El Paso Property Taxes

Welcome to the comprehensive guide on El Paso property taxes, a topic that is essential for homeowners, investors, and anyone interested in understanding the financial landscape of this vibrant Texas city. El Paso, with its rich history and diverse community, presents a unique tax environment that deserves a detailed exploration. This article will delve into the intricacies of property taxes in El Paso, providing valuable insights and expert analysis.

Understanding El Paso’s Property Tax Landscape

El Paso, situated in the far western corner of Texas, boasts a dynamic real estate market influenced by its proximity to Mexico and its status as a major border city. The property tax system in El Paso is a crucial component of the local economy, impacting both residents and businesses. With a diverse tax base and a range of property types, understanding the intricacies of property taxation is key to making informed financial decisions.

Taxing Authorities and Assessment Process

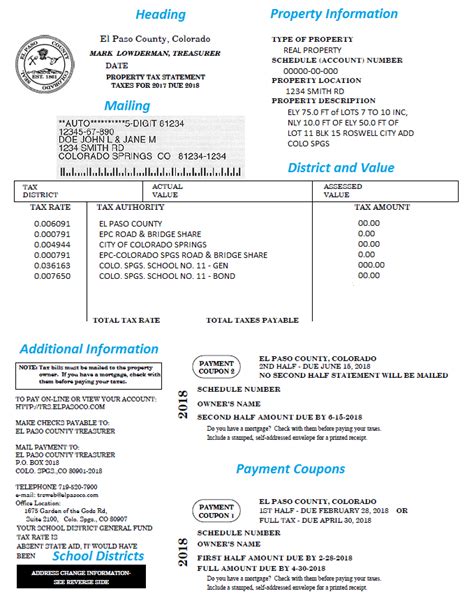

In El Paso, property taxes are levied by various taxing authorities, including the El Paso County, the City of El Paso, and several other special districts and entities. These authorities have specific roles in assessing and collecting taxes, each with its own tax rate and responsibilities.

The appraisal process begins with the El Paso Central Appraisal District (EPCAD), which is responsible for determining the market value of properties within the county. EPCAD employs certified appraisers who assess properties based on factors such as location, size, improvements, and recent sales data. This valuation forms the basis for calculating property taxes.

Once the appraisal is complete, the EPCAD sends out notices to property owners, detailing the appraised value and providing an opportunity for taxpayers to review and appeal if they believe the value is inaccurate. The appeal process ensures transparency and allows for adjustments to be made, ensuring fairness in the taxation system.

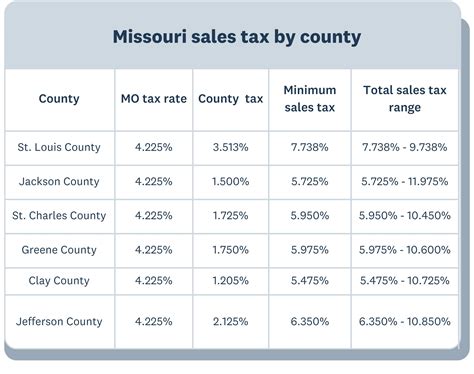

| Taxing Authority | Tax Rate (Effective Rate) | Responsibilities |

|---|---|---|

| El Paso County | 0.4500% | Maintains county infrastructure, including roads and public safety. |

| City of El Paso | 0.5500% | Funds city services like police, fire, and municipal facilities. |

| El Paso Independent School District | 1.4000% | Supports public education in the area. |

| El Paso Community College District | 0.1200% | Finances community college operations. |

| Other Special Districts | Varies | Provides specific services like water, fire protection, or transportation. |

Property Tax Rates and Calculations

Property taxes in El Paso are calculated based on the appraised value of the property and the tax rates set by the respective taxing authorities. The tax rate, expressed as a percentage, is multiplied by the taxable value of the property to determine the annual tax liability.

For instance, consider a residential property with an appraised value of $200,000. If the effective tax rate is 1.50% (a combination of all applicable tax rates), the annual property tax would be calculated as follows:

Taxable Value: $200,000

Effective Tax Rate: 1.50%

Annual Property Tax: $200,000 x 0.0150 = $3,000

It's important to note that El Paso, like many other areas, offers various exemptions and discounts to certain property owners. These can include homestead exemptions for primary residences, elderly exemptions, and exemptions for disabled veterans. These exemptions reduce the taxable value of the property, resulting in lower tax bills.

Property Tax Trends and Market Impact

El Paso’s property tax landscape is influenced by several factors, including the local economy, real estate market trends, and government policies. Over the past decade, El Paso has experienced a steady increase in property values, driven by factors such as population growth, economic development, and an improving job market.

