Sales Tax Nc

Sales tax in North Carolina is an important topic for both businesses and consumers alike. It is a vital component of the state's revenue system, and understanding its intricacies is crucial for effective financial planning and compliance. This article aims to provide an in-depth analysis of sales tax in NC, covering its rates, applicability, collection, and potential impacts on the economy and individual businesses.

Understanding Sales Tax Rates in North Carolina

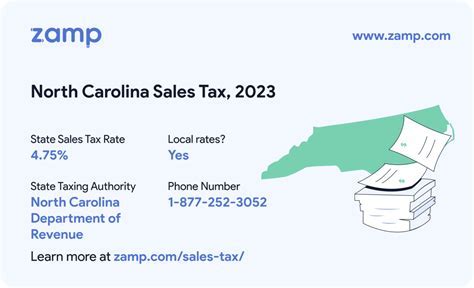

The sales tax rate in North Carolina consists of two components: the state sales tax rate and the local sales tax rate. As of my last update in January 2023, the state sales tax rate is fixed at 4.75%, which is applied uniformly across the state. However, it is important to note that local governments, such as counties and municipalities, have the authority to levy an additional local sales tax, which can vary significantly.

These local sales tax rates are often imposed to fund specific projects or initiatives within the local community. As a result, the total sales tax rate can differ significantly from one region to another. It is crucial for businesses and consumers to be aware of these variations, as they can impact the final cost of goods and services.

| Locality | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Asheville | 2.25% | 7% |

| Charlotte | 2% | 6.75% |

| Raleigh | 2% | 6.75% |

| Winston-Salem | 2% | 6.75% |

| Durham | 1.5% | 6.25% |

Exemptions and Special Rates

North Carolina, like many other states, offers exemptions and special sales tax rates for certain goods and services. These exemptions are designed to provide relief to specific industries, promote economic development, or support social causes. Some common exemptions and special rates include:

- Groceries and Food Products: Many essential food items, such as unprepared groceries and certain staple foods, are exempt from sales tax in NC. This exemption aims to reduce the tax burden on basic necessities.

- Prescription Drugs: Sales of prescription medications are generally exempt from sales tax, making healthcare more affordable for residents.

- Manufacturing Equipment: Sales tax exemptions are often provided for the purchase of machinery and equipment used in manufacturing processes, encouraging investment in the state’s industrial sector.

- Tourism and Hospitality: To promote tourism, certain accommodations and services, such as hotel stays and restaurant meals, may be subject to reduced sales tax rates.

- Charitable Organizations: Sales made by registered charitable organizations are often exempt from sales tax, supporting non-profit initiatives.

Sales Tax Collection and Compliance

Sales tax collection in North Carolina is the responsibility of businesses that make taxable sales. These businesses act as agents for the state and are required to remit the collected sales tax to the North Carolina Department of Revenue on a regular basis. The frequency of remittance depends on the business’s sales volume and can range from monthly to annually.

Registration and Permits

Any business making taxable sales in North Carolina must obtain a sales and use tax permit from the state. This permit authorizes the business to collect and remit sales tax. The application process typically involves providing basic business information, such as the business’s legal name, address, and taxpayer identification number.

Once registered, businesses are provided with a unique permit number, which must be displayed prominently at the point of sale. This number helps the state track sales tax collection and ensures compliance.

Record-Keeping and Reporting

Businesses are required to maintain accurate records of all sales transactions, including the amount of sales tax collected. These records must be retained for a minimum of three years, as they may be subject to audit by the state.

Reporting sales tax is typically done through online portals provided by the state. Businesses must submit periodic reports detailing their taxable sales and the corresponding sales tax collected. Late or inaccurate reporting can result in penalties and interest charges.

Impact on Businesses and the Economy

Sales tax in North Carolina has a significant impact on both businesses and the overall economy. For businesses, sales tax can influence pricing strategies, operational costs, and cash flow management. Here are some key considerations:

Pricing Strategies

Businesses often incorporate sales tax into their pricing strategies. Including sales tax in the displayed price can provide transparency to consumers and simplify the purchasing process. However, businesses must ensure that their pricing remains competitive, especially in regions with higher sales tax rates.

Operational Costs

Sales tax collection and remittance can add administrative costs to a business’s operations. Businesses must dedicate resources to accurately calculate, collect, and remit sales tax, which can impact their overall profitability.

Economic Development and Equity

The sales tax system in North Carolina, with its varying local rates, can influence economic development and equity within the state. Regions with higher sales tax rates may have access to additional funding for local projects, while areas with lower rates may face challenges in attracting businesses and investments.

Furthermore, the distribution of sales tax revenue can impact the state's ability to fund essential services, such as education, healthcare, and infrastructure development.

Future Implications and Trends

Sales tax in North Carolina is subject to ongoing discussions and potential reforms. As the state’s economy evolves, there may be calls for adjustments to the sales tax system to address emerging challenges and opportunities.

Online Sales Tax

With the growth of e-commerce, the collection of sales tax on online sales has become a significant issue. North Carolina, like many states, is working to ensure that online retailers collect and remit sales tax accurately. This includes implementing laws and regulations to hold online marketplaces and remote sellers accountable for sales tax collection.

Sales Tax Simplification

There have been proposals to simplify the sales tax system in North Carolina by reducing the number of local sales tax jurisdictions or implementing a uniform sales tax rate across the state. Such reforms aim to reduce administrative burdens on businesses and provide a more predictable tax environment.

Emerging Technologies and Compliance

Advancements in technology, such as point-of-sale systems and tax automation software, are making sales tax compliance more efficient for businesses. These tools can help businesses accurately calculate and remit sales tax, reducing the risk of errors and non-compliance.

Conclusion

Sales tax in North Carolina is a complex yet crucial aspect of the state’s financial landscape. Understanding the rates, exemptions, and compliance requirements is essential for businesses and consumers to navigate the tax system effectively. As the state continues to evolve, staying informed about sales tax trends and reforms will be vital for businesses to remain competitive and compliant.

What is the current state sales tax rate in North Carolina?

+The current state sales tax rate in North Carolina is 4.75%.

Are there any local sales tax rates in North Carolina?

+Yes, local governments in North Carolina can levy additional sales tax rates, which can vary significantly from one region to another.

What are some common exemptions from sales tax in NC?

+Common exemptions include groceries, prescription drugs, manufacturing equipment, and sales made by charitable organizations.

How often do businesses need to remit sales tax in North Carolina?

+The frequency of remittance depends on the business’s sales volume. It can range from monthly to annually, with businesses required to submit sales tax reports through online portals.

What are the potential impacts of sales tax on businesses in NC?

+Sales tax can impact businesses’ pricing strategies, operational costs, and cash flow management. It may also influence economic development and equity within the state.