Oregon Tax Return Status

Stay informed about the status of your Oregon tax return with this comprehensive guide. As the filing season approaches, understanding the various stages and updates of your tax return is crucial. In this article, we will delve into the Oregon tax return process, exploring the different ways to check your return status and providing valuable insights to ensure a smooth and timely process.

Understanding the Oregon Tax Return Process

Oregon, known for its beautiful landscapes and progressive tax system, offers residents and businesses a range of tax obligations and incentives. The Oregon Department of Revenue handles the processing of tax returns, ensuring compliance with state tax laws and regulations.

When it comes to filing your Oregon tax return, there are several key steps to consider. First, gather all necessary documents, including income statements, deductions, and any relevant tax credits. Then, choose your filing method. Oregon taxpayers have the option to file electronically or by mail, depending on their preferences and the complexity of their return.

Once you have filed your return, the journey towards receiving your refund or finalizing your tax obligations begins. The Oregon Department of Revenue employs a meticulous process to review and process each return, ensuring accuracy and compliance.

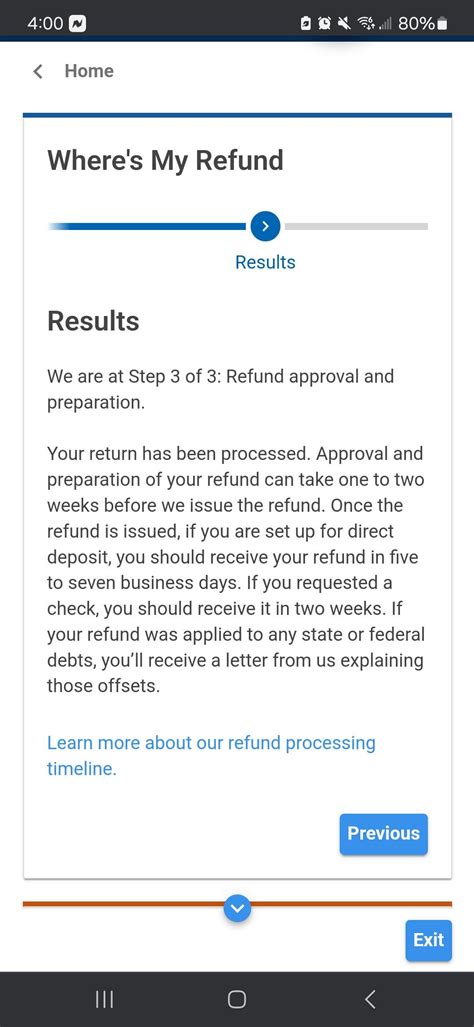

Checking Your Oregon Tax Return Status

Staying informed about the status of your Oregon tax return is essential, especially if you are awaiting a refund or have specific questions regarding your tax obligations. Here are the primary methods to check your return status:

1. Online Account Access

The Oregon Department of Revenue provides an online portal, MyOregon.gov, which allows taxpayers to create an account and access their tax information securely. Through this portal, you can check the status of your return, view your account balance, and track any refunds or payments. It offers a convenient and efficient way to stay updated throughout the tax season.

2. Automated Phone System

For those who prefer a more traditional method, the Oregon Department of Revenue offers an automated phone system. By calling the designated number, you can receive automated updates on the status of your return. This system is especially useful for taxpayers who may not have easy access to the internet or prefer a quick phone call to obtain information.

3. Direct Contact with Tax Authorities

In certain situations, such as complex tax scenarios or unresolved issues, direct contact with the Oregon Department of Revenue may be necessary. Taxpayers can reach out to the department's customer service representatives via phone or email. These professionals are equipped to provide personalized assistance and address specific concerns related to tax return status.

Processing Times and Expectations

Understanding the typical processing times for Oregon tax returns is crucial for managing expectations and planning accordingly. The Oregon Department of Revenue strives to process returns as efficiently as possible, but the timeline can vary depending on several factors.

For electronic returns, the processing time is generally faster compared to mailed returns. The department aims to process electronic returns within 4 weeks, provided all information is accurate and complete. Mailed returns, on the other hand, may take slightly longer, with a typical processing time of 6 to 8 weeks.

