Michigan State Income Tax

The state of Michigan has a progressive income tax system, which means that the tax rate increases as taxable income increases. Understanding Michigan's income tax structure is crucial for residents and businesses alike, as it directly impacts their financial obligations and planning. This article aims to provide an in-depth analysis of Michigan's state income tax, covering its history, current rates, exemptions, and deductions, along with real-world examples and insights for effective tax management.

History and Evolution of Michigan’s Income Tax

The journey of Michigan’s income tax system began in 1933, when the state legislature first introduced the idea of a state income tax. However, it wasn’t until 1967 that Michigan adopted its first income tax, with a flat rate of 4.5%. This flat tax rate remained unchanged until 1993, when it was reduced to 4.4% to encourage economic growth and competitiveness.

In 2007, a significant shift occurred when Michigan transitioned from a flat tax rate to a progressive tax structure. This change aimed to distribute the tax burden more equitably among taxpayers. The progressive system introduced four tax brackets, each with its own rate, ensuring that higher-income earners contributed a larger share to the state's revenue.

Current Income Tax Rates and Brackets

As of my last update in January 2023, Michigan’s income tax rates and brackets are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| Up to $36,000 | 4.25% |

| $36,001 - $57,000 | 4.275% |

| $57,001 - $227,000 | 4.35% |

| Over $227,000 | 4.4% |

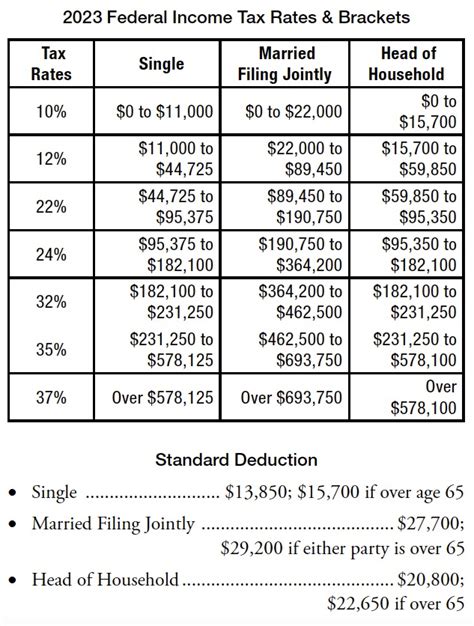

These tax rates are applied to taxable income, which is the income remaining after certain deductions and exemptions are taken into account. It's important to note that Michigan's income tax is separate from federal income tax, and taxpayers must calculate and pay both taxes based on their individual circumstances.

Example: Calculating Michigan State Income Tax

Let’s consider an example to illustrate how Michigan’s progressive tax system works. Suppose an individual resident of Michigan has an annual income of $80,000. Here’s how their state income tax would be calculated:

- The first $36,000 of income falls into the 4.25% bracket, resulting in a tax of $1,500.

- The next $21,000 ($36,001 - $57,000) falls into the 4.275% bracket, adding a tax of $905.25.

- The remaining $23,000 ($57,001 - $80,000) falls into the 4.35% bracket, contributing a tax of $1,009.50.

The total Michigan state income tax for this individual would be $3,414.75.

Exemptions and Deductions

Michigan offers several exemptions and deductions that can reduce the amount of taxable income and, consequently, the tax liability. These exemptions and deductions are designed to provide relief to specific groups of taxpayers and encourage certain behaviors.

Personal Exemptions

Michigan allows a personal exemption of $4,500 for each qualifying taxpayer, spouse, and dependent. This exemption reduces the taxable income, providing a direct benefit to taxpayers with families or multiple sources of income.

Standard Deduction

The state of Michigan also provides a standard deduction of 5,000 for single filers and 10,000 for joint filers. This deduction reduces taxable income and is particularly beneficial for taxpayers who don’t have many itemized deductions.

Itemized Deductions

Taxpayers can choose to itemize their deductions instead of taking the standard deduction if it results in a larger reduction of taxable income. Some common itemized deductions in Michigan include:

- Medical expenses exceeding 7.5% of adjusted gross income

- State and local taxes, including property taxes

- Mortgage interest on primary and secondary residences

- Charitable contributions

- Casualty and theft losses

It's important to note that Michigan allows taxpayers to deduct a portion of their federal income tax liability from their state taxable income. This deduction, known as the Michigan Credit for Tax Paid to Other States, can further reduce the state income tax burden.

