Tax Deductible Car Loan Interest

The concept of tax deductions on car loan interest has gained significant attention among individuals and businesses alike, especially with the evolving tax laws and the ever-changing automotive landscape. Understanding the intricacies of this topic is crucial for anyone considering a car purchase or looking to optimize their tax strategies. This article aims to provide a comprehensive guide to tax-deductible car loan interest, exploring the eligibility criteria, the process of claiming deductions, and the potential benefits and limitations.

Understanding Tax-Deductible Car Loan Interest

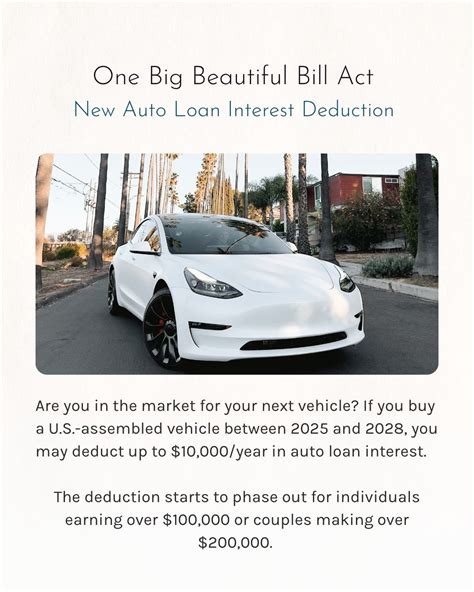

Tax-deductible car loan interest refers to the portion of interest expenses paid on a car loan that can be legally subtracted from an individual’s or business’s taxable income. This deduction reduces the overall tax liability, potentially resulting in substantial savings. However, not all car loans or interest expenses qualify for tax deductions. The Internal Revenue Service (IRS) has specific guidelines and criteria that must be met for an individual or business to claim these deductions.

Eligibility Criteria for Individuals

For individuals, the IRS allows tax deductions on car loan interest under specific circumstances. The primary requirement is that the car must be used for business purposes. This includes individuals who use their vehicles for work-related activities, such as sales representatives, contractors, or individuals who commute to multiple job sites.

Additionally, individuals must maintain accurate records of business mileage and expenses. The IRS accepts various methods for tracking business mileage, such as a mileage log or a mileage tracking app. It's essential to document the business purpose of each trip and maintain a clear separation between personal and business use to ensure eligibility for tax deductions.

| Eligibility Criteria for Individuals |

|---|

| Vehicle Used for Business Purposes |

| Accurate Record-Keeping of Business Mileage and Expenses |

Eligibility Criteria for Businesses

Businesses have a slightly different set of criteria when it comes to tax-deductible car loan interest. The primary requirement is that the vehicle must be used for business purposes, similar to individuals. However, businesses have a broader range of potential deductions, as they can claim expenses related to various aspects of vehicle ownership and operation.

For businesses, the IRS allows deductions for interest expenses on car loans used to purchase or lease vehicles for business use. This includes interest on loans for company cars, vans, trucks, or any other vehicles used primarily for business purposes. Additionally, businesses can deduct other expenses related to vehicle ownership, such as fuel, maintenance, insurance, and depreciation.

| Eligibility Criteria for Businesses |

|---|

| Vehicle Used Primarily for Business Purposes |

| Interest Expenses on Car Loans for Business Vehicles |

| Deductions for Other Vehicle-Related Expenses |

Claiming Tax Deductions on Car Loan Interest

Once an individual or business meets the eligibility criteria, the process of claiming tax deductions on car loan interest involves a series of steps to ensure accuracy and compliance with IRS regulations.

Step-by-Step Guide for Individuals

- Calculate Business Mileage: Individuals must calculate the total business mileage for the tax year. This can be done using a mileage log or tracking app, ensuring that only business-related miles are included.

- Determine the Standard Mileage Rate: The IRS provides an annual standard mileage rate, which is the amount deductible per mile driven for business purposes. This rate is subject to change each year.

- Calculate Deduction: Multiply the standard mileage rate by the total business miles driven. This gives the total deduction for business mileage.

- Calculate Interest Expenses: Calculate the total interest expenses paid on the car loan during the tax year. This information can be obtained from loan statements or tax documents.

