Wa Property Tax Rate

The Property Tax Rate in Washington State is a crucial factor for homeowners, investors, and businesses, as it directly impacts their financial obligations and overall cost of living or operation. Understanding how this tax rate works, its variations across the state, and its implications is essential for anyone navigating the real estate landscape in Washington. This comprehensive guide will delve into the intricacies of the WA Property Tax Rate, offering an in-depth analysis and practical insights.

Understanding the WA Property Tax Rate

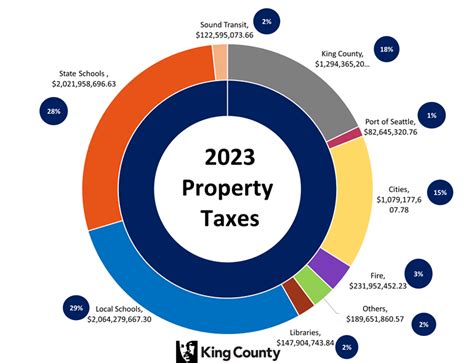

In Washington, property taxes are levied by various taxing districts, including cities, counties, and special purpose districts. These taxes fund essential services like schools, libraries, fire departments, and road maintenance. The tax rate is determined by the combined levy rate of all these districts that have taxing authority over a particular property.

The property tax rate is expressed as a millage rate, which represents the amount of tax per $1,000 of assessed value. For instance, a millage rate of 10 would mean $10 in taxes for every $1,000 of assessed property value. This rate can vary significantly depending on the location and the services provided by the taxing districts.

Calculation and Assessment

The process begins with the assessment of the property’s value. Assessors typically conduct this valuation every two years, taking into account factors like property size, improvements, and market conditions. Once the assessed value is determined, it is multiplied by the applicable tax rate to arrive at the property tax liability.

For example, if a property has an assessed value of $250,000 and the applicable tax rate is 12 mills, the property tax liability would be calculated as follows: $250,000 x 0.012 = $3,000. This means the property owner would owe $3,000 in property taxes for that year.

| Property Value | Tax Rate (Mills) | Tax Liability |

|---|---|---|

| $200,000 | 10 | $2,000 |

| $350,000 | 12 | $4,200 |

| $500,000 | 8 | $4,000 |

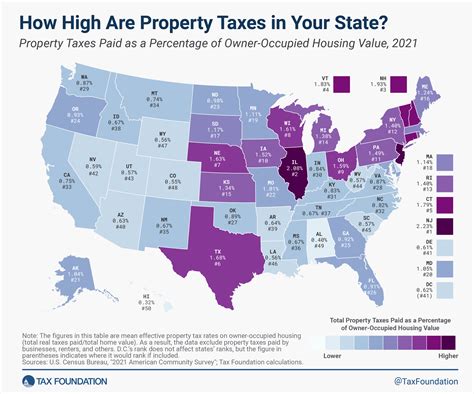

Variations Across Washington

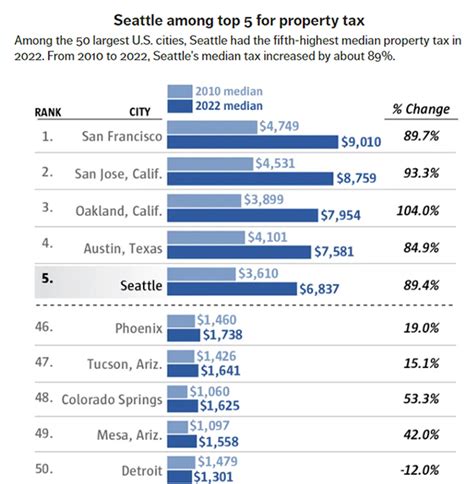

Washington’s diverse landscape and wide range of services mean that property tax rates can vary significantly from one area to another. While some areas may have lower tax rates, they might also have fewer services and amenities. On the other hand, areas with higher tax rates often offer more extensive services and better infrastructure.

