How To Find Tax Lien Properties

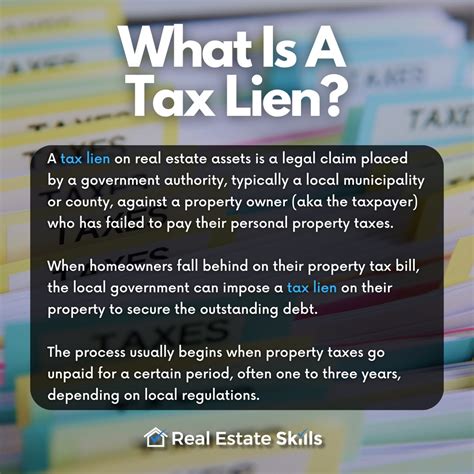

Tax lien properties offer a unique opportunity for investors and homebuyers alike. These properties are acquired by the government when owners fail to pay their property taxes, resulting in a lien being placed on the property. This process can lead to lucrative opportunities for those willing to navigate the complex world of tax liens and real estate.

Understanding Tax Lien Sales

A tax lien sale is a public auction organized by a local government body, usually a county or city, to recover unpaid property taxes. During these sales, investors can purchase tax liens on properties, which gives them the right to collect the outstanding taxes plus interest. If the property owner fails to pay the taxes and interest within a specified redemption period, the investor can then acquire the property.

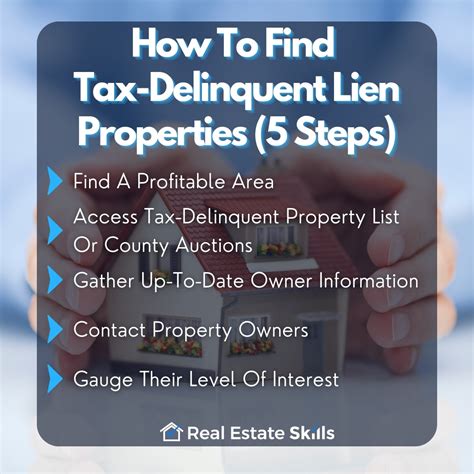

The process of acquiring a tax lien property varies by jurisdiction, but generally, it involves several key steps. First, potential investors must research and identify properties with tax liens. This often requires accessing public records, which can be a tedious but necessary process.

Researching Tax Lien Properties

Research is the cornerstone of success in tax lien investing. Investors must thoroughly investigate the properties they are interested in. This includes understanding the property’s history, its current market value, and the potential for future appreciation. Here are some essential research steps:

- Check the property's tax history to understand the extent of the lien and the owner's payment patterns.

- Examine the property's title to identify any other liens or claims that may impact the investment.

- Conduct a thorough market analysis to determine the property's current value and its potential for resale or rental.

- Visit the property, if possible, to assess its condition and the neighborhood's desirability.

By conducting meticulous research, investors can make informed decisions and identify properties with the best potential for success.

Attending Tax Lien Auctions

Once investors have identified target properties, they must attend the tax lien auction. These auctions are typically open to the public and often conducted online or in person at a designated location. The bidding process can be competitive, so it’s crucial to have a clear strategy and a set budget.

At the auction, investors bid on the right to collect the outstanding taxes and interest. The minimum bid is usually the amount of back taxes owed, plus interest and fees. The investor with the highest bid wins the right to collect these funds.

| Auction Type | Description |

|---|---|

| Certificate of Sale | The investor receives a certificate representing the right to collect taxes and interest. If the owner doesn't pay, the investor can foreclose. |

| Deed Sale | The investor immediately receives the property deed, but the owner has a redemption period to pay off the lien and keep the property. |

Strategies for Tax Lien Investing

Tax lien investing is a strategic game, and successful investors employ various tactics to maximize their chances of success. Here are some key strategies to consider:

Targeted Bidding

Rather than bidding on every available property, successful investors often focus on a specific type of property or location. This targeted approach allows them to build expertise in a particular market, understand local trends, and make more informed investment decisions.

