Tax Collector Escambia County

In the realm of local government and administrative services, the role of the Tax Collector is often integral to the smooth functioning of a county's financial ecosystem. Escambia County, situated in the Florida Panhandle, is no exception. The office of the Tax Collector in Escambia County serves as a vital hub for a myriad of essential services, from the collection of taxes to the provision of vehicle registration and titling, as well as offering assistance with property appraisals and the processing of driver licenses and ID cards. In this article, we delve into the diverse responsibilities and services of the Tax Collector's office in Escambia County, shedding light on its crucial role within the county's administrative framework.

The Scope of the Tax Collector’s Office: A Multifaceted Role

At the heart of Escambia County’s administration, the Tax Collector’s office is responsible for a wide array of critical tasks. Beyond the collection of taxes, which forms the backbone of local government revenue, the office provides a comprehensive suite of services to the residents of Escambia County. This includes the registration and titling of vehicles, a process that is essential for the efficient management of the county’s motor vehicle records and the enforcement of relevant laws and regulations.

The Tax Collector's office also plays a pivotal role in facilitating property appraisals, a service that is vital for both individual homeowners and commercial property owners. Accurate property appraisals are crucial for determining the fair market value of real estate, which in turn influences property taxes and other related fees. By providing this service, the Tax Collector's office ensures that property owners in Escambia County have access to fair and transparent assessments, fostering trust and confidence in the county's property valuation system.

Vehicle Registration and Titling: A Comprehensive Service

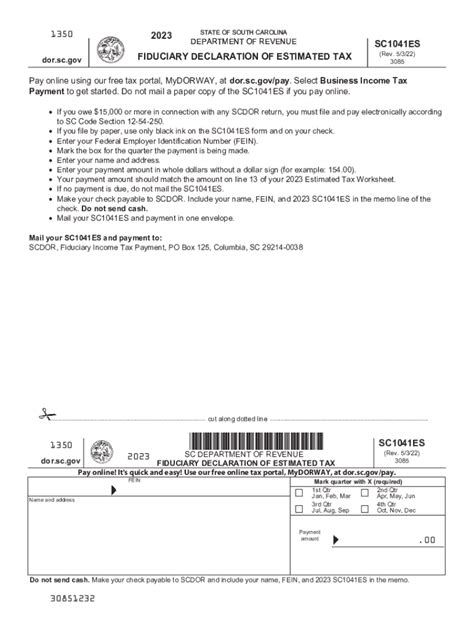

The registration and titling of vehicles is a critical service offered by the Tax Collector’s office in Escambia County. This service ensures that all vehicles operated within the county are properly registered and titled, in compliance with state and local laws. The process typically involves the collection of relevant documentation, such as proof of ownership, vehicle identification information, and insurance coverage, as well as the payment of applicable fees and taxes.

For residents of Escambia County, the vehicle registration and titling service offered by the Tax Collector's office provides a one-stop solution for all their motor vehicle-related needs. Whether it's registering a newly purchased vehicle, renewing an existing registration, or obtaining a title transfer, the Tax Collector's office streamlines these processes, making them more efficient and convenient for the county's residents.

Online Services for Vehicle Registration and Titling

In an effort to enhance convenience and accessibility, the Tax Collector’s office in Escambia County has embraced digital technology by offering online services for vehicle registration and titling. This means that residents can now complete many of these transactions from the comfort of their homes or offices, without the need to physically visit the Tax Collector’s office. This online platform allows users to upload required documents, pay fees, and complete the registration or titling process in a secure and efficient manner.

The online services offered by the Tax Collector's office not only save time and effort for residents but also contribute to a more sustainable and eco-friendly approach to vehicle registration and titling. By reducing the need for physical paperwork and in-person visits, the office helps to minimize its environmental footprint, aligning with the county's commitment to sustainability and digital innovation.

| Vehicle Registration Type | Fees and Requirements |

|---|---|

| New Vehicle Registration | Requires proof of ownership, vehicle identification, insurance, and applicable fees. Fees may vary based on the vehicle type and weight. |

| Renewal of Existing Registration | Renewals can be done online or in-person. Fees are typically based on the vehicle's age and weight. |

| Title Transfer | Involves submitting the required documentation, including proof of ownership and payment of transfer fees. Fees may vary depending on the vehicle's value. |

Property Appraisals: Ensuring Fair and Transparent Assessments

The Tax Collector’s office in Escambia County also plays a significant role in facilitating property appraisals. This service is crucial for determining the fair market value of real estate within the county, which forms the basis for property taxes and other related fees. By providing an independent and impartial property appraisal service, the Tax Collector’s office ensures that property owners receive fair and transparent assessments, fostering trust and confidence in the county’s property valuation system.

The property appraisal process involves a comprehensive evaluation of a property's physical attributes, such as its size, location, and condition, as well as an analysis of market trends and comparable sales data. This information is then used to determine the property's fair market value, which serves as the basis for calculating property taxes. The Tax Collector's office works closely with the county's property appraisers to ensure that the appraisal process is accurate, consistent, and in line with state and local regulations.

