New York State Tax Lawyer

In the intricate world of taxation, especially within the dynamic landscape of New York State, the role of a tax lawyer becomes crucial. These legal professionals navigate the complex web of tax laws and regulations, offering invaluable guidance and representation to individuals and businesses alike. As we delve into this field, we'll explore the key aspects, challenges, and opportunities that define the practice of a New York State tax lawyer.

The Role and Responsibilities of a New York State Tax Lawyer

A New York State tax lawyer serves as a vital advocate for taxpayers, providing legal expertise and strategic advice on a wide range of tax-related matters. Their practice encompasses a diverse set of responsibilities, from offering compliance guidance to representing clients in tax disputes and litigation.

One of the primary duties is to ensure tax compliance. This involves advising clients on the most favorable tax structures, interpreting complex tax laws and regulations, and ensuring that all tax obligations are met accurately and timely. Tax lawyers also play a crucial role in tax planning, helping clients structure their financial affairs to minimize tax liabilities and maximize benefits.

In cases where taxpayers face disputes with the Internal Revenue Service (IRS) or the New York State Department of Taxation and Finance, tax lawyers step in to provide legal representation. They navigate the often-complicated process of audits, appeals, and litigation, advocating for their clients' rights and interests.

The role extends to various areas, including individual and business taxation, estate planning, international tax law, and more. Tax lawyers may also specialize in specific sectors, such as real estate, healthcare, or technology, where unique tax considerations apply.

Key Skills and Expertise

-

Legal Knowledge and Research: Tax lawyers must have a deep understanding of tax law, including the Internal Revenue Code, Treasury Regulations, and relevant court decisions. They utilize legal research skills to stay updated on evolving tax laws and regulations.

-

Analytical and Problem-Solving Abilities: The ability to analyze complex tax issues, identify potential problems, and develop creative solutions is essential. Tax lawyers often need to think critically and strategically to resolve tax-related disputes.

-

Communication and Negotiation Skills: Effective communication is key, as tax lawyers interact with clients, IRS representatives, and other legal professionals. Strong negotiation skills are advantageous when settling tax disputes or negotiating tax liabilities.

-

Attention to Detail: Precision is paramount in tax law, as even minor errors can have significant consequences. Tax lawyers must pay meticulous attention to detail when preparing tax returns, drafting legal documents, and reviewing tax-related paperwork.

Navigating the Complexities of New York State Taxation

Practicing tax law in New York State presents unique challenges and opportunities due to the state’s diverse tax landscape. New York is known for its progressive tax system, which includes various taxes such as income tax, sales and use tax, estate tax, and more.

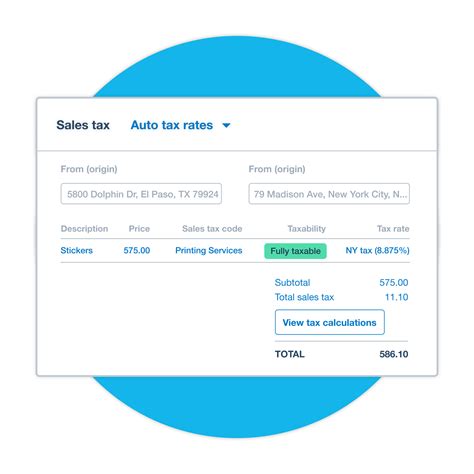

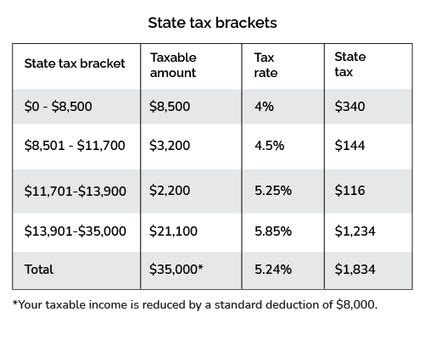

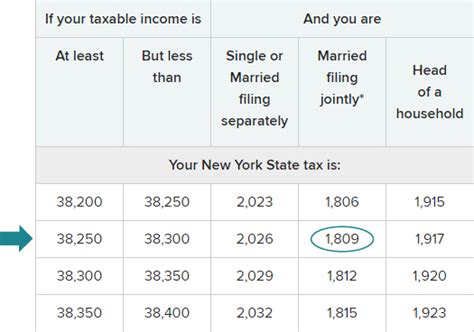

The income tax structure in New York is progressive, with tax rates ranging from 4% to 8.82% for individual taxpayers. Businesses face a corporate income tax rate of 6.5%, while sales and use taxes can vary based on the location and the type of goods or services being sold.

