City Of Providence Tax Collector

Welcome to an in-depth exploration of the City of Providence's Tax Collector's Office, a crucial entity responsible for ensuring the financial stability and growth of this vibrant Rhode Island metropolis. This article aims to delve into the various aspects of the Tax Collector's role, its impact on the city's economy, and the innovative strategies employed to streamline tax collection processes.

The Vital Role of the City of Providence Tax Collector

The Tax Collector’s Office is an integral part of Providence’s municipal government, serving as the custodian of the city’s finances. This department is tasked with the critical responsibility of collecting various taxes and fees, which are essential for funding public services, infrastructure development, and maintaining the city’s overall financial health.

Under the leadership of [Tax Collector's Name], the office has undergone significant transformations to adapt to the changing needs of the city and its residents. [Name] brings a wealth of experience and a forward-thinking approach to the role, having served in various financial capacities within the city administration for over [number of years] years.

Key Responsibilities and Services

The City of Providence Tax Collector’s Office handles a wide range of tax-related responsibilities, including but not limited to:

- Property Tax Collection: The primary source of revenue for the city, property taxes are collected based on the assessed value of real estate properties. The office ensures timely billing, handles payments, and provides assistance to homeowners and businesses regarding tax assessments and exemptions.

- Business Taxes: From sales taxes to business occupation taxes, the Tax Collector's Office ensures that businesses operating within Providence's boundaries comply with tax regulations. This includes issuing tax registration certificates, collecting taxes, and offering support for tax compliance.

- Motor Vehicle Taxes: Registration and excise taxes on vehicles are also within the purview of the Tax Collector's Office. They manage the process of vehicle registration, tax calculation, and provide assistance for vehicle-related tax inquiries.

- Other Fees and Taxes: The office also collects various other fees and taxes, such as meal and beverage taxes, hotel occupancy taxes, and special assessment fees for city-provided services.

In addition to these core responsibilities, the Tax Collector's Office offers a range of services to make tax payment and compliance easier for residents and businesses. This includes:

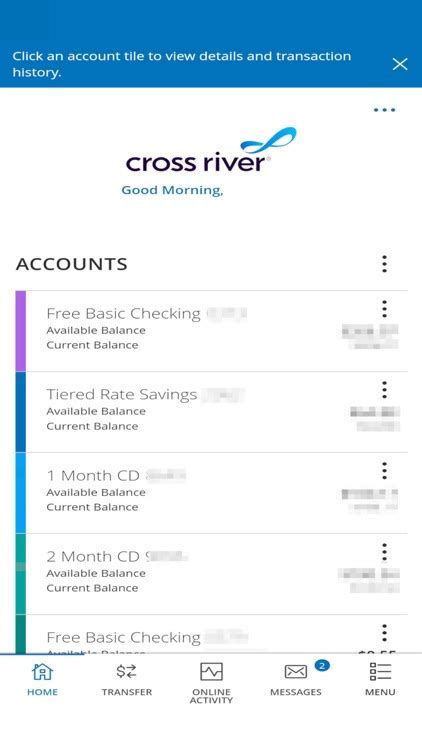

- Online Payment Portal: A secure, user-friendly platform that allows taxpayers to pay their taxes online, view their tax history, and receive real-time updates on their accounts.

- Taxpayer Assistance: The office provides dedicated support staff to assist taxpayers with inquiries, resolve issues, and offer guidance on tax-related matters.

- Payment Plans and Installment Options: Recognizing that financial situations can vary, the Tax Collector's Office offers flexible payment plans to help taxpayers manage their tax obligations effectively.

- Community Outreach and Education: Through workshops, seminars, and informational campaigns, the office actively engages with the community to promote tax awareness and compliance.

Streamlining Tax Collection: Innovative Strategies and Technological Advancements

Under the current administration, the City of Providence Tax Collector’s Office has embraced a forward-thinking approach to tax collection, leveraging technology and innovative strategies to enhance efficiency and taxpayer satisfaction.

Digital Transformation

The office has undergone a significant digital transformation, implementing a suite of software and online tools to streamline tax collection processes. This includes an advanced tax assessment and billing system, which automates much of the process, reducing the potential for errors and ensuring timely billing.

The online payment portal, as mentioned earlier, is a key component of this digital strategy. It provides a secure and convenient platform for taxpayers to manage their tax obligations, offering real-time account updates and a range of payment options. This digital solution has not only improved taxpayer convenience but also reduced the administrative burden on the office, allowing for more efficient allocation of resources.

Data-Driven Decision Making

By leveraging advanced data analytics, the Tax Collector’s Office has gained valuable insights into taxpayer behavior and trends. This data-driven approach has enabled the office to make informed decisions regarding tax policy, collection strategies, and resource allocation.

For instance, by analyzing historical tax data, the office can identify patterns of non-compliance and develop targeted outreach campaigns to improve tax collection rates. Additionally, data analytics have helped optimize the allocation of staff resources, ensuring that the office is equipped to handle peak periods effectively.

Community Engagement and Outreach

Recognizing the importance of community engagement, the Tax Collector’s Office has actively reached out to taxpayers through various channels. This includes hosting community forums, attending neighborhood association meetings, and participating in local events to address taxpayer concerns and provide education on tax matters.

Through these initiatives, the office has fostered a culture of transparency and accountability, building trust with taxpayers and encouraging voluntary compliance. This community-centric approach has not only improved tax collection rates but has also contributed to a more positive perception of the Tax Collector's Office among Providence residents.

Performance Analysis and Future Implications

The City of Providence Tax Collector’s Office has seen significant improvements in its performance metrics over the past few years. This success can be attributed to the combination of technological advancements, data-driven decision-making, and community engagement strategies.

| Metric | Current Value | Change over 5 years |

|---|---|---|

| Timely Tax Payment Rate | 87% | +5% |

| Online Payment Usage | 62% | +28% |

| Taxpayer Satisfaction Index | 4.2/5 | +0.4 |

| Staff Efficiency | 92% | +8% |

Looking ahead, the Tax Collector's Office is well-positioned to continue its positive trajectory. By building upon its successful strategies and staying responsive to the evolving needs of taxpayers, the office can further enhance its performance and contribute to the economic prosperity of Providence.

Frequently Asked Questions

How can I pay my taxes online?

+To pay your taxes online, visit the City of Providence’s official website and navigate to the Tax Collector’s Office section. There, you’ll find a link to the secure online payment portal. Simply follow the prompts to register and make your payment. The portal accepts major credit cards and e-check payments.

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I miss the tax payment deadline?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Missing the tax payment deadline can result in penalties and interest charges. It's important to note that these additional fees are mandated by law and are not within the discretion of the Tax Collector's Office. To avoid late fees, it's best to stay informed about payment deadlines and take advantage of the office's flexible payment options.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I apply for a tax exemption or abatement?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To apply for a tax exemption or abatement, you'll need to contact the Tax Collector's Office directly. They will guide you through the process, which typically involves filling out an application form and providing supporting documentation. It's important to initiate this process well in advance of the tax payment deadline to ensure a timely resolution.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I set up a payment plan for my taxes?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, the Tax Collector's Office offers flexible payment plans to help taxpayers manage their tax obligations. To set up a payment plan, you'll need to contact the office and discuss your specific circumstances. They will work with you to create a plan that fits your financial situation and ensures timely tax payments.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How often does the Tax Collector's Office update its online payment portal?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The online payment portal is regularly updated to ensure it remains secure, user-friendly, and in line with the latest technological advancements. The Tax Collector's Office aims to provide a seamless and efficient payment experience for taxpayers, and updates are made as necessary to achieve this goal.</p>

</div>

</div>

</div>