Online Property Appraisal Tools

To enhance transparency and accessibility, the Tax Collector’s office in Escambia County provides online property appraisal tools. These tools allow property owners to access information about their property’s assessed value, as well as compare it with similar properties in the area. This online platform not only provides valuable insights into the property’s valuation but also empowers property owners to make informed decisions about their real estate holdings.

In addition to providing property appraisal data, the online platform also offers a range of other services, such as the ability to pay property taxes online, view tax bill history, and access relevant tax documents. This digital approach not only improves convenience for property owners but also reduces the administrative burden on the Tax Collector's office, allowing for more efficient and effective service delivery.

| Property Appraisal Services | Description |

|---|---|

| Property Value Search | Allows property owners to search for their property's assessed value, as well as view the property's characteristics and recent sales history. |

| Comparable Sales Analysis | Provides a detailed analysis of recent sales of similar properties in the area, helping property owners understand the market value of their property. |

| Property Tax Payment | Offers a secure online platform for property owners to pay their property taxes, view payment history, and manage their tax accounts. |

Additional Services: Driver Licenses and ID Cards

In addition to tax collection and vehicle-related services, the Tax Collector’s office in Escambia County also assists with the processing of driver licenses and ID cards. This service is particularly beneficial for residents who may not have easy access to the Department of Highway Safety and Motor Vehicles (DHSMV) offices, which are typically located in larger cities or towns.

The Tax Collector's office acts as a satellite office for the DHSMV, providing a convenient and local option for residents to apply for, renew, or replace their driver licenses and ID cards. This service not only saves time and travel for residents but also helps to reduce congestion at the main DHSMV offices, improving efficiency and customer satisfaction.

Driver License and ID Card Renewal

For individuals whose driver licenses or ID cards are nearing their expiration dates, the Tax Collector’s office offers a convenient renewal service. This process typically involves providing updated personal information, paying the applicable fees, and submitting any required documentation, such as proof of address or name change. The Tax Collector’s office can then process the renewal and issue a new license or ID card, which can be picked up at the office or mailed to the resident’s address.

The renewal process at the Tax Collector's office is designed to be simple and efficient, with clear instructions and guidance available both online and in-person. This service ensures that residents can keep their licenses and ID cards up-to-date without the need to travel long distances or navigate complex bureaucratic processes.

| Driver License and ID Card Services | Description |

|---|---|

| New Driver License Application | Assists individuals in applying for their first driver license, including scheduling road tests and providing necessary documentation. |

| Driver License Renewal | Offers a convenient renewal service for individuals whose licenses are nearing expiration, including fee payment and document submission. |

| ID Card Application | Assists residents in applying for state-issued ID cards, which can be used for identification purposes, including proof of age and residency. |

The Impact of the Tax Collector’s Office on Escambia County

The Tax Collector’s office in Escambia County serves as a vital link between the county’s residents and the local government, providing a range of essential services that impact the daily lives of citizens. From the collection of taxes that fund critical county services to the provision of vehicle registration and titling, property appraisals, and assistance with driver licenses and ID cards, the Tax Collector’s office plays a multifaceted role in the county’s administrative landscape.

By offering these services in a professional, efficient, and customer-centric manner, the Tax Collector's office contributes to the overall well-being and satisfaction of Escambia County's residents. The office's commitment to transparency, accessibility, and innovation, as evidenced by its adoption of online services, further enhances its effectiveness and responsiveness to the needs of the community.

In conclusion, the Tax Collector's office in Escambia County is a key pillar of the county's administrative framework, ensuring that residents have access to a wide range of vital services. Through its dedication to excellence and its focus on customer satisfaction, the Tax Collector's office plays a crucial role in fostering a sense of community, trust, and engagement among the residents of Escambia County.

What are the office hours for the Tax Collector in Escambia County?

+The Tax Collector’s office in Escambia County is open from Monday to Friday, typically from 8:00 a.m. to 5:00 p.m. However, hours may vary on specific days or during special events, so it’s advisable to check the official website or call the office to confirm the current hours of operation.

How can I pay my property taxes in Escambia County?

+Property taxes in Escambia County can be paid online through the Tax Collector’s official website. Alternatively, you can pay in person at the Tax Collector’s office by cash, check, or credit card. It’s important to note that payment methods and options may vary, so it’s best to check the official website or contact the office for the most up-to-date information.

Can I renew my driver license at the Tax Collector’s office in Escambia County?

+Yes, the Tax Collector’s office in Escambia County offers a convenient service for renewing driver licenses. This service includes fee payment and document submission. However, it’s important to note that certain types of driver licenses, such as commercial or motorcycle licenses, may require additional steps or testing. It’s advisable to check the official website or contact the office for specific requirements and procedures.