When Will No Tax On Overtime Start

The concept of no tax on overtime has gained traction in recent years, particularly in discussions surrounding labor rights, economic incentives, and work-life balance. While there are proponents advocating for such a change, it's important to delve into the complexities and implications of this proposal. This article aims to explore the factors influencing the potential implementation of a no-tax policy on overtime, providing a comprehensive analysis of its feasibility and impact.

Understanding Overtime Tax Policies

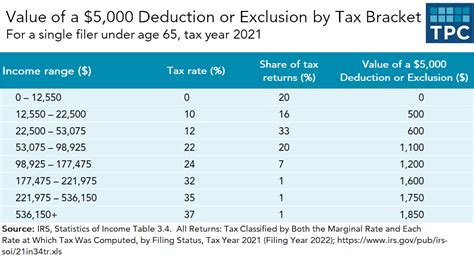

Overtime tax policies vary widely across different countries and jurisdictions, reflecting unique economic, social, and cultural considerations. In many regions, overtime work is subject to additional taxation, often at a higher rate than regular earnings. This serves multiple purposes, including discouraging excessive working hours, promoting a balanced lifestyle, and generating additional revenue for governments.

However, there is a growing discourse advocating for the elimination of overtime tax. Proponents argue that removing this tax burden can incentivize employees to work longer hours, leading to increased productivity and economic growth. They suggest that the potential benefits, such as higher disposable income for workers and enhanced business competitiveness, outweigh the concerns of potential overwork and reduced tax revenue.

Factors Influencing the Timeline

The question of when a no-tax policy on overtime might be implemented is multifaceted and dependent on several key factors. Here’s an in-depth exploration of these aspects:

Economic Conditions and Priorities

The state of the economy plays a pivotal role in shaping tax policies. During economic downturns or recessions, governments often prioritize measures to stimulate growth and employment. In such scenarios, removing the tax on overtime could be seen as a strategy to encourage businesses to expand operations and create more job opportunities. Conversely, in periods of economic prosperity, governments might focus on other priorities, such as social welfare programs or infrastructure development, which could take precedence over tax reforms.

Economic conditions also influence public sentiment and political will. When unemployment rates are high, the focus might shift towards protecting jobs and ensuring workers' rights, potentially slowing down the adoption of a no-tax policy on overtime. On the other hand, in a robust job market, there might be more openness to exploring innovative tax structures.

Political Landscape and Legislative Processes

The political climate and legislative procedures within a country significantly impact the timeline for implementing tax reforms. In some regions, tax policy changes require extensive public consultations, rigorous legislative processes, and potential amendments to existing laws. This can prolong the timeline, especially if there are competing priorities or significant opposition from certain sectors.

Political ideologies and party platforms also come into play. Parties advocating for a smaller government and reduced taxation might be more inclined to support a no-tax policy on overtime. Conversely, those prioritizing social welfare and equitable distribution of wealth might view such a policy as a potential threat to workers' rights and tax revenue.

Labor Market Dynamics

The state of the labor market is a critical factor. In industries facing skilled labor shortages, removing the tax on overtime could be an attractive incentive to retain and attract talent. However, in sectors with a surplus of labor or where overtime is already prevalent, the impact might be less significant. Understanding the unique dynamics of different industries and occupations is essential for gauging the potential effects of a no-tax policy.

Labor unions and worker advocacy groups also play a crucial role. Their support or opposition can significantly influence the trajectory of policy discussions. If unions perceive a no-tax policy as a threat to workers' rights or as a means to exploit employees, they might actively campaign against it, potentially delaying or altering the implementation timeline.

International Precedents and Best Practices

Examining how other countries have approached overtime tax policies can provide valuable insights. Some nations have implemented innovative models, such as progressive overtime tax structures or tax-free thresholds for overtime earnings. Studying these precedents can inform policy decisions and help identify potential pitfalls or successful strategies.

