Sales And Use Tax California

Welcome to our comprehensive guide on Sales and Use Tax in California. This state, known for its vibrant economy and diverse business landscape, has unique tax regulations that impact businesses and consumers alike. Understanding these regulations is crucial for anyone operating within the Golden State, as it can significantly affect financial strategies and compliance requirements.

In this article, we will delve deep into the world of Sales and Use Tax in California, providing you with an in-depth analysis and expert insights. We will cover the essential aspects of this tax system, from its definition and purpose to its practical implications for businesses and consumers. By the end of this guide, you will have a clear understanding of how Sales and Use Tax works in California and the steps you can take to navigate this complex yet vital aspect of doing business in the state.

Understanding Sales and Use Tax in California

Sales and Use Tax in California is a vital component of the state’s revenue system, contributing significantly to its budget and funding various public services. It is a form of consumption tax, which means it is levied on the sale or use of tangible personal property and certain services within the state. The tax is collected by registered businesses and remitted to the California Department of Tax and Fee Administration (CDTFA), the governing body responsible for tax administration and enforcement in California.

The purpose of Sales and Use Tax is twofold: to generate revenue for the state and to ensure a level playing field for businesses. By taxing sales, the state can fund essential services like education, healthcare, and infrastructure development. Additionally, by imposing a tax on both sales and use, the state discourages businesses from evading taxes by purchasing goods outside the state and then using them within California without paying tax.

Sales Tax vs. Use Tax

Sales Tax and Use Tax are closely related, but they apply in different scenarios and have unique characteristics. Sales Tax is levied on the sale of goods and certain services within California. It is typically charged to the buyer at the point of sale and is included in the total price of the transaction. The rate varies depending on the location of the sale, as different cities and counties have different tax rates on top of the base state rate.

On the other hand, Use Tax is imposed on the storage, use, or consumption of tangible personal property in California when the sales tax has not been paid. This tax applies to purchases made outside the state, such as online purchases from out-of-state retailers, or to property brought into California for use in the state. Use Tax is essentially a catch-all measure to ensure that all purchases are taxed, regardless of where they are made.

For example, if you purchase a laptop online from an out-of-state retailer and have it shipped to your home in California, you are technically liable for Use Tax on that purchase. This tax is the buyer's responsibility and must be self-reported to the CDTFA. However, in many cases, online retailers will collect Use Tax at the time of purchase and remit it to the state on the buyer's behalf.

Registration and Compliance

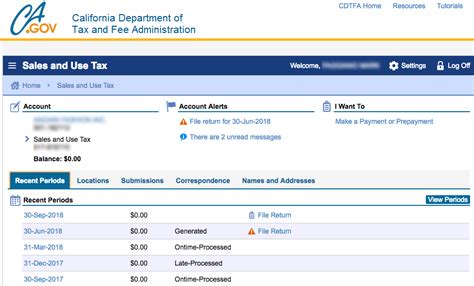

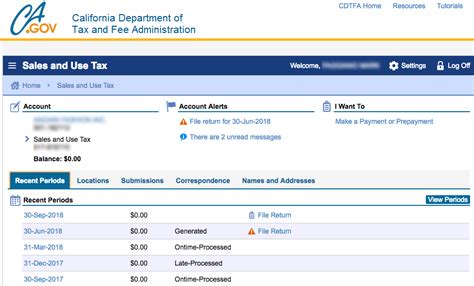

Businesses operating in California must register with the CDTFA to collect and remit Sales and Use Tax. This registration process involves providing detailed information about the business, including its legal name, physical address, and tax identification number. Once registered, businesses are assigned a permit number and are required to file regular tax returns, typically on a quarterly basis.

Compliance with Sales and Use Tax regulations is critical for businesses. Failure to register, collect, or remit taxes can result in significant penalties and interest charges. The CDTFA conducts audits to ensure compliance and may impose fines for non-compliance. It's essential for businesses to maintain accurate records, including sales invoices, purchase orders, and tax returns, to facilitate the audit process and demonstrate their tax obligations.

Sales and Use Tax Rates and Exemptions

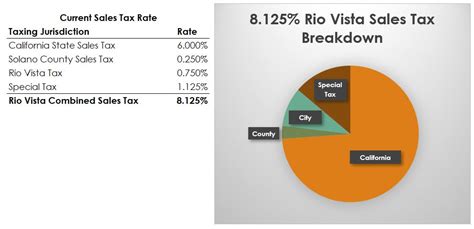

Sales and Use Tax rates in California vary depending on the location of the transaction. The state has a base rate of 7.25%, but this rate can be higher or lower depending on the county and city where the sale occurs. This variation in rates is known as the District Tax Rate, which is added to the base rate to determine the total Sales and Use Tax liability.

For example, in the city of San Francisco, the District Tax Rate is 1.5%, resulting in a combined Sales and Use Tax rate of 8.75% (7.25% base rate + 1.5% District Tax Rate). On the other hand, in the city of Los Angeles, the District Tax Rate is 1.25%, resulting in a combined rate of 8.5% (7.25% base rate + 1.25% District Tax Rate). These variations in tax rates can have a significant impact on the final cost of goods and services for consumers.

