Ga Car Sales Tax

In the state of Georgia, the purchase of a vehicle is subject to a sales tax, which can significantly impact the overall cost for buyers. Understanding the intricacies of the Georgia car sales tax is crucial for both individuals and businesses engaged in automotive transactions. This article aims to provide a comprehensive guide, shedding light on the specifics of this tax, its implications, and how it is calculated.

Understanding the Georgia Car Sales Tax

The car sales tax in Georgia is a percentage-based tax levied on the purchase price of a vehicle. It is an essential component of the state’s revenue generation and is applicable to new and used car sales alike. The tax is calculated based on the purchase price, including any additional fees and charges associated with the vehicle, such as dealer fees and optional add-ons.

The state of Georgia has a standard sales tax rate of 4%, which applies to most goods and services. However, when it comes to vehicle purchases, an additional 3% local option sales tax is often applicable, bringing the total sales tax rate to 7%. This local option tax is implemented in many counties across the state and is used to fund specific local projects and initiatives.

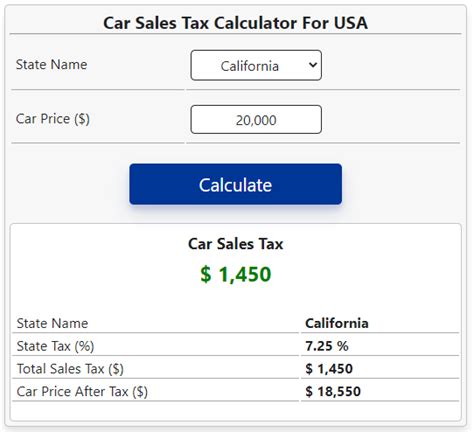

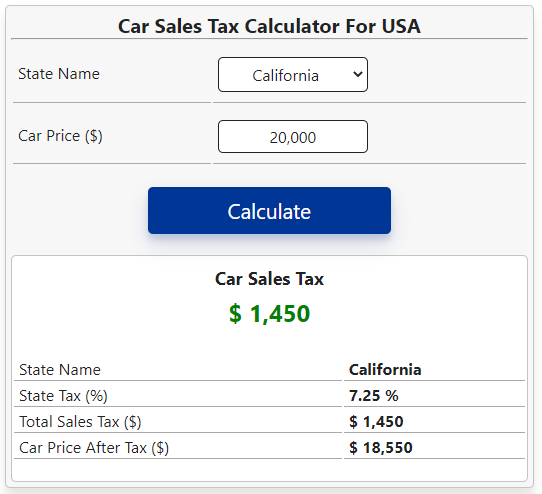

For example, if an individual purchases a used car for $20,000 in a county with the 3% local option sales tax, the sales tax calculation would be as follows:

| Purchase Price | Sales Tax Rate | Sales Tax Amount |

|---|---|---|

| $20,000 | 7% | $1,400 |

In this scenario, the buyer would need to pay an additional $1,400 in sales tax on top of the purchase price.

Exemptions and Special Cases

While the Georgia car sales tax is generally applicable to all vehicle purchases, there are certain exemptions and special cases to consider. One notable exemption is for military personnel who are stationed in Georgia. Active-duty military members are eligible for a sales tax exemption when purchasing a vehicle, provided they meet specific criteria and present the necessary documentation.

Additionally, certain types of vehicles may have different tax rates or exemptions. For instance, electric vehicles (EVs) often benefit from reduced sales tax rates or tax credits to encourage their adoption. The specifics of these incentives can vary based on the county and the type of EV being purchased.

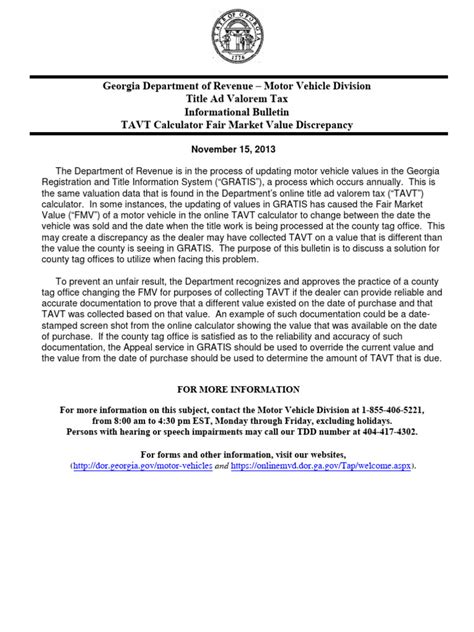

Registration and Title Transfer Process

The car sales tax is an essential part of the vehicle registration and title transfer process in Georgia. When a vehicle is purchased, the buyer is typically required to pay the sales tax at the time of registration. This tax payment is necessary to obtain a valid vehicle title and registration certificate, which are crucial for legal operation on Georgia’s roads.

