Gwinnett County Property Taxes

Welcome to our comprehensive guide on Gwinnett County Property Taxes, an essential topic for every homeowner and real estate enthusiast in the region. Understanding the ins and outs of property taxes is crucial for managing your finances effectively and ensuring compliance with local regulations. In this article, we will delve into the intricacies of Gwinnett County's property tax system, providing you with valuable insights, expert analysis, and practical tips.

Unraveling the Gwinnett County Property Tax Landscape

Gwinnett County, nestled in the heart of Georgia, boasts a thriving real estate market and a diverse range of properties. As a homeowner or prospective buyer, it’s imperative to grasp the intricacies of the local property tax system. In this section, we will navigate through the fundamental aspects of Gwinnett County’s property taxes, shedding light on how they are calculated, assessed, and managed.

Understanding the Assessment Process

The journey towards comprehending Gwinnett County property taxes begins with the assessment process. The county’s tax assessor’s office plays a pivotal role in evaluating property values, which forms the basis for tax calculations. Here’s a breakdown of the key steps involved:

- Property Identification: Each property in Gwinnett County is assigned a unique identification number, ensuring accurate record-keeping.

- Physical Inspection: The tax assessor’s team conducts regular physical inspections of properties to assess their condition, improvements, and any changes that may impact their value.

- Data Collection: Assessors gather relevant data, including recent sales of comparable properties, construction costs, and market trends, to establish an accurate valuation.

- Assessment Notice: Property owners receive an assessment notice, detailing the estimated value of their property and the corresponding tax liability.

It’s crucial to review these assessment notices carefully, as they provide valuable information about your property’s value and any potential changes from the previous year.

Tax Rate Calculation

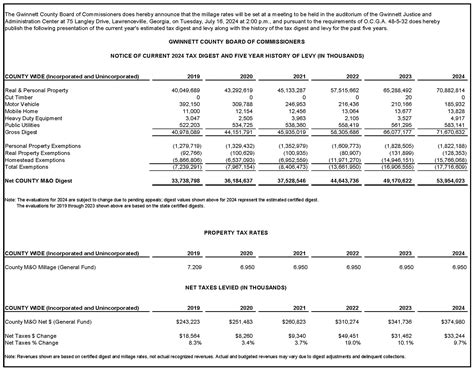

Once the assessed value of a property is determined, the tax rate comes into play. Gwinnett County utilizes a millage rate, which is expressed in mills per dollar of assessed value. Here’s how the process unfolds:

- Millage Rate Determination: The millage rate is set by local governing bodies, including the county government and various municipalities within Gwinnett County. These entities consider factors such as budget requirements, service needs, and economic conditions when determining the rate.

- Tax Rate Calculation: The millage rate is applied to the assessed value of the property to calculate the annual tax liability. For instance, if a property has an assessed value of 200,000 and the millage rate is 18 mills, the annual tax would be calculated as follows: <strong>200,000 x 0.018 = $3,600.

It’s worth noting that the millage rate may vary across different areas within Gwinnett County, so it’s essential to stay informed about the specific rate applicable to your property.

Property Tax Due Dates and Payment Options

Understanding when property taxes are due and the available payment options is vital for effective financial planning. In Gwinnett County, property taxes are typically due in two installments, with specific due dates set by the tax commissioner’s office. Here’s a glimpse of the process:

- First Installment Due Date: The first installment of property taxes is typically due in January or February. Property owners receive a tax bill detailing the amount due and payment instructions.

- Second Installment Due Date: The second installment is due several months later, often in July or August. It’s crucial to keep track of these due dates to avoid late fees and penalties.

- Payment Options: Gwinnett County offers a variety of convenient payment methods, including online payments through the tax commissioner’s website, in-person payments at designated locations, and traditional mail-in payments. Some taxpayers may also be eligible for payment plans or other arrangements.

Staying organized and aware of these due dates ensures a smooth and stress-free tax payment process.

Exemptions and Discounts: Maximizing Your Savings

Gwinnett County recognizes the importance of providing relief to certain property owners through exemptions and discounts. These measures can significantly reduce your tax liability, making it essential to understand the eligibility criteria and application process.

- Homestead Exemption: Gwinnett County offers a homestead exemption to qualifying homeowners, reducing the assessed value of their primary residence for tax purposes. This exemption can provide substantial savings, especially for long-term residents.

