Why Would I Owe Taxes

Taxes are an essential component of any functioning society, playing a pivotal role in funding public services and infrastructure that benefit citizens. However, understanding the reasons behind tax liabilities can be complex, as it involves delving into various financial aspects and legal obligations. This article aims to provide a comprehensive analysis of the factors that contribute to tax obligations, offering a detailed exploration of the "why" behind tax payments.

The Fundamentals of Taxation

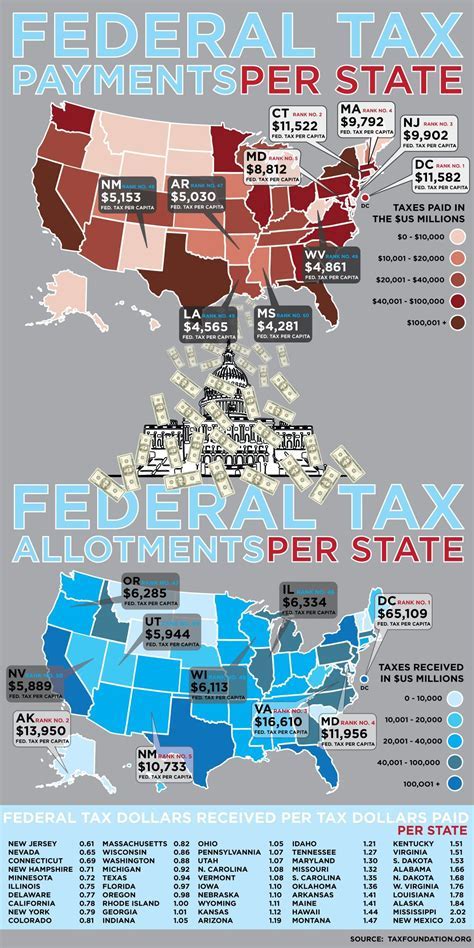

At its core, taxation is a mechanism through which governments raise revenue to finance public expenditures. These expenditures cover a wide range of services and initiatives, including but not limited to healthcare, education, national defense, social security, and public works projects. Without taxes, governments would lack the necessary funds to provide these essential services, leading to a significant decline in the overall standard of living for citizens.

The concept of taxation is founded on the principle of progressive taxation, where those with higher incomes contribute a larger proportion of their earnings to the public purse. This ensures that the tax burden is distributed equitably across society, with those who have more means contributing more. Progressive taxation is a key component of a fair and just tax system, promoting social equity and economic stability.

Income and Taxation

One of the primary factors determining an individual’s tax liability is their income level. Tax systems are designed to tax various sources of income, including wages, salaries, investments, and business profits. The higher one’s income, the higher their tax bracket, resulting in a higher tax rate and, consequently, a larger tax liability.

For instance, let's consider a hypothetical tax system with three tax brackets: 10% for incomes up to $50,000, 20% for incomes between $50,000 and $100,000, and 30% for incomes exceeding $100,000. In this system, an individual earning $75,000 annually would fall into the second bracket, paying 20% tax on their income. This translates to a tax liability of $15,000.

| Income Bracket | Tax Rate | Tax Liability |

|---|---|---|

| $0 - $50,000 | 10% | $5,000 |

| $50,001 - $100,000 | 20% | $15,000 |

| Over $100,000 | 30% | $30,000 |

It's important to note that tax systems often incorporate various deductions, credits, and allowances to reduce the tax burden on individuals and encourage certain behaviors, such as investing in retirement plans or donating to charitable causes.

Capital Gains Tax

Taxation also extends to capital gains, which are profits made from the sale of assets, such as stocks, bonds, or real estate. These gains are subject to capital gains tax, which is typically levied at a lower rate than regular income tax. The rationale behind this is to encourage investment and long-term wealth creation.

For example, if an individual buys a stock for $1,000 and sells it for $1,500, they have realized a capital gain of $500. If the capital gains tax rate is 15%, they would owe $75 in taxes on this gain.

