Tax 5498 Form

The Form 5498, also known as the Information Return on IRA Contributions, is a crucial document in the realm of tax reporting and retirement planning. This form, mandated by the Internal Revenue Service (IRS), serves as a vehicle for taxpayers to report their Individual Retirement Account (IRA) contributions and for financial institutions to transmit this information to the IRS.

With its role in facilitating accurate tax reporting and providing transparency in retirement savings, Form 5498 is a critical component of the U.S. tax system. This article delves into the intricacies of Form 5498, exploring its purpose, key elements, and its broader implications for taxpayers and financial institutions.

Understanding Form 5498: Purpose and Functionality

At its core, Form 5498 is a reporting tool designed to ensure the accurate tracking and reporting of contributions made to Individual Retirement Accounts (IRAs). The IRS requires financial institutions, including banks, credit unions, and brokerage firms, to file this form annually for each IRA they maintain. The form captures essential details about the IRA, including the account holder’s name, the account number, and the total amount contributed during the tax year.

One of the key purposes of Form 5498 is to provide a clear and concise record of IRA contributions. This is particularly important for taxpayers who make deductible contributions to their IRAs, as these contributions may reduce their taxable income. The form also plays a vital role in ensuring that taxpayers receive the appropriate tax benefits for their retirement savings.

Additionally, Form 5498 serves as a mechanism for the IRS to cross-reference reported contributions with the information it receives from taxpayers on their tax returns. This helps prevent discrepancies and potential tax evasion, promoting a fair and transparent tax system.

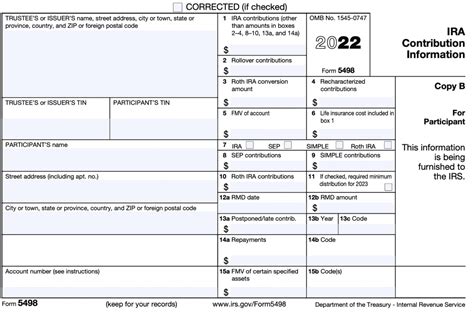

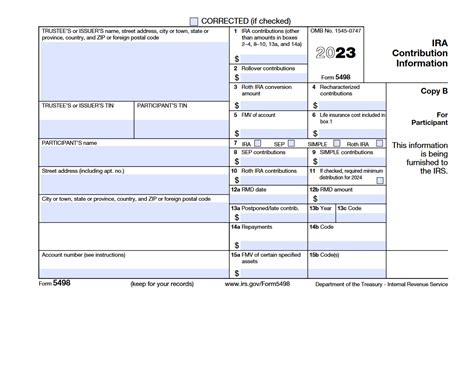

Key Elements of Form 5498

Form 5498 is a straightforward document, consisting of the following key elements:

- Account Holder's Information: This section includes the taxpayer's name, address, and Taxpayer Identification Number (TIN), typically their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Accurate identification is crucial for the IRS to match the form with the taxpayer's records.

- Account Information: Here, the financial institution provides details about the IRA, including the account number, the type of IRA (traditional, Roth, or SEP), and the opening date of the account. This information helps the IRS track and manage IRA accounts effectively.

- Contribution Details: The heart of the form lies in this section, where the financial institution reports the total contributions made to the IRA during the tax year. This includes both deductible and non-deductible contributions, as well as any rollover contributions from other IRAs or qualified plans.

- Additional Information: Depending on the type of IRA, there may be additional fields to report. For example, in the case of Roth IRAs, the financial institution may need to indicate whether the contribution was a conversion or a regular contribution. This section ensures that all relevant details are captured accurately.

The Impact of Form 5498 on Taxpayers

Form 5498 has significant implications for taxpayers, especially those who rely on IRAs as a key component of their retirement savings strategy. By reporting IRA contributions, taxpayers can claim deductions or credits on their tax returns, potentially reducing their taxable income and overall tax liability.

For instance, taxpayers who contribute to a traditional IRA can deduct their contributions from their taxable income, subject to certain income limits and eligibility criteria. Similarly, those who make non-deductible contributions to a traditional IRA may choose to convert those contributions to a Roth IRA, which offers tax-free growth and tax-free withdrawals in retirement. Form 5498 plays a crucial role in tracking and reporting these contributions accurately.

Furthermore, Form 5498 provides taxpayers with a clear record of their IRA contributions, which can be valuable for long-term retirement planning. Taxpayers can use this information to assess their progress toward their retirement goals and make informed decisions about future contributions.

Common Misconceptions and Best Practices

While Form 5498 is relatively straightforward, there are some common misconceptions and best practices to consider:

- Timing of Contributions: It's important to note that Form 5498 reflects contributions made during the tax year, regardless of when the contributions were actually made. For instance, if a taxpayer makes a contribution in December for the current tax year, that contribution will be reported on the following year's Form 5498.