One of the notable complexities is the New York City Unincorporated Business Tax (UBT), which applies to sole proprietors, partnerships, and LLCs doing business in the city. This tax adds an additional layer of complexity for businesses operating in the city.

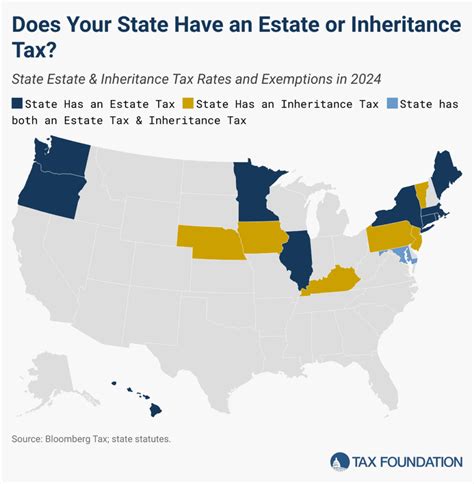

Estate and gift tax planning is another critical area, especially given New York's high estate tax threshold. Tax lawyers assist clients in structuring their estates to minimize tax liabilities and ensure a smooth transfer of assets to beneficiaries.

Special Considerations for New York State Tax Lawyers

-

State and Local Tax Laws: New York’s tax system includes a variety of state and local taxes, each with its own set of rules and regulations. Tax lawyers must stay updated on these laws to provide accurate advice and representation.

-

Compliance with Federal Tax Laws: While focusing on state tax matters, tax lawyers also need to ensure compliance with federal tax laws. This includes understanding the interplay between state and federal tax laws, especially in areas like business taxation and estate planning.

-

New York City Taxes: As mentioned, New York City has its own set of taxes, such as the UBT. Tax lawyers practicing in or around the city must be well-versed in these unique tax requirements.

-

Estate and Gift Tax Planning: With New York’s high estate tax threshold, tax lawyers often play a crucial role in helping clients navigate the complex world of estate planning, ensuring that assets are transferred efficiently and with minimal tax consequences.

The Impact of Tax Law Changes and Policy Updates

The field of tax law is dynamic, and changes in tax policies and regulations can significantly impact the practice of tax lawyers. New York State, like other jurisdictions, experiences frequent updates and amendments to its tax laws, often in response to changing economic conditions, political priorities, and federal tax reforms.

Recent years have seen several significant tax law changes at both the federal and state levels. For instance, the Tax Cuts and Jobs Act (TCJA) of 2017 brought about substantial changes to federal tax laws, impacting individual and corporate tax rates, deductions, and credits. These changes had a ripple effect on state tax laws, as many states, including New York, had to adapt their tax structures to accommodate the federal reforms.

In New York, recent tax law changes include adjustments to income tax brackets, modifications to tax credits and deductions, and the introduction of new tax incentives to promote economic development and support specific industries. These changes present both challenges and opportunities for tax lawyers, as they must stay abreast of these updates to provide accurate advice and representation to their clients.

Key Considerations in Responding to Tax Law Changes

-

Understanding the Impact: Tax lawyers must thoroughly understand the implications of tax law changes on their clients’ tax obligations and strategies. This involves analyzing how new laws affect income tax, sales tax, estate tax, and other relevant areas of taxation.

-

Advising Clients: Based on their understanding of the changes, tax lawyers provide guidance to clients on how to adapt their tax planning and compliance strategies. This may involve restructuring business operations, revising estate plans, or adjusting investment strategies to optimize tax benefits.

