County Of Ventura Property Tax

Welcome to an in-depth exploration of the County of Ventura Property Tax, a vital aspect of financial obligations for homeowners and property owners in the vibrant Ventura County, California. This comprehensive guide aims to provide a clear understanding of the tax process, its implications, and how it contributes to the economic fabric of the region. By unraveling the intricacies of property taxation, we aim to empower residents with knowledge, ensuring a smooth and transparent experience when it comes to one of the most significant financial responsibilities of homeownership.

Understanding the County of Ventura Property Tax

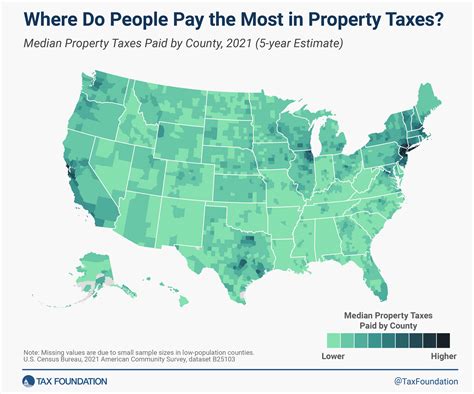

The County of Ventura Property Tax is a fundamental revenue source for the local government, playing a crucial role in funding essential services such as education, public safety, infrastructure development, and more. It is a yearly assessment levied on the value of real estate properties within the county, including residential, commercial, and industrial properties.

The tax system in Ventura County operates under the principles set forth by the California Revenue and Taxation Code, which outlines the procedures for assessing, collecting, and disbursing property taxes. These taxes are calculated based on the assessed value of the property, which is determined by the Ventura County Assessor's Office, an impartial agency responsible for evaluating properties annually.

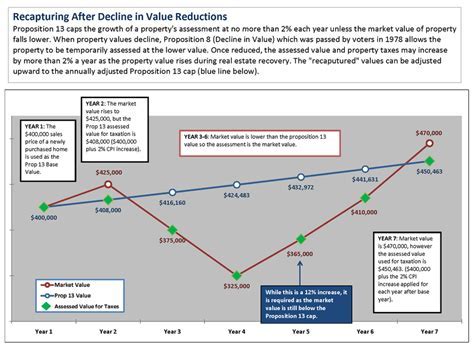

Assessed Value and Property Tax Calculation

The assessed value of a property is not the same as its market value. In California, the assessed value is based on the property’s value as of a specific date, known as the lien date. The lien date in Ventura County is January 1st of each year. This means that any changes in property value that occur after this date will not be reflected in the assessed value until the following tax year.

The property tax rate is then applied to the assessed value to calculate the annual tax amount. The tax rate is comprised of several components, including the general tax rate, voter-approved bonds and overrides, and special assessments for specific services or improvements. The general tax rate is set by the county and is uniform for all properties within the county.

| Tax Rate Component | Description |

|---|---|

| General Tax Rate | The base tax rate set by the county, typically used to fund general services. |

| Voter-Approved Bonds/Overrides | Additional taxes approved by voters for specific projects or services, such as school bonds. |

| Special Assessments | Charges for specific services or improvements, like fire protection or flood control. |

The formula for calculating the property tax is as follows:

Property Tax = (Assessed Value x Tax Rate) + Special Assessments

Property Tax Bill and Payment

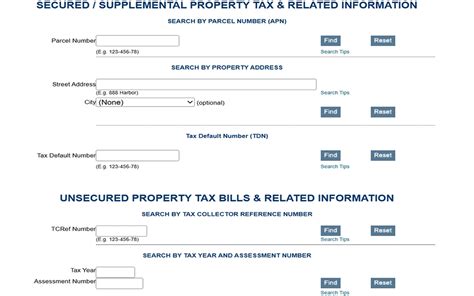

The Ventura County Tax Collector’s Office is responsible for issuing property tax bills and collecting payments. Tax bills are typically mailed out twice a year, with the first installment due by December 10th and the second by April 10th of the following year. It is crucial for property owners to pay their taxes on time to avoid penalties and potential legal consequences.

Payment options include online payment through the county's website, payment by mail, or in-person payment at the Tax Collector's Office. Property owners can also choose to escrow their property taxes, where the annual tax amount is included in their mortgage payments, ensuring timely payment and providing a convenient option for many homeowners.

Challenges and Exemptions in Ventura County Property Taxes

While property taxes are a necessary contribution to the community, there are circumstances where property owners may face challenges or be eligible for exemptions. Understanding these aspects is crucial for managing property tax obligations effectively.

Challenging Property Assessments

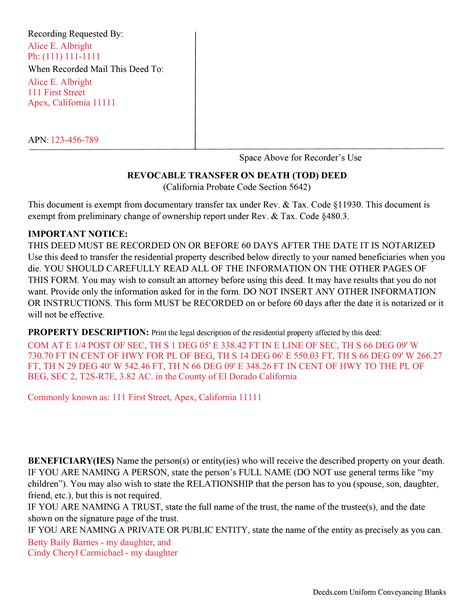

Property owners in Ventura County have the right to appeal their property’s assessed value if they believe it is inaccurate or excessive. The process involves filing an Application for Changed Assessment with the Ventura County Assessment Appeals Board, providing evidence to support the requested change. Common reasons for appeals include recent property damage, inaccurate property characteristics recorded by the assessor, or a significant drop in property value.

