Tax Deferred Annuity

Tax Deferred Annuities, often referred to as TDAs, are powerful financial instruments designed to help individuals save for retirement while offering significant tax advantages. This article delves into the intricate world of Tax Deferred Annuities, exploring their definition, mechanics, and the benefits they provide to savers. By understanding the nuances of TDAs, investors can make informed decisions to optimize their retirement planning.

Unraveling the Concept of Tax Deferred Annuities

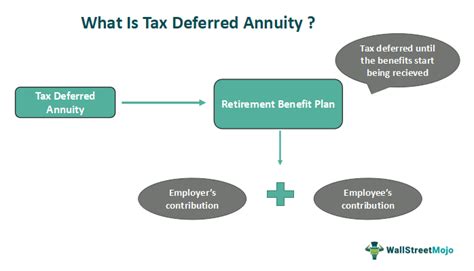

A Tax Deferred Annuity is a contract between an investor and an insurance company, wherein the investor commits to make regular contributions to the annuity over a specified period or for life. In return, the insurance company guarantees a future stream of income, typically during the investor's retirement years. The key differentiator of a TDA is its tax treatment, offering unique advantages that can significantly impact an investor's retirement savings.

The primary attraction of Tax Deferred Annuities lies in their tax-deferred status. This means that any earnings and growth within the annuity contract are not subject to current income taxes. Instead, taxes are deferred until the investor begins to receive payments from the annuity, which is typically in retirement when the investor may be in a lower tax bracket.

Key Features and Benefits of Tax Deferred Annuities

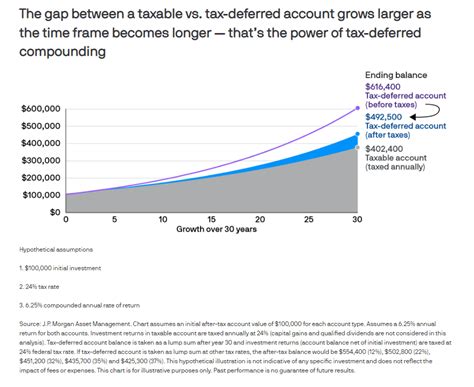

- Tax-Deferred Growth: As mentioned, the most significant advantage of TDAs is the tax-deferred growth of investments. This allows the investor's money to grow faster, as taxes are not deducted from the earnings each year. Over time, this can lead to a substantial increase in the annuity's value.

- Retirement Income Stream: TDAs are designed to provide a guaranteed income stream during retirement. This income can be structured in various ways, depending on the investor's needs and preferences, offering a stable and predictable source of funds during retirement.

- Investment Flexibility: Many TDAs offer a wide range of investment options, allowing investors to customize their portfolios according to their risk tolerance and investment goals. This flexibility ensures that investors can tailor their annuity to their specific needs and preferences.

- Protection from Creditors: In most cases, the funds within a TDA are protected from creditors in the event of bankruptcy or legal judgments. This feature provides a layer of security for investors, ensuring that their retirement savings remain intact.

| Feature | Description |

|---|---|

| Tax Treatment | Earnings and growth are tax-deferred, providing substantial long-term benefits. |

| Income Stream | Guarantees a steady income during retirement, offering financial security. |

| Investment Options | Wide range of choices, allowing customization based on individual risk profiles. |

| Creditor Protection | Funds are typically protected from creditors, adding an extra layer of financial security. |

Understanding the Mechanics of Tax Deferred Annuities

The operation of Tax Deferred Annuities involves several key phases, each with its own set of rules and considerations. Understanding these phases is crucial for investors to make informed decisions and maximize the benefits of TDAs.

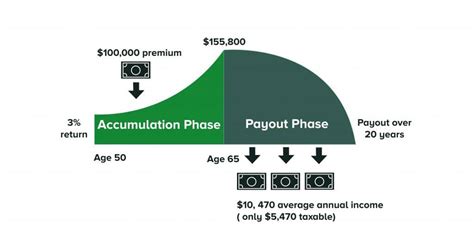

Accumulation Phase

During the accumulation phase, the investor makes regular contributions to the TDA, which can be done on a monthly, quarterly, or annual basis. These contributions grow tax-deferred, meaning that the investor does not pay taxes on the earnings until they start withdrawing from the annuity.

The accumulation phase can last for several decades, allowing the investor's contributions and earnings to compound over time. The longer the accumulation period, the more significant the potential for growth, thanks to the power of compound interest. This phase is crucial for building a substantial retirement fund.

Annuity Phase

Once the investor reaches a predetermined age or chooses to retire, the TDA enters the annuity phase. This is when the investor starts receiving regular payments from the annuity, providing a steady income stream during retirement. The payment amount and frequency can be customized to the investor's needs.

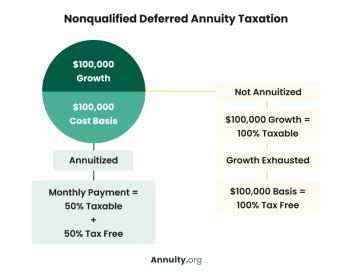

During the annuity phase, the investor pays taxes on the earnings portion of each payment. However, the principal amount remains tax-deferred, continuing to grow tax-free within the annuity. This feature allows the investor to maintain a tax-efficient income stream during retirement.

