Ga State Tax Estimator

Welcome to our comprehensive guide on the Georgia State Tax Estimator, a tool designed to assist individuals and businesses in understanding and managing their tax obligations within the state of Georgia. As an expert in tax planning and compliance, I will delve into the intricacies of this estimator, providing valuable insights and a deep dive into its features and benefits. With a focus on clarity and specificity, we aim to demystify the world of Georgia state taxes and offer practical guidance for effective tax management.

Unveiling the Georgia State Tax Estimator

The Georgia State Tax Estimator is a sophisticated online tool developed by the Georgia Department of Revenue to empower taxpayers with accurate and up-to-date information regarding their state tax liabilities. This estimator goes beyond a simple calculator, offering a comprehensive platform for individuals and businesses to navigate the complex landscape of Georgia’s tax system.

By leveraging advanced algorithms and real-time data, the estimator provides a precise estimation of various tax components, including income tax, sales tax, property tax, and more. It serves as a valuable resource for taxpayers, ensuring they can make informed decisions and effectively plan their financial strategies.

Key Features and Benefits of the Estimator

The Georgia State Tax Estimator offers a multitude of features and benefits that enhance the tax planning experience. Here are some of the key highlights:

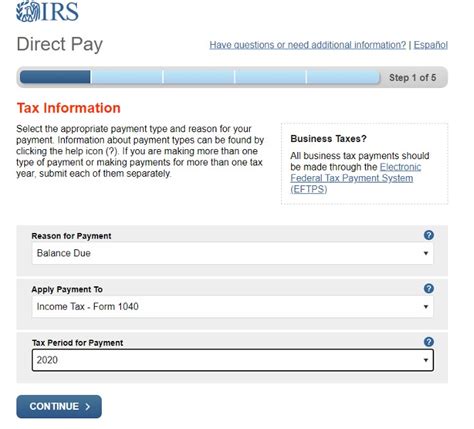

- Income Tax Estimation: Calculate your estimated income tax liability based on your filing status, income sources, and deductions. The estimator considers various tax brackets and credits to provide an accurate assessment.

- Sales Tax Calculator: Determine the sales tax applicable to your purchases within Georgia. This feature is particularly useful for businesses and consumers alike, ensuring compliance with state sales tax regulations.

- Property Tax Estimation: Assess your property tax obligations by inputting details about your real estate holdings. The estimator factors in the assessed value, tax rates, and any applicable exemptions to provide an estimate of your property tax liability.

- Tax Credit Eligibility: Discover the tax credits you may be eligible for based on your personal circumstances. The estimator takes into account factors such as family size, income level, and other qualifying criteria to identify potential tax savings.

- Business Tax Tools: Businesses can benefit from specialized tools tailored to their needs. The estimator offers features like estimated tax payments, payroll tax calculations, and business license requirements, simplifying the tax compliance process for entrepreneurs.

- Historical Data Analysis: Access historical tax data to analyze trends and make informed predictions. This feature is invaluable for long-term financial planning and understanding the evolution of tax policies within Georgia.

Real-World Applications and Testimonials

The Georgia State Tax Estimator has proven to be an indispensable tool for taxpayers across the state. Let’s explore some real-world scenarios and testimonials that highlight its impact:

| Scenario | Estimator Impact |

|---|---|

| Small Business Owner |

Sarah, a small business owner in Atlanta, utilized the estimator to calculate her estimated tax payments. The tool helped her budget effectively and plan for quarterly payments, ensuring she remained compliant and avoided penalties. |

| Retiree |

John, a retiree living in Savannah, used the estimator to assess his income tax liability after receiving a pension. The tool provided clarity on his tax obligations, allowing him to make informed decisions about his retirement finances. |

| Real Estate Investor |

Emily, a real estate investor in Athens, relied on the property tax estimation feature to understand her tax liabilities for multiple properties. This enabled her to factor in tax expenses when evaluating potential investment opportunities. |

These testimonials showcase the practical benefits of the Georgia State Tax Estimator, emphasizing its role in empowering taxpayers with knowledge and facilitating financial decision-making.

Future Implications and Updates

As tax policies and regulations evolve, the Georgia State Tax Estimator remains committed to staying up-to-date. The development team continuously monitors legislative changes and tax law amendments to ensure the estimator reflects the most current tax landscape. This dedication to accuracy and reliability ensures that taxpayers can rely on the estimator as a trusted source of information.

In the coming years, the estimator is expected to introduce additional features and enhancements, such as improved user interfaces, expanded data visualization tools, and enhanced integration with tax preparation software. These advancements will further streamline the tax planning process and cater to the diverse needs of taxpayers.

Expert Insights and Recommendations

💡 As a tax expert, I highly recommend leveraging the Georgia State Tax Estimator as a fundamental tool in your tax planning arsenal. Its accuracy, ease of use, and comprehensive coverage of tax components make it an invaluable resource for individuals and businesses alike. By incorporating the estimator into your financial strategy, you can proactively manage your tax obligations, identify potential savings, and ensure compliance with Georgia’s tax regulations.

Remember, effective tax planning is a critical aspect of financial management, and the Georgia State Tax Estimator provides an accessible and reliable platform to navigate the complexities of state taxes. Stay informed, plan ahead, and make the most of this powerful tool to optimize your tax strategy.

Frequently Asked Questions

Is the Georgia State Tax Estimator accurate for all tax scenarios?

+

The estimator is designed to provide accurate estimates based on the information provided. However, for complex tax situations or specific circumstances, it is recommended to consult with a tax professional for personalized advice.

How often is the estimator updated to reflect tax law changes?

+

The estimator is regularly updated to align with tax law amendments and legislative changes. The development team strives to ensure that the tool remains current and reflects the latest tax policies.

Can the estimator assist with tax filing and preparation?

+

While the estimator provides valuable insights and estimations, it does not directly assist with tax filing or preparation. It serves as a planning tool, and taxpayers may still need to engage with tax professionals or use specialized tax software for filing purposes.

Are there any limitations to the estimator’s functionality?

+

The estimator is designed to cover a wide range of tax scenarios, but it may have certain limitations for highly specialized tax situations. For instance, it may not account for certain niche tax credits or unique business structures. In such cases, consulting with tax experts is advisable.

How can I access the Georgia State Tax Estimator?

+

The estimator is available online through the official website of the Georgia Department of Revenue. Simply navigate to the website, locate the “Tax Estimator” section, and follow the instructions to access the tool.