Virginia State Tax Refund

If you've ever filed taxes in the state of Virginia, you may have experienced the joy (or relief) of receiving a tax refund. A tax refund is essentially a repayment of excess taxes that you've paid to the state government, and it can be a welcome financial boost for many individuals and families. In this comprehensive guide, we'll delve into the world of Virginia state tax refunds, exploring the process, timelines, and strategies to maximize your refund.

Understanding Virginia State Tax Refunds

A Virginia state tax refund is a reimbursement issued by the Virginia Department of Taxation when your total tax payments exceed the amount you actually owe. This can occur for various reasons, including overpayment of estimated taxes, changes in your income or deductions, or eligibility for tax credits and deductions that reduce your taxable income.

The Virginia state tax refund system is designed to ensure that taxpayers receive their rightful returns promptly and accurately. The state aims to process refunds within a specific timeframe, taking into account the complexity of individual tax returns and the volume of filings during the tax season.

Eligibility and Qualifying Factors

Not everyone who files taxes in Virginia is eligible for a refund. Your eligibility depends on several factors, including your filing status, income level, deductions, and credits claimed. Here are some key considerations:

- Filing Status: Your filing status (single, married filing jointly, head of household, etc.) can impact your tax liability and potential refund. Some filing statuses may offer more tax benefits or deductions, affecting the amount you owe or are eligible to receive back.

- Income Level: Virginia's tax system is progressive, meaning higher incomes are taxed at higher rates. If your income exceeds certain thresholds, you may be eligible for additional deductions or credits, potentially increasing your refund.

- Deductions and Credits: Claiming eligible deductions and credits is crucial for maximizing your refund. These can include standard deductions, itemized deductions for expenses like mortgage interest or charitable contributions, and various tax credits for education, childcare, or energy-efficient improvements.

- Tax Withholdings: If your employer withholds too much tax from your paychecks throughout the year, you may be due a refund. Reviewing your W-4 form and adjusting your withholdings can help ensure you're not overpaying taxes.

The Process of Claiming Your Virginia State Tax Refund

Claiming your Virginia state tax refund involves several steps, from preparing your tax return to receiving your refund. Let’s break down the process to ensure you navigate it smoothly.

Preparing Your Tax Return

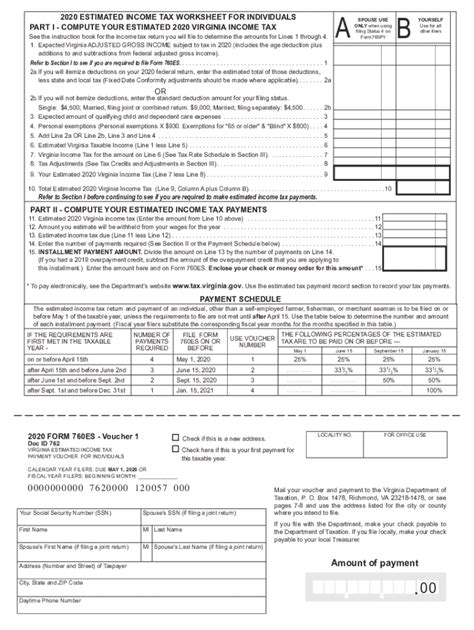

The first step towards claiming your refund is preparing your Virginia state tax return accurately and completely. Here’s a step-by-step guide to help you through the process:

- Gather Your Documents: Collect all necessary documents, including W-2 forms, 1099s, receipts for deductions, and any other relevant tax-related paperwork. Having your documents organized will streamline the preparation process.

- Choose Your Filing Method: Virginia offers both paper and electronic filing options. Electronic filing is generally faster and more convenient, and it's the preferred method for many taxpayers. However, if you prefer a more traditional approach, paper filing is still an option.

- Calculate Your Tax Liability: Use tax preparation software, online calculators, or the assistance of a tax professional to determine your tax liability accurately. This step is crucial to ensure you're not overpaying or underpaying your taxes.

