Collin County Property Tax Search

Welcome to the comprehensive guide on Collin County Property Tax Search. This expert-level journal article aims to provide an in-depth analysis of the process, offering valuable insights and practical tips for those navigating the world of property taxes. With Collin County being a prominent region in Texas, understanding its property tax landscape is essential for homeowners, investors, and anyone interested in the local real estate market.

Exploring the Collin County Property Tax Ecosystem

Collin County, located in the northeastern part of Texas, is renowned for its vibrant communities, thriving economy, and rapidly growing population. As a result, the property tax system plays a vital role in the county’s overall financial structure. Property taxes in Collin County are assessed and collected annually, contributing significantly to the funding of local government services, schools, and infrastructure.

The property tax search process in Collin County involves accessing public records to obtain information about a specific property's tax assessment, exemptions, and payment history. This transparent system ensures that property owners have access to accurate and up-to-date data, fostering trust and accountability within the community.

Key Components of the Property Tax Search

When conducting a property tax search in Collin County, several critical components come into play. These include:

- Property Appraisal Records: These records provide detailed information about a property's assessed value, improvements, and any applicable exemptions. The appraisal district is responsible for maintaining and updating these records, ensuring their accuracy and accessibility.

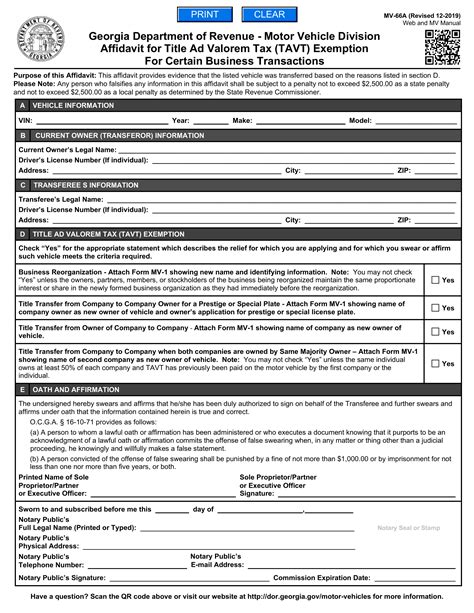

- Tax Rates and Assessments: Collin County, like other Texas counties, operates with a system of ad valorem taxation. This means that property taxes are calculated based on the property's appraised value. The tax rates are set annually by the various taxing entities, including the county, cities, school districts, and special districts.

- Payment History and Due Dates: Property tax search results also include information on the property's tax payment history. Homeowners can quickly access details about the current tax year's assessment, due dates, and any outstanding balances. This transparency helps property owners stay on top of their financial obligations and plan their budgets accordingly.

By understanding these key components, individuals can navigate the property tax search process with confidence, ensuring they have the necessary information to make informed decisions regarding their real estate investments and financial planning.

Online Property Tax Search Tools

In today’s digital age, Collin County offers convenient online platforms for property tax searches. These user-friendly tools provide quick access to vital property tax information, saving time and effort for residents and investors alike. Here’s an overview of the online property tax search tools available in Collin County:

| Tool Name | Description |

|---|---|

| Collin Central Appraisal District (CCAD) | The official website of CCAD provides an online search portal where property owners and the public can access appraisal records, tax rates, and other essential property information. Users can search by property address, account number, or even perform an advanced search based on specific criteria. |

| Collin County Tax Office | The Collin County Tax Office maintains an online property tax database, allowing taxpayers to look up their account information, view tax bills, and make online payments. This platform ensures convenience and efficiency for taxpayers, especially during tax season. |

| Third-Party Property Search Platforms | Several third-party websites and applications offer property search services, including tax information. These platforms aggregate data from various sources, providing users with comprehensive property profiles. While not official sources, these tools can be valuable for quick reference and initial research. |

Utilizing these online tools not only simplifies the property tax search process but also empowers individuals with timely and accurate information, contributing to a more transparent and efficient real estate market in Collin County.

Step-by-Step Guide: Conducting a Property Tax Search in Collin County

Now, let’s delve into a detailed, step-by-step guide on how to conduct a property tax search in Collin County. By following these instructions, you’ll be able to efficiently navigate the process and obtain the information you need.