The appeals process can be complex, and it is advisable for property owners to seek professional assistance or consult with the Assessment Appeals Board for guidance. Successful appeals can result in a reduced assessed value, leading to lower property taxes for the owner.

Property Tax Exemptions

Ventura County offers various property tax exemptions to eligible individuals and organizations. These exemptions aim to provide relief to certain groups or encourage specific types of development.

- Homestead Exemption: This exemption provides a partial reduction in property taxes for primary residences. To qualify, the property must be the owner's principal place of residence, and the owner must apply for the exemption annually.

- Veterans' Exemption: Eligible veterans may receive a property tax exemption based on their military service. The exemption amount varies depending on the veteran's disability status and length of service.

- Senior Citizen Exemption: Ventura County offers a property tax exemption to seniors aged 65 and above who meet certain income and residency requirements. This exemption helps alleviate the financial burden of property taxes for older residents.

- Disabled Persons' Exemption: Individuals with disabilities may qualify for a property tax exemption if their disability limits their ability to work and earn income. The exemption amount is determined by the degree of disability.

- Open Space Exemption: Property owners who dedicate their land for agricultural or open space preservation may be eligible for this exemption. The land must be actively used for farming or conservation purposes to qualify.

The Impact of Property Taxes on the Ventura County Economy

Property taxes are a significant contributor to the economic health of Ventura County. The revenue generated from these taxes funds critical public services and infrastructure projects, directly impacting the quality of life for residents and the overall economic vitality of the region.

Funding Public Services and Infrastructure

Property tax revenue is a primary source of funding for essential public services in Ventura County. These services include:

- Education: Property taxes support local schools, ensuring adequate resources for student learning and teacher salaries.

- Public Safety: The tax revenue helps maintain a robust public safety system, including police, fire, and emergency services.

- Healthcare: A portion of the property taxes goes towards funding public health programs and medical facilities.

- Transportation: Property taxes contribute to the development and maintenance of roads, highways, and public transportation systems.

- Environmental Protection: The revenue is used to support environmental initiatives, such as conservation efforts and pollution control.

Economic Development and Growth

Property taxes also play a crucial role in fostering economic growth and development in Ventura County. The stable revenue stream from property taxes allows the county to invest in infrastructure projects, attract businesses, and create job opportunities.

Additionally, the presence of a robust property tax system provides confidence to investors and developers, encouraging them to contribute to the local economy. The resulting growth leads to increased property values, further boosting tax revenue and creating a positive cycle of economic development.

The Future of Property Taxation in Ventura County

As Ventura County continues to evolve and adapt to changing economic and demographic trends, the property tax system will also need to evolve to remain fair, efficient, and responsive to the needs of the community.

Potential Changes and Reforms

There are ongoing discussions and proposals to reform the property tax system in California, including in Ventura County. Some of the proposed changes include:

- Revising Assessment Methods: Exploring alternative assessment methods to ensure properties are valued accurately and fairly.

- Increasing Tax Relief for Low-Income Homeowners: Expanding exemption programs to provide more relief to homeowners with limited financial means.

- Streamlining the Appeals Process: Making the process of challenging property assessments more accessible and efficient.

- Implementing Green Incentives: Offering tax incentives for energy-efficient upgrades and sustainable practices to encourage environmental stewardship.

Technology and Innovation in Tax Administration

The adoption of technology and innovative practices in tax administration can enhance the efficiency and transparency of the property tax system. Ventura County can explore the following advancements:

- Digital Property Assessment: Utilizing advanced data analytics and satellite imagery to assess properties more accurately and efficiently.

- Online Tax Payment Platforms: Developing user-friendly online systems for tax payment, providing convenience and reducing administrative costs.

- AI-Assisted Tax Collection: Employing artificial intelligence to optimize tax collection processes and reduce errors.

- Blockchain for Transparency: Implementing blockchain technology to ensure secure and transparent record-keeping of property tax transactions.

Conclusion: Navigating the County of Ventura Property Tax System

Understanding the intricacies of the County of Ventura Property Tax system is essential for property owners to manage their financial obligations effectively. From calculating the assessed value and tax rates to exploring exemptions and challenges, this guide provides a comprehensive overview of the process.

Furthermore, recognizing the impact of property taxes on the local economy and staying informed about potential reforms and technological advancements can empower residents to actively participate in shaping the future of their community. As Ventura County continues to thrive, a transparent and equitable property tax system will remain a cornerstone of its economic success and overall well-being.

When is the lien date for property tax assessments in Ventura County?

+The lien date in Ventura County is January 1st of each year. This means that any changes in property value after this date will not be reflected in the assessed value until the following tax year.

How often do property tax bills get issued in Ventura County?

+Property tax bills in Ventura County are typically issued twice a year. The first installment is due by December 10th, and the second installment is due by April 10th of the following year.

What happens if I miss the property tax payment deadline in Ventura County?

+If you miss the property tax payment deadline in Ventura County, you may be subject to penalties and interest charges. It is important to pay your property taxes on time to avoid additional costs and potential legal consequences.