- Claim Deductions and Credits: Review the list of eligible deductions and credits offered by Virginia. Claim any deductions or credits for which you qualify to reduce your taxable income and increase your potential refund. Some common deductions and credits include:

- Standard Deduction

- Personal Exemptions

- Child and Dependent Care Credit

- Education Credits (e.g., Lifetime Learning Credit, American Opportunity Credit)

- Property Tax Credit (for homeowners)

- Earned Income Tax Credit (for low- to moderate-income taxpayers)

- Review and Submit Your Return: Carefully review your completed tax return for accuracy. Ensure all calculations are correct and that you've claimed all eligible deductions and credits. Once satisfied, submit your return to the Virginia Department of Taxation.

Refund Processing Timeline

Once you’ve submitted your tax return, the Virginia Department of Taxation will process it, calculate your refund (if applicable), and issue the refund. The timeline for refund processing can vary based on several factors, including the complexity of your return and the volume of filings during the tax season.

In general, Virginia aims to process refunds within a specific timeframe, typically a few weeks to a couple of months after the filing deadline. The state provides regular updates on its website regarding refund processing times, which can be helpful for tracking the status of your refund.

Checking the Status of Your Refund

To check the status of your Virginia state tax refund, you can use the Where’s My Refund tool provided by the Virginia Department of Taxation. This online tool allows you to enter your personal information and receive an update on the status of your refund. It’s a convenient way to stay informed and ensure your refund is on track.

Receiving Your Refund

Virginia offers several options for receiving your state tax refund. You can choose to receive your refund via direct deposit, which is typically the fastest and most secure method. Alternatively, you can opt for a check mailed to your address on file with the Virginia Department of Taxation.

Direct deposit refunds are usually processed within a few days of your tax return being accepted, while mailed checks may take slightly longer. It's important to ensure that your banking information is accurate if you choose direct deposit and that your mailing address is up-to-date if you opt for a mailed check.

Maximizing Your Virginia State Tax Refund

While receiving a tax refund can be a pleasant surprise, it’s even better if you can maximize the amount you receive. Here are some strategies to consider when preparing your Virginia state tax return to potentially increase your refund:

Claim All Eligible Deductions and Credits

As mentioned earlier, claiming all eligible deductions and credits is crucial for reducing your taxable income and increasing your refund. Review the list of deductions and credits offered by Virginia thoroughly and ensure you qualify for each one before claiming it. Some common deductions and credits to consider include:

- Standard Deduction: Virginia offers a standard deduction amount that reduces your taxable income. If you don't itemize your deductions, claiming the standard deduction is a simple way to lower your tax liability.

- Itemized Deductions: If your expenses exceed the standard deduction amount, you may benefit from itemizing your deductions. Common itemized deductions include medical expenses, state and local taxes paid, mortgage interest, and charitable contributions.

- Education Credits: Virginia offers several education-related tax credits, such as the Lifetime Learning Credit and the American Opportunity Credit. These credits can significantly reduce your tax liability, especially if you or your dependents are enrolled in higher education programs.

- Child and Dependent Care Credit: If you incur expenses for child or dependent care while working or attending school, you may be eligible for this credit. It can help offset some of the costs associated with childcare.

Adjust Your Tax Withholdings

If you consistently receive large tax refunds each year, it may be an indication that you’re overpaying taxes throughout the year. In such cases, you can adjust your tax withholdings to ensure you’re not giving the government an interest-free loan. Here’s how:

- Review your W-4 form: The W-4 form is used to determine the amount of tax withheld from your paychecks. By adjusting your withholdings, you can ensure that the right amount of tax is withheld, reducing the likelihood of a large refund (or owing money at tax time).

- Use the IRS Withholding Calculator: The IRS provides an online withholding calculator that helps you determine the correct number of allowances to claim on your W-4. This tool considers your filing status, income, deductions, and credits to estimate your tax liability and recommend the appropriate withholding amount.

- Submit a New W-4 to Your Employer: Once you've determined the appropriate number of allowances, complete a new W-4 form and submit it to your employer. This will ensure that your tax withholdings are adjusted accordingly, potentially reducing the size of your refund (or increasing your take-home pay throughout the year).

Consider Tax-Advantaged Retirement Contributions

Contributing to tax-advantaged retirement accounts, such as a 401(k) or IRA, can reduce your taxable income and potentially increase your refund. These contributions are made with pre-tax dollars, which means the money is not taxed until you withdraw it in retirement. Here’s how it works:

- 401(k) Contributions: If your employer offers a 401(k) plan, consider contributing a portion of your pre-tax income to it. These contributions reduce your taxable income, potentially lowering your tax liability and increasing your refund. Additionally, your contributions grow tax-deferred until you withdraw them in retirement.

