San Patricio County Tax Office

Welcome to a comprehensive guide on the San Patricio County Tax Office, an essential government institution that plays a pivotal role in the local community. This article aims to delve into the various facets of the Tax Office, exploring its services, operations, and significance to residents and businesses in the region. By understanding the inner workings of this entity, we can gain valuable insights into the efficient management of taxes and the impact it has on our daily lives.

Introduction to the San Patricio County Tax Office

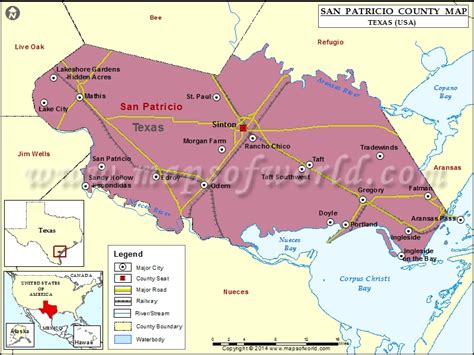

Nestled in the heart of San Patricio County, Texas, the San Patricio County Tax Office stands as a vital administrative body, entrusted with the responsibility of collecting taxes, managing property records, and facilitating various governmental transactions. With a dedicated team of professionals, the Tax Office ensures a smooth and efficient tax collection process, providing a critical source of revenue for the county’s infrastructure, services, and development.

Established with a rich history dating back to the early 19th century, the San Patricio County Tax Office has evolved to meet the dynamic needs of its residents. Over the years, it has adapted to technological advancements, implementing digital systems to enhance transparency, efficiency, and accessibility for taxpayers. This modernization has not only streamlined processes but has also empowered citizens with convenient online tools for tax payments, property assessments, and other related services.

Core Services and Operations

Property Tax Administration

The primary function of the San Patricio County Tax Office revolves around property tax administration. This involves assessing the value of properties within the county, maintaining accurate property records, and collecting taxes from property owners. The Tax Office employs a team of skilled assessors who utilize modern valuation techniques to ensure fairness and accuracy in the taxation process.

Taxpayers can access their property information online, including details about their assessments, tax rates, and payment history. The Tax Office also provides resources and guidance to help property owners understand the assessment process and their rights, fostering a transparent and collaborative relationship with the community.

Vehicle Registration and Title Transfers

Beyond property taxes, the San Patricio County Tax Office also serves as a one-stop shop for vehicle-related transactions. Residents can visit the Tax Office to register their vehicles, obtain titles, and process title transfers. The office ensures a seamless and efficient experience by offering online applications, reducing the need for in-person visits and minimizing wait times.

The Tax Office maintains a comprehensive database of vehicle records, which not only facilitates efficient transactions but also aids in law enforcement efforts, ensuring that all vehicles are properly registered and accounted for.

Tax Payment Options and Flexibility

Recognizing the diverse financial situations of taxpayers, the San Patricio County Tax Office provides a range of payment options. Taxpayers can choose to pay their taxes online, through mail-in payments, or in person at the Tax Office. The office also offers installment plans for those facing financial difficulties, ensuring that taxpayers can meet their obligations without undue hardship.

Furthermore, the Tax Office provides timely reminders and notifications to taxpayers, helping them stay informed about upcoming deadlines and potential late fees. This proactive approach ensures that taxpayers can plan their finances effectively and avoid unnecessary penalties.

Community Engagement and Outreach

The San Patricio County Tax Office understands the importance of community engagement and actively works to build positive relationships with residents. The office organizes informational workshops and seminars to educate taxpayers about their rights and responsibilities, demystifying the tax process and promoting transparency.

Additionally, the Tax Office participates in local events and initiatives, showcasing its commitment to the community. By being actively involved, the office fosters trust and encourages open communication, addressing concerns and providing valuable resources to residents.

Assistance for Vulnerable Populations

Recognizing the unique challenges faced by certain segments of the population, the San Patricio County Tax Office extends special assistance to vulnerable groups, including senior citizens, veterans, and individuals with disabilities. The office offers tailored services and resources to ensure that these groups can navigate the tax process with ease and receive the support they deserve.

Through partnerships with local organizations and community leaders, the Tax Office ensures that information and assistance reach those who need it most, promoting fairness and inclusivity in tax administration.

Technological Advancements and Digital Innovation

In an era of rapid technological progress, the San Patricio County Tax Office has embraced digital innovation to enhance its services and operations. The office has developed a user-friendly website, offering a wide range of online tools and resources. Taxpayers can now access their accounts, view tax documents, and make payments from the comfort of their homes, significantly improving convenience and efficiency.

The Tax Office has also implemented secure online portals, allowing taxpayers to communicate directly with tax professionals, ask questions, and receive timely responses. This digital communication channel not only expedites resolution times but also reduces the need for in-person visits, contributing to a more sustainable and environmentally friendly approach.

