Gas Tax In California

The gas tax in California has been a subject of much discussion and debate, especially in recent years as fuel prices have soared and the state's infrastructure needs continue to grow. This article delves into the intricacies of California's gas tax, exploring its history, purpose, impact on consumers, and the ongoing efforts to ensure a sustainable transportation system while keeping costs manageable for drivers.

Understanding California’s Gas Tax

California’s gas tax is a levy imposed on the sale of gasoline and diesel fuel within the state. The primary purpose of this tax is to fund the maintenance, improvement, and expansion of the state’s vast transportation infrastructure, including roads, bridges, and public transit systems. With a network of highways and roads spanning over 179,000 miles, California relies heavily on this tax to keep its transportation system functioning efficiently.

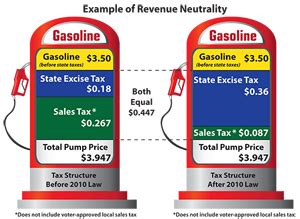

The gas tax in California is unique in several ways. Firstly, it is one of the primary sources of revenue for the California Transportation Commission, which oversees the allocation of funds for transportation projects across the state. Secondly, the tax rate is subject to periodic adjustments to account for inflation and the rising costs of transportation projects. This dynamic nature ensures that the state can keep up with the ever-evolving demands of its transportation network.

Historical Perspective

The history of California’s gas tax dates back to the early 20th century when the state first recognized the need for a dedicated funding source to develop and maintain its growing road network. Over the decades, the tax rate has been adjusted multiple times, with the most recent significant change occurring in 2017.

In 2017, California implemented the Road Repair and Accountability Act, commonly known as the "Gas Tax." This legislation increased the gas tax by 12 cents per gallon for gasoline and 20 cents per gallon for diesel fuel. The act also adjusted the vehicle registration fee, with the proceeds going towards critical transportation projects, such as the repair and maintenance of roads, bridges, and public transportation systems.

The 2017 Gas Tax aimed to address the significant backlog of road repairs and infrastructure improvements, estimated at over $130 billion. By increasing the gas tax, the state anticipated generating approximately $5 billion annually to tackle these urgent needs. This act was a comprehensive approach to ensuring the long-term sustainability of California's transportation system.

| Year | Gas Tax Rate (cents/gallon) | Key Projects Funded |

|---|---|---|

| 2017 | 30 (gasoline), 40 (diesel) | Statewide road repairs, bridge upgrades, public transit enhancements |

| 2010 | 18 (gasoline), 21.5 (diesel) | Highway construction, maintenance, and safety improvements |

| 1990 | 14 (gasoline), 17 (diesel) | Interstate highway expansion, local road grants |

Impact on Consumers and the Economy

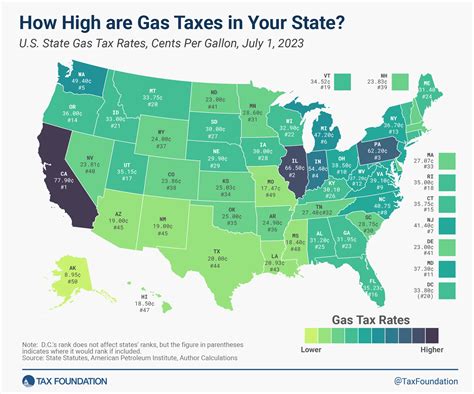

While the gas tax is essential for funding transportation infrastructure, it also has a direct impact on the wallets of California’s residents and businesses. With one of the highest gas taxes in the nation, the increased costs can significantly affect daily life and economic activities.

Consumer Perspective

For the average Californian, the gas tax translates to higher fuel costs. A recent study by the California Fuel Institute revealed that the state’s gas prices, including taxes, are on average 40% higher than the national average. This disparity can be particularly burdensome for those living in rural areas, where driving long distances is often necessary.

However, it's important to note that the gas tax revenue is used to improve the very roads and highways that Californians rely on for their daily commutes and travels. The state's efficient transportation network can enhance productivity and quality of life, despite the increased costs.

Economic Considerations

From an economic standpoint, the gas tax can influence various sectors, including transportation, logistics, and tourism. Higher fuel costs can lead to increased operational expenses for businesses, which may be passed on to consumers. This can potentially affect the state’s competitive position in the global market.

On the other hand, the investment in transportation infrastructure can also boost the economy by creating jobs, improving efficiency, and attracting businesses that rely on well-maintained roads and efficient transportation systems.

| Economic Impact | Description |

|---|---|

| Increased Operational Costs | Higher fuel costs impact businesses, especially those reliant on transportation, potentially leading to price increases for consumers. |

| Job Creation | Infrastructure projects funded by the gas tax create employment opportunities, stimulating the local economy. |

| Improved Business Environment | Well-maintained roads and efficient transportation networks can attract businesses, boosting economic growth. |

Future of California’s Gas Tax

As California continues to grow and evolve, the state’s transportation needs will also change. The future of the gas tax will be shaped by several factors, including technological advancements, environmental considerations, and the state’s commitment to sustainability.

Electric Vehicles and Alternative Fuels

The rise of electric vehicles (EVs) and alternative fuel technologies presents a unique challenge and opportunity for California’s gas tax. As more drivers transition to EVs, the demand for gasoline and diesel fuel may decrease, potentially reducing the revenue generated by the gas tax.

To address this, California is exploring innovative solutions, such as a road usage charge, where drivers would pay a fee based on the number of miles driven, regardless of the fuel type. This approach ensures that all road users, including EV owners, contribute to the maintenance of the transportation system.

Environmental Sustainability

California has long been at the forefront of environmental initiatives, and the state’s gas tax plays a role in promoting sustainability. The revenue generated by the tax is used to fund projects that reduce greenhouse gas emissions, such as the development of electric vehicle charging infrastructure and the improvement of public transit systems.

Looking ahead, California aims to continue leading the way in sustainable transportation. The state's ambitious goals, including achieving carbon neutrality by 2045, will require significant investments in clean energy and innovative transportation solutions.

Public-Private Partnerships

To address the state’s vast infrastructure needs, California is increasingly exploring public-private partnerships (PPPs). These partnerships can leverage private sector expertise and funding to accelerate transportation projects, ensuring timely and efficient delivery.

PPPs can also provide a more stable funding source, as private investors may be willing to take on some of the financial risks associated with large-scale infrastructure projects. This approach could help California maintain its transportation network while managing the impact on taxpayers.

Conclusion

California’s gas tax is a critical component of the state’s transportation funding strategy. While it presents challenges, particularly for consumers and businesses, it is essential for maintaining the state’s world-class transportation system. As California moves forward, the state will need to adapt its funding mechanisms to accommodate evolving technologies and environmental goals, ensuring a sustainable and efficient transportation network for future generations.

How is the gas tax revenue allocated in California?

+The gas tax revenue is allocated through the Road Repair and Accountability Act, which directs funds towards various transportation projects. Approximately 70% of the revenue goes to local transportation projects, while the remaining 30% is allocated to state highway projects and transit systems.

Are there any exemptions or discounts for certain drivers in California’s gas tax system?

+California does not offer exemptions or discounts based on income or vehicle type for the gas tax. However, the state does provide tax credits and incentives for the purchase and use of electric vehicles and alternative fuel vehicles to encourage environmentally friendly transportation options.

How does California’s gas tax compare to other states in the US?

+California’s gas tax is among the highest in the nation, with a combined state and federal tax rate of approximately 60 cents per gallon for gasoline and 70 cents per gallon for diesel fuel. This is significantly higher than the national average, which stands at around 30-40 cents per gallon.