Tax Lawyer Los Angeles

Welcome to an in-depth exploration of the world of tax law in Los Angeles, California. In this comprehensive guide, we delve into the intricate realm of tax law practice, offering a unique insight into the legal landscape of one of the most dynamic and diverse cities in the United States. Los Angeles, known for its entertainment industry, diverse population, and complex business ecosystem, presents a unique set of challenges and opportunities for tax lawyers. This article aims to shed light on the crucial role these legal professionals play in navigating the city's tax landscape and the strategies they employ to assist individuals and businesses in optimizing their tax positions while ensuring compliance with the law.

The Role of a Tax Lawyer in Los Angeles

A Tax Lawyer in Los Angeles serves as a crucial legal advisor and advocate, specializing in the complex and ever-evolving field of taxation. Their expertise lies in interpreting and applying federal, state, and local tax laws, regulations, and rulings to assist clients in navigating the intricate web of tax obligations and opportunities.

The role extends beyond mere compliance. Tax lawyers are often engaged in strategic tax planning, helping clients structure their financial affairs to minimize tax liabilities while remaining within the legal boundaries. This involves a deep understanding of the client's financial situation, business objectives, and personal goals, allowing the lawyer to provide tailored advice and solutions.

In Los Angeles, with its diverse economy and population, tax lawyers are particularly adept at addressing the unique tax challenges presented by the entertainment industry, high-net-worth individuals, startups, and multinational corporations. They are often called upon to advise on international tax matters, estate planning, business transactions, and tax disputes, ensuring that their clients' financial interests are protected and optimized.

Key Responsibilities and Services:

- Tax Planning: Developing strategies to minimize tax liabilities for individuals and businesses, including advice on investment structures, business formations, and estate planning.

- Compliance and Filing: Ensuring accurate and timely tax return preparation and filing, including income taxes, property taxes, sales taxes, and payroll taxes.

- Tax Dispute Resolution: Representing clients in tax audits, appeals, and litigation, negotiating with the IRS or state tax authorities to resolve disputes and minimize penalties.

- Business Transactions: Providing tax advice during mergers, acquisitions, and other business transactions to ensure optimal tax outcomes.

- Estate and Gift Tax Planning: Helping clients plan and structure their estates to minimize tax liabilities upon transfer or inheritance.

- International Tax Matters: Advising on cross-border transactions, expatriate tax issues, and foreign investment structures.

| Area of Expertise | Specific Services |

|---|---|

| Individual Tax Planning | Investment advice, retirement planning, tax-efficient strategies for income and capital gains. |

| Business Tax Law | Entity selection, structuring transactions for tax efficiency, tax incentives, and credits. |

| Tax Controversy | Representing clients in tax court, negotiating with tax authorities, and handling tax debt resolution. |

| Estate and Trust Taxation | Estate planning, generation-skipping transfer tax, and fiduciary tax compliance. |

The Tax Landscape of Los Angeles

Los Angeles, with its vibrant economy and diverse population, presents a unique and dynamic tax landscape. The city’s tax environment is shaped by a complex interplay of federal, state, and local tax laws, regulations, and policies, which tax lawyers must navigate with precision and expertise.

Key Tax Considerations in Los Angeles:

