Michigan Refund Tax Status

The Michigan Department of Treasury handles state tax refunds, and its website offers a convenient tool to check the status of a tax refund. This service is designed to provide taxpayers with real-time information on the processing of their refunds. However, understanding the various factors that influence refund timing and navigating potential delays or issues can be crucial for taxpayers.

Understanding Michigan Tax Refund Status

When you file your Michigan income tax return, the state has a set timeline for processing refunds. Typically, the Michigan Department of Treasury aims to process refunds within 45 days of receiving the return. This timeframe is an estimate and can vary based on several factors, including the complexity of the return and the volume of returns being processed.

The tax refund status is an indicator of where your refund stands in this process. It can provide insights into whether your refund is being processed, has been approved, or if there are any issues that need to be addressed. Here's a breakdown of some common status updates you might encounter:

- Return Received: This status indicates that the Department has successfully received your tax return. It's a good sign, but it doesn't mean your refund is imminent. The processing stage is yet to begin.

- Processing: Your return is now in the hands of the processing team. This stage can take some time, especially if your return is complex or has errors that need correction.

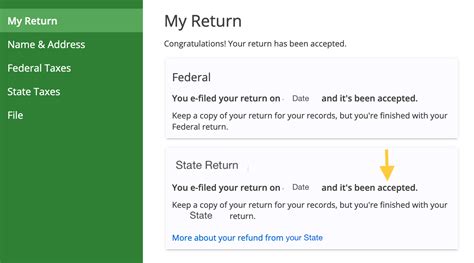

- Approved: Congratulations! Your refund has been approved, and the Department is preparing to send it out. This status is a positive indicator, and you can expect your refund soon.

- Sent: The refund has been dispatched, and it's on its way to you. Depending on the method of payment, this could mean a direct deposit has been initiated or a check has been mailed.

- Pending Review: This status might indicate that there's an issue with your return that requires further examination. It could be an error, missing information, or a potential fraud flag. In such cases, the Department might contact you for more details.

It's important to note that these statuses are general guidelines, and individual experiences may vary. The actual processing time can be influenced by a multitude of factors, including the time of year, the method of filing (online vs. paper), and any issues with the return.

Factors Affecting Michigan Tax Refund Status

Several factors can impact the Michigan tax refund status and the overall timeline for receiving your refund. Being aware of these factors can help you manage your expectations and take appropriate action if needed.

- Time of Filing: The time of year when you file your return can significantly impact processing times. The Michigan Department of Treasury experiences a surge in returns during the traditional tax season (late January to mid-April). During this period, resources are stretched thin, and processing times can be longer.

- Method of Filing: Online filing, also known as e-filing, is generally faster and more efficient. The Department can process electronic returns more quickly than paper returns, which require manual data entry.

- Errors or Incomplete Information: Returns with errors or missing information can cause delays. The Department might need to reach out to you for clarification, which can extend the processing time.

- Suspicious Activity or Potential Fraud: If the Department detects any suspicious activity or potential fraud, your refund might be held for further review. This is a security measure to protect taxpayers and ensure the integrity of the system.

- Complex Returns: Returns with complex situations, such as business income, multiple W-2s, or unique deductions, may take longer to process. These returns often require more manual review.

By understanding these factors, taxpayers can anticipate potential delays and take proactive steps to ensure a smoother refund process. For instance, filing early in the tax season, opting for e-filing, and double-checking returns for accuracy can all contribute to a faster refund.

Tracking Your Michigan Tax Refund

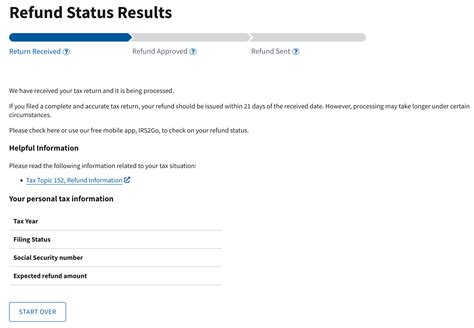

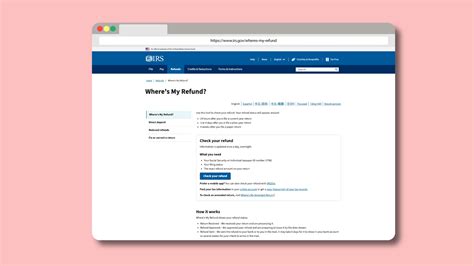

The Michigan Department of Treasury offers a convenient online tool for tracking tax refunds. This tool provides real-time updates on the status of your refund, helping you stay informed throughout the process. To use this tool, you'll need some basic information from your tax return, such as your Social Security Number, filing status, and the exact amount of your expected refund.

