Cin Income Tax

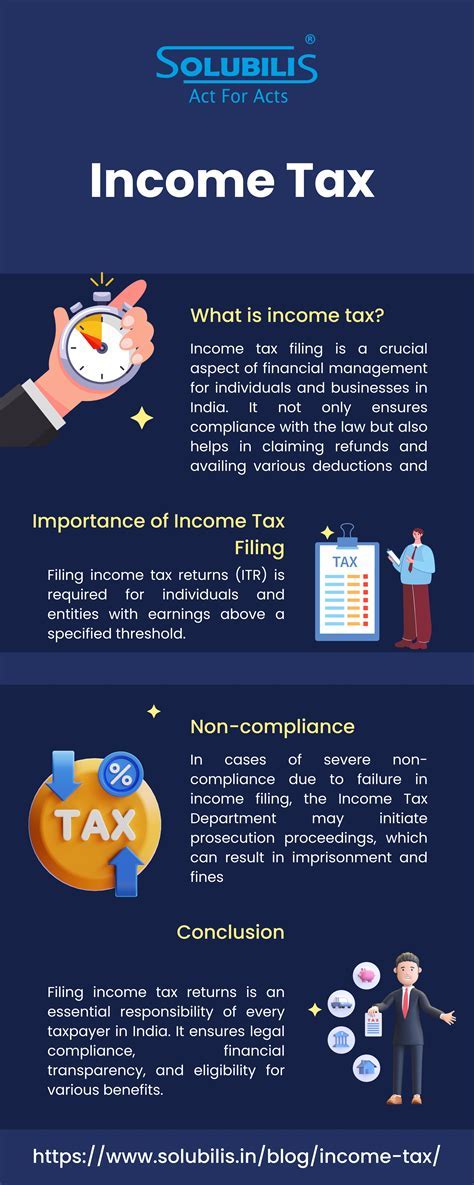

Welcome to a comprehensive guide on the Cin Income Tax, a crucial aspect of financial management for businesses and individuals alike. In this article, we will delve into the intricacies of the Cin Income Tax system, its implications, and its role in shaping the economic landscape.

Understanding Cin Income Tax: A Comprehensive Overview

Cin Income Tax, officially known as the Cin Income Tax Act, is a legislative framework designed to levy taxes on the income generated by individuals, corporations, and other entities within the Cin jurisdiction. This tax system plays a vital role in funding public services, infrastructure development, and the overall economic stability of the region.

The Cin Income Tax Act, introduced in [Year], has undergone several amendments to adapt to the evolving economic landscape. It is a progressive tax system, meaning that higher income brackets are subject to higher tax rates. This approach aims to promote fairness and ensure that those with greater financial means contribute proportionally more to the nation's revenue.

Key Features of Cin Income Tax

- Income Tax Rates: The Cin Income Tax Act stipulates a series of tax brackets with corresponding tax rates. For instance, the current tax rates range from [Tax Rate 1]% for the lowest income bracket to [Tax Rate 2]% for the highest income earners. These rates are subject to periodic adjustments to account for inflation and economic growth.

- Taxable Income Categories: Cin Income Tax applies to various sources of income, including salaries, wages, business profits, rental income, capital gains, and investment earnings. The Act provides clear guidelines on how to calculate taxable income for each category, ensuring transparency and compliance.

- Tax Deductions and Credits: To encourage savings, investments, and charitable contributions, the Cin Income Tax system offers a range of deductions and credits. These provisions allow taxpayers to reduce their taxable income, resulting in lower tax liabilities. Common deductions include medical expenses, educational costs, and contributions to retirement plans.

