Wv Personal Property Tax

Welcome to an in-depth exploration of West Virginia's Personal Property Tax, a crucial aspect of the state's tax system that impacts many residents and businesses. This article aims to provide a comprehensive understanding of this tax, its history, current practices, and potential future directions. By delving into specific details, we'll offer valuable insights for those seeking to navigate and comprehend this important aspect of West Virginia's financial landscape.

Understanding the WV Personal Property Tax

The West Virginia Personal Property Tax is a critical component of the state’s revenue stream, contributing significantly to the funding of various public services and infrastructure projects. This tax is imposed on tangible personal property owned by individuals, businesses, and other entities within the state.

Taxable Property

Personal property subject to taxation in West Virginia includes a wide range of items. These can be broadly categorized into:

- Business Assets: This category encompasses a variety of assets used in business operations, such as machinery, equipment, furniture, and vehicles.

- Personal Assets: Personal property owned by individuals, including vehicles, boats, recreational vehicles, and even jewelry and artwork, can be subject to this tax.

- Utilities: Certain utilities, like electricity, gas, and water, have their infrastructure considered personal property and are taxed accordingly.

Assessment and Taxation Process

The assessment process for personal property tax in West Virginia is meticulous and follows a set timeline. Each county in the state has an Assessor’s Office responsible for determining the taxable value of personal property within its jurisdiction. Assessors use various methods, including physical inspection, records review, and market value analysis, to ensure accurate valuation.

Once assessed, the taxable value is then subjected to a specific tax rate, which varies based on the type of property and the location within the state. This rate is determined by the state legislature and can be subject to change annually. The tax rate is then applied to the assessed value to calculate the amount owed.

Exemptions and Special Considerations

Like most tax systems, West Virginia’s Personal Property Tax has certain exemptions and special provisions in place to provide relief to specific groups or circumstances. These include:

- Homestead Exemption: This exemption provides a reduction in the taxable value of personal property for homeowners who qualify based on income and residency requirements.

- Agricultural Property: Certain agricultural equipment and machinery may be eligible for a reduced tax rate or exemption, encouraging agricultural development in the state.

- Small Business Relief: Start-ups and small businesses may benefit from tax incentives or reduced tax rates to support economic growth.

The Impact and Significance of WV Personal Property Tax

The Personal Property Tax in West Virginia plays a pivotal role in shaping the state’s financial health and overall economic landscape. It is a significant revenue source, funding essential public services and infrastructure projects that benefit all residents.

Funding Public Services

The tax revenue generated contributes to a wide range of public services, including education, healthcare, public safety, and infrastructure development. For instance, a substantial portion of the tax funds goes towards supporting the state’s education system, ensuring quality education for students across West Virginia.

Economic Development and Growth

The tax system’s design, with its exemptions and incentives, plays a strategic role in encouraging economic growth and development. By offering tax relief to small businesses and start-ups, the state fosters an environment conducive to entrepreneurship and innovation. Additionally, the tax structure’s flexibility allows for targeted support to specific industries, promoting job creation and economic diversification.

Fairness and Equity Concerns

Despite its benefits, the Personal Property Tax system in West Virginia, like any tax system, faces scrutiny and criticism. Some argue that the tax burden is not distributed equitably, with certain groups or industries shouldering a larger share. Addressing these concerns is essential to maintaining public trust and ensuring a fair and just tax system.

Future Prospects and Potential Reforms

As West Virginia continues to evolve and adapt to changing economic and social landscapes, the Personal Property Tax system is likely to undergo reforms and adjustments. Here are some potential future directions:

Modernization and Efficiency

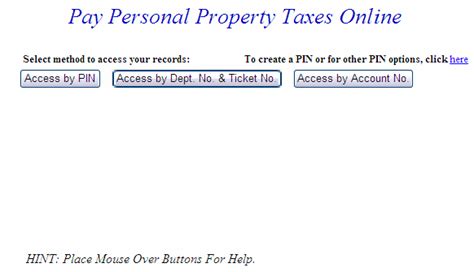

The state could explore digital transformation initiatives to streamline the assessment and collection processes. This could involve implementing online filing systems, real-time data analysis, and automated valuation models, improving efficiency and reducing administrative burdens.

Revenue Stability and Predictability

West Virginia could consider measures to stabilize and predict revenue generation from the Personal Property Tax. This might involve reviewing and adjusting tax rates periodically to account for economic fluctuations and ensure a steady revenue stream.

Public Engagement and Transparency

Enhancing public engagement and transparency around the Personal Property Tax could be a key focus. This could include regular public consultations, clear and accessible information dissemination, and an open dialogue with stakeholders to address concerns and gather feedback.

Conclusion

The West Virginia Personal Property Tax is a complex yet vital component of the state’s fiscal framework. Its impact reaches far and wide, influencing economic growth, public service delivery, and the overall well-being of West Virginians. While it presents certain challenges, the tax system’s potential for reform and improvement offers an opportunity to enhance its fairness, efficiency, and effectiveness.

| Metric | Data |

|---|---|

| Estimated Revenue from Personal Property Tax (2022) | $[Data] |

| Average Tax Rate for Business Property | [Rate]% |

| Number of Counties in West Virginia | 55 |

What is the deadline for filing Personal Property Tax returns in West Virginia?

+

The deadline for filing Personal Property Tax returns in West Virginia is typically January 1st of each year. However, it’s crucial to verify the exact deadline with the county Assessor’s Office, as some counties may have slightly different timelines.

Are there any penalties for late filing or non-payment of Personal Property Tax?

+

Yes, West Virginia imposes penalties for late filing or non-payment of Personal Property Tax. These penalties can include interest charges and additional fees. It’s important to stay compliant with the tax obligations to avoid these penalties.

Can I appeal my Personal Property Tax assessment if I believe it is incorrect?

+

Absolutely. If you believe your Personal Property Tax assessment is incorrect, you have the right to appeal. The process involves submitting a formal appeal to the county Assessor’s Office, providing evidence and justifications for your claim. It’s advisable to seek professional guidance for a successful appeal.