- Reporting Responsibility: The responsibility for reporting IRA contributions lies with the financial institution, not the taxpayer. However, taxpayers should still review their Form 5498 carefully to ensure that all contributions are accurately reflected. If there are any discrepancies, taxpayers should contact their financial institution to resolve the issue.

- Understanding Deductible and Non-Deductible Contributions: Taxpayers should be aware of the difference between deductible and non-deductible IRA contributions. Deductible contributions reduce taxable income, while non-deductible contributions do not. Non-deductible contributions can be converted to a Roth IRA, which has its own set of benefits and considerations.

Form 5498 and Financial Institutions

For financial institutions, Form 5498 is a critical component of their compliance and reporting obligations. Financial institutions must file this form for each IRA they maintain, ensuring that all contributions are accurately reported to the IRS.

The accuracy of Form 5498 is essential for financial institutions to maintain a positive relationship with the IRS and their clients. Any discrepancies or errors in reporting can lead to penalties and negative tax consequences for both the institution and the taxpayer.

Financial institutions should also provide clear and concise guidance to their clients regarding IRA contributions and the reporting process. This includes explaining the timing of contributions, the difference between deductible and non-deductible contributions, and the potential tax benefits associated with each type of IRA.

Challenges and Best Practices for Financial Institutions

Financial institutions face several challenges when it comes to Form 5498 reporting, including:

- Data Accuracy: Ensuring that all contribution data is accurate and up-to-date can be challenging, especially for institutions with a large number of IRA accounts. Financial institutions should implement robust data validation processes to minimize errors and discrepancies.

- Timely Reporting: The IRS requires financial institutions to file Form 5498 by a specific deadline, typically by May 31st for the previous tax year. Meeting this deadline can be a challenge, particularly for institutions with complex IRA structures or a large volume of accounts.

- Client Education: Financial institutions should proactively educate their clients about the importance of accurate IRA contribution reporting and the potential tax benefits associated with different types of IRAs. This can help clients make informed decisions and avoid costly mistakes.

Future Implications and Evolving Landscape

As the landscape of retirement planning and tax reporting continues to evolve, Form 5498 will likely play an even more critical role. With the increasing popularity of IRAs and the complexity of tax laws, accurate reporting and transparency will become increasingly important.

The IRS may introduce new regulations or guidelines to enhance the reporting process and ensure compliance. Financial institutions and taxpayers should stay informed about these changes to maintain accurate and compliant reporting practices.

Additionally, the rise of digital platforms and online financial services may bring about new opportunities for streamlining the Form 5498 reporting process. Financial institutions and technology providers may collaborate to develop innovative solutions that simplify reporting and reduce the risk of errors.

Conclusion

Form 5498 is a vital component of the U.S. tax system, serving as a bridge between taxpayers, financial institutions, and the IRS. By understanding the purpose, functionality, and implications of this form, taxpayers and financial institutions can navigate the complex world of IRA contributions and tax reporting with confidence.

As the retirement planning landscape continues to evolve, Form 5498 will remain a crucial tool for ensuring accurate reporting, promoting transparency, and facilitating the tax benefits associated with IRAs. By staying informed and adopting best practices, taxpayers and financial institutions can maximize the benefits of IRAs while maintaining compliance with tax regulations.

What happens if a financial institution fails to file Form 5498 on time or makes errors in reporting?

+Financial institutions are required to file Form 5498 by a specific deadline, typically by May 31st for the previous tax year. Failure to meet this deadline or making errors in reporting can result in penalties and interest charges imposed by the IRS. Additionally, inaccurate reporting may lead to discrepancies in taxpayers’ tax returns, potentially triggering an audit or other tax-related issues.

Can taxpayers rely solely on Form 5498 for their tax reporting, or do they need additional documentation?

+While Form 5498 provides valuable information about IRA contributions, taxpayers should not rely solely on this form for their tax reporting. Taxpayers should also maintain accurate records of their contributions, including receipts, statements, and other supporting documentation. These additional records can be crucial in the event of an audit or if there are discrepancies between the Form 5498 and the taxpayer’s records.

How can taxpayers verify the accuracy of the information on their Form 5498?

+Taxpayers should carefully review their Form 5498 when they receive it. They should compare the information on the form with their own records, including contribution statements and receipts. If there are any discrepancies, taxpayers should promptly contact their financial institution to resolve the issue. It’s important to address any inaccuracies promptly to avoid potential tax complications.

Are there any limitations or restrictions on the types of contributions that can be reported on Form 5498?

+Form 5498 is designed to report contributions made to IRAs, including traditional IRAs, Roth IRAs, and SEP IRAs. However, there are certain types of contributions that are not reported on Form 5498. For example, contributions to employer-sponsored retirement plans, such as 401(k)s or pension plans, are not reported on this form. Additionally, contributions made after the tax year end, even if they are for the current tax year, are not reflected on the current year’s Form 5498.