Tax Records Monmouth

In the world of financial management and record-keeping, tax records play a crucial role, especially in a bustling county like Monmouth. For residents and businesses alike, understanding the ins and outs of tax obligations and the availability of tax records is essential for compliance and financial planning. This comprehensive guide aims to shed light on the significance of tax records in Monmouth County and how they impact individuals and entities.

The Importance of Tax Records in Monmouth County

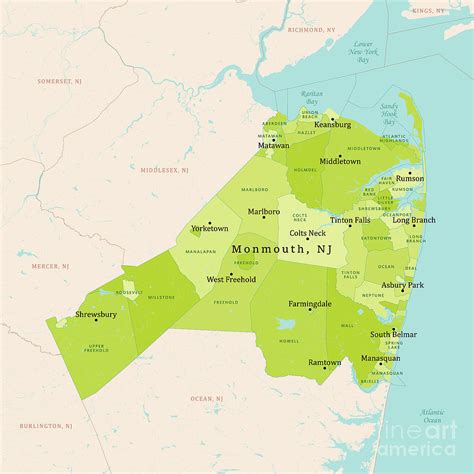

Monmouth County, nestled in the heart of New Jersey, boasts a vibrant economy, diverse businesses, and a thriving residential community. With a rich history dating back to the 17th century, the county has evolved into a hub of economic activity, attracting a wide range of industries and entrepreneurs.

In this dynamic environment, tax records serve as the backbone of financial transparency and accountability. They provide a detailed account of an individual's or business's financial transactions, income, and expenses, offering a clear picture of their tax obligations and financial health.

Tax records in Monmouth County are crucial for several reasons:

- Compliance with Tax Laws: Accurate tax records ensure that individuals and businesses meet their legal obligations under state and federal tax laws. Failure to maintain proper records can result in penalties, fines, and even legal repercussions.

- Financial Planning: Tax records provide a historical perspective on an entity's financial performance. They help in assessing income trends, identifying areas for cost reduction, and making informed decisions for future financial strategies.

- Business Operations: For businesses, tax records are essential for managing cash flow, budgeting, and making strategic decisions. They provide insights into revenue streams, expenses, and tax liabilities, enabling efficient resource allocation.

- Real Estate Transactions: Tax records are vital in real estate dealings. They offer information on property values, tax assessments, and historical ownership, aiding buyers, sellers, and investors in making well-informed decisions.

- Community Development: Tax records contribute to the overall development of Monmouth County. They provide data for economic planning, infrastructure projects, and community initiatives, ensuring sustainable growth and a high quality of life for residents.

Accessing and Understanding Tax Records in Monmouth County

Monmouth County has implemented a user-friendly system for accessing tax records, making it convenient for residents and businesses to retrieve the information they need. The Monmouth County Tax Records Portal, accessible online, serves as a centralized platform for various tax-related services.

Key features of the Tax Records Portal include:

- Property Tax Records: Residents and property owners can access detailed property tax records, including assessed values, tax rates, and payment history. This information is vital for budgeting and understanding tax obligations.

- Business Tax Records: Businesses operating in Monmouth County can retrieve their tax records, including income tax filings, sales tax reports, and payroll tax information. This data aids in financial planning and compliance.

- Historical Tax Data: The portal offers access to historical tax records, providing a comprehensive view of an entity's financial history. This feature is particularly beneficial for long-term financial analysis and strategic planning.

- Tax Calendar and Reminders: The portal includes a tax calendar, ensuring residents and businesses stay informed about important tax deadlines. It also provides reminder notifications, reducing the risk of late payments and penalties.

- Online Payment Options: For added convenience, the portal offers secure online payment options for various taxes, including property taxes, business taxes, and other applicable fees.

Navigating the Monmouth County Tax Records Portal

Accessing tax records through the Monmouth County Tax Records Portal is a straightforward process. Here's a step-by-step guide:

- Visit the Portal: Navigate to the official Monmouth County website and locate the Tax Records Portal link. Alternatively, you can directly access the portal using the URL provided on the county's website.

- Registration (if required): Depending on your needs, you may need to register for an account. This step is usually necessary for accessing detailed tax records and utilizing all the portal's features.

- Login: If you have an account, log in using your credentials. If not, proceed to the guest access option to retrieve basic tax information.

- Select Record Type: Choose the type of tax record you require, such as property tax, business tax, or historical records. Each category provides specific options for further refinement.

- Enter Search Criteria: Provide the necessary details to locate the desired tax record. This may include property address, business name, or tax ID.