However, it's essential to recognize that each country's economic, social, and cultural context is unique. What works in one region might not translate seamlessly to another. Therefore, while international precedents can offer guidance, they should be carefully adapted to align with local circumstances.

Potential Impact and Considerations

The implementation of a no-tax policy on overtime could have far-reaching consequences, both positive and negative. Here’s a comprehensive overview of the potential impacts:

Economic Growth and Productivity

Advocates of a no-tax policy argue that removing the tax burden on overtime can stimulate economic growth. With higher disposable income, workers might be more inclined to spend, boosting consumer demand and economic activity. Additionally, businesses could benefit from increased productivity and competitiveness, especially in industries where overtime is common.

However, it's crucial to consider the potential downside. Excessive overtime can lead to burnout, reduced productivity over the long term, and negative impacts on workers' health and well-being. Balancing the incentive for increased productivity with measures to protect workers' rights and health is essential.

Revenue Generation and Government Expenditure

Removing the tax on overtime would undoubtedly impact government revenue. Overtime earnings often contribute significantly to tax collections, especially in sectors with high overtime rates. Governments would need to carefully evaluate the potential revenue loss and consider alternative sources to maintain fiscal stability.

On the expenditure side, a no-tax policy might lead to increased demand for social welfare programs, such as healthcare and unemployment benefits, as workers could face higher risks of burnout and related health issues. Balancing the potential loss in tax revenue with the need for robust social safety nets is a complex task.

Worker Welfare and Rights

The well-being of workers is a central concern in discussions surrounding overtime policies. While a no-tax policy might provide short-term benefits to workers in terms of higher take-home pay, it could also lead to potential exploitation if not accompanied by robust labor regulations.

Ensuring that workers are protected from excessive overtime, have adequate rest periods, and are not subjected to unfair working conditions is essential. Balancing the incentives for increased productivity with measures to safeguard workers' rights and health is a delicate task that requires careful policy formulation.

Industry-Specific Impacts

The impact of a no-tax policy on overtime is likely to vary significantly across industries. In sectors where overtime is already prevalent and considered a standard practice, the policy might have limited effect. However, in industries with a culture of avoiding overtime or where skilled labor is in high demand, the incentive to work longer hours could be substantial.

Understanding the unique dynamics of each industry is crucial for policymakers. Targeted approaches, such as industry-specific tax structures or incentives, might be more effective than a blanket no-tax policy. This would ensure that the benefits are distributed equitably and that potential negative impacts are minimized.

A Comprehensive Approach

Implementing a no-tax policy on overtime is a complex endeavor that requires a holistic approach. It involves careful consideration of economic, social, and political factors, as well as a deep understanding of industry-specific dynamics. Here’s a proposed strategy for a comprehensive and effective implementation process:

Step 1: Comprehensive Impact Assessment

Conduct a thorough analysis of the potential impacts on various stakeholders, including workers, businesses, and the government. This assessment should cover economic, social, and health-related aspects. By understanding the full spectrum of effects, policymakers can make informed decisions and develop targeted strategies.

Step 2: Stakeholder Engagement

Engage with a diverse range of stakeholders, including labor unions, business associations, and industry experts. Seek their insights and feedback on the potential policy. This collaborative approach can help identify potential challenges and develop solutions that align with the interests of all parties involved.

Step 3: Progressive Tax Structure

Instead of a blanket no-tax policy, consider implementing a progressive tax structure for overtime earnings. This approach acknowledges the need for incentives while also considering the potential negative impacts. For instance, a reduced tax rate for a certain threshold of overtime hours, followed by a higher rate for excessive overtime, could encourage productivity while protecting workers’ rights.

Step 4: Labor Regulations and Worker Protection

Strengthen labor regulations to ensure that workers are not subjected to excessive overtime or unfair working conditions. Implement measures to guarantee adequate rest periods, fair compensation, and a healthy work-life balance. This can include setting maximum overtime hours, mandating rest days, and providing access to healthcare and mental health support.