Step 1: Identify Your Property

Before beginning your property tax search, it’s crucial to have the correct property information. Gather the following details:

- Property Address: Ensure you have the exact street address, including the city and zip code.

- Account Number: If you have access to the property's account number, it can streamline the search process.

- Legal Description: This includes the lot number, block number, and any other unique identifiers for the property.

Step 2: Access the Official Collin County Property Tax Search Portal

The Collin Central Appraisal District (CCAD) maintains an official property tax search portal. This is the primary source for accurate and up-to-date property tax information. Follow these steps to access the portal:

- Visit the CCAD website: Go to the official CCAD website, which serves as the gateway to various property-related services.

- Navigate to the Property Search Section: Look for the "Property Search" or "Tax Search" link on the homepage. This section will provide access to the online search tool.

- Select the Search Option: Choose the appropriate search method based on your available information. You can search by address, account number, or use the advanced search feature for more specific queries.

Step 3: Enter Property Details and Submit the Search

Once you’ve selected the search option, enter the property details accurately. Double-check the information to ensure precision. Click the “Submit” or “Search” button to initiate the query.

Step 4: Review the Search Results

After submitting your search, the portal will display the property’s tax information. Here’s what you can expect to find:

- Property Details: Basic information about the property, including the address, legal description, and ownership details.

- Appraisal Records: Access the property's appraisal history, including the assessed value, improvements, and any applicable exemptions.

- Tax Rates: View the current tax rates set by the various taxing entities, such as the county, cities, and school districts.

- Payment History: Check the property's tax payment history, including due dates, amounts paid, and any outstanding balances.

Step 5: Download and Save Relevant Documents

Most property tax search portals allow users to download and save important documents. This includes appraisal records, tax statements, and other relevant files. Ensure you download and save these documents for future reference.

Step 6: Understand the Information and Take Action

Take the time to thoroughly review the property tax information you’ve obtained. Compare the assessed value with recent sales in the area to ensure accuracy. If you have any questions or concerns, reach out to the CCAD or the Collin County Tax Office for clarification.

Understanding Property Tax Exemptions and Discounts in Collin County

Collin County offers various property tax exemptions and discounts to eligible homeowners, helping them reduce their tax burden. Understanding these exemptions is crucial for maximizing tax savings. Here’s an overview of the key exemptions available in Collin County:

Homestead Exemptions

The Homestead Exemption is one of the most significant tax benefits for homeowners in Collin County. It reduces the appraised value of a property used as the homeowner’s primary residence. To qualify, homeowners must meet certain residency and ownership requirements. The exemption amounts vary based on the homeowner’s age, disability status, and other factors.

Over-65 Homestead Exemption

Homeowners aged 65 or older who meet specific income and residency criteria can benefit from the Over-65 Homestead Exemption. This exemption freezes the property’s appraised value at the time of qualification, ensuring that the tax burden doesn’t increase due to rising property values.

Disabled Veteran Exemption

Collin County offers an exemption for qualifying disabled veterans. This exemption reduces the taxable value of a veteran’s primary residence, providing financial relief to those who have served our country. The amount of the exemption depends on the degree of disability.

Other Exemptions and Discounts

Collin County provides additional exemptions and discounts for various categories, including:

- Residential care facilities

- Charitable organizations

- Religious organizations

- Certain agricultural properties

- Historical landmarks

It's essential to review the specific criteria and qualifications for each exemption to determine eligibility. Consulting with a tax professional or the Collin County Appraisal District can provide further guidance on applying for these exemptions.

Challenging Property Tax Assessments: A Step-by-Step Guide

In some cases, homeowners may believe that their property’s assessed value is higher than it should be. If you find yourself in this situation, it’s essential to know how to challenge the assessment and potentially reduce your property taxes. Here’s a comprehensive guide on challenging property tax assessments in Collin County:

Step 1: Gather Evidence and Compare Values

Before initiating a challenge, collect evidence to support your claim. Compare your property’s assessed value with recent sales of similar properties in your area. Look for properties with similar features, square footage, and location. Ensure that the sales you reference are within a reasonable timeframe.

Step 2: Review the Appraisal Process

Familiarize yourself with the property appraisal process in Collin County. Understand how the appraisal district determines property values, including the methods and data sources they use. This knowledge will help you identify potential areas where your property’s value may have been overestimated.

