Why Is Turbo Tax Making Me Pay

Tax season is a challenging time for many individuals, and the process of filing taxes can be daunting, especially when unexpected costs arise. One of the most popular tax preparation software, TurboTax, has been a go-to choice for millions of taxpayers. However, some users have encountered situations where they are required to pay for services they may consider essential, leading to confusion and frustration. This article aims to delve into the reasons behind these payment requirements and provide clarity on the various aspects of TurboTax's pricing structure.

Understanding TurboTax's Pricing Model

TurboTax, developed by Intuit Inc., offers a range of products tailored to different taxpayer needs. While the company aims to provide a straightforward and user-friendly experience, the diversity of its offerings can sometimes lead to confusion about pricing. It's essential to understand that TurboTax's pricing model is designed to cater to various tax situations, from simple returns to complex ones, ensuring that users pay only for the features they require.

Free File Program and Eligibility

One of the key aspects of TurboTax's pricing strategy is its participation in the IRS Free File Program. This initiative, launched in collaboration with the Internal Revenue Service (IRS), provides free tax preparation and filing services to eligible taxpayers. Eligibility for the Free File Program is typically based on income, with those earning below a certain threshold qualifying for free services.

| Income Eligibility (Single Filers) | Income Eligibility (Married Filing Jointly) |

|---|---|

| $36,000 or less | $72,000 or less |

If you meet these income criteria and have a straightforward tax situation, you can use TurboTax's Free Edition to prepare and file your taxes at no cost. However, it's important to note that the Free Edition has certain limitations; for instance, it may not support more complex tax scenarios, such as self-employment income or investment gains.

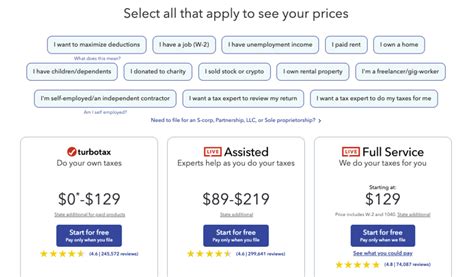

Premium Products and Additional Services

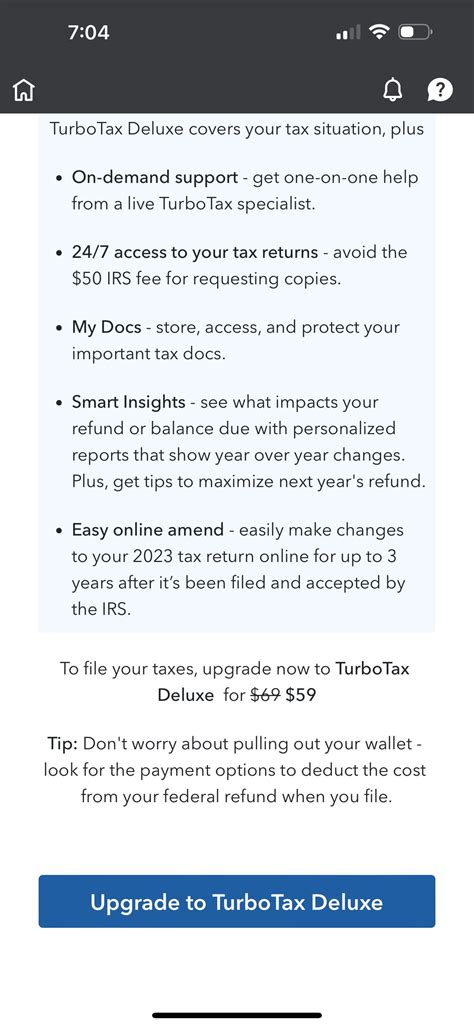

For taxpayers with more intricate tax situations, TurboTax offers a range of premium products. These products provide advanced features and guidance, catering to specific needs. For example, the TurboTax Deluxe edition is designed for those with investments, rental properties, or other more complex tax scenarios. The Premier edition is tailored for investors and homeowners, while the Self-Employed edition is specifically for sole proprietors and small business owners.

These premium products come at a cost, with prices varying based on the complexity of the tax return and the specific features required. For instance, the Deluxe edition might cost around $40, while the Self-Employed edition could range from $80 to $120, depending on the version and any additional services added.