Exemptions and Special Considerations

While Sales and Use Tax is broadly applicable to most transactions, there are certain exemptions and special considerations to be aware of. These exemptions can significantly impact a business’s tax liability and should be carefully considered when planning financial strategies.

- Food and Beverages: Some food and beverage items are exempt from Sales and Use Tax, such as unprepared food (e.g., raw fruits and vegetables) and non-alcoholic beverages. However, prepared foods and meals, as well as alcoholic beverages, are generally taxable.

- Prescription Drugs: Sales of prescription drugs are exempt from Sales and Use Tax, but non-prescription drugs and over-the-counter medications are taxable.

- Clothing and Footwear: Clothing and footwear items priced under $100 are exempt from Sales and Use Tax in California. This exemption provides a significant benefit to consumers, particularly those with lower incomes.

- Manufacturing and Resale: Sales of goods intended for manufacturing or resale are typically exempt from Sales and Use Tax. This exemption is designed to avoid double taxation and encourage economic growth.

- Agricultural Equipment: Sales of agricultural equipment and supplies are exempt from Sales and Use Tax, supporting the state's agricultural industry.

- Internet Sales: Online retailers are required to collect and remit Use Tax on sales to California residents. However, there are thresholds and exceptions based on the seller's gross receipts and the value of the sale.

It's important for businesses to stay informed about these exemptions and ensure they are accurately applying them in their tax calculations. Misapplication of exemptions can lead to significant tax liabilities and penalties.

Calculating and Collecting Sales and Use Tax

Calculating Sales and Use Tax in California can be complex due to the varying tax rates and exemptions. Businesses must first determine the applicable tax rate for each transaction, which is based on the location of the sale or use. Then, they must apply the appropriate rate to the taxable amount, ensuring that any applicable exemptions are considered.

For example, if a business sells a laptop for $1,000 in San Francisco, they would calculate the Sales Tax as follows: $1,000 x 8.75% = $87.50. This amount would be added to the price of the laptop, so the total cost to the consumer would be $1,087.50.

Collecting Sales and Use Tax is typically done at the point of sale. Businesses can use point-of-sale (POS) systems or accounting software to automatically calculate and apply the appropriate tax rate. It's essential to ensure that the tax is accurately calculated and collected to avoid discrepancies and potential penalties.

Record-Keeping and Reporting

Proper record-keeping is crucial for Sales and Use Tax compliance. Businesses must maintain detailed records of all transactions, including sales invoices, purchase orders, and tax returns. These records should include the date of the transaction, the amount of the sale, the applicable tax rate, and any exemptions or discounts applied.

Businesses are required to file regular tax returns with the CDTFA, typically on a quarterly basis. These returns must include a summary of all taxable sales and the corresponding tax amounts. The due dates for these returns are specific to each business and are based on the business's tax identification number.

Failure to file tax returns or provide accurate information can result in penalties and interest charges. It's essential for businesses to stay organized and ensure that their record-keeping and reporting processes are efficient and compliant with CDTFA regulations.

Remitting Sales and Use Tax

Once Sales and Use Tax has been collected, businesses are responsible for remitting these funds to the CDTFA. The remittance process involves submitting the collected tax amounts to the state, typically through electronic payment methods such as direct deposit or credit card. Businesses can also remit tax payments by mail using a payment voucher provided by the CDTFA.

It's important to note that the remittance process is separate from the tax return filing process. Even if a business has no taxable sales for a particular quarter, they are still required to file a "no tax due" return to maintain compliance with CDTFA regulations.

Late Payment and Penalty Fees

Failure to remit Sales and Use Tax on time can result in significant penalties and interest charges. The CDTFA imposes a late payment penalty of 10% of the unpaid tax, plus interest, which accrues daily until the payment is made. Additionally, the CDTFA may assess a 25% fraud penalty if it determines that the late payment was due to negligence or willful disregard of tax regulations.

To avoid late payment penalties, businesses should carefully monitor their tax obligations and plan their cash flow accordingly. It's also essential to stay informed about any changes in tax rates or regulations that could impact their tax liability.

Sales and Use Tax for Online Businesses

With the rise of e-commerce, online businesses must navigate a unique set of challenges when it comes to Sales and Use Tax. In California, online retailers are required to collect and remit Use Tax on sales to California residents, regardless of whether the retailer has a physical presence in the state.

Economic Nexus

The concept of economic nexus plays a significant role in determining whether an online retailer is required to collect and remit Use Tax in California. Economic nexus refers to the connection between an online retailer and a state, typically measured by the retailer’s gross receipts or the number of transactions in the state. If an online retailer meets certain economic nexus thresholds, they are considered to have a substantial connection to the state and are required to collect and remit Use Tax.

For example, if an online retailer's gross receipts from sales to California residents exceed $100,000 in a calendar year, they are considered to have economic nexus and must collect and remit Use Tax on all subsequent sales to California residents.