Key Considerations

- Withdrawal Options: Investors have several options for withdrawing funds from a TDA. They can choose to receive a lump-sum payment, regular payments for a fixed period, or lifetime payments. Each option has its own tax implications, so it's essential to consider these carefully.

- Surrender Charges: Some TDAs may impose surrender charges if the investor decides to withdraw funds before a certain age or period. These charges can significantly impact the value of the annuity, so investors should be aware of them when choosing a TDA.

- Fees and Expenses: Like most financial products, TDAs come with various fees and expenses, including management fees, administrative costs, and mortality and expense charges. These costs can impact the overall return on investment, so it's crucial to understand and compare these fees when choosing a TDA.

Maximizing the Benefits of Tax Deferred Annuities

To make the most of Tax Deferred Annuities, investors should consider several strategies to optimize their retirement savings and income.

Start Early

The earlier an investor starts contributing to a TDA, the more time their investments have to grow. The power of compound interest can significantly boost the value of the annuity over time. Starting early also allows investors to take advantage of the tax-deferred growth for a more extended period.

Maximize Contributions

Investors should aim to maximize their contributions to a TDA, especially if they are eligible for employer-matched contributions. The more money that goes into the annuity, the more it can grow over time. This is especially beneficial for high-income earners who can take advantage of the tax-deferral feature.

Diversify Investments

Many TDAs offer a wide range of investment options, from conservative to aggressive. Investors should consider diversifying their portfolio to manage risk effectively. Diversification can help protect the annuity's value during market downturns and ensure a balanced growth strategy.

Consider Different Withdrawal Options

When it comes to withdrawing funds from a TDA, investors have several options. They can choose a lump-sum payment, regular payments for a fixed period, or lifetime payments. Each option has its advantages and disadvantages, so investors should consider their retirement goals and financial needs when making this decision.

| Withdrawal Option | Pros | Cons |

|---|---|---|

| Lump-Sum Payment | Provides a large sum of money for immediate needs. | May be subject to high taxes and penalties if withdrawn before age 59½. |

| Regular Payments for a Fixed Period | Offers a steady income stream for a specified period. | Payments may not last as long as expected, leaving the investor without income. |

| Lifetime Payments | Provides a guaranteed income for life, regardless of the annuity's value. | Payments may be smaller, and the investor may outlive their income stream. |

The Future of Tax Deferred Annuities

The landscape of retirement planning is constantly evolving, and Tax Deferred Annuities are no exception. As financial markets and regulations change, TDAs will likely adapt to meet the evolving needs of investors. Here are some potential future implications and considerations.

Regulatory Changes

Tax laws and regulations can change over time, potentially impacting the tax advantages of TDAs. Investors should stay informed about any changes that may affect their TDA strategies. For example, changes in tax brackets or the introduction of new tax laws could impact the attractiveness of TDAs as a retirement savings vehicle.

Market Volatility

The financial markets are inherently volatile, and this can impact the performance of investments within TDAs. While TDAs offer a degree of protection against market downturns through their tax-deferred growth, investors should be prepared for potential fluctuations in their annuity's value.

Emerging Technologies

The rise of digital platforms and technologies in the financial sector could significantly impact the future of TDAs. These technologies can improve the efficiency and accessibility of TDAs, making them more attractive to investors. Additionally, technological advancements may lead to the development of new types of TDAs with innovative features and benefits.

Increased Awareness and Education

As more individuals become aware of the benefits of TDAs, there may be a growing demand for these products. Increased education about retirement planning and the advantages of TDAs could lead to a broader adoption of these annuities, especially among younger investors.

Frequently Asked Questions

How do Tax Deferred Annuities compare to other retirement savings vehicles, like 401(k)s or IRAs?

+Tax Deferred Annuities offer unique advantages, particularly in terms of tax treatment and guaranteed income streams. While 401(k)s and IRAs also provide tax benefits, TDAs stand out with their potential for tax-deferred growth and the flexibility to customize the income stream during retirement. However, it's essential to compare the specific features and limitations of each option based on individual needs and financial goals.

<div class="faq-item">

<div class="faq-question">

<h3>Are there any income or contribution limits for Tax Deferred Annuities?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Income limits can vary depending on the specific TDA product and the investor's age. In some cases, there may be annual contribution limits to ensure the annuity remains within certain tax guidelines. It's crucial to consult with a financial advisor to understand the specific limits and how they may impact your retirement savings strategy.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I withdraw funds from my TDA before the age of 59½?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Withdrawing funds from a TDA before the age of 59½ may result in penalties and additional taxes. These penalties are designed to discourage early withdrawals and ensure that TDAs are primarily used for retirement purposes. However, there are certain exceptions, such as for qualified education expenses or disability, that may exempt you from these penalties.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I inherit a Tax Deferred Annuity from a deceased family member?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, TDAs can be inherited. The rules for inherited TDAs may differ depending on the relationship between the deceased and the beneficiary. Inherited TDAs may be subject to different tax rules and withdrawal options. It's essential to consult with a financial advisor to understand the specific implications of inheriting a TDA.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any fees associated with Tax Deferred Annuities?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, TDAs typically come with various fees, including management fees, administrative costs, and mortality and expense charges. These fees can vary depending on the specific TDA product and the insurance company. It's crucial to understand these fees and how they may impact the overall return on your investment.</p>

</div>

</div>

</div>