-

Compliance and Reporting: With tax law changes, compliance requirements may also evolve. Tax lawyers assist clients in ensuring they meet the new reporting standards and avoid potential penalties for non-compliance.

-

Representing Clients in Disputes: In cases where tax law changes lead to disputes with tax authorities, tax lawyers represent their clients in negotiations, audits, and litigation. They advocate for their clients’ rights and interests, ensuring fair treatment under the new tax regime.

The Future of Tax Law Practice in New York State

Looking ahead, the practice of tax law in New York State is expected to continue evolving in response to economic, technological, and political shifts. Here are some key trends and considerations for the future of tax law practice in the state:

Digital Transformation and Tax Technology

The tax industry is experiencing a digital revolution, with an increasing focus on tax technology and automation. Tax lawyers will need to adapt to this digital shift, leveraging technology to enhance efficiency, accuracy, and client service. This includes utilizing tax software, data analytics, and blockchain technology to streamline tax compliance and planning processes.

Economic and Political Influences

Economic conditions and political landscapes will continue to shape tax laws and policies. As New York State navigates economic challenges and opportunities, tax lawyers will play a crucial role in advising clients on how to navigate these shifts. This includes understanding the impact of economic policies on tax obligations and identifying potential tax incentives or challenges associated with specific industries or sectors.

Tax Policy Reform and Simplification

There is an ongoing push for tax policy reform and simplification at both the federal and state levels. Tax lawyers will need to stay updated on these efforts and their potential impact on tax laws. They will also play a role in advocating for their clients’ interests during the reform process, ensuring that any changes are fair and practical.

International Tax Considerations

With the global nature of business, international tax considerations will continue to be relevant for tax lawyers in New York State. This includes staying updated on international tax laws, assisting clients with cross-border transactions and investments, and helping them navigate the complexities of double taxation agreements.

Enhanced Client Service and Education

Tax lawyers will need to focus on providing exceptional client service, including clear and concise communication about complex tax matters. This involves educating clients on tax laws, their rights and obligations, and the potential impacts of tax changes. Building strong client relationships and trust will be crucial in a competitive market.

Conclusion: The Crucial Role of New York State Tax Lawyers

As we’ve explored, the role of a New York State tax lawyer is multifaceted and vital to individuals and businesses navigating the complex tax landscape. From ensuring tax compliance to representing clients in disputes, tax lawyers provide essential legal guidance and strategic advice. In a state with a diverse and progressive tax system, their expertise is invaluable.

As tax laws continue to evolve, tax lawyers must stay at the forefront of these changes, adapting their practices to provide the best possible service. With a focus on legal knowledge, analytical skills, and client-centric approaches, New York State tax lawyers will continue to play a pivotal role in shaping the tax landscape and guiding taxpayers toward compliance and financial success.

What qualifications are required to become a New York State tax lawyer?

+To become a tax lawyer in New York State, you typically need a law degree (Juris Doctor) from an accredited law school. After graduating, you must pass the New York State Bar Exam and obtain a license to practice law in the state. Additionally, gaining experience in tax law, either through internships, clerkships, or working for a tax law firm, is highly beneficial. Some tax lawyers also pursue advanced degrees, such as a Master of Laws (LL.M.) in Taxation, to deepen their expertise in this specialized field.

How do tax lawyers assist individuals with tax planning and compliance?

+Tax lawyers play a crucial role in helping individuals understand and navigate complex tax laws. They provide guidance on tax planning strategies, such as optimizing deductions and credits, structuring investments, and planning for retirement. Tax lawyers also ensure compliance with tax obligations, assist with tax return preparation, and represent individuals in tax audits or disputes with tax authorities.

What challenges do tax lawyers face in the New York State tax landscape?

+Practicing tax law in New York State comes with unique challenges due to the state’s diverse tax system. Tax lawyers must stay updated on a range of taxes, including income tax, sales tax, estate tax, and more. They also navigate the complexities of New York City’s unincorporated business tax. Additionally, keeping up with frequent tax law changes and ensuring compliance with both state and federal tax laws can be demanding.