How Can I Get A Tax Id

In the realm of business and financial management, obtaining a Tax Identification Number (TIN) is a crucial step for any entity, whether it's an individual, a business, or an organization. A TIN, also known as an Employer Identification Number (EIN) in the United States, serves as a unique identifier for tax purposes and plays a vital role in various financial and legal processes. This comprehensive guide aims to provide an in-depth understanding of the process of acquiring a TIN, shedding light on the requirements, procedures, and considerations involved.

Understanding Tax Identification Numbers

A Tax Identification Number, often referred to as a TIN, is a unique numerical code assigned to individuals, businesses, and other entities for tax administration purposes. In the United States, the Internal Revenue Service (IRS) is responsible for issuing TINs, which are used to identify taxpayers and their tax-related activities. TINs are essential for various reasons, including filing tax returns, reporting income, and conducting financial transactions.

Types of TINs

There are several types of TINs, each serving a specific purpose and applicable to different entities:

- Social Security Number (SSN): This is the most common TIN for individuals. An SSN is typically assigned to US citizens, permanent residents, and eligible non-citizens. It is used for personal identification and tax filing purposes.

- Individual Taxpayer Identification Number (ITIN): An ITIN is issued to individuals who are required to have a TIN but do not qualify for an SSN. This includes foreign nationals and certain non-resident aliens.

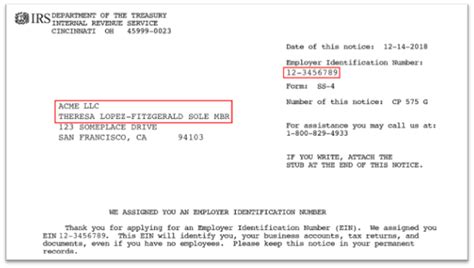

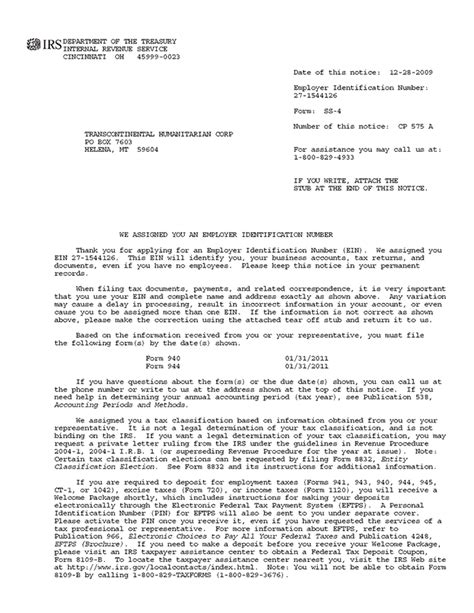

- Employer Identification Number (EIN): Also known as a Federal Tax Identification Number, an EIN is used to identify a business entity for tax purposes. It is required for corporations, partnerships, LLCs, and other business structures.

- Pre-Assigned Control Number (PCN): A PCN is a temporary TIN assigned to certain entities, such as government agencies or foreign entities, that are exempt from having an EIN.

The Importance of TINs

TINs play a critical role in the financial and legal landscape. They are essential for various reasons, including:

- Filing tax returns: TINs are required to file income tax returns, whether it’s for personal income or business profits.

- Reporting income: Employers use TINs to report wages and other income to the tax authorities, ensuring accurate tax withholding and reporting.

- Opening business accounts: Many financial institutions require an EIN to open a business bank account, facilitating secure financial transactions.

- Contracting and compliance: TINs are often requested by clients or partners to ensure compliance with tax regulations and to establish trust in business relationships.

- Government programs: TINs may be necessary to participate in government programs, grants, or contracts, ensuring proper tax handling and eligibility.

Obtaining a Tax Identification Number

The process of acquiring a TIN can vary depending on the type of TIN required and the entity’s circumstances. Here’s a step-by-step guide to obtaining the most common types of TINs:

Social Security Number (SSN)

To obtain an SSN, individuals typically follow these steps:

- Eligibility Check: Ensure you meet the eligibility criteria, which include being a US citizen, permanent resident, or an eligible non-citizen.

- Application Form: Complete Form SS-5, the Application for a Social Security Card. This form requires personal information, proof of identity, citizenship or immigration status, and other relevant details.

- Supporting Documents: Gather the necessary supporting documents, such as birth certificates, passports, or other official documents that prove your identity and eligibility.

- Submit Application: Submit the completed form and supporting documents to your local Social Security Administration (SSA) office or by mail.

- Processing and Receipt: The SSA will process your application, and you will receive your SSN card in the mail. The processing time can vary, so plan accordingly.

Individual Taxpayer Identification Number (ITIN)

If you are not eligible for an SSN, you can apply for an ITIN. The process includes:

- Eligibility Check: Determine if you meet the ITIN eligibility requirements, which include being a foreign national or non-resident alien with tax reporting obligations.

- Application Form: Complete Form W-7, the Application for IRS Individual Taxpayer Identification Number. This form requires personal information and the reason for the application.

