Toronto Property Tax

Property taxes are a significant aspect of homeownership, and for residents of Toronto, understanding the intricacies of the property tax system is essential. This article aims to provide a comprehensive guide to Toronto's property tax, offering insights into how it works, how it's calculated, and what it means for homeowners and prospective buyers in the city.

The Basics of Toronto Property Tax

Toronto’s property tax system is a key source of revenue for the city, funding various municipal services and infrastructure projects. The tax is based on the assessed value of a property and is calculated annually by the Municipal Property Assessment Corporation (MPAC). MPAC is an independent agency responsible for assessing all properties in Ontario, ensuring fairness and accuracy in the process.

The property tax is an essential part of the city's financial structure, contributing to the maintenance of roads, public transit, community centers, and other vital services. It also plays a role in funding local schools, emergency services, and cultural initiatives.

Property Assessment: A Crucial Step

Property assessment is a complex process that determines the value of a property for tax purposes. MPAC uses a range of factors to assess a property’s value, including:

- Location: Properties in prime locations, such as downtown Toronto or near popular amenities, tend to have higher assessments.

- Size and Features: The size of a property, including the square footage of the building and the land area, influences its assessment. Additional features like pools, garages, or finished basements can also impact the value.

- Recent Sales: MPAC considers recent sales of similar properties in the area to ensure assessments are in line with the current market value.

- Property Type: Different property types, such as residential, commercial, or industrial, have distinct assessment criteria.

After assessing a property, MPAC provides homeowners with a Notice of Property Assessment, detailing the assessed value and any changes from the previous year. Homeowners can review this notice and, if they disagree with the assessment, have the right to file an appeal with MPAC.

| Property Type | Average Assessment Value (2023) |

|---|---|

| Residential (Single-Family Home) | $1,200,000 |

| Condominium Apartment | $750,000 |

| Commercial (Office Space) | $3,000,000 |

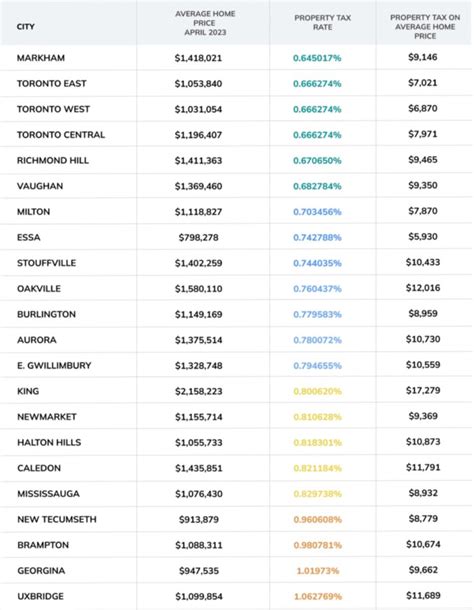

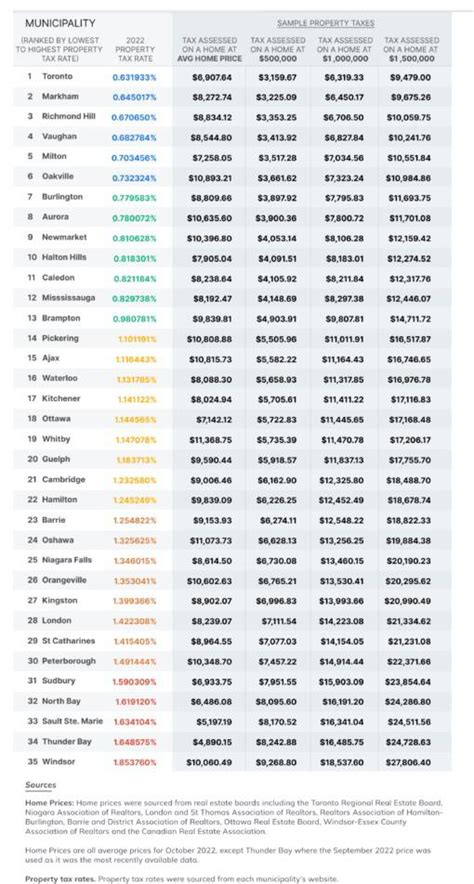

Calculating Toronto Property Tax

The calculation of Toronto property tax involves two main steps: determining the tax rate and applying it to the assessed value of the property. The tax rate is set annually by the City of Toronto and can vary based on the type of property and its location within the city.

Tax Rate Determination

The City of Toronto’s budget and the funding requirements for various municipal services influence the tax rate. The rate is typically expressed as a percentage and is applied uniformly to all properties within a given class (e.g., residential, commercial, or industrial). For the year 2023, the tax rates are as follows:

| Property Type | Tax Rate (%) |

|---|---|

| Residential | 0.838181 |

| Commercial | 2.386717 |

| Industrial | 2.386717 |

These rates are subject to change annually and are set to ensure the city's financial needs are met while maintaining a balanced budget.

