New Markets Tax Credit

The New Markets Tax Credit (NMTC) is a powerful economic development tool that has been instrumental in revitalizing communities and fostering growth in underserved and low-income areas across the United States. Since its inception, the NMTC program has played a significant role in driving investments into areas that have historically lacked access to capital, creating jobs, and stimulating economic activity. This comprehensive guide will delve into the intricacies of the NMTC, exploring its history, impact, eligibility criteria, and the process of obtaining this valuable tax credit.

Understanding the New Markets Tax Credit

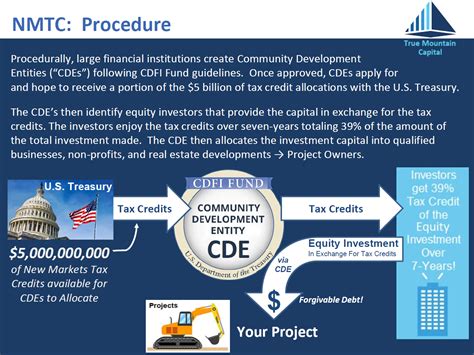

The New Markets Tax Credit program was established by the Community Renewal Tax Relief Act of 2000, with the primary objective of encouraging private investments in distressed communities. It is administered by the Community Development Financial Institutions Fund (CDFI Fund) under the Department of the Treasury. The NMTC offers a unique opportunity for investors to generate tax benefits while making a positive impact on economically disadvantaged areas.

The credit operates through a complex yet effective system, providing investors with a tax credit equal to 39% of their qualified equity investment in a Certified New Markets Capital Company (CNMCC). This credit is claimed over a seven-year period, with 5% of the credit claimed annually for the first three years and the remaining 20% claimed in equal installments over the subsequent four years. This structure incentivizes long-term investments in eligible projects.

Impact and Success Stories

The impact of the NMTC program is evident in the numerous success stories it has facilitated. One notable example is the transformation of a struggling industrial park in a rural area into a thriving business hub. With NMTC funding, the park underwent extensive renovations, attracting new businesses and creating hundreds of jobs. The project not only provided economic opportunities but also improved the local infrastructure and enhanced the quality of life for residents.

Another remarkable success involves the development of affordable housing units in an urban neighborhood, targeting low-income families. The NMTC investment not only provided much-needed housing but also revitalized the surrounding area, reducing crime rates and increasing property values. This project demonstrated the program's ability to address multiple social and economic issues simultaneously.

| Metric | Value |

|---|---|

| Total NMTC Investment | $85.4 billion (as of 2022) |

| Jobs Created/Retained | 1.2 million |

| Businesses Assisted | 120,000 |

| Housing Units Developed | 350,000 |

Eligibility and Criteria

The NMTC program is designed to benefit specific types of communities and projects. To be eligible, a project must be located in a designated Low-Income Community (LIC) or serve a population with at least 50% of its residents living in an LIC. These areas are identified based on factors such as poverty rates, income levels, and unemployment rates.

Additionally, the program focuses on supporting businesses and organizations that align with specific sectors. These include manufacturing, healthcare, education, affordable housing, and various other industries that contribute to the community's economic development. The NMTC also prioritizes projects that demonstrate a strong commitment to job creation and retention.

Investment Process and Requirements

Obtaining NMTC funding involves a comprehensive application process. Investors or project developers must first identify a Certified Community Development Entity (CDE) that will serve as the intermediary for the investment. CDEs are organizations approved by the CDFI Fund to allocate NMTCs to eligible projects.

The application process typically includes a detailed project proposal, financial analysis, and a demonstration of the project's impact on the targeted community. The CDFI Fund conducts a rigorous review, considering factors such as job creation potential, economic benefits, and the project's alignment with NMTC goals. Once approved, the CDE allocates NMTCs to the project, facilitating the investment.

| NMTC Allocation Process | |

|---|---|

| 1. CDE Application | CDEs apply to the CDFI Fund for NMTC allocation. |

| 2. Allocation Award | The CDFI Fund awards NMTCs to successful CDEs. |

| 3. Project Identification | CDEs identify eligible projects in LICs. |

| 4. Investment | Investors partner with CDEs to make qualified equity investments. |

Maximizing NMTC Benefits

To make the most of the NMTC program, investors and project developers should consider several key strategies. First, it is crucial to thoroughly understand the eligibility criteria and ensure that the project aligns with NMTC objectives. This includes demonstrating a clear impact on the targeted community and providing detailed financial projections.

Additionally, collaboration with experienced CDEs can greatly enhance the chances of success. CDEs with a strong track record and expertise in specific sectors can provide valuable insights and guidance throughout the process. They can also assist in identifying potential funding gaps and exploring additional financing options to complement NMTCs.

Risk Management and Due Diligence

Given the complex nature of NMTC investments, thorough due diligence is essential. Investors should carefully assess the financial viability of the project, considering factors such as market demand, competition, and the financial health of the business. It is also crucial to evaluate the track record and reputation of the project developers and other key stakeholders involved.

Risk management strategies should be implemented to mitigate potential challenges. This includes monitoring the project's progress, conducting regular financial assessments, and ensuring compliance with NMTC regulations. Regular communication with the CDE and project developers can help identify and address any issues promptly.

Future Prospects and Evolution

The NMTC program has proven to be a successful tool for community development, and its impact is expected to continue growing. With ongoing support from the federal government and a growing network of CDEs, the program is well-positioned to reach more underserved communities.

Looking ahead, there are opportunities for further innovation and expansion. The program could explore ways to increase flexibility in funding structures, allowing for more customized approaches to meet the diverse needs of communities. Additionally, collaboration with other economic development initiatives and the private sector could enhance the NMTC's effectiveness and reach.

Conclusion

The New Markets Tax Credit program is a testament to the power of innovative financial solutions in driving positive change. By incentivizing investments in underserved communities, the NMTC has become a vital tool for community development, job creation, and economic revitalization. With its proven track record and ongoing support, the program is poised to continue making a significant impact on the lives of millions across the United States.

What are the key benefits of the NMTC program for investors?

+

The NMTC program offers investors a unique opportunity to generate tax benefits while making a positive social impact. It provides a 39% tax credit over seven years, incentivizing long-term investments in underserved communities. Additionally, the program facilitates access to high-quality investment opportunities that may not be readily available in the traditional market.

How can communities benefit from NMTC investments?

+

NMTC investments have a profound impact on communities. They drive economic growth, create jobs, and improve the overall quality of life. By targeting underserved areas, the program helps bridge the gap in access to capital, leading to business expansion, infrastructure development, and increased social mobility.

What are the key challenges in accessing NMTC funding?

+

Accessing NMTC funding can be complex due to the program’s rigorous eligibility criteria and application process. Additionally, the limited allocation of NMTCs and the competitive nature of the program make it challenging to secure funding. Collaborating with experienced CDEs and conducting thorough due diligence can help navigate these challenges.