The refund tracking tool is user-friendly and can be accessed through the Department's website. Simply navigate to the refund status page, enter the required information, and click "Check Status." The tool will then provide you with an update on your refund's progress. It's a quick and convenient way to stay informed without having to wait for a refund check to arrive in the mail.

| Tracking Tool Benefits | Real-World Example |

|---|---|

| Real-time updates | You filed your return and are eagerly awaiting your refund. By using the tracking tool, you can see that your return is still in the "Processing" stage, giving you a realistic idea of when to expect your refund. |

| Error notifications | Imagine discovering a mistake on your return after filing. The tracking tool might notify you of this error, allowing you to take prompt action to correct it and avoid further delays. |

| Peace of mind | Knowing that you can easily check the status of your refund at any time can provide peace of mind, especially for those who are anxious about their tax situation. |

It's worth noting that while the tracking tool is a valuable resource, it's not always an exact science. The information provided is based on the latest data available, and there might be occasional delays or discrepancies. However, it remains a reliable and convenient way to stay informed about your refund status.

Addressing Michigan Tax Refund Delays

Despite best efforts, tax refund delays can sometimes occur. These delays can be frustrating, but understanding the potential causes and taking appropriate action can help mitigate the impact. Here's a guide on how to address Michigan tax refund delays:

Common Causes of Refund Delays

Several factors can contribute to Michigan tax refund delays. Identifying the cause of the delay is the first step towards resolving the issue. Common causes include:

- Processing Backlog: The Michigan Department of Treasury, like most tax agencies, experiences peak periods where the volume of returns surpasses processing capacity. This can lead to delays, especially for returns filed towards the end of the tax season.

- Errors or Incomplete Returns: Returns with errors or missing information often require manual review, which can significantly slow down the process. Common errors include incorrect Social Security Numbers, math mistakes, or missing signatures.

- Suspicious Activity or Fraud Flags: Tax fraud is a serious issue, and the Department takes steps to prevent it. If your return triggers any fraud detection systems, it might be held for manual review, causing delays.

- Identity Verification Issues: In some cases, the Department might need to verify your identity, especially if there's a discrepancy between the information on your return and their records. This process can take time and delay your refund.

- Complex Returns: Returns with complex financial situations, such as business income, substantial capital gains, or unique deductions, often require additional scrutiny, which can lead to delays.

Steps to Take if Your Refund is Delayed

If you've checked your Michigan tax refund status and it's been longer than the estimated 45-day processing time, there are steps you can take to address the delay:

- Check the Tracking Tool Again: It's possible that your refund status has updated, and you simply need to refresh the information. The tracking tool is designed to provide real-time updates, so it's worth checking again.

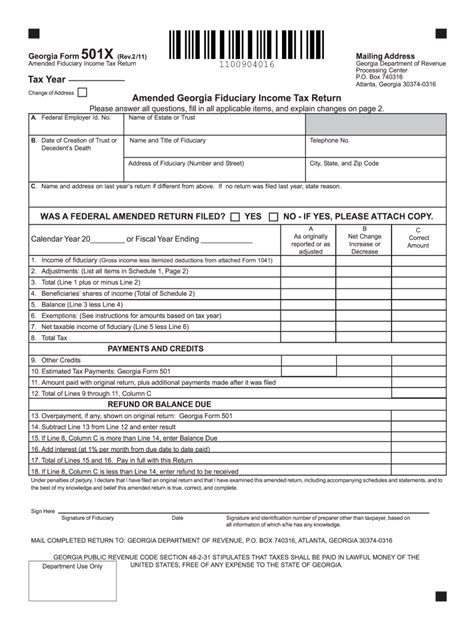

- Review Your Return: Take a close look at your tax return to ensure there are no errors or omissions. Double-check your calculations, the accuracy of your personal information, and any deductions or credits claimed. If you find an error, amend your return as soon as possible.

- Contact the Michigan Department of Treasury: If you've confirmed that your return is error-free, it's time to reach out to the Department. Their customer service team can provide specific information about your refund and guide you through the next steps.

- Provide Additional Documentation (if requested): In some cases, the Department might request additional documentation to support your return. This could include pay stubs, receipts, or other proof of income or deductions. Ensure you provide these promptly to avoid further delays.

- Be Patient and Persistent: Tax refund processes can be slow, especially during peak periods. While it's important to follow up on your refund, avoid inundating the Department with frequent calls or emails. Allow some time for them to process your request, and then follow up if necessary.

