tax, offering relief to consumers and businesses alike. Here are some key exemptions:

- Groceries: Food items purchased for consumption at home are exempt from sales tax, providing a significant savings for Georgia's families.

- Prescription Drugs: Medications purchased with a valid prescription are not subject to sales tax, ensuring healthcare is more affordable.

- Manufacturing Equipment: Machinery and equipment used directly in manufacturing processes are exempt, encouraging investment in the state's industrial sector.

- Agricultural Products: Sales of agricultural products, including livestock, are exempt, supporting Georgia's vibrant farming community.

Additionally, Georgia offers sales tax holidays, during which specific items are exempt from sales tax for a limited period. These holidays often coincide with back-to-school shopping or energy-efficient appliance purchases, providing consumers with substantial savings.

Impact on Businesses

Georgia’s sales tax system has a profound impact on businesses operating within the state. While it provides a vital revenue stream for the state, it also presents unique challenges and considerations for businesses, especially those engaged in e-commerce or with a multi-state presence.

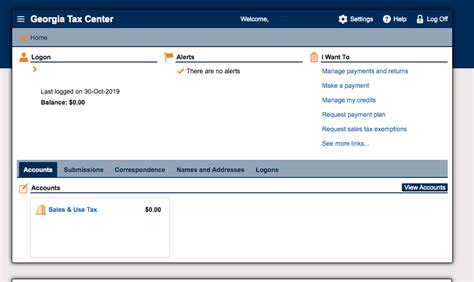

Sales Tax Registration and Collection

Businesses are required to register with the Georgia Department of Revenue and obtain a sales tax permit if they meet certain criteria, such as having a physical presence in the state or exceeding a threshold in sales volume. Once registered, businesses are responsible for collecting and remitting sales tax on all taxable transactions.

The process of sales tax collection can be complex, especially for businesses with a diverse product range or those offering services. Businesses must ensure they are aware of the applicable tax rates and exemptions to comply with the law and avoid penalties.

Nexus and Economic Presence

With the rise of e-commerce, the concept of nexus has become increasingly important. Nexus refers to a business’s physical or economic presence in a state, which can trigger sales tax collection obligations. Georgia, like many other states, has expanded its definition of nexus to include economic presence, meaning businesses without a physical presence in the state may still be required to collect sales tax if they have a substantial economic connection.

This expansion of nexus has had a significant impact on out-of-state businesses, especially those selling goods online. Businesses must carefully evaluate their nexus in Georgia to ensure compliance and avoid penalties.

Compliance and Audits

Compliance with Georgia’s sales tax laws is critical for businesses. The Georgia Department of Revenue conducts audits to ensure businesses are correctly collecting and remitting sales tax. These audits can be detailed and comprehensive, often involving a review of sales records, tax returns, and even customer transactions.

Businesses should maintain accurate records and have a solid understanding of their sales tax obligations to facilitate smooth audits and maintain good standing with the state.

Consumer Perspective

From a consumer perspective, understanding Georgia’s sales tax is essential for making informed purchasing decisions. The state’s sales tax rates can significantly impact the final cost of goods and services, especially when considering the various local option sales taxes.

Comparing Prices and Tax Rates

When shopping, consumers should be aware of the applicable sales tax rate in their area. Comparing prices across different retailers, both online and offline, can help consumers identify the best deals, especially when considering the impact of sales tax.

For instance, a consumer in Atlanta may find a lower overall price at a retailer outside the city limits, where the sales tax rate is lower, offering a potential savings opportunity.

Sales Tax and Online Shopping

The rise of e-commerce has presented unique challenges for both consumers and businesses regarding sales tax. Online retailers are required to collect sales tax based on the consumer’s location, often determined by their shipping address. This can lead to varying sales tax rates, depending on where the consumer resides.

Consumers should be aware of the sales tax implications of online shopping, especially when purchasing from out-of-state retailers. It's essential to understand the total cost, including sales tax, to make an informed decision.

Future Implications and Trends

Georgia’s sales tax system is not static and is subject to change and evolution. Several trends and developments are shaping the future of sales tax in the state, impacting both businesses and consumers.

Online Sales Tax Collection

With the growth of e-commerce, the collection of sales tax on online sales has become a significant focus for state governments, including Georgia. The state has implemented measures to ensure online retailers collect and remit sales tax accurately, especially for out-of-state sellers.

This trend is expected to continue, with more emphasis on ensuring a level playing field between brick-and-mortar and online retailers, and ensuring all sales are taxed fairly.

Simplification and Modernization

Georgia, like many other states, is exploring ways to simplify its sales tax system. This includes efforts to streamline tax rates, reduce the complexity of exemptions, and modernize the sales tax registration and filing processes.

These initiatives aim to reduce the administrative burden on businesses and improve compliance, making it easier for businesses to navigate the state's sales tax landscape.

Sales Tax Holidays and Incentives

Georgia’s sales tax holidays have proven popular with consumers, providing an opportunity to save on essential items. The state may continue to offer these holidays or explore new incentives to boost consumer spending and support specific industries.

Additionally, the state may consider expanding its list of sales tax exemptions to encourage certain economic activities or support specific sectors.

Conclusion

Georgia’s sales tax system is a critical component of the state’s economy, providing essential revenue for state and local governments. It impacts both businesses and consumers, influencing purchasing decisions, tax obligations, and economic development.

Understanding Georgia's sales tax is vital for businesses to comply with the law and for consumers to make informed choices. As the state continues to evolve and adapt its sales tax system, staying informed and aware of these changes will be key to navigating the state's economic landscape successfully.

How often do sales tax rates change in Georgia?

+Sales tax rates in Georgia can change annually, often effective from January 1st. However, local option sales taxes may be implemented or changed at any time, typically with a public hearing and approval process.

Are there any penalties for not collecting sales tax in Georgia?

+Yes, businesses that fail to collect and remit sales tax in Georgia can face significant penalties. These may include fines, interest, and even criminal charges in severe cases. It’s crucial for businesses to understand their sales tax obligations and comply with the law.

Can individuals register for a sales tax exemption in Georgia?

+Yes, individuals in Georgia can apply for a sales tax exemption if they meet certain criteria. This is often the case for individuals with specific medical needs or those purchasing goods for resale. The process involves completing an application and providing supporting documentation.