- Senior Citizen Discount: Elderly residents of Gwinnett County may be eligible for a senior citizen discount on their property taxes. The discount is based on age and income criteria, providing much-needed relief for retirees.

- Veteran’s Exemption: The county also extends its gratitude to veterans by offering a veteran’s exemption, which can reduce the assessed value of properties owned by eligible veterans.

Exploring these exemptions and discounts can significantly impact your overall tax liability, so it’s worth taking the time to understand your eligibility and navigate the application process.

Challenging Your Property Assessment: A Guide to Appeals

In certain circumstances, property owners may feel that their assessed value is inaccurate or unfair. Gwinnett County provides a formal appeals process to address such concerns. Here’s a step-by-step guide to challenging your property assessment:

- Review Your Assessment Notice: Carefully examine your assessment notice, looking for any discrepancies or errors. Identify the specific aspects of the assessment you wish to dispute.

- Gather Evidence: Collect supporting documentation, such as recent property appraisals, comparable sales data, or expert opinions, to strengthen your case.

- File an Appeal: Submit a formal appeal to the Gwinnett County Board of Equalization, detailing your reasons for disputing the assessment and providing the supporting evidence. Ensure you meet the filing deadline to avoid delays.

- Appeal Hearing: If your appeal is accepted, you will be invited to attend a hearing before the Board of Equalization. Prepare your case thoroughly, and consider seeking professional representation if needed.

- Decision and Next Steps: The Board of Equalization will issue a decision, which you can accept or further appeal to the Superior Court if you remain dissatisfied. It’s essential to understand the appeals process and your rights to ensure a fair outcome.

Gwinnett County Property Taxes: An In-Depth Analysis

Now that we’ve covered the foundational aspects of Gwinnett County property taxes, let’s dive deeper into specific areas of interest, providing you with a comprehensive understanding of this complex topic.

The Impact of Property Value Fluctuations

Property values in Gwinnett County, like in any dynamic real estate market, can fluctuate over time due to various factors, including market trends, economic conditions, and property improvements. These fluctuations directly impact property tax liabilities, making it crucial for homeowners to stay informed and proactive.

When property values rise, it often results in higher tax assessments, leading to increased tax obligations. Conversely, declining property values can provide some relief, as tax assessments may decrease accordingly. Staying abreast of local market trends and understanding how they influence property values is essential for effective financial planning.

Homeowners can leverage tools such as online property value estimators and consult with real estate professionals to gain insights into their property’s value. By staying informed, they can anticipate potential changes in their tax liability and make informed decisions regarding improvements, renovations, or strategic selling.

Navigating Special Assessments and Millage Rates

In addition to the standard property taxes, Gwinnett County may impose special assessments on certain properties to fund specific infrastructure projects or improvements. These assessments are typically levied on a per-property basis and are separate from the regular tax rate.

Understanding the purpose and impact of special assessments is crucial for property owners. While these assessments can provide benefits such as improved infrastructure or enhanced community amenities, they also represent an additional financial burden. Homeowners should carefully review any notices regarding special assessments, ensuring they understand the project’s scope, timeline, and their individual financial obligations.

Furthermore, the millage rate, as mentioned earlier, is a critical component of the property tax calculation. Gwinnett County’s millage rate may vary from year to year, influenced by factors such as budget requirements and economic conditions. Staying informed about changes in the millage rate is essential, as it directly impacts the overall tax liability. Property owners can access information about the current millage rate through official county websites or by contacting the tax assessor’s office.

Exploring Tax Relief Programs for Eligible Homeowners

Gwinnett County recognizes the importance of providing tax relief to certain segments of the population, offering a range of programs to assist eligible homeowners. These programs aim to alleviate financial burdens and promote homeownership stability.

One notable program is the Homestead Tax Relief, which provides a credit against the state income tax for qualifying homeowners. This relief can significantly reduce the tax liability for those who meet the eligibility criteria, which typically include age, income, and property ownership requirements.

Additionally, the county offers the Property Tax Deferral Program, which allows eligible senior citizens and disabled individuals to defer the payment of their property taxes until the property is sold or transferred. This program provides much-needed financial flexibility for those facing limited income or financial constraints.

Understanding the eligibility criteria and application process for these tax relief programs is crucial. Homeowners should explore these options thoroughly and seek guidance from the county’s tax offices or designated assistance programs to ensure they receive the benefits they are entitled to.

