Missouri Vehicle Sales Tax

Understanding Missouri's vehicle sales tax is crucial for anyone considering purchasing a vehicle in the state. The tax system in Missouri, like in many other places, can be complex, but it's essential to navigate it correctly to ensure you're not overpaying and to plan your finances effectively. This article will provide an in-depth analysis of Missouri's vehicle sales tax, its calculation methods, exemptions, and more, helping you make informed decisions when buying a car in the Show-Me State.

The Basics of Missouri Vehicle Sales Tax

In Missouri, vehicle sales tax is imposed on the purchase of most vehicles, including cars, trucks, motorcycles, and even certain recreational vehicles. The tax is calculated as a percentage of the vehicle’s purchase price, with the specific rate varying depending on the location of the sale and the type of vehicle being purchased. It’s important to note that the sales tax in Missouri is not a flat rate; instead, it is administered locally, meaning the tax rate can differ from one county to another.

The state of Missouri sets a minimum sales tax rate of 4.225%, but many counties add a local option tax on top of this. This local option tax can increase the sales tax rate significantly, often reaching rates of 5% or more. For instance, in the city of St. Louis, the total sales tax rate for vehicles is 6.225%, which includes the state minimum plus a 2% local option tax. These varying tax rates can have a substantial impact on the overall cost of your vehicle purchase, so it's crucial to research the tax rate in the county where you plan to buy your vehicle.

Calculating Vehicle Sales Tax in Missouri

To calculate the vehicle sales tax in Missouri, you’ll need to consider both the state minimum tax rate and any applicable local option taxes. Here’s a step-by-step guide to help you estimate the sales tax on your vehicle purchase:

-

Determine the Purchase Price: Start by knowing the exact purchase price of the vehicle. This should include any additional fees or charges, but exclude sales tax and registration fees.

-

Identify the Relevant Tax Rates: Look up the sales tax rates for the county where you are purchasing the vehicle. You can typically find this information on the website of the Missouri Department of Revenue or on local government websites.

-

Calculate the State Tax: Multiply the purchase price by the state minimum tax rate (4.225%). This will give you the base amount for the state sales tax.

-

Add Local Option Taxes: If there are any applicable local option taxes, add these to the base state tax. Each county may have different rates, so be sure to check the specific rates for your location.

-

Total Sales Tax: The sum of the state tax and local option taxes is the total sales tax you'll need to pay on your vehicle purchase.

Let's look at an example to clarify this process. Suppose you're buying a car in Jackson County, Missouri, and the purchase price is $25,000. The state minimum tax rate is 4.225%, and Jackson County has a local option tax of 1.25%. Here's how you'd calculate the sales tax:

| Calculation | Amount |

|---|---|

| State Tax (4.225% of $25,000) | $1,056.25 |

| Local Option Tax (1.25% of $25,000) | $312.50 |

| Total Sales Tax | $1,368.75 |

Exemptions and Special Cases

While most vehicle purchases in Missouri are subject to sales tax, there are certain exemptions and special cases to be aware of. These can significantly reduce or even eliminate the sales tax you owe, so it’s important to understand them.

Vehicle Exemptions

Missouri offers sales tax exemptions for specific types of vehicles, including:

- Motorcycles and Off-Road Vehicles: Certain motorcycles, all-terrain vehicles (ATVs), and off-road vehicles are exempt from sales tax if they are purchased for off-road use only. This exemption applies to vehicles that are not intended for or capable of highway use.

- Alternative Fuel Vehicles: Vehicles that use alternative fuels, such as electric, hybrid, hydrogen, or compressed natural gas (CNG) vehicles, are eligible for a sales tax deduction. This deduction can be substantial, often amounting to hundreds or even thousands of dollars.

- Vehicles for People with Disabilities: Missouri provides a sales tax exemption for vehicles purchased or leased specifically for people with disabilities. This exemption is designed to make transportation more accessible and affordable for individuals with disabilities.

Out-of-State Purchases

If you purchase a vehicle out of state and bring it into Missouri, you will typically be required to pay a use tax equivalent to the sales tax you would have paid if you had purchased the vehicle in Missouri. This use tax ensures that all vehicle owners pay their fair share, regardless of where they purchase their vehicles.

To calculate the use tax, you'll need to determine the sales tax rate in the county where the vehicle will be registered. You can then apply this rate to the purchase price of the vehicle, similar to the calculation for in-state purchases. It's important to note that Missouri allows a credit for any sales or use tax paid to another state, so be sure to keep records of any taxes paid out of state.

Vehicle Trade-Ins

When trading in a vehicle as part of a new purchase, the trade-in value is typically subtracted from the purchase price of the new vehicle before calculating the sales tax. This means that the sales tax you pay is based on the net purchase price, which is the difference between the new vehicle’s price and the trade-in value. This can result in a significant reduction in the sales tax amount.

