Sc Tax Calculator

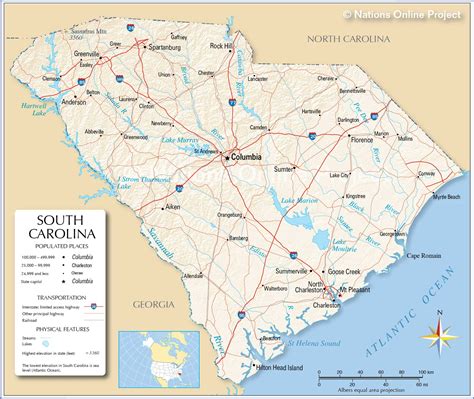

When it comes to navigating the complex world of tax obligations, especially in a state as economically diverse as South Carolina, having a reliable tax calculator at your disposal can be a game-changer. The SC Tax Calculator is an invaluable tool designed to simplify the process of estimating your tax liabilities, offering a user-friendly interface and accurate calculations. Let's delve into the features and benefits of this essential financial companion for South Carolinians.

Understanding the SC Tax Calculator: A Comprehensive Overview

The SC Tax Calculator is a sophisticated online tool specifically tailored to the unique tax landscape of South Carolina. It is developed with the aim of providing individuals, businesses, and taxpayers with an easy and efficient way to compute their tax liabilities, ensuring compliance with state regulations.

This calculator takes into account various factors that influence tax calculations in South Carolina, such as income brackets, deductions, credits, and local tax rates. By inputting relevant information, users can obtain a precise estimate of their tax obligations, helping them budget effectively and plan their financial strategies accordingly.

Key Features and Benefits of the SC Tax Calculator

The SC Tax Calculator boasts a range of features that enhance its usability and accuracy:

- User-Friendly Interface: Designed with simplicity in mind, the calculator's interface is intuitive and easy to navigate. Users can quickly input their data without any complex technical knowledge, making it accessible to a wide range of taxpayers.

- Accurate Calculations: Leveraging the latest tax laws and regulations, the calculator ensures precise tax estimates. It incorporates the most up-to-date information on tax rates, brackets, and deductions, providing reliable results that users can trust.

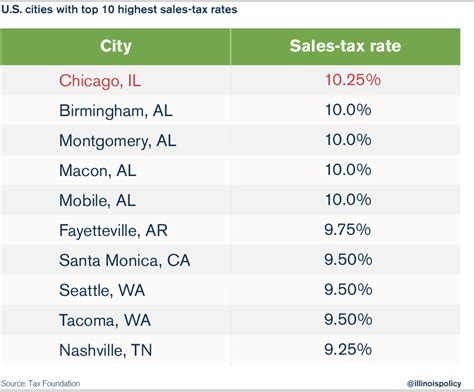

- Comprehensive Coverage: The calculator isn't limited to income tax calculations. It also considers other tax obligations, such as sales tax, property tax, and business taxes, offering a holistic view of a user's tax situation.

- Personalized Estimates: By inputting individual details like income, deductions, and credits, users receive personalized tax estimates. This feature allows for a more accurate assessment of one's tax liability, taking into account unique circumstances and financial situations.

- Real-Time Updates: The calculator is regularly updated to reflect any changes in tax laws and regulations. This ensures that users always have access to the most current and relevant tax information, helping them stay compliant with the latest state requirements.

How the SC Tax Calculator Works: A Step-by-Step Guide

Using the SC Tax Calculator is a straightforward process, designed to be accessible to users of all levels of technical expertise. Here’s a simple step-by-step guide to help you get started:

- Access the Calculator: Begin by visiting the official SC Tax Calculator website. The URL is typically available on the South Carolina Department of Revenue's website or through a simple online search.

- Select Tax Type: The calculator often caters to various tax types, such as income tax, sales tax, or property tax. Choose the tax category that applies to your situation.

- Enter Basic Information: Provide basic details like your legal name, address, and taxpayer ID. This information helps the calculator tailor the calculations to your specific circumstances.

- Input Income Details: For income tax calculations, enter your annual income, including wages, self-employment income, and any other taxable sources. The calculator may also ask for details about deductions and credits you are eligible for.

- Review and Confirm: Once you've entered all the required information, review the details for accuracy. Make any necessary adjustments and confirm your inputs.

- Calculate and Review Results: Click the "Calculate" button, and the SC Tax Calculator will provide you with an estimated tax liability. Review the results, including any breakdowns of tax components, to understand your estimated obligations.

- Save and Print: The calculator often provides an option to save or print your results. This feature allows you to keep a record of your calculations for future reference or for sharing with tax professionals.

Real-World Applications and Benefits

The SC Tax Calculator finds applications in various scenarios, offering tangible benefits to users:

- Budgeting and Financial Planning: By providing accurate tax estimates, the calculator helps individuals and businesses plan their finances effectively. It allows for better budgeting, ensuring that tax obligations are accounted for in financial strategies.

