Maximize Savings by Understanding Tennessee Sales Tax Rates

In the intricate landscape of state taxation, sales tax often emerges as a pivotal factor influencing consumer behavior, business operations, and public revenue. Tennessee’s sales tax system exemplifies a complex yet transparent framework that can significantly impact taxpayers' everyday decisions. As economic interdependencies deepen and fiscal policies evolve, fully grasping the nuances of Tennessee's sales tax rates becomes essential for residents, retailers, and policymakers alike. This article offers an authoritative review of Tennessee sales tax rates, dissecting their structure, historical context, and strategic implications for maximizing savings. Through a systematic analysis of components, regional variances, and practical application, this comprehensive overview aims to elevate understanding and empower stakeholders to optimize their fiscal positions.

Understanding Tennessee Sales Tax Structure: Foundations and Components

The Tennessee sales tax modality functions as a multifaceted instrument of state revenue, amalgamating statutory rates, regional adjustments, and specific exemptions. Its structure is characterized by a state-level base rate, supplemented by local jurisdictions, resulting in a composite rate that varies across counties and municipalities.

A pivotal element underpinning Tennessee's sales tax architecture is the statutory state rate, which as of 2023 stands at 7%. This baseline rate encompasses the general sales tax levy, but the actual payable amount is often higher due to local additions. The combined effective sales tax rate can range from 8.5% to over 10%, influenced by district-specific increments. This layered approach allows for targeted fiscal strategies while maintaining a degree of uniformity at the state level.

State-Level Rate and Regional Variations

The core state rate of 7% forms the foundation for all taxable transactions. However, local governments—counties and cities—impose additional taxes, which can be allocated for specific infrastructure projects, public services, or other administrative needs. These supplementary rates are codified through local ordinances and often fluctuate based on regional budget requirements.

| Applicable Region | Average Total Rate |

|---|---|

| Memphis (Shelby County) | 9.45% |

| Nashville (Davidson County) | 9.75% |

| Knoxville (Knox County) | 9.5% |

| Chattanooga (Hamilton County) | 9.25% |

Historical Evolution and Policy Drivers of Tennessee Sales Tax Rates

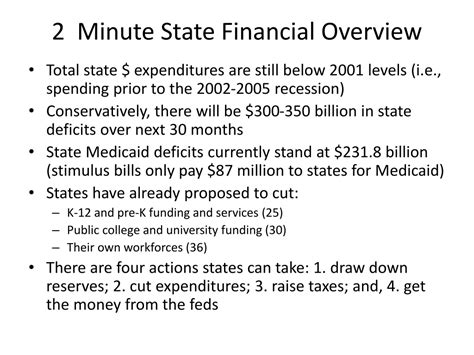

The trajectory of Tennessee’s sales tax rates reflects a balancing act between fiscal growth, political consensus, and socio-economic needs. Initially introduced in 1947 at a modest rate of 2%, the system has undergone progressive expansions, reaching its current tiered structure. Major legislative reforms in the late 20th century sought to broaden the tax base and address state budget shortfalls, especially during economic downturns.

Understanding the policy drivers behind rate adjustments reveals broader fiscal strategies aimed at balancing revenues and expenditures. Notably, the inclusion of local option taxes expanded regional autonomy, allowing districts to tailor sales tax rates based on local priorities. This evolution highlights the necessity for residents and businesses to stay informed about ongoing legislative changes that could impact their financial planning.

Key legislative milestones include:

- 1995: Introduction of local option sales taxes to fund transportation infrastructure.

- 2002: Revisions to exemptions and scope, broadening the taxable retail base.

- 2018: Implementation of measures to curb tax evasion and streamline compliance processes.

Taxable Goods and Exceptions: Navigating the Opportunities for Savings

While general merchandise is subject to Tennessee sales tax, certain categories benefit from exemptions, reduced rates, or special conditions. Detailed comprehension of these nuances enables consumers and retailers to harness legal avenues for savings.

Categories of taxable and exempt items

Most retail products, including apparel, electronics, and furniture, are taxable under the standard rate. Conversely, essential goods such as groceries (except prepared foods), prescription medications, and certain medical devices are exempt or taxed at reduced rates, depending on specific regulations.

| Item Category | Tax Status |

|---|---|

| Groceries (unprepared food) | Exempt |

| Prepared food (restaurant dine-in) | Taxable at 9.75% |

| Prescription medications | Exempt |

| Clothing | Taxable, with exemptions for certain items under specific thresholds |

Implementing Strategies for Maximizing Savings

Awareness alone does not suffice; proactive measures translate knowledge into tangible savings. Employers, consumers, and small business owners can adopt specific tactics to mitigate the impact of sales tax and capitalize on opportunities.

Timing and transaction optimization

Time-sensitive purchasing, such as scheduling big-ticket acquisitions during tax-free periods or promotional events, can significantly reduce tax burdens. Tennessee offers occasional sales tax holidays, notably for back-to-school shopping, during which certain items are exempt from sales tax. Tracking these windows through official state calendars ensures the best timing for large purchases.

Utilizing exemptions and tax-free items

Strategic use of exemptions—like buying prescription medications or qualifying clothing—reduces taxable base. Moreover, business owners can leverage tax incentives and exemptions for manufacturing equipment and wholesale transactions, aligning operational strategies with legal provisions for savings.

Leveraging digital tools and resources

Modern technological solutions, including online tax calculators and geospatial rate mapping, facilitate precise determination of applicable rates. This meticulous approach minimizes overpayment and informs effective budgeting.

Legal Compliance and Future Outlook for Tennessee Sales Tax

Maintaining legal compliance amid a dynamic tax landscape necessitates ongoing education and adherence to administrative updates. Tennessee’s Department of Revenue provides authoritative guidance, enforcement, and resources for taxpayers. Penalties for non-compliance include fines, interest charges, and potential legal consequences, underscoring the importance of proactive engagement.

Forecasting future trends involves analyzing legislative agendas, economic indicators, and regional development plans. Proposals for rate adjustments, expansion of exemptions, and technological integrations suggest a trajectory toward more nuanced and efficient sales tax administration.

Summary of key strategic considerations

- Monitor regional rate variations through official channels.

- Capitalize on statutory exemptions and tax holiday periods.

- Leverage digital tools for precise rate determination.

- Stay informed about legislative reforms impacting rates and exemptions.

- Align purchasing timing with tax holiday schedules.

How often do Tennessee sales tax rates change?

+Changes occur through legislative amendments, typically aligned with state fiscal cycles or regional needs. The Department of Revenue updates rates annually or as needed for specific local option tax adjustments.

Are there any ongoing legislative proposals to modify sales tax rates or exemptions in Tennessee?

+Yes, various proposals are periodically debated, including potential expansions of exemptions for digital goods or adjustments to local rates to fund infrastructure. Keeping track of state legislative sessions offers insight into future modifications.

What are the best resources for accurate and current Tennessee sales tax information?

+The Tennessee Department of Revenue website and official publications provide authoritative, real-time data on rates, rules, and exemptions, making them essential reference points for consumers and businesses.