- Review and Download: Once the search is complete, review the tax record details. You can download the record for future reference or print it for immediate use.

The Monmouth County Tax Records Portal is designed with user experience in mind, offering a seamless and intuitive interface. However, for any assistance or further guidance, the county's tax office provides dedicated support, ensuring a positive experience for all users.

Case Study: The Impact of Tax Records on Business Decisions

To illustrate the practical application of tax records, let’s consider a case study involving a local business, EcoTech Solutions, an innovative renewable energy company based in Monmouth County.

EcoTech Solutions has been operating in the county for over a decade, providing sustainable energy solutions to residential and commercial clients. As the company expanded, its leadership team recognized the need for a more strategic approach to financial management, and tax records played a pivotal role in this transformation.

By analyzing their tax records, EcoTech Solutions gained valuable insights into their financial performance. They identified trends in revenue growth, assessed the impact of various tax policies, and optimized their tax strategies. This data-driven approach enabled them to make informed decisions, such as:

- Expanding Operations: Tax records revealed a steady increase in revenue, prompting EcoTech Solutions to expand their operations by opening a new office in a nearby town. This strategic move allowed them to tap into a larger market and increase their customer base.

- Tax Incentive Utilization: Through careful examination of tax records, the company identified applicable tax incentives and credits for their industry. They leveraged these incentives to reduce their tax liability, reinvesting the savings into research and development for new products.

- Cost-Saving Measures: By reviewing historical tax data, EcoTech Solutions identified areas where they could reduce expenses. They optimized their procurement processes, negotiated better terms with suppliers, and streamlined their operational costs, resulting in significant savings.

- Financial Forecasting: With access to detailed tax records, the company's finance team could create accurate financial forecasts. This enabled them to secure favorable loan terms and investor support for future projects, ensuring sustainable growth.

The case of EcoTech Solutions highlights the transformative power of tax records. By utilizing these records effectively, businesses can make data-driven decisions, optimize their financial strategies, and drive sustainable growth.

Future Implications and Technological Advancements

As technology continues to evolve, the landscape of tax record-keeping and accessibility is poised for significant advancements. Monmouth County, being at the forefront of digital transformation, is well-positioned to leverage these innovations for the benefit of its residents and businesses.

Here’s a glimpse into the future of tax records in Monmouth County:

- Blockchain Technology: The implementation of blockchain technology can enhance the security and transparency of tax records. By storing tax data on a decentralized ledger, the integrity of records can be ensured, reducing the risk of fraud and errors.

- Artificial Intelligence (AI): AI-powered systems can analyze tax records with unparalleled efficiency and accuracy. These systems can identify patterns, predict tax obligations, and provide personalized recommendations, simplifying the tax management process.

- Real-Time Data Integration: The integration of real-time data sources, such as point-of-sale systems and accounting software, can provide up-to-date tax records. This ensures that financial information is always current, aiding in timely decision-making.

- Enhanced Security Measures: With the increasing sophistication of cyber threats, Monmouth County is committed to implementing advanced security protocols to protect tax records. This includes encryption, multi-factor authentication, and regular security audits.

- Community Engagement: The county aims to foster a culture of financial literacy and engagement. Educational initiatives and community workshops can empower residents to understand their tax obligations and utilize tax records effectively, leading to better financial management.

FAQs

What are the key benefits of accessing tax records in Monmouth County?

+

Accessing tax records provides benefits such as ensuring compliance with tax laws, aiding in financial planning and budgeting, and offering valuable insights for business decisions. It also facilitates real estate transactions and supports community development initiatives.

How can I access my property tax records in Monmouth County?

+

To access your property tax records, you can visit the Monmouth County Tax Records Portal online. Log in or register for an account, then select “Property Tax Records” and enter your property address or tax ID. You can then review and download the records.

Are there any fees associated with accessing tax records online?

+

Accessing tax records through the Monmouth County Tax Records Portal is generally free of charge. However, certain services, such as expedited record requests or certified copies, may incur nominal fees to cover administrative costs.

Can I access historical tax records for research purposes?

+

Yes, the Monmouth County Tax Records Portal provides access to historical tax records. This feature is particularly useful for researchers, analysts, and individuals seeking a comprehensive understanding of financial trends and historical data.

What support is available if I encounter difficulties accessing tax records?

+

If you face any issues while accessing tax records, Monmouth County’s tax office provides dedicated support. You can reach out to their team via phone, email, or in-person visits for assistance and guidance.