Florida Car Tax

Florida, known for its vibrant sun-soaked beaches and diverse population, has a unique approach to vehicle taxation. The Florida Car Tax, or the "Ad Valorem Tax" as it is officially known, is a key revenue generator for the state. This tax is an annual assessment on the value of vehicles, making it an important consideration for both residents and prospective vehicle owners. In this comprehensive guide, we will delve into the intricacies of the Florida Car Tax, exploring its history, calculation methods, and its impact on Floridians' wallets.

The Evolution of the Florida Car Tax

The Florida Car Tax has undergone several transformations since its inception. It was first introduced as a way to generate revenue for the state’s infrastructure projects, particularly for road and highway maintenance. Over the years, the tax has become an integral part of Florida’s fiscal landscape, with its structure and collection methods evolving to meet the changing needs of the state.

Initially, the tax was calculated based on the vehicle's purchase price, with a flat rate applied to all vehicles. However, as vehicle prices varied widely, this method proved to be somewhat unfair, especially for those who purchased more expensive vehicles. In response, Florida introduced a system where the tax was calculated based on the vehicle's value, taking into account factors such as age, make, and model.

The current system, which is based on a vehicle's assessed value, was implemented to provide a more equitable tax structure. This value is determined by the county property appraiser and is typically lower than the vehicle's purchase price, especially for older vehicles. This assessment method aims to ensure that individuals with older, less valuable vehicles pay a fair and proportional tax.

How is the Florida Car Tax Calculated?

The calculation of the Florida Car Tax involves several steps and factors. Here’s a breakdown of the process:

Assessed Value Determination

The first step in calculating the car tax is to determine the assessed value of the vehicle. This value is established by the county property appraiser and is influenced by the vehicle’s age, make, model, and any special features or modifications. The appraiser uses guidelines set by the state to ensure consistency across counties.

Tax Rate Application

Once the assessed value is determined, the applicable tax rate is applied. This rate varies by county and is set by the local government. It is expressed as a percentage of the vehicle’s assessed value. For instance, if the tax rate is 2% and the vehicle’s assessed value is 10,000, the tax payable would be 200.

| County | Tax Rate (%) |

|---|---|

| Miami-Dade County | 1.5% |

| Broward County | 1.25% |

| Palm Beach County | 1.75% |

| Hillsborough County | 1.5% |

| Orange County | 1.25% |

These rates are subject to change annually, so it's advisable to check with your county's tax assessor's office for the most up-to-date information.

Exemptions and Discounts

Florida offers certain exemptions and discounts on the car tax to eligible individuals. For instance, seniors aged 65 and above may be eligible for a discount on their vehicle tax. Additionally, individuals with disabilities may also qualify for reduced tax rates or exemptions.

It's important to note that these exemptions and discounts are not automatically applied. Vehicle owners must apply for them and provide the necessary documentation to the tax assessor's office.

The Impact of the Florida Car Tax

The Florida Car Tax has a significant impact on the state’s economy and its residents. On one hand, it generates substantial revenue for the state and local governments, contributing to the maintenance and improvement of roads, bridges, and other infrastructure. This ensures that Florida’s transportation network remains efficient and reliable.

However, the tax also imposes a financial burden on vehicle owners. The amount payable can vary significantly based on the vehicle's value and the county's tax rate. For instance, a vehicle with an assessed value of $20,000 in a county with a 2% tax rate would result in a tax bill of $400. This amount can be a substantial expense, especially for those on a tight budget or those with multiple vehicles.

To mitigate this burden, Florida has implemented a homestead exemption, which provides a discount on the vehicle tax for individuals who own a home in the state. This exemption is particularly beneficial for long-term residents and encourages homeownership.

Comparison with Other States

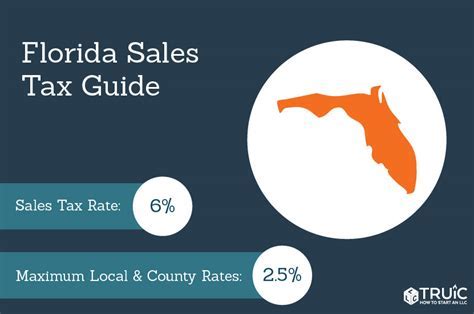

Florida’s car tax system is quite unique compared to other states. Many states have a sales tax on vehicle purchases, which is a one-time cost. In contrast, Florida’s Ad Valorem Tax is an annual assessment, providing a steady stream of revenue for the state. This difference in taxation can make Florida a more attractive option for those purchasing a vehicle, as the initial cost may be lower compared to states with high sales taxes.

Additionally, Florida's tax system is seen as more equitable for long-term vehicle owners, as the tax is based on the vehicle's assessed value, which declines over time. This means that individuals who keep their vehicles for several years pay a lower tax rate compared to those who frequently purchase new vehicles.

Future Implications and Potential Changes

As with any tax system, there are ongoing discussions and proposals for changes to the Florida Car Tax. One potential area of focus is the implementation of a flat tax rate across all counties. This would provide consistency and simplify the tax calculation process, making it easier for vehicle owners to understand their tax obligations.

Another potential change could be the introduction of a hybrid tax system, where the tax is calculated based on a combination of the vehicle's purchase price and its assessed value. This would ensure that both new and older vehicles are taxed fairly, striking a balance between the current system's equity and the simplicity of a flat-rate sales tax.

Furthermore, with the rise of electric vehicles (EVs) and the potential for a shift towards a more sustainable transportation system, there may be discussions around tax incentives or discounts for EV owners. This could encourage the adoption of environmentally friendly vehicles and reduce the state's carbon footprint.

Conclusion

The Florida Car Tax, or Ad Valorem Tax, is a crucial component of the state’s fiscal framework, generating revenue for essential infrastructure projects while also impacting the finances of vehicle owners. Its evolution over the years has aimed to create a fair and equitable tax system, taking into account the value and age of vehicles. While it provides a stable source of revenue for the state, it also presents a financial consideration for those planning to purchase or own a vehicle in Florida.

As the state continues to grow and adapt to changing transportation needs and environmental concerns, the Florida Car Tax system may undergo further modifications to ensure it remains relevant and beneficial for both the state and its residents.

When is the Florida Car Tax due?

+The Florida Car Tax is typically due on the first day of the month following the vehicle’s registration or purchase. For instance, if you register your vehicle in March, the tax would be due on April 1st. However, it’s important to check with your county’s tax assessor’s office for any specific deadlines or grace periods.

How can I pay the Florida Car Tax?

+The Florida Car Tax can be paid online, by mail, or in person at the tax collector’s office. Online payment is often the most convenient method, as it allows for quick and secure transactions. However, you can also pay by check or money order through the mail or by visiting the tax collector’s office during business hours.

Are there any penalties for late payment of the Florida Car Tax?

+Yes, late payment of the Florida Car Tax can result in penalties and interest. The exact amount and timing of these penalties vary by county, so it’s important to check with your local tax assessor’s office for specific details. To avoid penalties, it’s advisable to pay the tax on time or arrange for a payment plan if needed.