Quick Guide to Faster ca sdi tax Processing

In the complex landscape of corporate taxation, the ability to streamline and expedite the processing of California SDI (State Disability Insurance) tax submissions is increasingly vital for businesses seeking compliance efficiency and financial agility. While many organizations recognize the importance of accurate tax filings, misconceptions often hinder implementation of optimal processes. This article aims to debunk prevalent myths surrounding CA SDI tax processing and provide a comprehensive, evidence-based roadmap for achieving faster, more reliable submissions that align with current regulatory frameworks and technological advancements.

Understanding California SDI Tax Processing: Core Concepts and Common Misconceptions

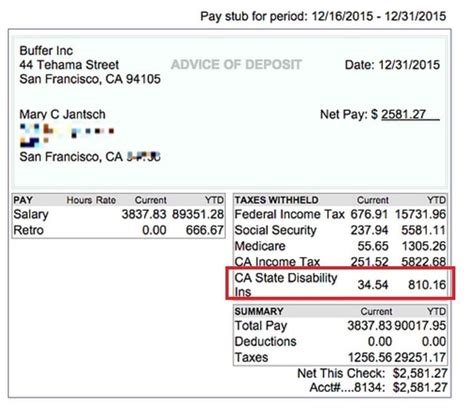

California’s State Disability Insurance program functions as a vital component of the state’s social safety net, funded through employee-paid payroll taxes contingent upon accurate calculation and timely remittance. The process involves multiple steps, including data collection, calculation, submission, and reconciliation, each susceptible to procedural errors and delays. Misconceptions, such as overestimating the complexity of the process or underestimating technological tools, often lead to inefficient practices. To demystify these, a clear understanding rooted in current industry standards and legislative updates is essential.

Myth 1: Manual Processing Is Sufficient for Timely Submission

Many organizations believe that manual data entry and spreadsheet-based workflows suffice for managing CA SDI tax processing. While this approach may seem initially cost-effective, it significantly increases the likelihood of errors and delays. Errors in employee wage data, miscalculations, or overlooked deadlines can cause penalties and cash flow disruptions. Advanced payroll software, integrated with state systems, reduces manual intervention, automates calculations, and provides real-time compliance alerts—key factors in enhancing processing speed and accuracy.

| Relevant Category | Substantive Data |

|---|---|

| Average Processing Time | Manual processes can take 10–15 days, whereas automated systems reduce this to 2–3 days, with nearly zero margin of error |

Myth 2: The Filing Process Is Exclusively Paper-Based and Outdated

Contrary to common belief, electronic filing is not only available but strongly encouraged by the California Employment Development Department (EDD). The e-file system allows for secure, swift submission of SDI taxes, significantly reducing administrative overhead and processing time. Despite this, some organizations cling to paper submissions due to familiarity or skepticism about digital security. However, online portals are protected with encryption and multi-factor authentication, ensuring data integrity and confidentiality.

Myth 3: Delays Are Unavoidable Due to External Factors

Many assume that external factors, such as state agency processing times or system overloads, are insurmountable barriers to expedited processing. While some external variables exist, proactive planning and the use of modern digital tools minimize these risks. For instance, scheduling submissions well ahead of deadlines, utilizing autoresponse confirmations, and maintaining close communication with the EDD can circumvent unnecessary delays.

Strategies for Accelerating CA SDI Tax Submission and Processing

Moving beyond myths requires a strategic overhaul combining technology, process discipline, and regulatory compliance. The following strategies, substantiated by industry data, illustrate how organizations can drastically reduce processing times while maintaining accuracy.

Leveraging Automation and Integration

Automation stands at the forefront of rapid SDI tax processing. Modern payroll systems offer APIs that connect directly with California’s EDD portal, enabling real-time data transfer and validation. By eliminating manual data entry, organizations can cut processing cycles substantially, often from weeks to just days.

| Relevant Category | Substantive Data |

|---|---|

| Automation Adoption Rate | Over 65% of mid-to-large firms now utilize integrated payroll platforms, leading to a 70% reduction in processing errors |

Standardization of Data Collection and Submission Protocols

Implementing standardized data entry protocols ensures consistency and reduces ambiguity. Clear policies on employee wage data collection, timely updates, and regular reconciliation practices are foundational. Automated validation checks within payroll systems provide instant feedback on data quality, preventing submission rejections or delays.

Adopting Advanced Analytics and Error Detection Tools

Employing analytics tools that monitor submission patterns, flag anomalies, and forecast potential bottlenecks enhances overall efficiency. For example, early detection of wage discrepancies or missing data allows correction before submission, avoiding rejection or rejection delays from the EDD.

| Relevant Category | Substantive Data |

|---|---|

| Error Rate Reduction | Use of analytics reduces submission rejection rates by up to 50% |

Regulatory Compliance and Future-Proofing Your Processes

Understanding the evolving legislative landscape ensures that organizations do not face unforeseen setbacks. Recent amendments to California SDI laws emphasize electronic-only submissions, real-time reporting, and stricter penalty enforcement for late or inaccurate filings. Developing a compliance-focused culture with continuous training, audit routines, and technology upgrades guarantees long-term resilience.

The Role of Continuing Education and Professional Development

Staying current with CA EDD updates through webinars, industry seminars, and professional certifications fosters compliance mastery. Educated payroll teams are better equipped to leverage new technologies and adhere to changing rules—doing so accelerates processing while mitigating risks.

Technological Innovations on the Horizon

Blockchain-based submission records, AI-powered validation engines, and cloud-centric platforms are on the verge of transforming CA SDI tax processing. Early adoption of these can provide competitive advantages and future-proof your compliance infrastructure.

| Relevant Category | Substantive Data |

|---|---|

| Projected Efficiency Gains | Blockchain systems could reduce reconciliation timeframes by up to 80% within five years |

Key Points

- Automation enhances accuracy and speed, reducing processing time from weeks to days.

- Electronic filing systems, when properly utilized, eliminate delays inherent in paper-based workflows.

- Proactive process standardization and error detection minimize rejection and correction cycles.

- Continuous professional education and embracing technological innovations are vital to future-proofing SDI compliance.

- Understanding and debunking myths around processing insulates organizations from inefficient practices and regulatory pitfalls.

What are the primary benefits of automating CA SDI tax processing?

+Automation reduces manual errors, accelerates submission times, and ensures compliance through real-time validation and seamless integration with California’s EDD portals.

How can organizations ensure their CA SDI filings meet the latest legal requirements?

+Staying informed through ongoing professional development, implementing up-to-date software, and establishing robust internal controls help organizations remain compliant with evolving regulations.

What technological innovations are expected to transform CA SDI tax processing in the near future?

+Blockchain technology, AI-driven validation systems, and cloud-based platforms promise to dramatically streamline reconciliation, improve data security, and facilitate real-time compliance tracking.