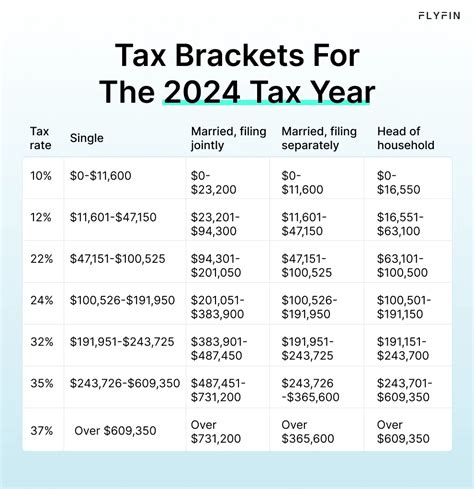

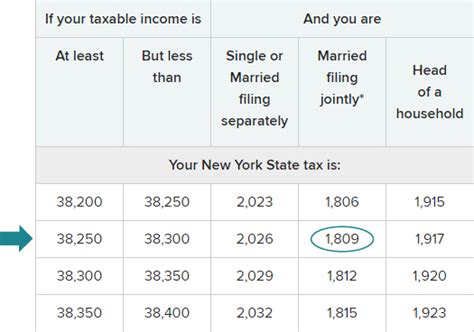

- Income Tax: California has a progressive income tax system, with seven tax brackets ranging from 1% to 12.3%. Los Angeles County also imposes an additional local income tax, varying from 0.65% to 3.55%.

- Sales and Use Tax: The city of Los Angeles has a sales tax rate of 9.5%, which includes the state sales tax of 7.25% and additional local taxes. Use tax applies to goods purchased outside of Los Angeles and brought into the city for use.

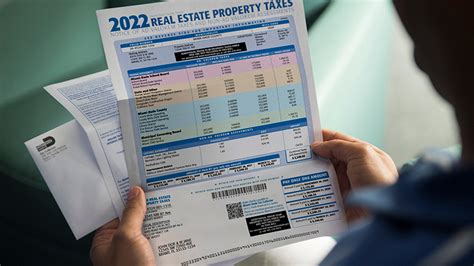

- Property Tax: Property taxes in Los Angeles are based on the assessed value of real property and are subject to Proposition 13, which limits annual increases to no more than 2% unless there is a change in ownership.

- Estate and Gift Tax: California has its own estate tax, separate from the federal estate tax, with a lower exemption amount. Gift taxes are also applicable, although California does not have its own gift tax law.

- Business Taxes: Los Angeles County imposes a Business Tax on businesses operating within the county. The tax is based on gross receipts and is collected annually.

Tax Incentives and Programs:

Los Angeles, like many other jurisdictions, offers a range of tax incentives and programs aimed at attracting and supporting businesses and individuals. These include:

- Enterprise Zones: Areas designated to promote economic development, offering tax incentives for businesses that operate within these zones.

- Film and Television Tax Credits: Incentives for film and television productions to encourage production in Los Angeles.

- Research and Development Tax Credits: Credits available for businesses engaged in research and development activities.

- Low-Income Housing Tax Credits: Programs to encourage the development of affordable housing.

The Tax Lawyer’s Toolkit: Strategies and Techniques

Tax lawyers in Los Angeles employ a variety of strategies and techniques to help their clients navigate the complex tax landscape. These professionals are adept at identifying opportunities for tax savings, optimizing tax positions, and ensuring compliance with the law.

Key Strategies and Techniques:

- Entity Selection and Structuring: Choosing the right business entity (sole proprietorship, partnership, corporation, LLC, etc.) and structuring it in a way that minimizes tax liabilities and maximizes benefits.

- Tax-Efficient Investment Strategies: Advising clients on investment structures and strategies that optimize tax outcomes, such as tax-advantaged retirement accounts, tax-free bonds, and capital gains planning.

- Tax Incentive Utilization: Identifying and leveraging applicable tax incentives, credits, and deductions to reduce tax liabilities.

- Estate Planning: Utilizing estate planning tools like trusts, gifting strategies, and life insurance to minimize estate and gift taxes.

- Tax Controversy Management: Representing clients in tax audits, appeals, and litigation, negotiating with tax authorities to resolve disputes and minimize penalties.

| Strategy | Description |

|---|---|

| Cost Segregation | A strategy used to accelerate depreciation deductions by reclassifying certain assets as personal property or land improvements, which can reduce current tax liabilities. |

| Like-Kind Exchanges | Also known as 1031 exchanges, these allow for the deferral of capital gains taxes on the sale of an investment property by reinvesting the proceeds into a "like-kind" replacement property. |

| Captive Insurance Companies | A strategy where a business creates its own insurance company to provide coverage for its unique risks, which can offer tax advantages and potential cost savings. |

The Impact of Tax Law on Los Angeles Businesses and Residents

The practice of tax law in Los Angeles has a profound impact on the city’s businesses and residents. Tax lawyers play a critical role in ensuring that individuals and businesses are able to thrive within the complex tax environment, offering strategic advice and guidance to optimize their financial positions.