Step 5: Industry-Specific Strategies

Develop industry-specific strategies to address unique challenges and opportunities. Some industries might benefit more from targeted incentives, while others might require stricter regulations. For instance, in sectors facing labor shortages, offering tax incentives for overtime might be more effective than a blanket policy.

Step 6: Public Education and Awareness

Launch public awareness campaigns to educate workers, employers, and the general public about the new policy. Explain the benefits, potential risks, and the importance of maintaining a healthy work-life balance. This can help mitigate potential misunderstandings and ensure that the policy is implemented effectively.

Step 7: Continuous Evaluation and Adjustment

Establish mechanisms for continuous evaluation and adjustment of the policy. Monitor its impact on various stakeholders and make necessary modifications to address any unforeseen challenges or to enhance its effectiveness. This iterative approach ensures that the policy remains aligned with the evolving needs of the economy and society.

Future Outlook and Recommendations

The landscape of overtime tax policies is likely to evolve as economies, technologies, and societal expectations change. Here’s a glimpse into the potential future trajectory and recommendations for policymakers:

Embracing Flexibility

As remote work and flexible work arrangements become more prevalent, the traditional concept of “overtime” might need to be redefined. Policies should embrace flexibility, acknowledging that work hours might be less structured and more adaptable. This could involve exploring innovative tax structures that incentivize productivity without penalizing workers for working non-standard hours.

Focus on Worker Well-being

With growing awareness of mental health and well-being, policies should prioritize worker health. This includes not only physical health but also mental and emotional well-being. Policies should aim to create a work environment that supports healthy lifestyles and promotes work-life balance.

Technological Integration

Leverage technological advancements to streamline the implementation and monitoring of overtime policies. Digital platforms and tools can help track work hours accurately, ensure compliance with regulations, and provide real-time data for policymakers to make informed decisions.

International Collaboration

As the global economy becomes increasingly interconnected, there is an opportunity for international collaboration on overtime tax policies. Sharing best practices, learning from each other’s experiences, and harmonizing policies can lead to more effective and equitable outcomes. This collaboration can also help address cross-border challenges related to remote work and digital nomadism.

Regular Review and Adaptation

Tax policies should not be seen as static but rather as living documents that require regular review and adaptation. As economic conditions, technological advancements, and societal expectations evolve, policies must be updated to remain relevant and effective. This ensures that the tax system remains fair, efficient, and aligned with the needs of a dynamic economy.

Conclusion

The question of when a no-tax policy on overtime might be implemented is complex and multifaceted. It involves navigating economic priorities, political landscapes, labor dynamics, and international precedents. While there are compelling arguments for and against such a policy, a comprehensive and balanced approach is essential to ensure that any changes align with the broader goals of economic growth, worker welfare, and societal well-being.

As we move forward, policymakers, economists, and societal leaders must work collaboratively to find innovative solutions that address the challenges of the modern workforce while also promoting economic prosperity and social equity. The journey towards a fair and effective tax system is an ongoing process, and staying adaptable and responsive to changing circumstances is key to success.

How does the current overtime tax policy impact worker motivation and productivity?

+The current overtime tax policy can have both positive and negative effects on worker motivation and productivity. On one hand, it serves as a disincentive for excessive overtime, encouraging a balanced work-life approach. However, in certain industries, it might create a perception of reduced take-home pay, potentially impacting motivation. Balancing tax policies with incentives for overtime productivity could be a strategic approach.

What are the potential challenges in implementing a no-tax policy on overtime?

+Implementing a no-tax policy on overtime could face challenges such as potential revenue loss for governments, concerns over worker exploitation, and the need for robust labor regulations to protect worker rights. Balancing incentives with protections is crucial to ensure a fair and effective policy.

How can governments ensure worker protection under a no-tax policy on overtime?

+Governments can implement robust labor regulations, including maximum overtime hours, mandatory rest periods, and access to healthcare and mental health support. By setting clear standards and enforcing them, governments can protect workers from exploitation while allowing for increased productivity.