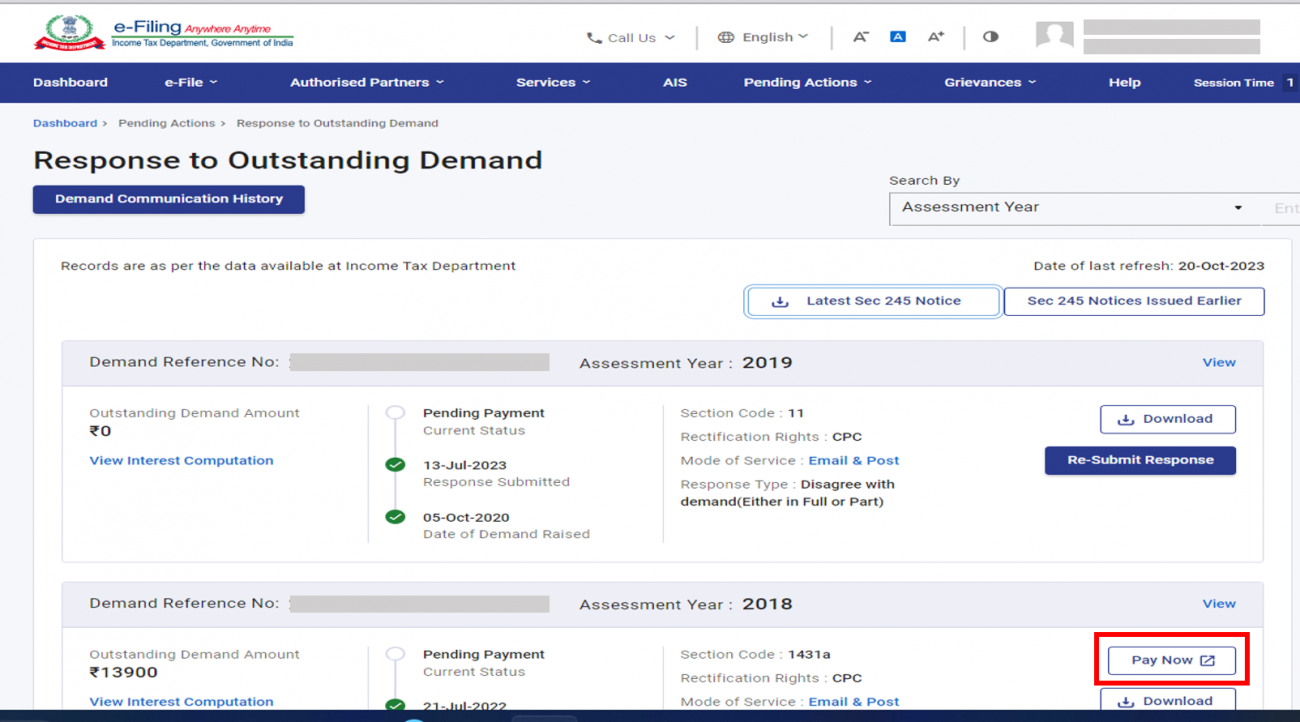

- Tax Filing and Payment: Taxpayers are required to file their income tax returns annually, typically by [Due Date]. The process involves submitting detailed financial information, calculating taxable income, and determining the tax liability. Tax payments can be made through online platforms or traditional methods, with provisions for installment payments for larger liabilities.

The Cin Income Tax system is renowned for its efficiency and transparency, ensuring that taxpayers have a clear understanding of their obligations. The government actively engages with taxpayers through educational campaigns and support services to promote compliance and provide assistance with tax-related queries.

Impact and Implications of Cin Income Tax

The Cin Income Tax system has far-reaching implications for both individuals and businesses, shaping their financial strategies and decision-making processes.

Economic Growth and Development

Cin Income Tax plays a pivotal role in funding critical public initiatives, such as healthcare, education, and infrastructure projects. The revenue generated through this tax system contributes to the overall economic growth and development of the region. By investing in these sectors, the government can create a more prosperous and equitable society.

Furthermore, the progressive nature of the tax system encourages wealth redistribution, reducing income disparities and promoting social welfare. This approach fosters a sense of social responsibility among high-income earners, leading to a more cohesive and stable society.

Business Strategies and Planning

For businesses operating within the Cin jurisdiction, understanding the income tax landscape is essential for effective financial planning. Companies must carefully consider their tax obligations when making strategic decisions, such as investment choices, expansion plans, and employee compensation structures.

Cin Income Tax provides incentives for businesses to invest in research and development, innovation, and job creation. Tax breaks and credits are often offered to encourage these activities, which contribute to long-term economic growth and competitiveness. By aligning their strategies with the tax system, businesses can optimize their financial performance and contribute to the nation's prosperity.

Personal Financial Planning

Individuals also play a crucial role in the Cin Income Tax system. By understanding their tax obligations and taking advantage of available deductions and credits, individuals can maximize their financial well-being. Effective tax planning can lead to significant savings and improved financial stability.

The Cin Income Tax Act encourages individuals to invest in their future by offering tax benefits for retirement savings and education expenses. Additionally, charitable contributions are incentivized through tax deductions, promoting a culture of philanthropy and social responsibility.