Additional Services and Fees

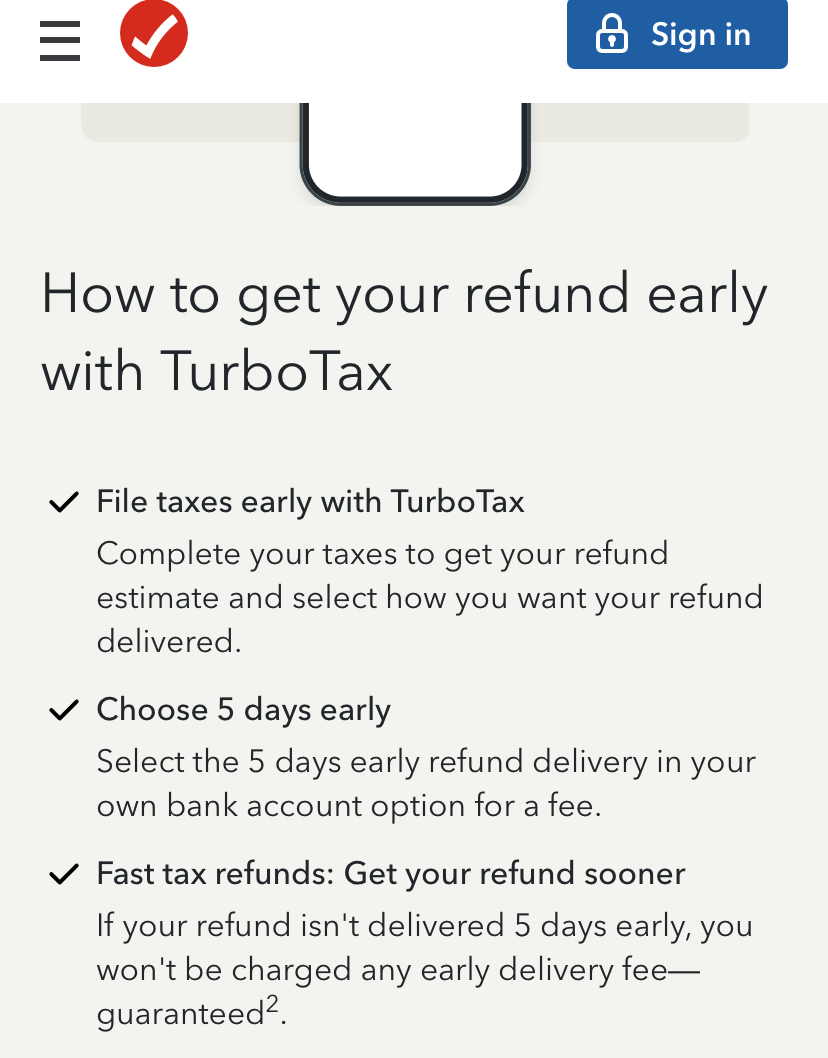

Apart from the core tax preparation products, TurboTax offers a variety of additional services that can incur fees. These services are often optional but can provide significant value, especially for taxpayers seeking extra support or specific benefits.

- Audit Defense: TurboTax's Audit Defense service provides taxpayers with expert guidance and representation in the event of an IRS audit. While this service comes at an additional cost, it can offer peace of mind and significant savings for those facing an audit.

- Tax Identity Theft Protection: With the rise in tax-related identity theft, TurboTax offers a service to help protect taxpayers' identities and provide support in the event of identity theft. This service, while optional, can be crucial for maintaining financial security.

- Tax Extension Filing: For those unable to file their taxes by the deadline, TurboTax offers a service to file an extension. While this service is not free, it can provide much-needed time for taxpayers to gather their information and prepare their returns accurately.

The Evolution of TurboTax's Pricing

Over the years, TurboTax's pricing model has evolved to meet the changing needs of taxpayers and to adapt to the increasingly complex tax landscape. While the company initially offered a simpler, more straightforward pricing structure, the addition of new features and the diversification of tax scenarios have led to a more nuanced approach.

Introduction of Free Edition

In response to growing concerns about the cost of tax preparation, TurboTax introduced its Free Edition, a significant move that made tax filing more accessible to millions of Americans. This edition, available both online and through the TurboTax app, allows eligible taxpayers to file their federal and state returns at no cost. It's a testament to TurboTax's commitment to providing affordable tax solutions, especially for those with basic tax needs.

Expansion of Premium Products

As tax laws and regulations became more intricate, TurboTax expanded its range of premium products. The introduction of products like the Deluxe, Premier, and Self-Employed editions was a strategic move to cater to the diverse needs of taxpayers. These products provide specialized guidance and support, ensuring that taxpayers can navigate their unique tax situations with confidence. The pricing for these products is designed to reflect the added value and expertise they offer.

Enhanced Additional Services

TurboTax has also enhanced its additional services, recognizing the growing need for tax-related support beyond basic preparation. Services like Audit Defense and Tax Identity Theft Protection have become increasingly relevant as taxpayers face new challenges. While these services come at an additional cost, they provide essential protection and support, especially for those who may be at higher risk of tax-related issues.