It's important to note that during peak tax season, processing times may be slightly extended due to the high volume of returns being processed. Taxpayers are encouraged to plan their financial matters accordingly and allow for sufficient time for their returns to be processed.

| Return Type | Typical Processing Time |

|---|---|

| Electronic Return | 4 weeks |

| Mailed Return | 6 to 8 weeks |

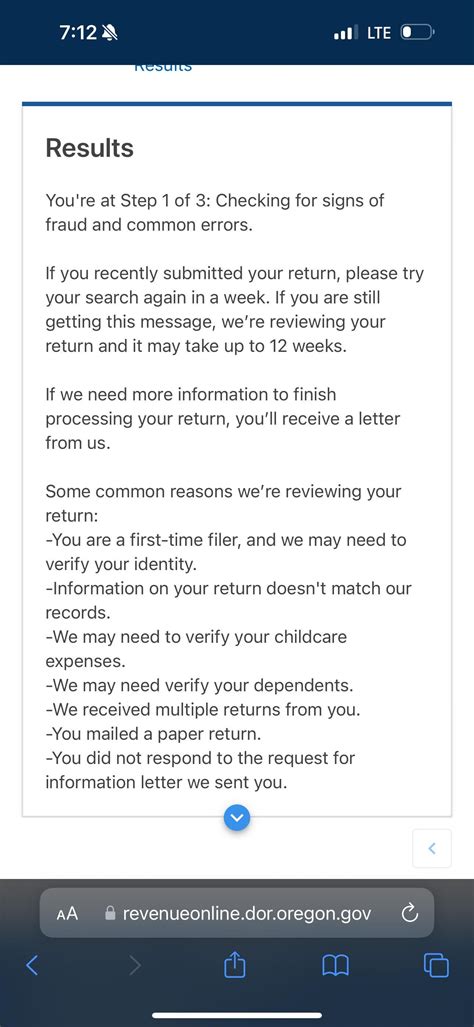

Common Issues and Resolutions

While the Oregon tax return process is generally smooth, there may be occasions where taxpayers encounter issues or have specific questions. Here are some common scenarios and their resolutions:

1. Return Rejected or Error Message

In some cases, a tax return may be rejected by the system due to errors or missing information. If you receive a rejection notice or error message, carefully review the error details provided. Common issues include incorrect Social Security numbers, missing signatures, or discrepancies in income statements. Addressing these errors promptly and resubmitting the return is essential to ensure timely processing.

2. Refund Delays

If your refund seems delayed beyond the expected processing time, there could be several reasons. Common causes for refund delays include missing or incomplete information, discrepancies in tax forms, or additional review required by the department. In such cases, contacting the Oregon Department of Revenue and providing any necessary documentation can help expedite the refund process.

3. Tax Obligations and Payment Plans

For taxpayers with outstanding tax obligations, the Oregon Department of Revenue offers various payment options and plans. If you are unable to pay your taxes in full, consider setting up a payment plan to manage your obligations effectively. The department provides guidance and support to ensure taxpayers can fulfill their tax responsibilities while maintaining financial stability.

Future Outlook and Tax Innovations

As technology continues to advance, the Oregon Department of Revenue is exploring innovative ways to enhance the tax return process. The department is dedicated to implementing efficient systems and digital solutions to improve taxpayer experience and streamline operations.

One exciting development is the potential introduction of a real-time tax return status update system. This initiative aims to provide taxpayers with up-to-the-minute information on their return status, reducing the need for frequent manual checks. Additionally, the department is working towards integrating artificial intelligence and machine learning technologies to further automate and streamline the tax return processing journey.

Stay tuned for these exciting advancements, as they have the potential to revolutionize the way taxpayers interact with the Oregon Department of Revenue and make the tax filing process even more efficient and user-friendly.

How can I check the status of my Oregon tax refund?

+You can check the status of your Oregon tax refund by accessing your online account on MyOregon.gov or by calling the automated phone system provided by the Oregon Department of Revenue. These methods offer quick and convenient ways to stay updated on your refund status.

What if I need to amend my Oregon tax return after filing?

+If you need to amend your Oregon tax return, you can file an amended return using Form OR-40X. It’s important to carefully review and correct any errors or omissions, as this process may impact your tax obligations or refund.

Can I track the progress of my mailed tax return?

+Unfortunately, tracking the progress of a mailed tax return is not available. However, you can estimate the processing time based on the typical timelines for mailed returns. It’s advisable to allow sufficient time for your return to be processed and consider using electronic filing for faster results.