Marketplace Facilitator Laws

California has implemented marketplace facilitator laws, which hold third-party platforms and marketplaces responsible for collecting and remitting Sales and Use Tax on behalf of their sellers. These laws apply to online marketplaces such as Amazon, eBay, and Etsy, which must collect and remit tax on behalf of their sellers if the sellers meet certain economic nexus thresholds.

For instance, if an individual seller on Amazon has gross receipts from sales to California residents exceeding $100,000 in a calendar year, Amazon is responsible for collecting and remitting Use Tax on the seller's behalf.

Simplified Seller Registration

To simplify the registration process for online sellers, California has implemented a Simplified Seller Registration program. This program allows online sellers to register for Sales and Use Tax collection and remittance with a single state, rather than having to register with multiple states. This program is particularly beneficial for sellers who operate in multiple states and can streamline their tax compliance obligations.

Sales and Use Tax for Consumers

While Sales and Use Tax primarily impacts businesses, consumers also play a significant role in this tax system. As buyers, consumers are responsible for paying Sales Tax at the point of sale and Use Tax on purchases made outside the state.

Sales Tax at the Register

When making a purchase in California, consumers will typically see the Sales Tax amount included in the total price of the transaction. This amount is calculated based on the applicable tax rate for the location of the sale. For example, if a consumer purchases a book for 20 in San Diego, where the combined Sales and Use Tax rate is <strong>7.75%</strong>, the total cost of the book would be 20 x 1.0775 = $21.55.

Use Tax on Out-of-State Purchases

Consumers are responsible for paying Use Tax on purchases made outside California, such as online purchases from out-of-state retailers or items brought into the state for use. While this tax is technically the buyer’s responsibility, many online retailers now collect Use Tax at the time of purchase and remit it to the state on the buyer’s behalf.

For example, if a consumer purchases a TV online from an out-of-state retailer for $500, they may see an additional charge for Use Tax on their order. This tax is calculated based on the applicable tax rate for the consumer's location in California.

Self-Reporting Use Tax

In cases where Use Tax is not collected at the time of purchase, consumers are responsible for self-reporting and paying this tax. The CDTFA provides a Use Tax Return form, which allows consumers to calculate and pay their Use Tax liability. This form must be filed annually and includes a summary of all taxable purchases made outside the state.

Future Implications and Changes

The Sales and Use Tax landscape in California is constantly evolving, with new regulations and changes in tax rates being introduced over time. It’s essential for businesses and consumers to stay informed about these changes to ensure compliance and take advantage of any new opportunities.

Potential Rate Increases

In recent years, there have been discussions and proposals for increasing Sales and Use Tax rates in California to fund specific initiatives or address budget shortfalls. While no significant rate increases have been implemented recently, it’s important for stakeholders to stay vigilant and monitor any proposed changes that could impact their tax obligations.

Streamlining Tax Collection

Efforts to streamline Sales and Use Tax collection and reporting processes are ongoing in California. These initiatives aim to simplify the tax system, reduce compliance burdens for businesses, and improve revenue collection for the state. Some of these efforts include the adoption of electronic filing and payment systems, as well as the implementation of simplified tax rates and exemptions.

Online Sales and Economic Nexus

The rise of e-commerce has prompted a reevaluation of Sales and Use Tax regulations for online businesses. California, along with many other states, is actively working to address the challenges posed by online sales and ensure that all businesses, regardless of their physical presence, contribute fairly to the state’s tax revenue.

As part of these efforts, California has implemented economic nexus thresholds and marketplace facilitator laws, which hold online retailers and marketplaces accountable for collecting and remitting Sales and Use Tax on behalf of their sellers. These measures aim to level the playing field for brick-and-mortar businesses and ensure that online sales are taxed appropriately.

Conclusion

Sales and Use Tax in California is a complex yet vital aspect of doing business in the state. It plays a significant role in generating revenue for the state and ensuring a fair and competitive business environment. By understanding the intricacies of this tax system, businesses and consumers can navigate their tax obligations with confidence and contribute to the economic growth of the Golden State.

This guide has provided an in-depth analysis of Sales and Use Tax in California, covering its definition, purpose, rates, and exemptions. We have also explored the practical implications for businesses and consumers, including registration, compliance, calculation, and remittance processes. By staying informed and proactive, stakeholders can ensure they are compliant with the ever-evolving tax regulations in California.

Frequently Asked Questions

How often do businesses need to file Sales and Use Tax returns in California?

+Businesses typically file Sales and Use Tax returns on a quarterly basis. However, the due dates for these returns are specific to each business and are based on their tax identification number. It’s important for businesses to stay informed about their filing deadlines to avoid late penalties.

Are there any sales that are exempt from Sales and Use Tax in California?

+Yes, there are several exemptions to Sales and Use Tax in California. These include food and beverages, prescription drugs, clothing and footwear under $100, manufacturing and resale items, and agricultural equipment. It’s crucial for businesses to stay informed about these exemptions to ensure they are accurately applied.