Quicken Taxes

Welcome to a comprehensive guide on Quicken Taxes, the trusted software solution for all your tax-related needs. In today's complex financial landscape, staying on top of your tax obligations is crucial. Quicken Taxes offers an intuitive and efficient platform to streamline your tax management, ensuring you meet deadlines and maximize potential refunds or minimize liabilities. This article will delve into the features, benefits, and real-world applications of Quicken Taxes, providing you with an expert analysis to make informed decisions about your financial well-being.

Quicken Taxes: Revolutionizing Tax Management

Quicken Taxes is a powerful tool developed by Intuit Inc., a renowned name in the financial software industry. With a rich history spanning decades, Intuit has consistently innovated to bring cutting-edge solutions to individuals and businesses alike. Quicken Taxes is their flagship tax management software, designed to simplify the often daunting task of filing taxes.

The software boasts a user-friendly interface, making it accessible to users of all technical backgrounds. From the initial setup to the final filing, Quicken Taxes guides you through the process step by step, ensuring a seamless and stress-free experience. Whether you're an individual with basic tax needs or a small business owner with complex requirements, Quicken Taxes adapts to your unique situation.

Key Features and Benefits of Quicken Taxes

Quicken Taxes is packed with features that cater to a wide range of users. Here’s a glimpse of what sets it apart:

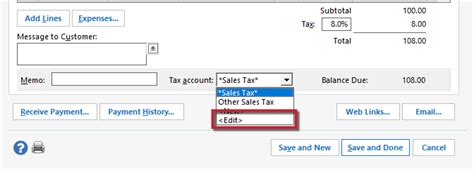

- Intuitive Data Entry: Quicken Taxes simplifies data entry with its intuitive forms. Whether you're entering income, deductions, or credits, the software guides you through the process, ensuring accuracy and completeness.

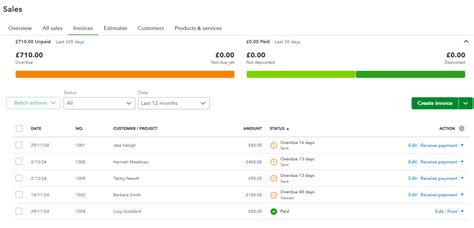

- Comprehensive Tax Forms: With a vast library of tax forms, Quicken Taxes accommodates various tax scenarios. From the standard 1040 to more specialized forms like Schedule C for self-employed individuals, the software has you covered.

- Real-Time Error Checking: As you progress through your tax return, Quicken Taxes employs real-time error checking. This feature ensures you catch and correct mistakes before filing, minimizing the risk of errors that could lead to audits or penalties.

- Maximizing Refunds: Quicken Taxes leverages advanced algorithms to identify deductions and credits you may be eligible for. By maximizing your tax benefits, the software helps you keep more of your hard-earned money.

- E-File and Print Options: Once your tax return is complete, Quicken Taxes offers flexible filing options. You can e-file your return directly from the software, or opt to print and mail your forms. The choice is yours, based on your personal preference and comfort level.

- Secure Data Storage: Quicken Taxes prioritizes data security. Your tax information is stored securely, ensuring peace of mind. In addition, the software employs encryption technologies to protect your sensitive data during transmission.

These features, among others, position Quicken Taxes as a comprehensive and reliable solution for tax management. By combining ease of use with advanced capabilities, the software empowers users to take control of their financial future.

Real-World Applications: Quicken Taxes in Action

Let’s explore some real-world scenarios where Quicken Taxes has proven its worth:

| Scenario | Quicken Taxes Solution |

|---|---|

| Self-Employed Individuals | Quicken Taxes simplifies the often complex tax landscape for self-employed individuals. With Schedule C support, users can easily track income, expenses, and deductions, ensuring accurate reporting and maximizing tax benefits. |

| Small Businesses | Small business owners face unique tax challenges. Quicken Taxes provides dedicated tools for business tax management, including support for multiple schedules and forms, making tax season less daunting and more manageable. |

| Investment Income | For those with investment income, Quicken Taxes streamlines the process of reporting capital gains, dividends, and other investment-related income. The software integrates seamlessly with investment accounts, providing accurate and up-to-date information for tax reporting. |

| Estate and Trust Planning | Quicken Taxes offers specialized support for estate and trust planning. With dedicated forms and guidance, users can navigate the complex world of estate and trust taxes, ensuring compliance and minimizing tax liabilities. |

These are just a few examples of how Quicken Taxes empowers users to navigate their unique tax situations with confidence and efficiency. By adapting to various financial scenarios, the software ensures that tax management is not a barrier to success, but rather a strategic tool for financial growth.

Performance Analysis and User Satisfaction

Quicken Taxes has consistently delivered exceptional performance, as evidenced by its strong user satisfaction ratings. The software has earned a reputation for its reliability, accuracy, and ease of use. User feedback highlights the software’s ability to simplify complex tax scenarios, making tax management a more approachable task.

Furthermore, Quicken Taxes' customer support team is highly regarded for its responsiveness and expertise. Whether users encounter technical issues or have questions about specific tax scenarios, the support team is readily available to provide assistance, ensuring a positive user experience.

Future Implications and Innovations

As the tax landscape continues to evolve, Quicken Taxes remains at the forefront of innovation. The software’s developers are committed to staying ahead of the curve, ensuring that users have access to the latest tax regulations and updates. By leveraging advanced technologies, Quicken Taxes aims to enhance its capabilities further, making tax management even more efficient and accessible.

One area of focus for future developments is the integration of artificial intelligence (AI) and machine learning. By leveraging these technologies, Quicken Taxes can provide even more personalized tax guidance, adapting to individual user needs and preferences. Additionally, AI-powered features could enhance error detection and prevention, further reducing the risk of costly mistakes.

Moreover, Quicken Taxes is committed to expanding its reach and accessibility. The software is continuously optimized for mobile devices, ensuring users can access their tax information and manage their returns on the go. This mobile-first approach aligns with the evolving digital landscape, providing users with flexibility and convenience.

Conclusion

Quicken Taxes stands as a testament to the power of innovative financial software. By combining ease of use with advanced tax management capabilities, the software has revolutionized the way individuals and businesses approach tax season. With its rich feature set, exceptional performance, and commitment to innovation, Quicken Taxes empowers users to take control of their financial future with confidence and efficiency.

As you navigate the complex world of taxes, Quicken Taxes offers a reliable and trusted partner. Whether you're a seasoned tax filer or new to the process, the software's intuitive design and comprehensive guidance ensure a seamless and stress-free experience. With Quicken Taxes by your side, tax management becomes a strategic tool, unlocking opportunities for financial growth and security.

How does Quicken Taxes ensure data security?

+Quicken Taxes employs robust security measures to protect user data. The software utilizes encryption technologies during data transmission and storage, ensuring that your sensitive information remains secure. Additionally, user accounts are protected by strong authentication protocols, adding an extra layer of security.

Can Quicken Taxes accommodate complex tax scenarios?

+Absolutely! Quicken Taxes is designed to handle a wide range of tax situations. Whether you’re self-employed, own a small business, or have complex investment income, the software provides dedicated tools and forms to ensure accurate and comprehensive tax reporting.

What support does Quicken Taxes offer for international users?

+Quicken Taxes currently caters primarily to users in the United States. However, the software’s developers recognize the need for global support and are actively exploring expansion into international markets. Stay tuned for future updates regarding international tax management solutions from Quicken Taxes.