Benefits to Individuals and Businesses:

- Tax Planning: Tax lawyers help individuals and businesses develop tax-efficient strategies, ensuring that their financial affairs are structured to minimize tax liabilities.

- Compliance and Peace of Mind: With the guidance of a tax lawyer, clients can rest assured that they are meeting their tax obligations, avoiding penalties, and reducing the risk of audits.

- Estate Planning: Tax lawyers assist in planning for the transfer of wealth, ensuring that estates are structured to minimize tax burdens and maximize the inheritance for beneficiaries.

- Business Growth and Expansion: By optimizing tax positions, tax lawyers enable businesses to reinvest more of their profits into growth and expansion, creating jobs and driving the local economy.

Case Study: Impact of Tax Law on a Los Angeles Startup

Consider the case of a technology startup based in Los Angeles. With the guidance of a tax lawyer, the startup was able to structure its business in a way that minimized tax liabilities, allowing it to reinvest more of its profits into research and development. This strategic tax planning not only helped the startup stay competitive but also contributed to its long-term success and growth, creating jobs and driving innovation in the city’s tech sector.

The Future of Tax Law in Los Angeles

The future of tax law in Los Angeles is likely to be shaped by a number of factors, including changes in federal, state, and local tax laws, economic trends, and technological advancements. Tax lawyers will need to stay abreast of these developments to continue providing effective and innovative solutions to their clients.

Potential Future Developments:

- Tax Reform: Potential changes in federal tax laws could have a significant impact on tax practices in Los Angeles, requiring tax lawyers to adapt their strategies and advice.

- Technological Advances: The increasing use of technology in tax preparation and compliance, such as blockchain for cryptocurrency tax reporting, will require tax lawyers to stay updated on these developments.

- Economic Trends: Changes in the local economy, such as shifts in industry focus or growth in specific sectors, may lead to new tax challenges and opportunities.

- International Tax Matters: With the global nature of business, tax lawyers in Los Angeles may see an increase in international tax matters, requiring a deeper understanding of cross-border tax issues.

Staying Informed and Adaptable:

Tax lawyers in Los Angeles will need to maintain a deep understanding of the tax landscape and be prepared to adapt their practices to stay ahead of these potential developments. This may involve ongoing professional development, networking, and collaboration with other professionals to stay informed and offer the most effective advice to their clients.

What qualifications do tax lawyers in Los Angeles typically have?

+Tax lawyers in Los Angeles typically hold a Juris Doctor (J.D.) degree from an accredited law school and have passed the California Bar Exam. Many also possess a Master of Laws (LL.M.) in Taxation, which provides specialized training in tax law. Additionally, tax lawyers often have prior experience working in accounting, finance, or with the IRS, providing them with a well-rounded understanding of tax issues.

How do tax lawyers stay updated with the ever-changing tax laws and regulations?

+Tax lawyers in Los Angeles employ various strategies to stay updated with the complex and dynamic nature of tax laws. This includes regularly attending continuing legal education (CLE) courses and seminars focused on tax law, subscribing to legal databases and newsletters that provide timely updates, and actively participating in tax-focused professional organizations and networks. Many tax lawyers also collaborate with other professionals, such as accountants and financial advisors, to stay informed about industry trends and changes.

What is the average cost of hiring a tax lawyer in Los Angeles?

+The cost of hiring a tax lawyer in Los Angeles can vary widely depending on the complexity of the case, the lawyer’s experience and reputation, and the specific services required. Generally, tax lawyers charge either an hourly rate, which can range from 300 to 800 per hour, or a flat fee for specific services. In some cases, tax lawyers may offer contingency fee arrangements, particularly for tax controversy matters, where the fee is contingent on the outcome of the case.