- Supporting Documents: Provide the necessary supporting documents, such as passports, visas, or other official documents that prove your identity and eligibility.

- Acceptance Agent: You may need to work with an Acceptance Agent, who is authorized to assist with ITIN applications. They can help ensure your application is complete and accurate.

- Submit Application: Submit the application and supporting documents to the IRS. You can do this by mail or through an authorized IRS office.

- Processing and Receipt: The IRS will process your application, and you will receive your ITIN in the mail. Processing times can vary, so allow sufficient time for this process.

Employer Identification Number (EIN)

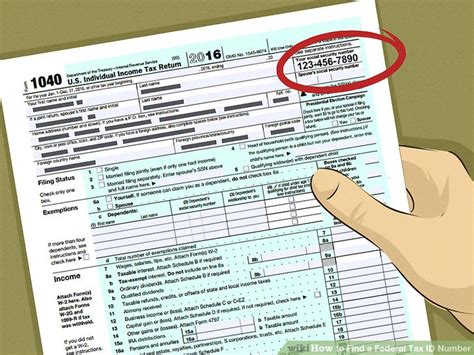

To obtain an EIN for your business, follow these steps:

- Eligibility Check: Ensure your business entity is eligible for an EIN. This includes sole proprietorships, partnerships, corporations, LLCs, and other business structures.

- Online Application: Visit the IRS website and use the EIN Assistant tool to complete the online application. This tool guides you through the process and ensures you provide the necessary information.

- Business Information: Provide details about your business, including the business name, address, and the entity’s structure.

- Responsible Party: Identify the responsible party for the business, which could be an owner, partner, or other authorized individual.

- Submit Application: Submit the online application, and you will receive your EIN immediately upon approval.

- Other Methods: If you prefer, you can also apply for an EIN by fax, mail, or through a third-party designee. These methods may have longer processing times.

Considerations and Best Practices

When obtaining a TIN, it’s essential to consider the following to ensure a smooth process and compliance with regulations:

Documentation and Proof

Ensure you have the necessary documentation to support your application. This includes official government-issued identification, such as passports, driver’s licenses, birth certificates, or other relevant documents. Keep these documents secure and readily accessible during the application process.

Accuracy and Completeness

Pay close attention to the accuracy and completeness of your application. Incomplete or incorrect information can lead to delays or even rejection of your application. Double-check all the details before submission.

Timely Application

Plan ahead and apply for your TIN in a timely manner. Processing times can vary, and you don’t want to be rushed or face delays in your business or personal affairs. Allow sufficient time for the application process, especially if you are applying for an ITIN or EIN.

Compliance and Regulations

Stay informed about the latest tax regulations and compliance requirements. Tax laws can change, and it’s crucial to understand your obligations as a taxpayer or business owner. Consult with tax professionals or legal advisors to ensure you are meeting all the necessary requirements.

Secure Storage and Use

Once you have obtained your TIN, treat it with care and security. Do not share your TIN unnecessarily, and ensure it is stored in a secure location. Only provide your TIN when required for official purposes, such as tax filing or opening a business account.

Future Implications and Benefits

Obtaining a TIN opens doors to various opportunities and benefits:

- Financial Transactions: With a TIN, you can conduct financial transactions more smoothly, whether it’s opening a business account, applying for loans, or participating in investment opportunities.

- Tax Compliance: A TIN ensures you can meet your tax obligations, report income accurately, and stay compliant with tax regulations.

- Business Growth: For businesses, an EIN facilitates growth and expansion, allowing you to hire employees, contract with clients, and participate in government programs.

- Legal Compliance: TINs are often required for legal purposes, ensuring your business or personal activities remain within the boundaries of the law.

- International Transactions: For individuals and businesses engaged in international activities, a TIN can facilitate cross-border transactions and reporting.

| TIN Type | Acquisition Timeframe |

|---|---|

| Social Security Number (SSN) | Varies, typically 2-4 weeks |

| Individual Taxpayer Identification Number (ITIN) | 6-10 weeks on average |

| Employer Identification Number (EIN) | Instant online approval; other methods may take up to 4 weeks |

Can I apply for a TIN online?

+Yes, many TIN applications can be completed online. For example, the IRS provides an online application for obtaining an EIN, which is instantaneously approved. However, for SSNs and ITINs, you may need to submit your application by mail or in person, depending on your circumstances.

What happens if I lose my TIN card or need a replacement?

+If you lose your TIN card or need a replacement, you can typically request a new one through the relevant issuing authority. For SSNs, you can contact the Social Security Administration, and for ITINs, you can reach out to the IRS. They will guide you through the replacement process.

Are there any fees associated with obtaining a TIN?

+In most cases, there are no fees for obtaining a TIN. However, if you engage the services of an Acceptance Agent for an ITIN application or a third-party designee for an EIN application, there may be associated fees for their services.

Can I have multiple TINs for different purposes?

+Yes, it is possible to have multiple TINs for different purposes. For example, an individual may have an SSN for personal tax filing and an EIN for their business. However, it’s essential to use each TIN for its intended purpose and to maintain accurate records.