Sedgwick County Kansas Property Tax

Understanding property taxes is crucial for homeowners and prospective buyers alike, as these taxes significantly impact the overall cost of owning a home. In Sedgwick County, Kansas, property taxes are an essential part of the local economy and play a vital role in funding public services. This comprehensive guide will delve into the intricacies of Sedgwick County's property tax system, providing an in-depth analysis of how it works, what it entails, and its impact on residents.

Unraveling the Property Tax Landscape in Sedgwick County

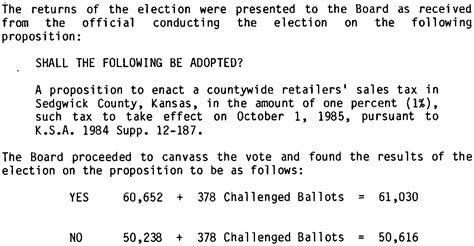

Sedgwick County, known for its vibrant communities and diverse neighborhoods, has a well-established property tax system that contributes to the maintenance and development of the area. The property tax is a significant revenue source for the county, funding essential services such as education, public safety, and infrastructure. The tax is determined by the assessed value of the property and the tax rate set by various taxing authorities.

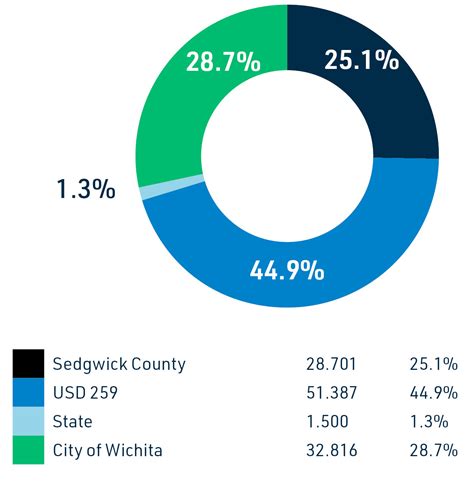

The process begins with the assessment phase, where the county appraiser determines the value of each property. This value is then multiplied by the applicable tax rate to calculate the tax liability. The tax rates are established by different entities, including the county government, school districts, and special taxing districts. These rates can vary across the county, leading to differences in property tax obligations.

Key Factors Influencing Property Tax Assessments

Several factors come into play when assessing property values in Sedgwick County. These include the property's location, as different neighborhoods and areas may have varying tax rates. The size and age of the property, as well as any improvements or renovations, also impact the assessment. Additionally, the property's market value, determined by recent sales of comparable properties, is a critical factor in the assessment process.

For instance, consider the case of two similar homes in different parts of Sedgwick County. Home A, located in a historic district, may have a higher assessed value due to its unique features and the neighborhood's appeal. On the other hand, Home B, situated in a newly developed area, might have a lower assessment due to its more recent construction and potentially lower land value.

Understanding the Tax Rate Structure

The tax rate in Sedgwick County is expressed as a percentage and is applied to the assessed value of the property. This rate is typically divided into two components: the general tax rate, set by the county government, and the special assessment rate, which funds specific services or improvements. The combined rate determines the overall tax obligation for property owners.

To illustrate, if the general tax rate is set at 1.5% and the special assessment rate is 0.3%, the total tax rate would be 1.8%. This rate is then applied to the assessed value of the property to calculate the tax liability. For a property with an assessed value of $200,000, the tax liability would be $3,600 (1.8% of $200,000). This amount is then divided into installments, usually paid semi-annually or annually, to cover the property tax obligation.

| Taxing Authority | Tax Rate | Funding Purpose |

|---|---|---|

| Sedgwick County | 1.2% | General County Operations |

| Sedgwick County Unified School District | 0.8% | Public Education |

| Special Road District | 0.2% | Road Maintenance and Improvements |

The Impact of Property Taxes on Residents

Property taxes in Sedgwick County have a significant influence on the financial well-being of residents. While these taxes contribute to the maintenance and improvement of public services, they also represent a substantial expense for homeowners. The impact is particularly notable in areas with higher property values or special assessment rates for specific services.

Budgeting and Financial Planning

Property taxes are a recurring expense that homeowners must budget for annually. The tax liability can vary significantly depending on the property's value and the tax rates in effect. As such, it is crucial for homeowners to understand their tax obligations and plan their finances accordingly. This includes setting aside funds specifically for property tax payments and considering the impact of tax increases or changes in assessment values.

For instance, a homeowner in Sedgwick County with a property valued at $300,000 and a total tax rate of 1.8% would have an annual tax liability of $5,400. This amount, paid in installments, represents a substantial portion of the homeowner's annual expenses and must be factored into their financial planning.

Property Tax Appeals and Assessments

Property owners in Sedgwick County have the right to appeal their property's assessed value if they believe it is inaccurate or unfair. The appeal process allows homeowners to challenge the county's assessment and potentially reduce their tax liability. This is particularly relevant in cases where the assessed value may not accurately reflect the property's market value or where there are discrepancies in the assessment process.

The appeal process typically involves a review by the county's Board of Tax Appeals, which considers the evidence presented by the homeowner and the county appraiser. If the appeal is successful, the assessed value may be adjusted, resulting in a lower tax liability for the property owner. It is essential for homeowners to gather supporting evidence, such as recent sales data or expert appraisals, to strengthen their case during the appeal process.

Community Development and Infrastructure

Property taxes play a crucial role in funding community development and infrastructure projects in Sedgwick County. These taxes contribute to the construction and maintenance of roads, bridges, and public facilities. Additionally, they support local initiatives such as parks, recreational areas, and community centers. As such, property taxes directly impact the quality of life and the overall development of the county's neighborhoods.

For example, a portion of the property taxes collected in Sedgwick County may be allocated to a special road district, specifically for road maintenance and improvements. This funding ensures that local roads are well-maintained and that necessary repairs and upgrades can be carried out efficiently. Similarly, property taxes contribute to the development of new parks and recreational areas, enhancing the community's recreational opportunities and overall well-being.

Frequently Asked Questions

What is the average property tax rate in Sedgwick County?

+The average property tax rate in Sedgwick County varies depending on the specific location and taxing authorities. However, as of [insert latest available data], the average combined tax rate is approximately [insert average rate]%, which includes both the general tax rate and special assessment rates.

<div class="faq-item">

<div class="faq-question">

<h3>How often are property taxes assessed in Sedgwick County?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Property taxes in Sedgwick County are assessed annually. The county appraiser conducts a comprehensive review of property values each year to determine the assessed value for the upcoming tax year. This assessment process ensures that property taxes are based on the most current and accurate property values.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I receive a property tax exemption in Sedgwick County?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Sedgwick County offers various property tax exemptions to eligible individuals and organizations. These exemptions can reduce the assessed value of the property or provide a partial or full waiver of the property tax liability. Common exemptions include those for seniors, veterans, and certain non-profit organizations.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I estimate my property tax liability in Sedgwick County?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To estimate your property tax liability in Sedgwick County, you can use an online property tax calculator or consult with a tax professional. These tools will help you calculate your estimated tax liability based on your property's assessed value and the applicable tax rates. It's important to note that this estimate may not be exact and is subject to change based on official assessments.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I fail to pay my property taxes in Sedgwick County?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Failure to pay property taxes in Sedgwick County can result in serious consequences. The county may place a lien on your property, which could lead to foreclosure if the taxes remain unpaid. Additionally, late payment penalties and interest may be applied, increasing your overall tax liability. It's crucial to stay current with your property tax payments to avoid these financial and legal complications.</p>

</div>

</div>