Washington Capital Gain Tax

In the realm of financial planning and tax strategies, understanding the nuances of state-specific tax laws is crucial, especially when it comes to capital gains taxes. Washington, known for its vibrant economy and diverse industries, imposes a unique set of rules regarding capital gains taxation. This article aims to delve into the specifics of Washington's capital gain tax, offering a comprehensive guide for investors, entrepreneurs, and financial advisors alike.

Washington’s Capital Gain Tax: An Overview

Washington, like many states in the United States, has its own set of tax regulations governing capital gains. Capital gains refer to the profits made from the sale of investments or assets, and they can be subject to taxation. The state’s approach to capital gains taxation is a key factor in shaping investment strategies and financial planning for residents and businesses alike.

The state of Washington levies a separate tax on capital gains, distinct from its regular income tax. This tax is designed to capture profits made from the sale of certain assets, primarily focusing on long-term investments and real estate transactions. Understanding this tax is essential for individuals and businesses looking to optimize their financial portfolios and minimize tax liabilities.

Key Features of Washington’s Capital Gain Tax

Washington’s capital gain tax operates under a unique framework, offering several distinctive features that set it apart from other states’ tax systems. Here’s a closer look at some of its key characteristics:

- Tax Rate: Washington's capital gain tax rate is 7% for individuals and 8.4% for corporations. This rate applies to the net capital gain, which is the total capital gains minus any capital losses. The tax is calculated separately from regular income tax and is often considered a "surplus tax" on profits from investments.

- Taxable Assets: The tax applies to a wide range of assets, including stocks, bonds, mutual funds, and real estate. However, there are certain exclusions, such as gains from the sale of a primary residence (up to a certain limit) and certain small business stock sales.

- Long-Term vs. Short-Term Gains: Washington distinguishes between long-term and short-term capital gains. Long-term gains, which are profits from assets held for more than one year, are generally taxed at a lower rate than short-term gains (assets held for one year or less). This distinction encourages long-term investments and strategic asset management.

- Reporting and Filing: Taxpayers are required to report capital gains and losses on their state tax returns. The process involves calculating the net capital gain and applying the appropriate tax rate. Filing deadlines align with the standard tax filing deadlines, usually by April 15th of the following year.

| Asset Type | Tax Rate |

|---|---|

| Stocks & Mutual Funds | 7% (Individuals) / 8.4% (Corporations) |

| Bonds | 7% (Individuals) / 8.4% (Corporations) |

| Real Estate | 7% (Individuals) / 8.4% (Corporations) |

Strategic Financial Planning for Washington Residents

For Washington residents, understanding the implications of the state’s capital gain tax is crucial for effective financial planning. Here are some strategic considerations to optimize your financial portfolio:

1. Long-Term Investment Strategies

Given the lower tax rate for long-term capital gains, it’s advantageous to adopt a long-term investment approach. Holding onto investments for more than a year can significantly reduce your tax liability. This strategy is particularly beneficial for stocks and mutual funds, as it allows you to take advantage of the favorable tax rates while still participating in the growth of the market.

2. Real Estate Transactions

When it comes to real estate, Washington’s capital gain tax applies to the sale of investment properties and second homes. However, there are exclusions for the sale of a primary residence. If you’re planning to sell a home that you’ve owned and lived in for a significant period, you may qualify for an exemption, reducing your tax burden.

For example, if you've owned and lived in your primary residence for at least two out of the last five years, you may be eligible for an exclusion of up to $250,000 for single filers and $500,000 for married couples filing jointly. This exclusion can significantly reduce your taxable capital gain, making it an attractive option for homeowners looking to downsize or relocate.

3. Tax-Efficient Investment Vehicles

Exploring tax-efficient investment options is crucial in Washington. Consider utilizing tax-advantaged accounts like IRAs or 401(k)s, which allow your investments to grow tax-free or tax-deferred. Additionally, investing in certain types of bonds, such as municipal bonds, can provide tax-free income, further reducing your tax liability.

