Sales Tax For Austin Tx

Sales tax in Austin, Texas, is a crucial aspect of the city's financial landscape and impacts various industries and businesses. With a vibrant economy and a thriving cultural scene, understanding the intricacies of sales tax is essential for both consumers and businesses operating within the city limits. This article aims to provide a comprehensive guide to sales tax in Austin, exploring its rates, applicability, and the potential implications for local businesses and the community.

Understanding Sales Tax in Austin

Sales tax in Austin, like many other regions, is a complex interplay of federal, state, and local regulations. It is a tax levied on the sale of goods and services, and it plays a significant role in funding essential public services, infrastructure, and community development projects.

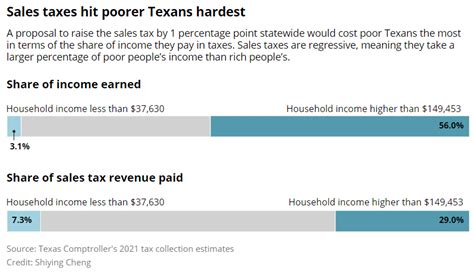

The sales tax system in Austin consists of a combination of state and local taxes. The state of Texas imposes a base sales tax rate, which is then augmented by additional taxes imposed by local governments, including cities, counties, and special purpose districts. This structure ensures that the revenue generated from sales tax is distributed across various levels of government, allowing for efficient resource allocation.

The Austin Sales Tax Breakdown

The sales tax in Austin is composed of several components. At the state level, the base sales tax rate is currently set at 6.25%. This rate applies uniformly across the state of Texas and is mandated by the Texas Comptroller of Public Accounts. However, the story doesn’t end there, as local governments have the authority to levy additional taxes.

| Taxing Authority | Sales Tax Rate |

|---|---|

| City of Austin | 2% |

| Travis County | 0.25% |

| Capital Metro Transit | 0.5% |

| Austin Community College | 0.125% |

When combined, these local taxes add up to a total of 3.075%, bringing the total sales tax rate in Austin to 9.325%. This means that every purchase made within the city limits is subject to this combined rate, which funds a range of vital services and projects.

Applicability of Sales Tax in Austin

Sales tax in Austin applies to a wide range of goods and services, covering most transactions made within the city. However, it’s essential to understand the exceptions and specific rules that govern certain industries and products.

Taxable Goods and Services

The vast majority of tangible personal property sold in Austin is subject to sales tax. This includes items such as:

- Clothing and accessories

- Electronics and appliances

- Furniture and home goods

- Automotive parts and accessories

- Sporting goods

- Books, music, and entertainment media

Additionally, services that are integral to the sale of these goods, such as delivery, installation, and repair, are also typically taxable. However, certain services, like professional services and some forms of digital products, may have different tax treatments, so it's crucial to consult specific guidelines.

Exemptions and Special Cases

While sales tax applies to a broad range of transactions, there are specific exemptions and special cases to consider. Here are some notable instances where sales tax may not apply in Austin:

- Food items for home consumption (grocery staples)

- Prescription medications

- Select medical devices

- Non-preparatory school books

- Certain agricultural inputs and equipment

- Residential rentals (subject to different tax treatments)

It's worth noting that these exemptions can be complex and may vary based on specific criteria, such as the nature of the product, its intended use, and the characteristics of the buyer. For instance, some food items may be taxable if they are considered "prepared food," and certain agricultural purchases may require special tax exemptions or certifications.

Implications for Austin Businesses

Sales tax compliance is a critical aspect of doing business in Austin. Businesses are responsible for collecting, reporting, and remitting sales tax to the appropriate authorities. Failure to comply can result in significant penalties and legal consequences.

Registration and Compliance

Any business operating in Austin that engages in taxable transactions must register with the Texas Comptroller of Public Accounts. This registration process ensures that businesses are equipped with the necessary tools and guidance to comply with sales tax regulations.

Businesses are required to collect sales tax from customers at the point of sale, based on the applicable tax rate. This collected tax must then be reported and remitted to the Comptroller's office on a regular basis, typically quarterly or monthly, depending on the business's tax liability.