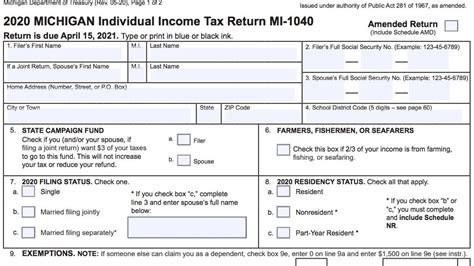

Tax Filing and Payment

Michigan taxpayers must file their state income tax returns by April 15th each year. This deadline aligns with the federal tax filing deadline. Taxpayers can choose to file their returns electronically or by mail, and the Michigan Department of Treasury provides online resources and forms to guide the process.

Taxpayers have several options for paying their Michigan state income tax, including electronic funds transfer, credit or debit card, and traditional check or money order. The state also offers payment plans for taxpayers who cannot afford to pay their taxes in full by the deadline.

Penalty and Interest

Failure to file or pay Michigan state income tax by the due date can result in penalties and interest charges. The penalty for late filing is 5% of the unpaid tax for each month (or part of a month) the return is late, up to a maximum of 25%. Interest on unpaid taxes is charged at a rate of 1% per month, or fraction thereof, until the tax is paid in full.

Conclusion and Future Outlook

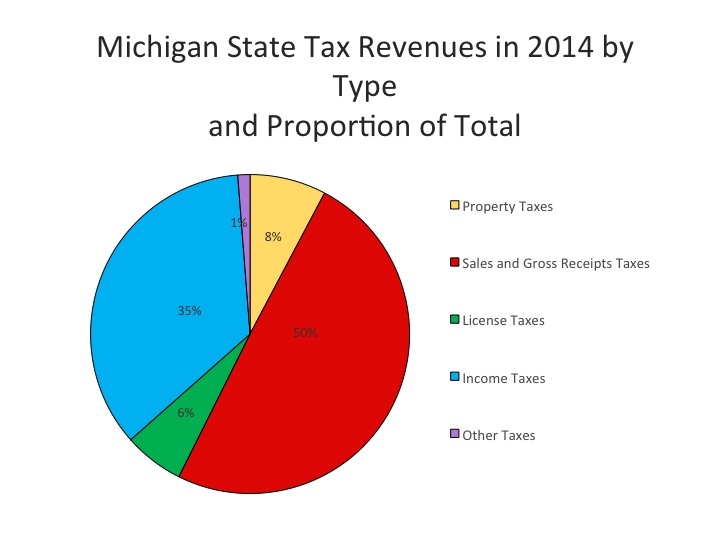

Michigan’s progressive income tax system is designed to balance the need for revenue with tax fairness. The current tax rates and brackets, along with various exemptions and deductions, aim to ensure that taxpayers contribute proportionally to the state’s financial needs while promoting economic growth and competitiveness.

Looking ahead, Michigan's tax landscape may evolve further to adapt to changing economic conditions and societal needs. The state's commitment to a progressive tax system suggests a continued focus on tax fairness and revenue generation. As the state's economy and demographics shift, it will be interesting to observe how Michigan's income tax policies respond to these changes.

How often are Michigan’s income tax rates reviewed and adjusted?

+

Michigan’s income tax rates are reviewed and adjusted periodically, typically every few years. The adjustments are made through legislative action and are influenced by various factors, including the state’s economic health, revenue needs, and tax policy objectives.

Are there any special tax considerations for Michigan residents with multiple sources of income?

+

Yes, Michigan residents with multiple sources of income, such as wages, investments, and business income, may need to consider the state’s rules for apportioning income and calculating the correct tax liability. It’s advisable to consult a tax professional to ensure compliance and optimize deductions.

What are the consequences of not filing or paying Michigan state income tax on time?

+

Failure to file or pay Michigan state income tax on time can result in significant penalties and interest charges. Late filing penalties can accumulate up to 25% of the unpaid tax, and interest is charged at a rate of 1% per month until the tax is paid in full. It’s important to file and pay on time to avoid these additional costs.