Georgia Car Sales Tax

The state of Georgia, nestled in the southeastern region of the United States, has a unique and comprehensive system for collecting sales tax on car purchases. Understanding the intricacies of this system is crucial for both car buyers and sellers, as it directly impacts the overall cost of buying a vehicle and the revenue generated for the state.

Unraveling the Georgia Car Sales Tax

In Georgia, the sales tax on vehicles is a vital component of the state's revenue stream, contributing significantly to its economic health. The tax rate and collection process are governed by the Georgia Department of Revenue, which ensures compliance and fairness across the state.

Unlike some other states, Georgia's sales tax is not a flat rate. Instead, it varies based on the county where the vehicle is registered. This county-specific approach ensures that local authorities have some control over their revenue generation, which can be vital for funding local projects and services.

The Rate Variation

As of the latest available data, the sales tax rate in Georgia ranges from 3% to 9% depending on the county. For instance, the rate in Atlanta is 8.9%, while in smaller counties like Wheeler, the rate is as low as 3%. This variation is a reflection of the state's commitment to local governance and the unique economic needs of each region.

The sales tax is calculated based on the purchase price of the vehicle, including any additional fees and dealer preparation costs. It does not include the title transfer fee or license fees, which are separate charges. For instance, if you buy a car for $20,000 in Atlanta, you would pay an 8.9% sales tax, amounting to $1,780.

| County | Sales Tax Rate |

|---|---|

| Atlanta | 8.9% |

| Columbus | 7% |

| Savannah | 7% |

| Macon | 6% |

| Albany | 6% |

| Athens-Clarke County | 7% |

| Augusta | 7% |

| Rome | 6% |

| Valdosta | 7% |

| Warner Robins | 6% |

Special Considerations for Used Cars

The sales tax treatment for used cars in Georgia differs slightly from that of new vehicles. When purchasing a used car, the sales tax is calculated based on the greater of either the purchase price or the "adjusted base price." The adjusted base price is the manufacturer's suggested retail price (MSRP) adjusted for depreciation.

For example, if you buy a 3-year-old used car for $15,000, and the adjusted base price is calculated to be $18,000, you will pay sales tax on the higher value, which is $18,000. This approach ensures that the state receives adequate revenue even for older vehicles.

Exemptions and Special Cases

Georgia offers certain exemptions and special provisions for sales tax on vehicles. For instance, active-duty military personnel, veterans, and disabled individuals may qualify for tax exemptions or reduced rates. Additionally, certain types of vehicles, such as electric cars, may also be eligible for tax credits or reduced rates, promoting eco-friendly transportation options.

The Process of Collecting Sales Tax

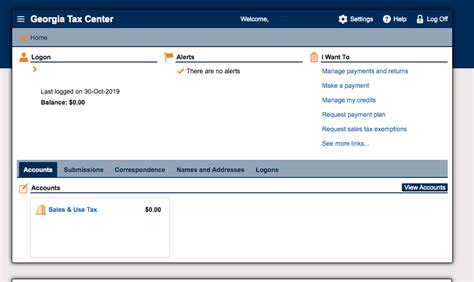

The collection of sales tax on car purchases in Georgia is a multi-step process that involves both the buyer and the seller. This process ensures compliance with state regulations and facilitates the timely transfer of funds to the state's coffers.

Step-by-Step Guide

- Upon purchasing a vehicle, the buyer is required to pay the sales tax to the seller, who is responsible for collecting and remitting the tax to the state.

- The seller then issues a sales tax receipt, which serves as proof of payment and is required for vehicle registration.

- The seller must then file a sales tax return with the Georgia Department of Revenue, reporting the sales tax collected and remitting the funds.

- The buyer is responsible for providing the necessary documentation, such as the bill of sale and proof of insurance, to the Department of Motor Vehicles (DMV) for vehicle registration.

- The DMV then processes the registration, ensuring that all required fees and taxes have been paid.

This meticulous process ensures that the state receives its rightful revenue and that car buyers are not overcharged. It also provides a framework for resolving any disputes or discrepancies that may arise during the transaction.