The rising property values have led to an increase in property tax revenue for the city and county, which has been utilized to enhance public services and infrastructure. However, for individual property owners, this trend can result in higher tax bills, making it essential to stay informed about tax rates and exemptions.

The real estate market in El Paso is diverse, with a range of property types, including single-family homes, apartments, commercial properties, and land. Each property type has its own unique tax considerations, and understanding these nuances is crucial for effective tax planning.

Managing Property Taxes: Strategies and Tips

Navigating the property tax landscape in El Paso requires a strategic approach. Here are some expert tips and strategies to help property owners and investors manage their tax obligations effectively:

Stay Informed About Tax Rates and Changes

Tax rates in El Paso can fluctuate from year to year, influenced by budget decisions and economic conditions. It’s crucial to stay updated on any changes to tax rates for the various taxing authorities. This information is typically available on the official websites of the El Paso County and the City of El Paso, as well as through local news sources.

Understand Your Property’s Appraised Value

The appraised value of your property is a critical factor in determining your tax liability. Review your appraisal notice carefully and ensure that the details, such as property characteristics and improvements, are accurate. If you disagree with the appraised value, you have the right to appeal, and the EPCAD provides guidance on the appeal process.

Explore Exemptions and Discounts

El Paso offers a range of exemptions and discounts that can significantly reduce your taxable value. Homestead exemptions, for example, can provide substantial savings for homeowners. Other exemptions, such as those for seniors, disabled veterans, and agricultural properties, may also apply. It’s essential to research and apply for these exemptions to take advantage of the available benefits.

Consider Tax Planning Strategies

Effective tax planning can help minimize your tax liability and ensure compliance with tax laws. This may involve strategies such as timing property purchases or sales to take advantage of tax benefits, utilizing tax-efficient financing options, or exploring tax-advantaged investment opportunities. Consulting with a tax professional or financial advisor can provide valuable insights tailored to your specific circumstances.

Stay Engaged with Local Government

Stay informed about local government initiatives and budget decisions that may impact property taxes. Attend public meetings, engage with local officials, and participate in community discussions. Your input and involvement can influence tax policies and ensure that your interests are considered in the decision-making process.

Utilize Online Resources and Tools

The El Paso County and City websites offer valuable resources and tools to help property owners navigate the tax system. These include online tax calculators, payment portals, and guides on the appeal process. Taking advantage of these resources can streamline your tax management and provide a more efficient experience.

The Future of El Paso Property Taxes

Looking ahead, the future of El Paso’s property tax landscape is closely tied to the city’s economic growth and development. As El Paso continues to attract businesses and residents, the demand for quality infrastructure and public services will likely increase. This, in turn, may influence tax rates and the allocation of tax revenue.

The city's commitment to economic development and job creation is expected to drive further growth, leading to increased property values and potentially higher tax revenues. However, the city's leadership has also expressed a commitment to maintaining a competitive tax environment to attract investment and support local businesses.

Additionally, the ongoing trend of technology-driven efficiency improvements in tax administration is expected to continue in El Paso. This includes the adoption of digital tools for tax assessment, billing, and payment, which can enhance transparency and convenience for taxpayers.

As El Paso continues to evolve, staying informed about property tax developments and engaging with the local community will be key to navigating the tax landscape effectively. The city's vibrant culture, strong sense of community, and economic potential make it an exciting place to live and invest, and understanding the property tax system is an essential part of that journey.

How often are property taxes assessed in El Paso?

+Property taxes in El Paso are typically assessed annually. The El Paso Central Appraisal District (EPCAD) conducts appraisals and determines the market value of properties each year.

Can I appeal my property’s appraised value in El Paso?

+Yes, property owners in El Paso have the right to appeal their appraised value if they believe it is inaccurate. The EPCAD provides a formal protest process, and taxpayers can attend an informal hearing or file a formal appeal.

What are the tax rates for the El Paso Independent School District (EPISD)?

+The tax rate for EPISD is set annually and can vary slightly. For the current tax year, the effective tax rate for EPISD is 1.4000%.

Are there any tax incentives for renewable energy projects in El Paso?

+Yes, El Paso offers tax incentives for renewable energy projects. The Texas Comptroller’s Office provides information on available tax abatements and incentives for qualifying renewable energy projects.

How can I pay my property taxes in El Paso?

+Property taxes in El Paso can be paid online through the El Paso County Tax Office’s website. They also accept payments by mail, in person at the Tax Office, or through authorized payment locations.