Tips for Choosing the Right TurboTax Product

Navigating TurboTax's pricing structure can be simplified by understanding your specific tax needs. Here are some tips to help you choose the most suitable product:

- Assess Your Tax Situation: Evaluate the complexity of your tax return. If you have a simple return with basic income and deductions, the Free Edition may suffice. However, if you have investments, own a business, or have more complex tax scenarios, consider the Deluxe, Premier, or Self-Employed editions.

- Review Features: Each TurboTax product offers a unique set of features. Review these features to ensure you choose the product that best matches your needs. For instance, if you have rental properties, the Premier edition's rental property guidance could be beneficial.

- Consider Additional Services: Evaluate your risk profile and potential needs. If you're concerned about an audit or tax-related identity theft, the Audit Defense and Tax Identity Theft Protection services could provide valuable peace of mind.

- Compare Prices: Don't forget to compare prices across different products and services. While the Free Edition is an excellent option for basic returns, premium products and additional services can vary significantly in cost. Ensure you understand the value you're receiving for the price.

The Future of TurboTax and Tax Preparation

As tax laws continue to evolve and technology advances, TurboTax is likely to further innovate its pricing and product offerings. The company has already demonstrated its commitment to accessibility and innovation with the introduction of the Free Edition and its focus on user experience. Looking ahead, we can expect TurboTax to continue enhancing its products, making tax preparation more efficient and accessible.

Potential Future Developments

- AI-Powered Assistance: With advancements in artificial intelligence, TurboTax could integrate AI-powered features to provide even more personalized guidance and support. This could enhance the accuracy and efficiency of tax preparation, especially for complex returns.

- Enhanced Mobile Experience: As more taxpayers use mobile devices for tax preparation, TurboTax may focus on optimizing its mobile app to provide a seamless and intuitive experience. This could include features like real-time data synchronization and improved security measures.

- Expanded Partnership Programs: TurboTax has already partnered with various organizations to offer discounted or free services to specific groups, such as military personnel and students. We may see the expansion of these partnership programs to include more diverse communities and professions.

The Importance of Staying Informed

In an ever-changing tax landscape, staying informed is crucial. Tax laws and regulations can evolve rapidly, and keeping up with these changes is essential to ensure accurate tax preparation and filing. TurboTax and other tax preparation software providers play a vital role in keeping taxpayers informed about these changes and offering solutions to navigate them effectively.

Conclusion

TurboTax's pricing structure is designed to provide a range of options for taxpayers with varying needs. From the Free Edition for basic returns to premium products for complex scenarios, TurboTax aims to ensure that taxpayers have access to the tools and guidance they need. While some users may find the cost of certain services unexpected, understanding the value and features these services provide can help taxpayers make informed choices.

As we move forward, the tax preparation landscape will continue to evolve, and TurboTax is likely to be at the forefront of these changes. By staying informed and choosing the right products and services, taxpayers can navigate the complexities of tax season with confidence and ease.

How do I know if I’m eligible for the Free File Program?

+Eligibility for the Free File Program is typically based on income. Single filers with an adjusted gross income of 36,000 or less and married filers with a combined income of 72,000 or less are usually eligible. However, it’s essential to check the specific criteria for the current tax year to ensure you meet all the requirements.

What happens if I don’t qualify for the Free Edition but my tax situation is still relatively simple?

+If you don’t qualify for the Free Edition but have a relatively simple tax situation, you might consider using the Deluxe edition. While it comes at a cost, it offers more features and guidance than the Free Edition, ensuring you can accurately prepare your return without the need for more advanced (and expensive) products.

Can I upgrade my TurboTax product after I’ve started my return?

+Yes, you can upgrade your TurboTax product at any time during the tax preparation process. If you realize that your tax situation is more complex than you initially thought, you can easily switch to a higher-tier product to access the necessary features and guidance. TurboTax will automatically transfer your data to the new product, making the upgrade process seamless.

Are there any hidden fees associated with TurboTax’s products or services?

+TurboTax is transparent about its pricing and does not typically have hidden fees. However, it’s essential to review the specific pricing details for each product and service to understand any potential additional costs, especially for state returns or certain additional services like Audit Defense or Tax Identity Theft Protection.

Can I get a refund if I’m not satisfied with my TurboTax purchase?

+TurboTax offers a satisfaction guarantee, allowing you to request a refund if you’re not satisfied with your purchase. However, it’s important to review the specific terms and conditions of the guarantee, as there may be limitations or exclusions. Typically, refunds are provided if you’ve not yet filed your return and haven’t used certain advanced features or services.