Online Sales and Out-of-State Purchases

With the rise of online car sales and out-of-state purchases, the Georgia Department of Revenue has implemented specific guidelines to ensure compliance with sales tax laws. If a car is purchased online or from another state, the buyer is still responsible for paying the applicable sales tax to the Georgia Department of Revenue. This is typically done when registering the vehicle in Georgia.

Impact on Car Buyers and Sellers

The sales tax on car purchases in Georgia has a profound impact on both buyers and sellers. For buyers, it can significantly increase the overall cost of the vehicle, especially in counties with higher tax rates. Therefore, understanding the tax implications is essential when budgeting for a car purchase.

For sellers, especially dealerships, the sales tax process adds an administrative burden. They must ensure accurate tax collection, timely remittance to the state, and proper documentation to avoid penalties. Despite this, the sales tax system provides a stable revenue stream for the state, which in turn supports various public services and infrastructure projects.

Tips for Car Buyers

- Research the sales tax rate in your county before finalizing a car purchase to budget accurately.

- Be aware of the total cost of ownership, including sales tax, title transfer fees, and registration fees.

- If purchasing from a private seller, ensure they provide a clear bill of sale with all relevant details.

- For out-of-state purchases, familiarize yourself with the tax laws and be prepared to pay the applicable sales tax when registering the vehicle in Georgia.

Advice for Car Sellers

- Stay updated with the latest sales tax rates and regulations to ensure compliance.

- Use reliable sales tax calculators to determine the correct tax amount for each transaction.

- Maintain accurate records of sales tax collected and remitted to the state to avoid penalties.

- Provide clear and transparent information to buyers regarding the sales tax, ensuring a smooth and fair transaction.

Future Outlook and Potential Changes

The Georgia Department of Revenue periodically reviews and updates its sales tax regulations to ensure fairness and adaptability to changing economic conditions. While the current system has served the state well, there may be future considerations to streamline the process or address emerging trends in the automotive industry.

Potential Scenarios

One potential scenario involves the integration of sales tax collection with online sales platforms. As more car purchases shift online, the state may explore partnerships with major platforms to ensure seamless tax collection and reporting. This could simplify the process for both buyers and sellers and reduce the administrative burden on dealerships.

Another consideration is the potential for tax reform to encourage the adoption of electric vehicles. With the growing focus on sustainability, the state may explore tax incentives or reduced rates for eco-friendly cars, similar to other states that have implemented such measures.

Conclusion

Understanding the Georgia car sales tax is crucial for anyone involved in the automotive industry or planning a car purchase in the state. With its county-specific rates and comprehensive collection process, Georgia's sales tax system is a vital component of its economic framework. While it adds complexity to car transactions, it also ensures fairness and provides essential revenue for the state.

As the automotive landscape evolves, the Georgia Department of Revenue is likely to adapt its sales tax policies to remain relevant and effective. Whether through technological integrations or policy reforms, the state's commitment to fair and efficient tax collection will continue to shape the automotive market in Georgia.

How often does Georgia revise its sales tax rates?

+The Georgia Department of Revenue typically revises sales tax rates annually, ensuring that they remain aligned with the state’s economic needs and local governance priorities.

Are there any online tools to calculate the sales tax on a car purchase in Georgia?

+Yes, several online calculators are available that allow users to input the purchase price and county to determine the exact sales tax amount. These tools provide a convenient way to estimate the tax liability before finalizing a purchase.

What happens if a car buyer fails to pay the sales tax when registering their vehicle in Georgia?

+Failure to pay the sales tax can result in the vehicle registration being denied or delayed. It may also lead to penalties and interest charges. Therefore, it’s crucial to prioritize sales tax payment to avoid legal complications.

Are there any tax incentives for purchasing electric or hybrid vehicles in Georgia?

+Currently, Georgia does not offer specific tax incentives for electric or hybrid vehicles. However, the state regularly reviews its tax policies, and there may be future initiatives to encourage the adoption of eco-friendly transportation options.

Can I negotiate the sales tax rate with the dealership when purchasing a car in Georgia?

+No, the sales tax rate is a legally mandated percentage set by the state and county. It cannot be negotiated with the dealership. However, you can explore different counties with lower tax rates to potentially save on your vehicle purchase.