The registration process involves submitting the necessary paperwork, including the bill of sale, odometer disclosure statement, and proof of insurance, along with the calculated sales tax amount. This process can be completed at a local Department of Driver Services (DDS) office or through online services provided by the state.

Online Registration and Title Transfer

Georgia offers a convenient online registration and title transfer system for vehicle purchases. This system allows buyers to complete the registration process remotely, providing a streamlined and efficient experience. To utilize this service, buyers will need to have the necessary documentation and payment information ready, including the calculated sales tax amount.

The online system guides users through the registration process, step by step, ensuring all required information is provided. Once the registration is complete, the buyer will receive a digital copy of their vehicle registration and title certificate, which can be printed for future reference.

Sales Tax Calculation: A Comprehensive Breakdown

Calculating the Georgia car sales tax accurately is essential to ensure compliance with state regulations and avoid any potential penalties. The tax calculation process involves several steps and considerations, which we will explore in detail.

Step 1: Determine the Purchase Price

The first step in calculating the sales tax is to establish the purchase price of the vehicle. This price should include all relevant fees and charges associated with the purchase, such as:

- Dealer Fees: These are fees charged by the dealership for services rendered, such as vehicle preparation and documentation.

- Optional Add-Ons: Any additional features or accessories installed on the vehicle, such as upgraded wheels or custom paint jobs.

- Title and Registration Fees: The costs associated with obtaining a valid vehicle title and registration, which are often included in the purchase price.

For instance, if the purchase price of a vehicle is $25,000, and it includes $500 in dealer fees and $1,000 for optional add-ons, the total purchase price for sales tax purposes would be $26,500.

Step 2: Identify the Applicable Tax Rate

Once the purchase price is determined, the next step is to identify the applicable tax rate. As mentioned earlier, Georgia has a standard sales tax rate of 4%, and many counties also implement a 3% local option sales tax, resulting in a combined rate of 7%.

To illustrate, if the vehicle purchase occurs in a county with the 3% local option sales tax, the applicable tax rate would be 7%. In this case, the sales tax calculation would be as follows:

| Purchase Price | Sales Tax Rate | Sales Tax Amount |

|---|---|---|

| $26,500 | 7% | $1,855 |

Step 3: Calculate the Sales Tax Amount

With the applicable tax rate identified, the final step is to calculate the actual sales tax amount. This is done by multiplying the purchase price by the sales tax rate. In our example, with a purchase price of 26,500</strong> and a <strong>sales tax rate</strong> of <strong>7%</strong>, the sales tax amount would be <strong>1,855.

Implications and Considerations

Understanding the implications of the Georgia car sales tax is crucial for both buyers and sellers. For buyers, the sales tax can significantly impact the overall cost of a vehicle purchase, often amounting to thousands of dollars. It is essential to factor this tax into the budget when considering a vehicle acquisition.

Sellers, on the other hand, must ensure that they are compliant with the state's sales tax regulations. This includes accurately calculating and collecting the sales tax from buyers, as well as remitting these taxes to the appropriate authorities within the specified timeframes.

Additionally, businesses involved in the automotive industry, such as dealerships and auto service centers, should be well-versed in the intricacies of the car sales tax. They play a critical role in ensuring that their customers are informed about the tax implications and that the tax is accurately calculated and paid.

Future Implications and Changes

As tax policies and regulations are subject to change, it is essential to stay informed about potential future implications and updates to the Georgia car sales tax. While the current tax structure is well-defined, there may be ongoing discussions or proposals for modifications, which could impact the tax rate or exemptions.

For instance, there have been recent debates surrounding the potential increase in the local option sales tax to fund specific infrastructure projects. While such proposals are still in the early stages, they highlight the dynamic nature of tax policies and the need for continuous awareness.

Furthermore, advancements in vehicle technology and the growing popularity of electric and hybrid vehicles may also influence tax policies. As these vehicles often come with unique incentives and tax benefits, their increasing market presence could lead to adjustments in the tax structure to encourage their adoption or to maintain revenue streams.

Staying updated on these potential changes is crucial for both buyers and businesses, as it allows for better financial planning and ensures compliance with any future tax regulations.

What happens if I fail to pay the car sales tax in Georgia?

+Failure to pay the car sales tax in Georgia can result in penalties and interest charges. Additionally, it may lead to delays in obtaining a valid vehicle registration and title, impacting your ability to legally operate the vehicle on Georgia’s roads.

Are there any tax incentives for purchasing electric vehicles in Georgia?

+Yes, Georgia offers various tax incentives for the purchase of electric vehicles (EVs). These incentives can include reduced sales tax rates, tax credits, and exemptions. It’s advisable to consult the official Georgia tax guidelines or seek professional advice to understand the specific incentives available.

Can I negotiate the sales tax amount with the dealership?

+The sales tax amount is determined by the state and local tax rates, so it is generally not negotiable. However, you can negotiate the overall purchase price of the vehicle, which can indirectly impact the sales tax amount.