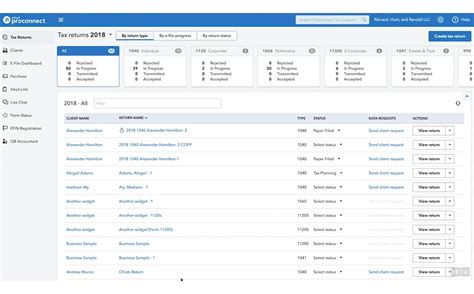

Proconnect Tax Online

Proconnect Tax Online: Revolutionizing Tax Preparation for Small Businesses

In the fast-paced world of small business ownership, efficient tax management is crucial for success. Proconnect Tax Online, a powerful cloud-based tax preparation platform, has emerged as a game-changer, empowering entrepreneurs to navigate the complexities of taxes with ease and confidence. This article delves into the features, benefits, and impact of Proconnect Tax Online, showcasing how it simplifies tax compliance and boosts productivity for small businesses.

Transforming Tax Preparation with Proconnect Tax Online

Proconnect Tax Online, developed by a leading provider of tax software, is designed specifically for small businesses and their tax professionals. With its intuitive interface and advanced features, it offers a seamless tax preparation experience, catering to the unique needs of entrepreneurs and their advisors.

This platform revolutionizes tax preparation by providing a comprehensive suite of tools and resources, enabling small businesses to efficiently manage their tax obligations. From data importation and automated calculations to e-filing and real-time collaboration, Proconnect Tax Online streamlines the entire tax process, saving time and reducing errors.

Key Features and Benefits of Proconnect Tax Online

Proconnect Tax Online boasts a range of features that make tax preparation more efficient and accurate:

- Intuitive Data Importation: Proconnect Tax Online simplifies data entry by seamlessly importing financial information from various sources, including accounting software, bank statements, and payroll systems. This feature eliminates manual data entry, saving hours of tedious work.

- Automated Calculations: With its advanced algorithms, the platform automatically calculates taxes, deductions, and credits, ensuring accuracy and reducing the risk of errors. This feature frees up valuable time for business owners to focus on their core operations.

- Real-Time Collaboration: Proconnect Tax Online enables secure collaboration between business owners and their tax professionals. Multiple users can access and work on tax returns simultaneously, fostering efficient communication and streamlined tax preparation.

- E-Filing and Instant Refunds: The platform offers a seamless e-filing process, allowing small businesses to file their tax returns electronically with ease. Additionally, it provides options for instant refunds, offering quick access to much-needed capital for business growth.

- Customizable Forms and Schedules: Proconnect Tax Online accommodates the diverse needs of small businesses by providing customizable forms and schedules. Whether it's adjusting depreciation methods or adding industry-specific deductions, the platform ensures a tailored tax preparation experience.

| Feature | Description |

|---|---|

| Data Importation | Seamless import of financial data from multiple sources, saving time and reducing errors. |

| Automated Calculations | Accurate tax calculations with advanced algorithms, ensuring compliance and minimizing errors. |

| Real-Time Collaboration | Secure collaboration between business owners and tax professionals, enhancing efficiency and communication. |

| E-Filing and Instant Refunds | Seamless electronic filing with options for instant refunds, providing quick access to funds. |

| Customizable Forms | Tailored tax preparation with customizable forms and schedules, accommodating diverse business needs. |

Impact on Small Businesses and Tax Professionals

Proconnect Tax Online has had a significant impact on the tax preparation landscape for small businesses. By streamlining the tax process, it has empowered entrepreneurs to take control of their tax obligations, reducing the need for extensive tax knowledge and saving valuable time.

For tax professionals, Proconnect Tax Online has enhanced their efficiency and effectiveness. The platform's collaboration features enable them to provide timely advice and support, fostering stronger client relationships. Additionally, the platform's accuracy and automation reduce the risk of errors, minimizing potential liabilities.

Real-World Success Stories

Proconnect Tax Online has been instrumental in helping small businesses achieve tax compliance and efficiency. For instance, Sarah, an e-commerce business owner, used the platform to streamline her tax preparation process, saving her valuable time and allowing her to focus on growing her online store. With Proconnect Tax Online's intuitive interface, Sarah could easily manage her tax obligations, ensuring compliance and maximizing deductions.

Similarly, John, a small business owner in the hospitality industry, found Proconnect Tax Online to be a game-changer. By importing his financial data directly into the platform, he saved hours of manual data entry. The platform's automated calculations and customizable forms helped him optimize his tax strategy, resulting in significant tax savings and improved cash flow.

Future Implications and Innovations

As tax regulations continue to evolve, Proconnect Tax Online remains committed to staying ahead of the curve. The platform's developers are continuously enhancing its features and functionality, ensuring small businesses have access to the latest tools for efficient tax management.

Looking ahead, Proconnect Tax Online aims to integrate advanced technologies such as artificial intelligence and machine learning. These innovations will further automate tax processes, provide personalized tax planning advice, and enhance the overall user experience. By leveraging these technologies, small businesses can stay ahead of tax obligations and make informed financial decisions.

Furthermore, Proconnect Tax Online plans to expand its reach and support for diverse business structures and industries. The platform's developers recognize the unique tax needs of different business types and are dedicated to providing tailored solutions for all small businesses, regardless of their size or industry.

Conclusion

Proconnect Tax Online has revolutionized tax preparation for small businesses, offering a powerful yet user-friendly platform for efficient tax management. With its intuitive features, collaboration capabilities, and automated processes, it has become an indispensable tool for entrepreneurs and tax professionals alike.

As small businesses continue to navigate the complexities of tax compliance, Proconnect Tax Online will remain a trusted partner, providing the necessary tools and support to thrive. By embracing this innovative platform, small businesses can focus on their core operations, knowing their tax obligations are being managed efficiently and effectively.

How does Proconnect Tax Online ensure data security and privacy?

+Proconnect Tax Online prioritizes data security and privacy. It employs advanced encryption protocols to protect sensitive information during transmission and storage. The platform also complies with industry standards and regulations, such as SSAE 16 and SOC 2, ensuring the highest level of data security and confidentiality.

Can Proconnect Tax Online accommodate complex tax scenarios for small businesses?

+Absolutely! Proconnect Tax Online is designed to handle a wide range of tax scenarios, including complex business structures, multi-state operations, and industry-specific tax requirements. Its customizable forms and schedules ensure that small businesses can accurately reflect their unique tax situations.

What support does Proconnect Tax Online provide for tax professionals and their clients?

+Proconnect Tax Online offers comprehensive support for tax professionals and their clients. It provides access to a dedicated support team, online training resources, and a knowledge base with step-by-step guides. Additionally, the platform’s real-time collaboration features facilitate efficient communication and assistance.