Diversification

Diversifying your portfolio is crucial in tax lien investing. By spreading your investments across multiple properties and locations, you mitigate risk and increase the likelihood of success. This strategy can help protect against potential issues with individual properties or local market fluctuations.

Due Diligence

Due diligence is an essential aspect of tax lien investing. It involves a thorough investigation of the property, its history, and any potential issues. This step is critical to identifying any hidden risks or challenges that could impact your investment.

Understanding Redemption Periods

Redemption periods vary by jurisdiction and are a critical aspect of tax lien investing. During this period, the property owner has the right to pay off the lien and keep the property. Investors must be aware of these timelines and plan their strategies accordingly.

Legal and Ethical Considerations

Tax lien investing is a legal and ethical process, but it’s essential to understand the potential pitfalls and best practices. Here are some key considerations:

Following Local Laws and Regulations

Each jurisdiction has its own set of laws and regulations governing tax lien sales. It’s crucial to understand these rules and ensure that your investment activities comply with local laws. Failure to do so can result in legal consequences and financial losses.

Ethical Investing

Tax lien investing can be a powerful tool for wealth creation, but it’s important to approach it ethically. This means being transparent in your dealings, respecting property owners’ rights, and conducting business with integrity. Avoid taking advantage of vulnerable homeowners or engaging in practices that could be considered predatory.

Maximizing Returns on Tax Lien Properties

Maximizing returns on tax lien properties requires a combination of strategic investing and effective property management. Here are some strategies to consider:

Renovation and Resale

If you acquire a tax lien property that requires renovations, you can add value by improving its condition. This could involve cosmetic updates or more significant repairs. Once the renovations are complete, you can sell the property at a higher market value, generating a substantial return on your investment.

Rental Properties

Tax lien properties can also be excellent rental opportunities. By purchasing a property in a desirable location, you can generate ongoing income through rent. This strategy requires careful property management, but it can provide a steady stream of revenue and long-term wealth accumulation.

Creative Financing

Creative financing options can help you maximize your returns on tax lien properties. This might include offering seller financing to buyers, which allows them to purchase the property with a loan from you. This strategy can provide you with a steady income stream and help you sell properties more quickly.

The Future of Tax Lien Investing

Tax lien investing is an evolving field, and as the real estate market continues to change, so do the opportunities and challenges. Here’s a look at some potential future developments:

Online Auctions and Technology

The rise of online tax lien auctions has made the process more accessible to a wider range of investors. This trend is likely to continue, with technology playing an increasingly significant role in the tax lien investing space. Online platforms may offer more efficient and transparent bidding processes, making it easier for investors to participate and manage their investments.

Market Volatility and Economic Factors

The tax lien market is influenced by economic factors and market volatility. During economic downturns, tax lien opportunities may increase as more homeowners struggle to pay their taxes. However, this also means there’s a higher risk of default and potential challenges in collecting on liens. Investors must stay informed about economic trends and adjust their strategies accordingly.

Regulatory Changes

Changes in tax laws and regulations can impact the tax lien market. It’s essential to stay updated on any legislative changes that could affect your investments. For example, changes in tax rates or foreclosure procedures could impact the value of tax liens and the overall market.

How do I find out about tax lien sales in my area?

+You can typically find information about tax lien sales on your local government’s website or by contacting the county treasurer’s office. They will have details on upcoming auctions and the properties involved.

What happens if the property owner pays off the lien during the redemption period?

+If the property owner pays off the lien within the redemption period, the investor receives the amount paid, including interest and fees. The property ownership reverts back to the owner, and the investor’s lien is released.

Are there any risks associated with tax lien investing?

+Yes, tax lien investing carries risks. These include the possibility of the property owner paying off the lien during the redemption period, the property being difficult to sell, or facing legal challenges related to the lien or the property’s title.