Step 3: Contact the Appraisal District

Reach out to the Collin Central Appraisal District (CCAD) to discuss your concerns. Explain your reasons for believing that the assessed value is incorrect. The CCAD staff can provide guidance on the next steps and inform you about the formal protest process.

Step 4: File a Protest

If you and the CCAD cannot reach an agreement, you have the right to file a formal protest. Follow these steps to initiate the protest process:

- Obtain a Protest Form: Download the protest form from the CCAD website or request one from their office.

- Complete the Form: Provide all the required information, including your contact details, property address, and reasons for the protest. Support your claim with evidence, such as recent sales data or professional appraisals.

- Submit the Form: Submit the completed protest form to the CCAD within the designated deadline. Ensure you have a copy for your records.

Step 5: Attend the Hearing

After submitting your protest, you’ll receive a hearing date and time. Attend the hearing, where you’ll have the opportunity to present your case to an Appraisal Review Board (ARB). Prepare a clear and concise presentation, highlighting the reasons why you believe the assessed value should be lowered.

Step 6: Receive the ARB’s Decision

Following the hearing, the ARB will make a decision on your protest. You’ll receive written notification of their ruling, which may include a change in the assessed value or a confirmation of the original assessment. If you disagree with the ARB’s decision, you have the option to appeal to district court.

Future Outlook: Trends and Changes in Collin County Property Taxes

As we look ahead, it’s essential to consider the future trends and potential changes in the Collin County property tax landscape. Here’s an analysis of what we can expect in the coming years:

Population Growth and Development

Collin County has experienced significant population growth over the past decade, and this trend is expected to continue. As the county’s population expands, so does the demand for housing and infrastructure. This growth often leads to increased property values, which can result in higher tax assessments. However, the county’s proactive planning and development strategies aim to manage this growth sustainably, ensuring a balanced approach to taxation.

Economic Factors

The local economy plays a crucial role in determining property tax rates. Collin County’s diverse economy, driven by industries such as technology, healthcare, and education, has contributed to its financial stability. However, economic fluctuations can impact tax revenues. The county’s leadership will need to navigate potential economic challenges while maintaining a fair and consistent tax structure.

Tax Reform and Legislative Changes

State and local governments periodically review and update tax laws and regulations. Collin County, like other Texas counties, may experience changes in tax policies, including potential reforms to the property tax system. Staying informed about these legislative changes is essential for homeowners and investors to understand how they might affect their tax obligations.

Community Engagement and Transparency

Collin County has a strong commitment to community engagement and transparency in its property tax processes. This includes regular town hall meetings, online resources, and outreach initiatives. By actively involving residents in discussions about property taxes, the county can ensure that the tax system remains fair, efficient, and responsive to the needs of the community.

Conclusion: Empowering Property Owners with Knowledge

In conclusion, this comprehensive guide on the Collin County Property Tax Search aims to empower property owners and investors with the knowledge and tools they need to navigate the property tax landscape effectively. By understanding the process, utilizing online resources, and staying informed about exemptions and challenges, individuals can make informed decisions regarding their real estate investments and tax obligations.

As Collin County continues to thrive and evolve, staying engaged and proactive in matters related to property taxes is essential. This journal article serves as a valuable resource, offering expert insights and practical guidance to ensure a transparent and equitable tax system for all residents.

How often are property taxes assessed in Collin County?

+Property taxes in Collin County are assessed annually. The appraisal district evaluates properties each year to determine their current market value, which forms the basis for tax calculations.

Can I pay my property taxes online in Collin County?

+Yes, Collin County offers convenient online payment options. You can access the Collin County Tax Office website to make secure online payments for your property taxes.

What is the deadline for filing property tax protests in Collin County?

+The deadline for filing property tax protests varies each year. It’s essential to check the official website of the Collin Central Appraisal District (CCAD) for the specific protest deadline for the current tax year.

Are there any property tax exemptions for military veterans in Collin County?

+Yes, Collin County offers property tax exemptions for qualifying military veterans. The Disabled Veteran Exemption reduces the taxable value of a veteran’s primary residence based on their degree of disability.