Property and Asset Ownership

Another significant aspect of taxation is the ownership of property and assets. Many countries impose property taxes on real estate, vehicles, and other valuable assets. These taxes are typically calculated based on the assessed value of the property or asset and are used to fund local services and infrastructure.

For instance, a homeowner might pay an annual property tax based on the appraised value of their home. This tax contributes to the maintenance of local roads, schools, and other public amenities.

Wealth and Inheritance Taxes

In some jurisdictions, taxes are levied on wealth, particularly when it is transferred from one generation to the next through inheritance. Inheritance taxes and estate taxes are designed to ensure that those who receive substantial wealth also contribute to the public coffers.

Suppose an individual inherits a property valued at $1 million from a deceased relative. If the inheritance tax rate is 20%, the beneficiary would owe $200,000 in taxes on this inheritance.

Sales and Consumption Taxes

Taxes are not limited to income and assets. Sales taxes and consumption taxes are imposed on goods and services purchased by consumers. These taxes are often included in the price of the product or service and are collected by businesses, which then remit the tax to the government.

For example, when you buy a new television, the sales tax is added to the purchase price, and the store collects this tax on behalf of the government. This tax revenue is then used to fund various government programs and services.

Value Added Tax (VAT)

In many countries, a value added tax (VAT) is applied to most transactions in the production and distribution chain. VAT is a consumption tax that is collected at each stage of the production process, with the final consumer bearing the full cost. This tax system is designed to capture a wider range of economic activities and promote fairness in taxation.

The Complexity of Tax Laws

While the above provides a simplified overview of taxation, it’s important to acknowledge the complexity of tax laws and regulations. Tax systems can vary widely between jurisdictions, and they often include numerous exceptions, deductions, and special provisions that can significantly impact an individual’s tax liability.

Tax laws are also subject to frequent changes and updates, reflecting evolving economic conditions and government policies. Staying informed about these changes is crucial for individuals and businesses to ensure compliance and optimize their tax strategies.

Tax Planning and Compliance

Given the complexity of tax laws, many individuals and businesses engage in tax planning to minimize their tax liabilities within the confines of the law. This involves a thorough understanding of tax regulations and the strategic use of deductions, credits, and allowances to reduce tax burdens.

However, it's essential to note that tax planning should not be confused with tax evasion, which is illegal and carries severe penalties. Compliance with tax laws is a responsibility shared by all taxpayers, and non-compliance can result in significant fines and legal repercussions.

Conclusion: The Purpose of Taxation

In conclusion, taxes are a vital mechanism for governments to raise revenue and fund the public services and infrastructure that support society. While tax liabilities can be complex and varied, they are essential for maintaining a functioning and prosperous society. Understanding the reasons behind tax obligations is crucial for individuals and businesses to navigate the tax system effectively and contribute to the common good.

As we've explored, taxation is a multifaceted system, designed to promote fairness, encourage investment, and support the provision of essential public services. By understanding the "why" behind taxes, we can appreciate the role they play in our society and ensure that we fulfill our civic duty to contribute to the greater good.

What are the consequences of not paying taxes?

+Failing to pay taxes can lead to severe legal consequences, including fines, penalties, and even criminal charges. It’s essential to fulfill your tax obligations to avoid these repercussions and maintain compliance with the law.

How can I reduce my tax liability legally?

+Engaging in tax planning strategies, such as maximizing deductions and credits, can help reduce your tax liability within the bounds of the law. Consulting with a tax professional can provide valuable insights into legitimate ways to optimize your tax situation.

Are there any tax benefits for specific industries or professions?

+Yes, certain industries and professions may be eligible for specific tax benefits or incentives. These can include tax credits for research and development, incentives for renewable energy investments, or deductions for specific expenses related to the profession. Staying informed about industry-specific tax provisions is crucial for optimizing your tax situation.