A Guide to Property Tax Deductions and Credits

Property owners in Gwinnett County can take advantage of various tax deductions and credits, which can significantly reduce their overall tax liability. These deductions and credits are designed to provide relief and promote specific objectives, such as energy efficiency, historic preservation, or affordable housing initiatives.

One prominent deduction available to homeowners is the Mortgage Interest Deduction. This deduction allows taxpayers to deduct the interest paid on their home mortgage loans, providing a significant tax benefit. Homeowners should carefully track and document their mortgage interest payments to maximize this deduction.

Additionally, Gwinnett County offers a Property Tax Credit for qualifying low-income homeowners. This credit can offset a portion of the property taxes owed, providing much-needed financial relief. To be eligible, homeowners must meet specific income and residency requirements, and the credit amount is typically determined based on household income and property value.

Exploring these deductions and credits thoroughly and understanding the eligibility criteria is essential. Homeowners can consult with tax professionals or seek guidance from the county’s tax offices to ensure they maximize their tax savings and take advantage of all available benefits.

The Future of Gwinnett County Property Taxes

As we look ahead, the future of Gwinnett County property taxes holds both challenges and opportunities. The dynamic nature of the real estate market, evolving economic conditions, and changing demographic trends will continue to influence property values and tax assessments.

One key aspect to watch is the potential impact of technological advancements and data analytics on property tax assessments. As Gwinnett County explores innovative assessment methods, such as automated valuation models and big data analysis, the accuracy and efficiency of property valuations may improve. However, it’s essential to ensure that these advancements are accompanied by robust oversight and transparency to maintain fairness and equity.

Furthermore, the county’s commitment to fiscal responsibility and sustainable budgeting will shape the future of property taxes. Balancing the need for revenue with the financial well-being of residents will remain a delicate task. Gwinnett County’s leadership and community engagement will play a pivotal role in determining the direction of property tax policies, ensuring that they remain equitable and aligned with the needs of the community.

Staying informed about local developments, participating in community discussions, and engaging with elected officials will empower homeowners and residents to shape the future of Gwinnett County’s property tax landscape. By actively contributing to the dialogue, residents can influence policies that impact their financial obligations and overall quality of life.

Conclusion

In this comprehensive guide, we’ve explored the intricate world of Gwinnett County property taxes, providing you with a deep understanding of the assessment process, tax calculation, and available relief options. By staying informed and proactive, homeowners can navigate the complexities of property taxes with confidence, ensuring they meet their financial obligations while maximizing their savings.

As we conclude, remember that knowledge is power when it comes to managing your property taxes effectively. Stay engaged with local developments, seek expert advice when needed, and leverage the resources available to make informed decisions. Your financial well-being and the stability of your real estate investments depend on your understanding of the ever-evolving property tax landscape.

We hope this guide has empowered you with the knowledge and tools to tackle Gwinnett County property taxes head-on. Should you have further questions or need additional guidance, don’t hesitate to reach out to the county’s tax offices or consult with trusted real estate and tax professionals. Here’s to a prosperous and financially secure future in Gwinnett County!

How often are property values reassessed in Gwinnett County?

+Property values in Gwinnett County are typically reassessed every four years. However, certain circumstances, such as significant property improvements or changes in market conditions, may trigger an earlier reassessment.

Can I appeal my property assessment if I disagree with the valuation?

+Yes, you have the right to appeal your property assessment if you believe it is inaccurate or unfair. The appeals process involves submitting a formal request to the Gwinnett County Board of Equalization, providing evidence to support your claim, and potentially attending a hearing to present your case.

What are the deadlines for paying property taxes in Gwinnett County?

+Property taxes in Gwinnett County are typically due in two installments. The first installment is due in January or February, and the second installment is due in July or August. It’s important to note that late payments may incur penalties and interest.

Are there any exemptions or discounts available for Gwinnett County property taxes?

+Yes, Gwinnett County offers several exemptions and discounts to eligible property owners. These include the homestead exemption, senior citizen discount, and veteran’s exemption. Each program has specific eligibility criteria, so it’s important to review the requirements and apply accordingly.

How can I stay informed about changes in Gwinnett County’s property tax policies and rates?

+Staying informed about property tax policies and rates is crucial. You can visit the official Gwinnett County website, subscribe to their newsletters, or follow their social media channels for updates. Additionally, attending community meetings and engaging with local government representatives can provide valuable insights into future tax developments.