Comparative Analysis

Here’s a comparison of property tax rates in some of Washington’s major cities:

| City | Average Tax Rate (Mills) |

|---|---|

| Seattle | 12.5 |

| Spokane | 10.8 |

| Tacoma | 11.2 |

| Vancouver | 9.5 |

| Bellevue | 13.2 |

These rates are averages and can vary depending on the specific location within these cities and the services required.

Factors Influencing Rates

Several factors influence the property tax rates in Washington:

- Local Services: The more services a district provides, the higher the tax rate may be to fund these services.

- Population Density: More densely populated areas often have higher tax rates to accommodate the needs of a larger community.

- Economic Factors: Areas with higher economic activity may have higher tax rates to support local businesses and infrastructure.

- Special Districts: Special purpose districts like fire protection or water districts can significantly impact the overall tax rate.

Implications and Strategies

Understanding the property tax rate is crucial for financial planning, especially for long-term property ownership. Here are some implications and strategies to consider:

Budgeting and Planning

Property taxes are a recurring expense, so it’s essential to factor them into your financial planning. If you’re considering purchasing a property, be sure to calculate the potential tax liability based on the assessed value and the applicable tax rate.

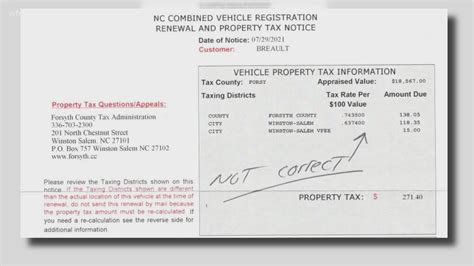

Appealing Assessments

If you believe your property’s assessed value is inaccurate, you have the right to appeal. This process can potentially reduce your tax liability. It’s advisable to consult a professional or your local assessor’s office for guidance on the appeal process.

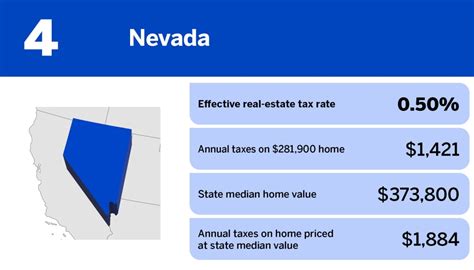

Investing Strategies

For investors, understanding the property tax landscape is crucial. Areas with lower tax rates might offer more attractive investment opportunities, especially if the lower rates are coupled with robust economic growth and good infrastructure.

Homestead Exemptions

Washington offers homestead exemptions, which can reduce the taxable value of a property for homeowners. This exemption is particularly beneficial for long-term residents and can significantly lower their property tax liability.

Future Outlook

The WA Property Tax Rate is expected to remain a critical component of the state’s revenue structure. As the state continues to grow and develop, the demand for services and infrastructure will likely increase, potentially leading to slight adjustments in tax rates over time. However, Washington’s commitment to maintaining a competitive business environment and supporting its residents is likely to keep any significant rate increases at bay.

Conclusion

In conclusion, the WA Property Tax Rate is a multifaceted topic, with variations across the state influenced by a range of factors. Understanding these rates is essential for anyone considering a property purchase, investment, or business operation in Washington. By staying informed and utilizing the available strategies, individuals and businesses can navigate the state’s property tax landscape effectively.

How often are property taxes assessed in Washington?

+Property taxes are typically assessed every two years in Washington. However, certain circumstances, such as significant improvements or changes to the property, can trigger a re-assessment before the scheduled two-year cycle.

Can I deduct my property taxes on my federal tax return?

+Yes, you can deduct your property taxes on your federal tax return if you itemize your deductions. This can provide a significant tax benefit, especially for homeowners with high property tax liabilities.

Are there any property tax relief programs in Washington?

+Yes, Washington offers several property tax relief programs, including the Senior Exemption Program, the Disabled Veterans Exemption, and the Low-Income Senior Property Tax Exemption Program. These programs provide tax relief to eligible individuals, helping them manage their property tax obligations.