South Carolina Retirement Taxes

When planning for retirement, understanding the tax implications is crucial. South Carolina, known for its vibrant culture, diverse landscapes, and retirement-friendly lifestyle, offers a unique tax environment for retirees. This article delves into the intricacies of South Carolina retirement taxes, providing an in-depth analysis to help retirees make informed financial decisions.

South Carolina’s Tax-Friendly Environment for Retirees

South Carolina boasts a reputation as a retirement haven, partially due to its favorable tax climate. The state offers various tax advantages that can significantly impact retirees’ financial plans. One of the key attractions is the absence of state taxes on Social Security benefits, a feature shared by only a handful of states.

Additionally, South Carolina does not impose an inheritance tax, which can provide substantial savings for those with substantial estates. While income tax rates in South Carolina are generally moderate, retirees can further benefit from the state's retirement income tax exclusion, allowing a portion of retirement income to be exempt from taxation.

Tax Benefits for Social Security Recipients

Social Security benefits are a significant source of income for many retirees. In South Carolina, these benefits are exempt from state income tax, a substantial advantage over many other states. This exclusion applies to both federal and state Social Security benefits, ensuring that retirees can enjoy their full retirement income without state tax deductions.

For instance, a retiree receiving $2,000 per month in Social Security benefits can save approximately $2,400 annually due to this exemption. This savings can make a notable difference in a retiree's financial planning and overall quality of life.

Inheritance and Estate Tax Considerations

South Carolina’s lack of an inheritance tax is a significant benefit for retirees with substantial assets. This means that when a retiree passes away, their beneficiaries won’t face state taxes on the inherited assets, which can include real estate, investments, and personal property.

Consider a retiree with a $1 million estate. Without an inheritance tax, their beneficiaries would receive the full $1 million, whereas in states with such taxes, a substantial portion could be deducted for tax purposes.

| Estate Value | Tax Savings with No Inheritance Tax |

|---|---|

| $500,000 | $25,000 (estimated) |

| $1,000,000 | $50,000 (estimated) |

| $2,000,000 | $100,000 (estimated) |

Income Tax Rates and Retirement Income Exclusion

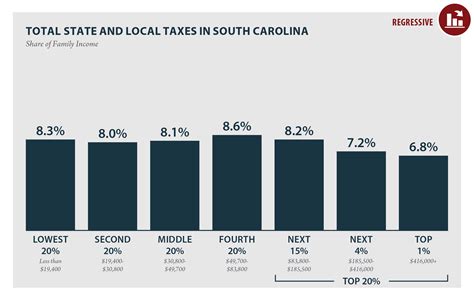

South Carolina’s income tax rates are relatively low compared to many other states. The state’s income tax structure consists of six tax brackets, ranging from 0% to 7% for taxable income over $16,455. This progressive tax system ensures that retirees with lower incomes pay less in taxes.

Furthermore, South Carolina allows retirees to exclude a portion of their retirement income from taxable income. This exclusion applies to both public and private retirement plans, providing a substantial tax benefit for those relying on retirement savings.

| Retirement Income Source | Exclusion Amount |

|---|---|

| Public Retirement Plans (e.g., PERS) | $12,000 |

| Private Retirement Plans (e.g., 401(k), IRA) | $8,000 |

Retirement Income Sources and Taxation

Understanding how different sources of retirement income are taxed is essential for financial planning. In South Carolina, various retirement income streams are treated differently for tax purposes, and being aware of these differences can help retirees optimize their financial strategies.

Taxation of Pension and Annuity Income

Pension and annuity income in South Carolina is subject to state income tax. However, as mentioned earlier, retirees can exclude a portion of this income from their taxable income, depending on the source.

For example, if a retiree receives $30,000 annually from a private pension plan, they can exclude up to $8,000, reducing their taxable income and potential tax liability.

Tax Treatment of 401(k) and IRA Withdrawals

Withdrawals from 401(k) plans and IRAs are generally taxed as ordinary income in South Carolina. This means that when a retiree withdraws funds from these accounts, the amount is added to their other taxable income and taxed at their applicable tax rate.

However, South Carolina does not impose an additional tax on early withdrawals, which can be beneficial for those who need access to their retirement savings before the age of 59½, typically subject to a 10% penalty at the federal level.