4. Timing Your Investments

Strategic timing of your investments can also impact your capital gain tax. By coordinating the purchase and sale of assets, you can potentially offset capital gains with capital losses, reducing your overall tax burden. This strategy, known as tax-loss harvesting, is a valuable tool for investors looking to optimize their tax efficiency.

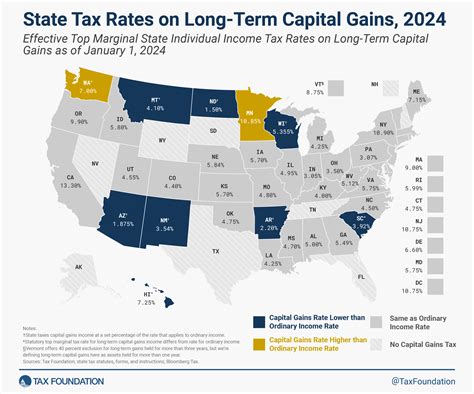

Comparison with Other States

Washington’s capital gain tax stands out among other states’ tax systems. While many states do not have a separate capital gains tax, Washington’s approach is designed to capture a portion of the profits made from investments, adding an additional layer of complexity to tax planning. Here’s a brief comparison with a few other states:

| State | Capital Gain Tax Rate | Notable Features |

|---|---|---|

| California | 13.3% | California has one of the highest capital gain tax rates in the nation, with a top rate of 13.3%. The state also offers a long-term capital gain exclusion for certain real estate sales. |

| Texas | None | Texas is one of the states that does not have a state-level income tax, including capital gains. This makes it an attractive option for investors seeking tax-efficient jurisdictions. |

| New York | 8.82% | New York has a high capital gain tax rate, similar to California. However, it offers a tax credit for capital gains on the sale of qualified small business stock, providing an incentive for certain types of investments. |

Future Implications and Tax Policy

Washington’s capital gain tax is a dynamic aspect of the state’s tax policy, subject to ongoing discussions and potential changes. As the state’s economy evolves, so too does the need for a flexible and responsive tax system. Here are some key considerations for the future:

1. Economic Impact

The capital gain tax has a significant impact on the state’s economy, particularly in sectors such as real estate and investment. The tax can influence investment patterns, real estate development, and business growth. Understanding the economic implications is crucial for policymakers and investors alike.

2. Tax Reform and Simplification

There are ongoing debates surrounding tax reform and simplification in Washington. Some argue for a more straightforward tax system, while others advocate for maintaining the current structure to support specific industries and encourage long-term investments. The future direction of tax policy will shape investment strategies and financial planning for years to come.

3. Federal vs. State Tax Coordination

Washington’s capital gain tax operates in conjunction with federal tax laws. As federal tax policies evolve, there is a need for coordination between state and federal authorities to ensure consistency and fairness. This coordination is essential to prevent double taxation and create a harmonious tax environment.

Conclusion

Washington’s capital gain tax is a critical component of the state’s tax system, offering unique opportunities and challenges for investors and financial planners. By understanding the intricacies of this tax, individuals and businesses can make informed decisions to optimize their financial portfolios and minimize tax liabilities. As the state’s economy continues to evolve, so too will the role of the capital gain tax, shaping the financial landscape for years to come.

How does Washington’s capital gain tax compare to other states’ tax systems?

+Washington’s capital gain tax is relatively high compared to some states, such as Texas, which has no state-level income tax. However, it is lower than states like California and New York, which have top capital gain tax rates of 13.3% and 8.82%, respectively. The tax rate in Washington is 7% for individuals and 8.4% for corporations.

Are there any exemptions or exclusions for capital gains in Washington?

+Yes, Washington offers certain exemptions and exclusions for capital gains. For instance, gains from the sale of a primary residence are exempt up to a specific limit (250,000 for single filers and 500,000 for married couples filing jointly). Additionally, gains from the sale of qualified small business stock may be eligible for an exclusion.

How can investors minimize their capital gain tax liability in Washington?

+Investors can minimize their capital gain tax liability by adopting long-term investment strategies, holding assets for more than a year to qualify for the lower tax rate. Additionally, utilizing tax-advantaged accounts like IRAs or 401(k)s, and investing in tax-free or tax-deferred instruments can reduce tax obligations.