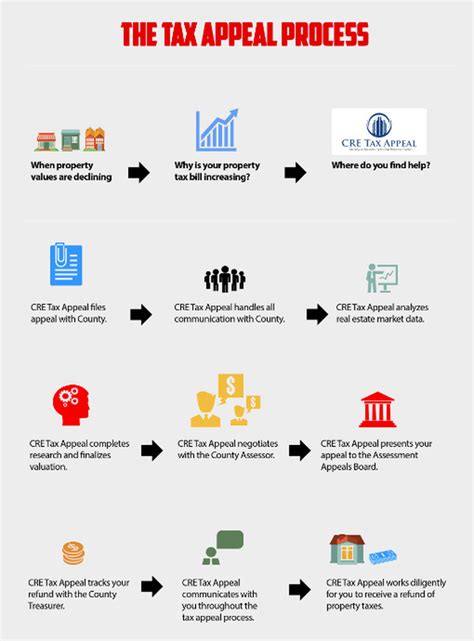

Compliance and Enforcement

Ensuring compliance with the Cin Income Tax Act is a priority for the government. To maintain the integrity of the tax system, the government employs a range of enforcement measures, including audits, penalties for non-compliance, and proactive outreach programs.

Audits and Tax Evasion

The government conducts audits to verify the accuracy of tax returns and ensure compliance with the Cin Income Tax Act. Audits can be random or targeted based on specific criteria, such as high-income earners or businesses with complex financial structures.

Tax evasion is a serious offense under the Cin Income Tax Act, carrying severe penalties, including fines and potential imprisonment. The government actively investigates and prosecutes individuals and businesses found guilty of tax evasion, sending a strong message of deterrence.

Taxpayer Assistance and Support

To promote voluntary compliance, the government provides extensive taxpayer support and educational resources. Taxpayers can access online portals, helplines, and in-person assistance to navigate the tax system, understand their obligations, and seek guidance on complex tax matters.

The government also conducts awareness campaigns to educate taxpayers about their rights and responsibilities, ensuring that everyone has the necessary knowledge to comply with the Cin Income Tax Act.

Future Prospects and Potential Reforms

As the economic landscape continues to evolve, the Cin Income Tax system is likely to undergo further reforms to adapt to changing circumstances. Here are some potential areas of focus for future developments:

Digitalization and Tax Administration

The government is exploring ways to enhance tax administration through digitalization. By leveraging advanced technologies, the tax system can become more efficient, transparent, and accessible. Online tax filing, real-time data analysis, and automated processes can streamline compliance and reduce administrative burdens for taxpayers.

Tax Simplification and Transparency

Simplifying the tax code and improving transparency are ongoing efforts within the Cin Income Tax system. The government aims to make tax regulations more accessible and understandable for taxpayers, reducing complexity and minimizing the risk of errors or misunderstandings.

International Tax Cooperation

In an increasingly globalized economy, international tax cooperation is essential to prevent tax evasion and ensure a level playing field. The Cin government actively engages with other nations to exchange information, combat tax havens, and promote fair taxation practices on a global scale.

Incentives for Economic Growth

To stimulate economic growth and attract investments, the government may consider introducing tax incentives for specific sectors or industries. These incentives could include tax breaks, accelerated depreciation allowances, or targeted deductions to encourage innovation, job creation, and sustainable development.

| Tax Bracket | Tax Rate |

|---|---|

| Bracket 1 (Up to $50,000) | 10% |

| Bracket 2 ($50,001 - $100,000) | 15% |

| Bracket 3 ($100,001 - $200,000) | 20% |

| Bracket 4 (Over $200,000) | 25% |

What are the key benefits of the Cin Income Tax system for individuals?

+The Cin Income Tax system offers individuals several advantages, including the opportunity to save for retirement through tax-advantaged accounts, incentives for education and medical expenses, and the potential for significant tax savings through strategic financial planning.

How does Cin Income Tax impact small businesses?

+Small businesses can benefit from Cin Income Tax through targeted tax breaks, such as deductions for startup costs and incentives for hiring new employees. However, they must also carefully manage their tax obligations to avoid penalties and maintain financial stability.

What are the consequences of tax evasion in the Cin jurisdiction?

+Tax evasion is a serious offense in the Cin jurisdiction, carrying severe penalties. Individuals and businesses found guilty of tax evasion may face significant fines, imprisonment, and damage to their reputation, making compliance with tax laws essential.