- Complete Tax Forms: Individuals must complete the appropriate tax forms, such as Schedule A (Form 1040) and Form 4562, to claim the deductions. These forms require detailed information about business mileage, interest expenses, and other relevant data.

- Submit Tax Return: Finally, individuals must submit their tax return, including the completed forms and supporting documentation, by the applicable deadline.

Step-by-Step Guide for Businesses

- Calculate Business Mileage: Similar to individuals, businesses must calculate the total business mileage for the tax year. This information is crucial for determining the extent of deductions.

- Determine Deduction Eligibility: Businesses should review their vehicle usage and ensure that the vehicles are primarily used for business purposes. This step is critical to establish eligibility for tax deductions.

- Calculate Interest Expenses: Calculate the total interest expenses paid on car loans used for business vehicles during the tax year. This information can be obtained from loan statements or accounting records.

- Other Deductions: Businesses can also claim deductions for other vehicle-related expenses, such as fuel, maintenance, insurance, and depreciation. These expenses should be accurately tracked and documented.

- Complete Tax Forms: Businesses must complete the appropriate tax forms, such as Form 4562 and Schedule C (Form 1040), to claim deductions for car loan interest and other vehicle-related expenses. These forms require detailed financial information and supporting documentation.

- Submit Tax Return: Businesses must submit their tax return, including the completed forms and supporting documents, by the applicable deadline.

Benefits and Limitations of Tax-Deductible Car Loan Interest

Claiming tax deductions on car loan interest offers several benefits, both for individuals and businesses. One of the primary advantages is the potential for significant tax savings. By deducting interest expenses and other vehicle-related costs, individuals and businesses can reduce their taxable income, resulting in lower tax liabilities.

Benefits for Individuals

For individuals, claiming tax-deductible car loan interest can be a powerful tool for managing personal finances. By reducing their taxable income, individuals can potentially save thousands of dollars in taxes, especially if they frequently use their vehicles for business purposes. This can free up financial resources for other investments or personal goals.

Benefits for Businesses

Businesses also stand to benefit significantly from tax-deductible car loan interest. By deducting interest expenses and other vehicle-related costs, businesses can optimize their tax strategies and potentially reduce their overall tax burden. This can improve cash flow, allowing businesses to reinvest savings into growth initiatives or expand their operations.

Limitations and Considerations

While tax-deductible car loan interest offers many advantages, it’s essential to consider certain limitations and potential challenges. One of the primary considerations is the need for accurate record-keeping. Both individuals and businesses must maintain detailed records of business mileage, interest expenses, and other relevant data to support their deductions. Failure to do so may lead to audits or penalties.

Additionally, the IRS periodically updates its guidelines and regulations regarding tax deductions. Staying informed about these changes is crucial to ensure compliance and maximize the benefits of tax-deductible car loan interest. It's recommended to consult with tax professionals or financial advisors to navigate the evolving tax landscape effectively.

Conclusion

Tax-deductible car loan interest is a valuable tool for individuals and businesses looking to optimize their tax strategies and reduce their tax liabilities. By understanding the eligibility criteria, following the proper procedures for claiming deductions, and staying informed about tax regulations, individuals and businesses can make the most of this opportunity.

Whether it's an individual using their vehicle for work-related activities or a business managing a fleet of vehicles, tax-deductible car loan interest can provide significant financial benefits. However, it's crucial to approach this topic with careful consideration and a commitment to accurate record-keeping to ensure compliance and maximize the potential savings.

Can I claim tax deductions on car loan interest for a personal vehicle?

+No, tax deductions on car loan interest are primarily applicable to vehicles used for business purposes. Personal vehicles generally do not qualify for these deductions unless they are used exclusively for business, which is a rare scenario.

Are there any limits to the amount of interest expenses I can deduct?

+Yes, the IRS sets limits on the amount of interest expenses that can be deducted. These limits are based on the type of business and the nature of the vehicle. It’s essential to consult with a tax professional to understand the specific limits applicable to your situation.

Can I deduct interest expenses for a leased vehicle?

+Yes, businesses can deduct interest expenses for leased vehicles used primarily for business purposes. However, the deduction is subject to certain limitations and requirements. It’s advisable to consult with a tax advisor to ensure compliance with the specific regulations.