Understanding Missouri’s Vehicle Sales Tax Laws

Missouri’s vehicle sales tax laws are designed to ensure fairness and consistency across the state while also allowing for local control through the implementation of local option taxes. By understanding these laws and the specific tax rates in your area, you can make more informed decisions about your vehicle purchase and ensure you’re not paying more than necessary.

Legislative Authority and Regulations

The authority to impose sales tax on vehicle purchases in Missouri is derived from state statutes and regulations. These laws outline the specific rates, exemptions, and procedures for collecting and remitting sales tax. The Missouri Department of Revenue is responsible for enforcing these laws and providing guidance to taxpayers and businesses.

It's important for vehicle dealers and purchasers to stay informed about any changes or updates to these laws. The Missouri Department of Revenue's website is a valuable resource for the latest information on sales tax rates, exemptions, and procedures.

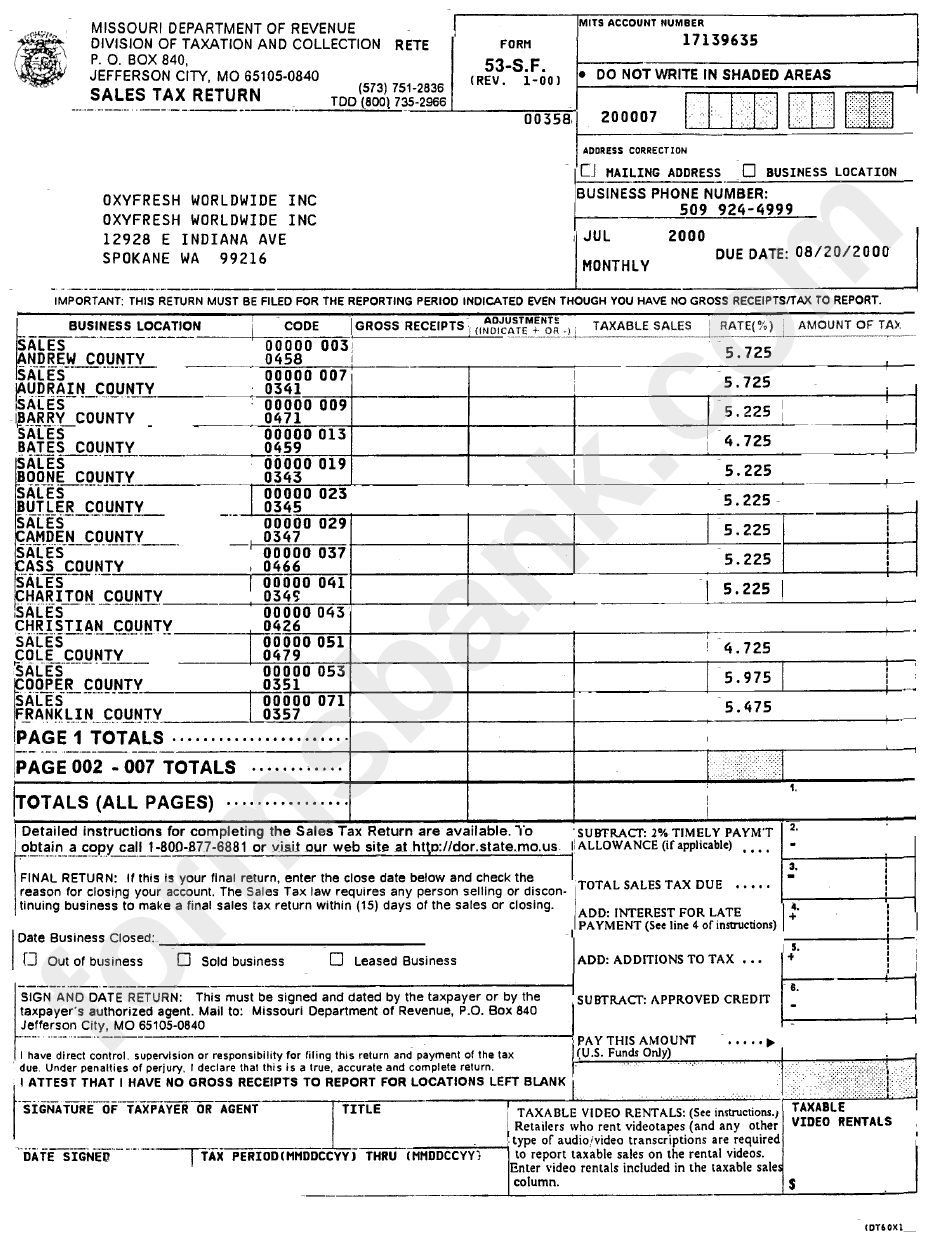

Sales Tax Collection and Remittance

Vehicle dealers in Missouri are typically responsible for collecting sales tax from purchasers at the time of sale. This tax is then remitted to the Missouri Department of Revenue on a regular basis, often monthly or quarterly, depending on the dealer’s sales volume. Failure to collect and remit sales tax can result in penalties and interest, so dealers must be diligent in their compliance.

