Mansion Tax In Ny

The concept of a "mansion tax" has sparked significant interest and debate in the real estate circles of New York City, particularly among homeowners and prospective buyers of high-value properties. This tax, officially known as the Mansion Tax Law, is a unique levy imposed on certain real estate transactions in New York State, targeting a specific segment of the property market.

In this comprehensive guide, we will delve deep into the intricacies of the Mansion Tax in New York, exploring its origins, how it works, who it affects, and its potential implications for the New York real estate market. By the end of this article, you will have a clear understanding of this complex tax and its role in shaping the city's property landscape.

Understanding the Mansion Tax Law

The Mansion Tax Law was introduced in New York State as a means to generate additional revenue for the state’s budget, with a specific focus on high-end real estate transactions. It is a transfer tax levied on the sale of residential properties with a value exceeding a certain threshold, which is periodically adjusted to account for inflation.

This tax aims to address the rising costs of living in New York City and ensure that those purchasing high-value properties contribute proportionally to the state's revenue. It is a progressive tax, meaning the rate increases as the property value increases, reflecting the ability-to-pay principle.

The law was first enacted in 1989 and has undergone several amendments over the years. The most recent adjustment to the threshold was in 2022, reflecting the continuous rise in property values across the state.

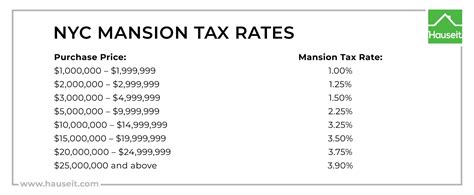

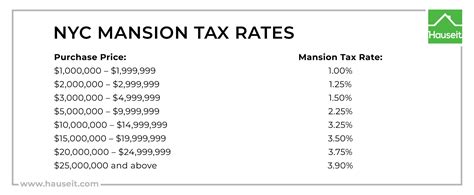

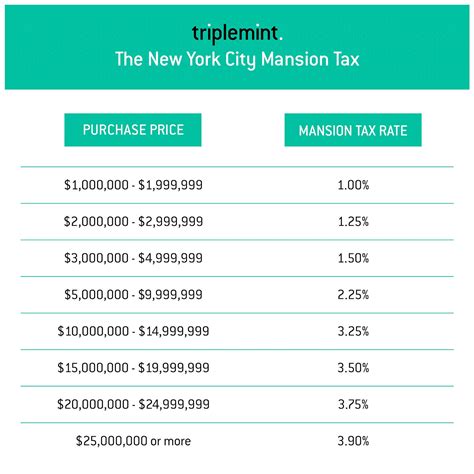

Mansion Tax Thresholds and Rates

The Mansion Tax Law applies to residential properties sold for a value exceeding a certain threshold. This threshold is adjusted annually to account for inflation. As of 2023, the threshold is set at 1 million for New York City and 2 million for the rest of the state.

| Property Value | Mansion Tax Rate |

|---|---|

| Over $1 million (NYC) / $2 million (Rest of NY) | 1% |

| Over $2 million (NYC) / $3 million (Rest of NY) | 1.25% |

| Over $3 million (NYC) / $4 million (Rest of NY) | 1.5% |

| Over $5 million (NYC) / $6 million (Rest of NY) | 2% |

| Over $10 million (NYC) / $11 million (Rest of NY) | 2.25% |

| Over $20 million (NYC) / $21 million (Rest of NY) | 2.5% |

It's important to note that these rates are applied to the portion of the property value that exceeds each threshold. For example, if a property in New York City sells for $3.5 million, the tax is calculated as follows: 1% on the first $2 million, 1.25% on the next $1 million, and 1.5% on the remaining $500,000.

Who Pays the Mansion Tax and When

The Mansion Tax is triggered when a residential property changes hands through a sale, including single-family homes, cooperatives, condominiums, and townhouses. It is important to note that the tax is not applicable to commercial properties or rental properties.

The tax is typically paid by the buyer of the property, although in some cases, the seller may choose to include the tax in the overall sale price, effectively passing the cost to the buyer. The tax is due at the time of closing, and failure to pay can result in significant penalties and interest charges.

The Mansion Tax Law does provide some exemptions and exclusions, primarily aimed at encouraging development and promoting affordable housing initiatives. These exemptions include:

- New construction: Properties that are newly constructed and have never been occupied are exempt from the Mansion Tax for the first two years after completion.

- Affordable housing: Certain transactions involving affordable housing units are exempt, provided they meet specific criteria set by the state.

- Owner-occupied properties: Primary residences owned and occupied by the seller for at least one year prior to the sale are exempt, although this exemption is subject to certain conditions.

The Impact of the Mansion Tax on New York’s Real Estate Market

The introduction of the Mansion Tax has had a noticeable impact on New York’s real estate market, particularly in the high-end property segment. While the tax was designed to generate revenue for the state, it has also influenced buyer behavior and market dynamics.

One of the most significant effects has been a shift in pricing strategies. Buyers and sellers often negotiate the tax burden, with sellers sometimes absorbing the tax or adjusting their asking price to make the property more attractive. This has led to a more competitive market, with buyers having greater leverage in negotiations.

The tax has also encouraged some buyers to explore alternative options, such as purchasing properties just below the threshold or considering other regions outside New York City. This has led to a dispersion of high-end real estate sales across the state, with certain areas experiencing increased demand.

Furthermore, the Mansion Tax has prompted discussions about tax equity and the distribution of tax burdens. While it targets high-value properties, it has also sparked debates about whether the tax should be extended to other segments of the market or whether alternative revenue-generating measures should be considered.