Applying the Tax Rate

Once the tax rate is determined, it is applied to the assessed value of the property. For example, a residential property with an assessed value of $1,000,000 would have a property tax calculated as follows:

Property Tax = Assessed Value x Tax Rate

Property Tax = $1,000,000 x 0.838181 = $838.18 (rounded to the nearest cent)

This calculation provides the annual property tax amount due for the property. However, the City of Toronto offers the option to pay property taxes in installments, making it more manageable for homeowners.

Understanding Property Tax Bills

The City of Toronto issues property tax bills twice a year, typically in March and September. These bills detail the property’s assessed value, the applicable tax rate, and the total tax amount due. They also include information on any applicable credits or exemptions, such as the Senior Citizens’ Property Tax Grant or the Rebate for Residential Properties.

Homeowners have the option to pay their property taxes online, by mail, or in person at designated payment centers. Late payments may incur penalties, so it's essential to stay informed about due dates and payment options.

Exemptions and Credits

Toronto offers several exemptions and credits to eligible homeowners, helping to reduce their property tax burden. These include:

- Senior Citizens' Property Tax Grant: Provides a grant to senior homeowners who meet specific criteria, reducing their property taxes.

- Rebate for Residential Properties: Offers a rebate to homeowners based on their property's assessed value, providing relief for those with lower-valued homes.

- First-Time Homebuyer Grant: A one-time grant for new homeowners, helping to offset some of the initial costs of homeownership.

Eligibility criteria and application processes vary for each exemption or credit, and homeowners should consult the City of Toronto's website for detailed information.

The Impact of Property Tax on Homeownership

Property tax is a significant consideration for anyone purchasing a home in Toronto. It adds to the overall cost of homeownership and can influence a buyer’s decision-making process. For investors or those considering a rental property, understanding the property tax implications is crucial for accurate financial planning.

Considerations for Buyers

When purchasing a home, buyers should factor in the property tax as part of their monthly costs. While the initial purchase price and mortgage payments may be the primary focus, property tax should not be overlooked. It’s essential to:

- Obtain a clear understanding of the property's assessed value and the associated tax rate.

- Calculate the annual property tax and determine how it fits into the overall budget.

- Consider the potential for tax increases in future years and how that might impact affordability.

Real estate agents and financial advisors can provide valuable insights and tools to help buyers understand the financial implications of property tax.

Strategies for Managing Property Tax

Homeowners have several strategies to manage their property tax obligations, including:

- Appealing Assessments: If a homeowner believes their property's assessed value is inaccurate, they can file an appeal with MPAC. A successful appeal could lead to a lower tax bill.

- Applying for Exemptions: Homeowners should explore the various exemptions and credits offered by the City of Toronto to see if they qualify for any relief.

- Budgeting and Payment Plans: Creating a budget that accounts for property tax and utilizing the installment payment option can make managing this expense more manageable.

Staying informed about property tax changes, budget proposals, and assessment processes is crucial for effective financial planning.

Conclusion: Navigating Toronto’s Property Tax Landscape

Toronto’s property tax system is a vital component of the city’s finances and homeownership landscape. Understanding how property taxes are assessed, calculated, and applied is essential for both current homeowners and prospective buyers. By staying informed and utilizing available resources, individuals can effectively manage their property tax obligations and make informed decisions about their financial future in the city.

For more information on Toronto's property tax system, visit the official websites of the City of Toronto and the Municipal Property Assessment Corporation (MPAC). These sources provide detailed guides, calculators, and resources to help navigate the complexities of property taxes in Toronto.

What is the average property tax rate in Toronto for residential properties?

+

The average property tax rate for residential properties in Toronto is approximately 0.838181% as of 2023. This rate is applied to the assessed value of the property to calculate the annual property tax.

How often does the City of Toronto review and adjust property tax rates?

+

The City of Toronto reviews and adjusts property tax rates annually. The new tax rates are typically announced as part of the city’s budget process, ensuring that the tax revenue aligns with the city’s financial needs and budget requirements.

Are there any exemptions or credits available to reduce property taxes in Toronto?

+

Yes, Toronto offers several exemptions and credits to eligible homeowners. These include the Senior Citizens’ Property Tax Grant, the Rebate for Residential Properties, and the First-Time Homebuyer Grant. Each of these provides financial relief to homeowners who meet specific criteria.

How can I appeal my property assessment if I believe it is incorrect?

+

If you believe your property assessment is incorrect, you can file an appeal with the Municipal Property Assessment Corporation (MPAC). The appeal process involves submitting documentation to support your claim and attending a hearing if necessary. MPAC will review your case and make a determination, which could result in a change to your assessed value and subsequent property tax.

What payment options are available for paying property taxes in Toronto?

+

The City of Toronto offers several payment options for property taxes, including online payment through the city’s website, payment by mail, and in-person payments at designated payment centers. Homeowners can also choose to pay their property taxes in installments to make the payments more manageable.