- IRA Contributions: An Individual Retirement Account (IRA) is another tax-advantaged option. You can contribute to a Traditional IRA or a Roth IRA, depending on your preferences and eligibility. Traditional IRA contributions are tax-deductible, which can lower your taxable income and potentially increase your refund. Roth IRA contributions are made with after-tax dollars, but the earnings grow tax-free, and qualified withdrawals in retirement are tax-free as well.

Explore Tax-Saving Strategies for Homeowners

If you’re a homeowner in Virginia, there are specific tax-saving strategies you can employ to potentially increase your refund. Here are a few options to consider:

- Mortgage Interest Deduction: If you have a mortgage on your primary residence, you may be able to deduct the interest you pay on your mortgage loan. This deduction can significantly reduce your taxable income and increase your refund. Keep track of your mortgage interest payments and claim them on your tax return.

- Property Tax Credit: Virginia offers a Property Tax Credit for homeowners. This credit can reduce the amount of property tax you owe, which can lower your overall tax liability and increase your refund. Ensure you understand the eligibility requirements and claim the credit if applicable.

- Home Improvement Tax Credits: Virginia provides tax credits for certain energy-efficient home improvements. If you've made eligible improvements to your home, you may be able to claim a credit on your tax return. These credits can reduce your tax liability and potentially increase your refund. Research the specific requirements and eligible improvements to determine if you qualify.

Conclusion: Making the Most of Your Virginia State Tax Refund

Understanding the process of claiming your Virginia state tax refund and employing strategies to maximize it can help you make the most of your financial situation. By carefully preparing your tax return, claiming all eligible deductions and credits, and adjusting your tax withholdings, you can potentially increase your refund and ensure you’re not overpaying taxes throughout the year.

Remember, tax laws and regulations can change, so it's essential to stay informed and seek professional advice when needed. With the right approach and a bit of planning, you can navigate the Virginia state tax refund process confidently and optimize your financial outcome.

FAQ

How long does it take to receive my Virginia state tax refund after filing my return?

+The timeline for receiving your Virginia state tax refund can vary depending on several factors, including the complexity of your return and the volume of filings during the tax season. In general, Virginia aims to process refunds within a few weeks to a couple of months after the filing deadline. The state provides regular updates on its website regarding refund processing times, so it’s a good idea to check there for the most accurate and up-to-date information.

Can I check the status of my Virginia state tax refund online?

+Yes, you can check the status of your Virginia state tax refund online using the Where’s My Refund tool provided by the Virginia Department of Taxation. This online tool allows you to enter your personal information and receive an update on the status of your refund. It’s a convenient way to stay informed and ensure your refund is on track.

What if I don’t receive my Virginia state tax refund within the expected timeframe?

+If you don’t receive your Virginia state tax refund within the expected timeframe, there are a few steps you can take. First, check the status of your refund using the Where’s My Refund tool to ensure there aren’t any processing delays or issues. If the tool indicates that your refund is pending, you may need to be patient and allow more time for processing. However, if the tool shows that your refund has been issued but you haven’t received it, you can contact the Virginia Department of Taxation for further assistance. They can help investigate the issue and provide guidance on next steps.

Can I receive my Virginia state tax refund as a direct deposit instead of a check?

+Yes, Virginia offers the option to receive your state tax refund via direct deposit. Direct deposit is generally the fastest and most secure method for receiving your refund. When filing your tax return, you’ll have the opportunity to provide your banking information for direct deposit. Ensure that your information is accurate to avoid any delays in receiving your refund.

Are there any deductions or credits specifically for Virginia residents that I should be aware of?

+Yes, Virginia offers several deductions and credits that are specific to its residents. Some of these include the Property Tax Credit for homeowners, the Virginia Earned Income Tax Credit for low- to moderate-income taxpayers, and tax credits for certain energy-efficient home improvements. It’s important to review the list of eligible deductions and credits provided by the Virginia Department of Taxation to ensure you claim all the benefits you’re entitled to.