Real-World Examples and Case Studies

To illustrate the impact of the Mansion Tax, let’s examine a few real-world scenarios and how the tax has influenced these transactions.

Scenario 1: Luxury Condo in Manhattan

John and Mary are selling their luxury condo in Manhattan, which they bought 10 years ago for 2 million. Over the years, the property's value has appreciated, and they are now looking to sell it for 4 million. With the current Mansion Tax rate, they would be liable for a tax of 1.5% on the portion exceeding 2 million, amounting to 30,000.

However, John and Mary decide to absorb the tax cost to make their property more competitive in the market. They adjust their asking price to $3.97 million, effectively covering the tax and making their condo an attractive option for buyers who may not want to deal with the tax burden.

Scenario 2: Waterfront Estate in Long Island

Sarah, a real estate investor, is purchasing a waterfront estate on Long Island for 6 million. Given the location and amenities, she expects a strong rental income from the property. With the Mansion Tax, she is liable for a tax of 2% on the portion exceeding 4 million, amounting to $40,000.

Sarah chooses to pass the tax cost to the tenants, incorporating it into the monthly rental fees. This way, she can maintain her expected return on investment while still meeting her tax obligations.

Scenario 3: Primary Residence Exemption

Michael and Emily have lived in their Brooklyn brownstone for over 15 years. They bought the property for 800,000 and have since renovated it extensively. Now, with a market value of 2.5 million, they are considering selling. However, they are eligible for the primary residence exemption, which means they won’t pay the Mansion Tax on the sale.

This exemption allows them to sell their property without incurring additional tax costs, making it a more attractive option for buyers who may be hesitant to take on the tax burden.

Navigating the Mansion Tax: Tips and Strategies

Understanding the Mansion Tax and its implications is crucial for both buyers and sellers of high-value properties in New York. Here are some tips and strategies to navigate this unique tax:

- Know the Thresholds and Rates: Stay updated with the latest Mansion Tax thresholds and rates. These can change annually, so it's important to consult with a tax professional or real estate agent who is well-versed in these matters.

- Explore Exemption Opportunities: If you're a seller, consider whether you're eligible for any exemptions, such as the primary residence exemption or the new construction exemption. These can significantly reduce or eliminate your tax liability.

- Negotiate Strategically: Buyers and sellers can negotiate the tax burden. Sellers might consider absorbing the tax to make their property more attractive, while buyers can negotiate a lower asking price to account for the tax.

- Consider Alternative Strategies: For buyers, explore properties just below the threshold or consider other regions outside New York City where the tax may be lower or non-existent. For investors, evaluate different ways to pass the tax cost, such as incorporating it into rental fees.

- Consult Professionals: Real estate transactions involving the Mansion Tax can be complex. Engaging the services of experienced real estate agents and tax advisors can help ensure compliance and optimize your financial position.

The Future of the Mansion Tax in New York

The Mansion Tax Law has been a significant component of New York’s tax policy for over three decades. Its effectiveness in generating revenue and its impact on the real estate market have made it a subject of ongoing discussion and debate.

As the real estate market continues to evolve, with changing trends and economic conditions, the Mansion Tax may undergo further adjustments. The state may consider revising the thresholds and rates to align with market realities, or it may explore alternative revenue-generating measures to supplement the tax.

Furthermore, the discussion around tax equity and the distribution of tax burdens is likely to continue. While the Mansion Tax targets high-value properties, there may be calls to extend similar taxes to other segments of the market or to explore more progressive tax structures.

The future of the Mansion Tax will be shaped by these ongoing discussions, economic trends, and the state's revenue needs. As a buyer or seller of high-value properties in New York, staying informed and engaged with these developments is crucial for making informed decisions.

Conclusion

The Mansion Tax in New York is a complex and influential component of the state’s tax policy, particularly for those involved in the high-end real estate market. Its progressive nature and targeted approach have generated revenue for the state while also shaping buyer behavior and market dynamics.

By understanding the intricacies of the Mansion Tax, buyers and sellers can navigate this unique tax landscape more effectively. Whether it's exploring exemptions, negotiating strategically, or considering alternative options, a well-informed approach can help optimize financial outcomes and ensure compliance with the law.

As New York's real estate market continues to evolve, the Mansion Tax will remain a key consideration for those looking to buy or sell high-value properties. Staying informed and engaging with the latest developments will be essential for making the most of this dynamic and ever-changing market.

How often are the Mansion Tax thresholds and rates adjusted?

+The Mansion Tax thresholds and rates are typically adjusted annually to account for inflation. The state reviews these rates and makes adjustments based on the changing economic conditions and property values.

Are there any plans to change or abolish the Mansion Tax in the future?

+The future of the Mansion Tax is subject to ongoing discussions and debates. While it has been an effective revenue generator, there may be calls to revise or even abolish the tax in favor of alternative measures. However, any changes would require legislative action and are not imminent.

Can the Mansion Tax be passed on to tenants in rental properties?

+For rental properties, the Mansion Tax is typically passed on to tenants as part of the rental fees. Investors often incorporate the tax cost into their rental rates to maintain their expected return on investment.

Are there any online tools or calculators to estimate the Mansion Tax for a specific property value?

+Yes, several online resources and calculators are available to estimate the Mansion Tax based on a property’s value. These tools can provide a quick estimate of the tax liability, although it’s recommended to consult with professionals for an accurate assessment.

How can I stay updated with the latest developments regarding the Mansion Tax in New York?

+To stay informed, you can regularly check the official New York State Department of Taxation and Finance website, which provides the latest updates and resources related to the Mansion Tax. Additionally, following reputable real estate and tax news sources can keep you up-to-date with any significant changes or developments.