Social Security Benefits and Medicare

While Social Security benefits are exempt from state income tax in South Carolina, a portion of these benefits may be subject to federal taxation, depending on the retiree’s total income. Medicare, on the other hand, is a federal program, and its premiums are not directly affected by state taxes.

For instance, if a retiree's total income, including half of their Social Security benefits, exceeds certain thresholds ($25,000 for single filers and $32,000 for joint filers), they may have to pay federal income tax on a portion of their Social Security benefits.

Real Estate and Property Taxes for Retirees

Property ownership is a common aspect of retirement planning, and understanding the property tax landscape in South Carolina is crucial for retirees.

Property Tax Rates and Assessments

Property taxes in South Carolina are determined at the county level, which means rates can vary significantly across the state. The average effective property tax rate in South Carolina is approximately 0.68%, which is lower than the national average of 1.08%.

Property tax assessments are based on the assessed value of the property, which is typically a percentage of the fair market value. Counties may use different assessment ratios, so it's essential to research the specific county where the property is located.

Homestead Exemptions and Tax Relief Programs

South Carolina offers several programs to provide tax relief for retirees, including homestead exemptions. These exemptions can reduce the assessed value of a retiree’s primary residence, resulting in lower property taxes.

For instance, the Residential Property Tax Relief Act provides an exemption of up to $50,000 of assessed value for primary residences. This can significantly reduce property taxes for retirees, making homeownership more affordable.

| Property Tax Relief Program | Eligibility | Benefit |

|---|---|---|

| Residential Property Tax Relief Act | Homeowners aged 65 or older | Up to $50,000 exemption |

| Disabled Veteran Exemption | Veterans with service-connected disabilities | 100% exemption on up to $400,000 assessed value |

| Senior Citizens Property Tax Relief | Homeowners aged 65 or older with income below $25,000 | Reimbursement of property taxes paid |

Financial Planning and Tax Strategies for Retirees

Effective financial planning is key to maximizing the benefits of South Carolina’s tax environment for retirees. Here are some strategies to consider:

Maximizing Tax Exemptions and Exclusions

Understanding the various tax exemptions and exclusions available in South Carolina can help retirees optimize their tax strategies. By strategically planning their income sources and timing withdrawals, retirees can minimize their taxable income and overall tax liability.

Diversifying Income Streams

Diversifying retirement income sources can provide flexibility and potential tax benefits. For instance, combining pension income, Social Security benefits, and withdrawals from tax-advantaged accounts like IRAs can help retirees stay within their desired tax brackets and maximize tax-free income.

Utilizing Tax-Efficient Investment Vehicles

Certain investment vehicles, such as municipal bonds, can provide tax-free income in South Carolina. Retirees can consider investing in these instruments to further reduce their taxable income and overall tax bill.

Seeking Professional Advice

The tax landscape can be complex, especially for retirees with diverse income sources and assets. Consulting with a financial advisor or tax professional can provide tailored advice to ensure retirees are making the most of South Carolina’s tax advantages.

Conclusion

South Carolina offers a compelling tax environment for retirees, with a combination of tax exclusions, favorable rates, and estate planning advantages. By understanding these tax benefits and implementing effective financial strategies, retirees can make the most of their retirement years while minimizing their tax obligations.

Are there any states with better tax advantages for retirees than South Carolina?

+Yes, some states like Florida, Texas, and Washington offer even more extensive tax advantages for retirees, including no state income tax on any retirement income. However, South Carolina’s tax environment is still highly competitive and offers significant benefits for retirees.

How can I calculate my estimated tax liability in South Carolina as a retiree?

+You can use online tax calculators or consult a tax professional to estimate your tax liability based on your specific retirement income and assets. These tools can help you understand your potential tax obligations and plan accordingly.

What are the income thresholds for Social Security benefits to be taxable at the federal level?

+The thresholds for federal taxation of Social Security benefits are 25,000 for single filers and 32,000 for joint filers. If your income exceeds these amounts, you may have to pay federal income tax on a portion of your Social Security benefits.

Are there any penalties for early withdrawals from retirement accounts in South Carolina?

+No, South Carolina does not impose additional penalties for early withdrawals from retirement accounts. However, at the federal level, early withdrawals before age 59½ may be subject to a 10% penalty, in addition to regular income tax.