For individuals purchasing vehicles privately, such as from a friend or online, it's essential to understand the use tax requirements. While the seller may not collect sales tax, the buyer is responsible for paying the equivalent use tax when registering the vehicle in Missouri.

Sales Tax and Vehicle Registration

Vehicle sales tax and registration are closely related in Missouri. When you purchase a vehicle, you’ll typically pay the sales tax at the time of purchase. Then, when you register the vehicle with the Missouri Department of Revenue, you’ll provide proof of payment for the sales tax or use tax. This ensures that the tax is paid before the vehicle can be legally operated on Missouri roads.

Registration Fees and Sales Tax

In addition to sales tax, there are other fees associated with registering a vehicle in Missouri. These fees include a title fee, a registration fee, and potentially other charges depending on the vehicle’s type and use. While these fees are separate from the sales tax, they are still an important part of the overall cost of vehicle ownership in Missouri.

Proof of Sales Tax Payment

When registering a vehicle, you’ll need to provide proof that the sales tax or use tax has been paid. This can be in the form of a sales tax receipt from the dealer or a use tax payment receipt if the vehicle was purchased out of state. It’s important to keep these records safe, as they may be required during the registration process.

If you're unsure about the sales tax or use tax requirements for your vehicle purchase, it's always best to consult with a tax professional or the Missouri Department of Revenue for guidance.

Tips for Minimizing Sales Tax

While you can’t avoid paying sales tax entirely, there are some strategies you can employ to minimize the amount you owe. Here are some tips to consider:

- Research Tax Rates: Before purchasing a vehicle, research the sales tax rates in the county where you plan to buy. This can help you make an informed decision about where to purchase and potentially save on sales tax.

- Consider Trade-Ins: Trading in your old vehicle can reduce the purchase price of your new vehicle, which in turn lowers the sales tax amount. Be sure to get multiple trade-in offers to ensure you're getting the best value.

- Explore Exemptions: If your vehicle qualifies for an exemption, such as for alternative fuel or disability, be sure to take advantage of it. These exemptions can significantly reduce your sales tax liability.

- Negotiate the Price: Negotiating a lower purchase price can also reduce the sales tax amount. While dealers have some flexibility on the selling price, they may be less willing to negotiate on the tax, as it's a set percentage.

- Purchase During Sales Tax Holidays: Missouri occasionally offers sales tax holidays, during which certain purchases, including vehicles, are exempt from sales tax. These holidays are typically short in duration, so plan your purchase accordingly.

Conclusion: Navigating Missouri’s Vehicle Sales Tax

Understanding Missouri’s vehicle sales tax system is crucial for making informed decisions when purchasing a vehicle. By knowing the tax rates, exemptions, and strategies for minimizing tax liability, you can ensure you’re getting the best deal and staying compliant with state laws. Whether you’re a resident or planning to move to Missouri, being familiar with these aspects of vehicle ownership can save you time, money, and potential headaches down the road.

Remember, staying informed and planning ahead are key when it comes to navigating Missouri's vehicle sales tax. By doing your research and understanding the system, you can make the process smoother and more cost-effective.

What is the average vehicle sales tax rate in Missouri?

+The average vehicle sales tax rate in Missouri varies by county, but it typically ranges from 4.225% to over 6%. This includes the state minimum tax rate of 4.225% plus any local option taxes, which can add up to 2% or more in some counties.

Are there any ways to reduce the sales tax I pay on a vehicle purchase in Missouri?

+Yes, there are several strategies to reduce sales tax. These include taking advantage of exemptions for alternative fuel vehicles or vehicles for people with disabilities, negotiating the purchase price, trading in your old vehicle, and timing your purchase to coincide with sales tax holidays.

How often do sales tax rates change in Missouri?

+Sales tax rates can change annually or even more frequently in some counties. It’s important to check the sales tax rates for your specific location before making a vehicle purchase to ensure you’re aware of the most up-to-date rates.

Do I need to pay sales tax if I buy a vehicle privately in Missouri?

+If you purchase a vehicle privately and it was previously registered in Missouri, you typically do not need to pay sales tax again. However, if the vehicle was not previously registered in Missouri or was purchased out of state, you will likely need to pay a use tax equivalent to the sales tax when registering the vehicle.

Are there any resources available to help me understand Missouri’s vehicle sales tax laws?

+Yes, the Missouri Department of Revenue provides a wealth of resources on their website, including information on sales tax rates, exemptions, and procedures. They also offer guidance and forms for vehicle purchases, sales, and registration. Additionally, tax professionals can provide personalized advice based on your specific situation.