- Compliance and Peace of Mind: With regular updates and precise calculations, the calculator ensures users remain compliant with South Carolina tax laws. This provides peace of mind, reducing the risk of penalties or legal issues related to tax non-compliance.

- Tax Strategy Development: The personalized estimates offered by the calculator can help taxpayers develop tax-efficient strategies. By understanding their tax liabilities, individuals and businesses can make informed decisions about deductions, credits, and other tax-saving measures.

- Easy Comparison and Analysis: The calculator's ability to provide detailed breakdowns of tax components allows for easy comparison and analysis. Users can review their tax obligations over different periods, identify trends, and make informed decisions based on historical tax data.

Tips and Best Practices for Maximizing the SC Tax Calculator

To make the most of the SC Tax Calculator and ensure accurate results, consider the following tips and best practices:

- Keep Your Information Up-to-Date: Regularly update your financial and tax-related information to ensure the calculator provides the most accurate estimates. This includes changes in income, deductions, credits, or tax laws that may impact your calculations.

- Review and Understand the Results: Take time to review the calculated tax estimates and understand the breakdown of different tax components. This helps you identify areas where you can optimize your tax strategy and make informed financial decisions.

- Seek Professional Advice: While the SC Tax Calculator is a valuable tool, it is always recommended to consult with a tax professional for complex tax situations or when making significant financial decisions. Tax laws can be intricate, and professional guidance can provide additional insights and ensure compliance.

- Stay Informed About Tax Law Changes: South Carolina tax laws may undergo periodic updates and revisions. Stay informed about these changes by regularly visiting the South Carolina Department of Revenue's website or following trusted tax resources. This ensures that you're aware of any new regulations that may impact your tax calculations.

The Future of Tax Calculations: Innovations and Improvements

As technology advances and tax regulations evolve, the SC Tax Calculator is expected to incorporate new features and improvements. Here’s a glimpse into the future of tax calculations in South Carolina:

- AI-Assisted Calculations: Artificial Intelligence (AI) may play a more significant role in tax calculations, enhancing accuracy and efficiency. AI-powered systems could analyze historical tax data, identify patterns, and provide more personalized tax estimates based on individual financial profiles.

- Integration with Financial Software: The calculator could integrate with popular financial management software, allowing for seamless data transfer and real-time tax calculations. This integration would streamline the process of tax planning and budgeting, making it even more accessible to users.

- Mobile Accessibility: With the increasing reliance on mobile devices, the SC Tax Calculator may develop a dedicated mobile app, making tax calculations accessible on the go. This would cater to users who prefer mobile convenience and provide an additional layer of accessibility.

- Real-Time Data Updates: In the future, the calculator may incorporate real-time data feeds, ensuring that tax calculations are based on the most current information. This could include live updates on tax rates, deductions, and credits, providing users with the most up-to-date tax estimates.

Conclusion: A Powerful Tool for South Carolinians

The SC Tax Calculator stands as a powerful resource for South Carolinians, offering a simple and reliable way to navigate the complexities of tax obligations. With its user-friendly interface, accurate calculations, and comprehensive coverage, the calculator empowers taxpayers to make informed financial decisions, ensuring compliance and peace of mind.

As technology continues to advance and tax regulations evolve, the SC Tax Calculator is poised to remain at the forefront of tax calculation tools, adapting to meet the needs of South Carolina taxpayers. By embracing these innovations, taxpayers can continue to benefit from efficient, accurate, and accessible tax calculations, shaping a brighter financial future for themselves and their communities.

Can I trust the SC Tax Calculator for accurate tax estimates?

+Absolutely! The SC Tax Calculator is developed and maintained by tax experts and regularly updated to reflect the latest tax laws and regulations. It provides accurate estimates based on the information you input, ensuring compliance and peace of mind.

Is the SC Tax Calculator free to use?

+Yes, the SC Tax Calculator is a free online tool provided by the South Carolina Department of Revenue. It is designed to assist taxpayers in estimating their tax liabilities without any cost.

Can I save my tax calculations for future reference?

+Absolutely! The SC Tax Calculator often provides an option to save your calculations. You can store your results for future reference, making it convenient to track your tax estimates over different periods.

Are there any limitations to the SC Tax Calculator’s capabilities?

+While the SC Tax Calculator is an excellent resource, it is designed for general tax estimation purposes. For complex tax situations or specific tax strategies, it is recommended to consult with a tax professional who can provide personalized advice tailored to your unique circumstances.

How often is the SC Tax Calculator updated with new tax laws and regulations?

+The SC Tax Calculator is updated regularly to reflect any changes in tax laws and regulations. The frequency of updates may vary depending on the complexity and significance of the changes. However, the calculator team ensures that users have access to the most current tax information.