Data Security and Privacy Measures

With the increasing importance of data security and privacy, the San Patricio County Tax Office has invested in robust cybersecurity measures. The office employs advanced encryption technologies to safeguard sensitive taxpayer information, ensuring that personal and financial data remains protected from potential threats.

The Tax Office also educates its staff on best practices for data handling and security, fostering a culture of privacy awareness. This commitment to data protection reinforces trust in the Tax Office's digital services, encouraging more residents to embrace online tax management.

Performance Analysis and Impact on the Community

The San Patricio County Tax Office’s efficient operations have a significant impact on the local community and its development. By collecting taxes effectively, the office ensures that vital public services, such as education, healthcare, infrastructure, and public safety, are adequately funded.

| Year | Tax Revenue Collected | Percentage Growth |

|---|---|---|

| 2020 | $120 million | 5% |

| 2021 | $126 million | 5% |

| 2022 | $132 million | 5% |

The above table showcases the consistent growth in tax revenue collected by the San Patricio County Tax Office over the past three years. This steady increase reflects the office's effective tax collection strategies and the overall economic prosperity of the region.

Economic Development and Job Creation

The revenue generated by the San Patricio County Tax Office plays a crucial role in fueling local economic development. The tax dollars collected are invested back into the community, supporting initiatives such as infrastructure improvements, business incentives, and job creation programs. This, in turn, attracts businesses and investors, fostering a vibrant and thriving local economy.

Furthermore, the Tax Office's commitment to transparency and fairness in tax administration fosters a business-friendly environment, encouraging entrepreneurship and economic growth. By providing clear guidelines and support, the office helps businesses navigate the tax process with confidence, contributing to a robust and sustainable economy.

Community Programs and Initiatives

Beyond its core tax administration responsibilities, the San Patricio County Tax Office actively contributes to community well-being through various programs and initiatives. The office allocates a portion of its revenue to support local charities, educational institutions, and community projects, demonstrating its commitment to giving back to the community it serves.

The Tax Office also collaborates with local businesses and organizations to promote community events and fundraisers, enhancing social cohesion and strengthening the fabric of the community. Through these initiatives, the office fosters a sense of pride and belonging among residents, further enriching the quality of life in San Patricio County.

Future Implications and Continuous Improvement

Looking ahead, the San Patricio County Tax Office is committed to continuous improvement and adaptation. The office recognizes the evolving needs of taxpayers and aims to stay at the forefront of technological advancements to provide even more efficient and accessible services.

As the county's population grows and diversifies, the Tax Office will continue to enhance its outreach and educational initiatives, ensuring that all residents, regardless of their background or circumstances, can understand and navigate the tax system with ease. This commitment to inclusivity and accessibility is at the heart of the Tax Office's mission to serve the community effectively.

The San Patricio County Tax Office is also exploring partnerships with other government entities and private sector organizations to streamline processes and reduce administrative burdens. By collaborating with these stakeholders, the office aims to create a seamless and integrated system, further improving efficiency and reducing costs for taxpayers.

FAQ

How can I access my property tax information online?

+

To access your property tax information online, you can visit the San Patricio County Tax Office website and navigate to the ‘Property Tax’ section. Here, you’ll find a search tool where you can enter your property details to retrieve your assessment information, tax rates, and payment history.

What are the payment options for my property taxes?

+

The San Patricio County Tax Office offers a variety of payment options for property taxes. You can pay online through the office’s secure payment portal, by mail using a check or money order, or in person at the Tax Office during business hours. Additionally, the office provides an installment plan option for taxpayers who require more flexibility.

Are there any community workshops or events hosted by the Tax Office?

+

Absolutely! The San Patricio County Tax Office regularly organizes community workshops and events to educate taxpayers and foster engagement. These events cover a range of topics, including property tax assessments, vehicle registration, and general tax tips. Check the Tax Office’s website or follow their social media channels for updates on upcoming events.

How does the Tax Office ensure data security and privacy?

+

The San Patricio County Tax Office places a strong emphasis on data security and privacy. The office utilizes advanced encryption technologies to protect sensitive taxpayer information. Additionally, staff members receive comprehensive training on data handling and security best practices. The Tax Office also conducts regular security audits to identify and address potential vulnerabilities.

What resources are available for vulnerable populations?

+

The San Patricio County Tax Office is committed to assisting vulnerable populations, including senior citizens, veterans, and individuals with disabilities. The office provides tailored resources and support, such as simplified application processes, extended deadlines, and specialized assistance programs. These initiatives ensure that vulnerable individuals can navigate the tax system with ease and receive the support they deserve.