Challenges and Strategies

Managing sales tax compliance can be a complex task, especially for businesses with diverse product offerings or those operating across multiple jurisdictions. Here are some key challenges and strategies for Austin businesses:

- Product Classification: Accurate classification of products and services is crucial. Misclassification can lead to incorrect tax rates and potential audits. Businesses should maintain detailed records and seek professional advice when needed.

- Remote Sales: With the rise of e-commerce, businesses selling to out-of-state customers must navigate the complexities of nexus laws and sales tax collection. Staying updated on changing regulations and utilizing tax automation tools can help streamline this process.

- Tax Rate Changes: Sales tax rates can change periodically, so businesses must stay informed to avoid undercharging or overcharging customers. Implementing automated tax rate updates in their systems can help ensure accuracy.

Community Impact and Revenue Allocation

The revenue generated from sales tax in Austin plays a pivotal role in shaping the city’s future. It funds a multitude of essential services and initiatives that contribute to the well-being and growth of the community.

Public Services and Infrastructure

A significant portion of sales tax revenue is allocated towards maintaining and improving public services and infrastructure. This includes funding for:

- Police and fire protection

- Parks and recreational facilities

- Public transportation

- Road and street maintenance

- Solid waste management

- Public libraries

By investing in these areas, Austin ensures the safety, accessibility, and overall quality of life for its residents and visitors.

Economic Development and Community Projects

Sales tax revenue also fuels economic development initiatives and community projects aimed at enhancing Austin’s reputation as a vibrant and innovative city. These funds support:

- Small business grants and loans

- Job training programs

- Cultural events and festivals

- Historic preservation projects

- Affordable housing initiatives

- Environmental sustainability programs

Through these efforts, Austin strives to create a thriving and inclusive community that attracts businesses, talent, and visitors alike.

Future Outlook and Potential Changes

As Austin continues to evolve and grow, the sales tax landscape may undergo changes to meet the city’s evolving needs. Here are some potential developments to watch out for:

Economic Growth and Tax Revisions

Austin’s rapid economic growth may prompt discussions about revising tax rates or exploring alternative revenue sources. While the city benefits from a robust economy, the increased demand for services and infrastructure could lead to considerations for additional funding.

Digital Economy and Sales Tax

The rise of the digital economy and e-commerce presents unique challenges for sales tax collection. Austin, along with other cities, may need to adapt its sales tax policies to address the complexities of online transactions and remote sellers.

Community Engagement and Transparency

Maintaining transparency and engaging the community in discussions about tax policies is essential. As Austin residents and businesses navigate the impacts of sales tax, open dialogue and collaboration can help shape fair and effective tax systems that benefit all stakeholders.

What is the current sales tax rate in Austin, TX?

+As of [most recent data available], the total sales tax rate in Austin, TX, is 9.325%, including the state base rate of 6.25% and additional local taxes.

Are there any sales tax holidays in Austin?

+Texas occasionally offers sales tax holidays for specific items, such as back-to-school supplies or energy-efficient appliances. These holidays provide tax-free shopping opportunities for consumers. However, the dates and eligible items can vary, so it’s best to check the Texas Comptroller’s website for the latest information.

How often do sales tax rates change in Austin?

+Sales tax rates can change periodically, typically due to legislative actions or local government decisions. It’s advisable to stay updated with the Texas Comptroller’s office and local government websites for any rate changes.

Can businesses apply for sales tax exemptions in Austin?

+Certain businesses or organizations may be eligible for sales tax exemptions or special treatments. This often applies to non-profit organizations, educational institutions, or specific industries. To determine eligibility, businesses should consult with the Texas Comptroller’s office or seek professional advice.

What are the consequences for non-compliance with sales tax in Austin?

+Non-compliance with sales tax regulations can result in penalties, interest charges, and potential legal actions. Businesses should prioritize compliance to avoid these consequences and maintain a positive relationship with the taxing authorities.