Remember, while tax refund delays can be frustrating, they are often temporary and resolvable. By staying informed, taking prompt action, and working collaboratively with the Michigan Department of Treasury, you can ensure that your refund is processed as efficiently as possible.

Michigan Tax Refund Payment Methods

The Michigan Department of Treasury offers several tax refund payment methods to accommodate different preferences and needs. Understanding these options can help taxpayers choose the most convenient and secure method for receiving their refund.

Direct Deposit

Direct deposit is the most common and fastest way to receive a Michigan tax refund. With this method, the Department electronically transfers the refund directly into the taxpayer's bank account. This method is not only convenient but also secure, as it eliminates the risk of a lost or stolen check.

To receive your refund via direct deposit, you'll need to provide your bank's routing number and your account number when filing your tax return. The Department will then initiate the transfer, typically within a few days of approving the refund. It's a quick and efficient way to ensure you have access to your refund as soon as possible.

Check by Mail

For those who prefer a more traditional method, the Michigan Department of Treasury also offers the option to receive a refund check by mail. This method might be more suitable for taxpayers who don't have access to a bank account or prefer a physical check.

When choosing this option, ensure that your mailing address is up-to-date with the Department. The refund check will be sent to the address on file, and it's important to notify the Department of any changes to avoid delays or misdirected mail. While not as fast as direct deposit, receiving a check by mail is a reliable and secure method for obtaining your refund.

Michigan Refund Tax Card

The Michigan Department of Treasury introduced the Michigan Refund Tax Card as a convenient and flexible way for taxpayers to receive their refunds. This prepaid debit card is loaded with the refund amount and can be used anywhere major credit cards are accepted. It's a particularly useful option for those without a bank account or those who prefer the convenience of a card over a check.

The Michigan Refund Tax Card offers several benefits, including immediate access to funds, the ability to make purchases online or in-store, and the convenience of ATM withdrawals. Additionally, the card comes with fraud protection and zero liability for unauthorized transactions, ensuring taxpayers' funds are secure.

| Payment Method | Advantages | Considerations |

|---|---|---|

| Direct Deposit | Fast, secure, and convenient. Ideal for those with bank accounts. | Requires accurate banking information. Some banks may have daily deposit limits. |

| Check by Mail | Traditional and reliable method. Suitable for those without bank accounts. | Slower than direct deposit. Requires a physical check to be cashed or deposited. |

| Michigan Refund Tax Card | Flexible, secure, and immediate access to funds. Ideal for those without bank accounts or who prefer card convenience. | May have associated fees for certain transactions. Requires activation and PIN setup. |

Each of these payment methods has its advantages and considerations, and taxpayers can choose the one that best suits their needs and preferences. Regardless of the chosen method, the Michigan Department of Treasury aims to ensure a smooth and efficient refund process for all taxpayers.

Future Outlook for Michigan Tax Refunds

As technology continues to advance and tax systems evolve, the future of Michigan tax refunds looks promising. The Michigan Department of Treasury is committed to implementing innovative solutions to enhance the refund process, making it faster, more secure, and more convenient for taxpayers.

Technological Advancements

The Department is exploring various technological advancements to streamline the tax refund process. One such advancement is the use of artificial intelligence (AI) and machine learning algorithms to automate certain aspects of refund processing. By leveraging these technologies, the Department can reduce human error, increase processing speed, and improve overall efficiency.

Additionally, the Department is investing in secure online platforms and mobile applications to enhance the user experience. These platforms will enable taxpayers to file their returns, track their refund status, and receive notifications in real-time, all from the convenience of their smartphones or computers.

Enhanced Security Measures

With the rise of cyber threats and identity theft, the Michigan Department of Treasury is prioritizing the implementation of robust security measures to protect taxpayer data and prevent fraud. This includes investing in advanced encryption technologies, multi-factor authentication, and continuous monitoring of systems for any suspicious activities.

Furthermore, the Department is working closely with financial institutions and payment processors to ensure that refund payments are secure and that taxpayers' financial information remains protected throughout the process.

Improved Taxpayer Experience

The Department recognizes the importance of a positive taxpayer experience and is dedicated to making the tax refund process as seamless as possible. This includes simplifying the filing process, providing clear and concise communication, and offering 24/7 customer support through various channels, such as live chat, email, and social media.

Additionally, the Department is committed to educating taxpayers about the refund process, providing resources and tools to help them understand their rights and responsibilities, and offering guidance on how to avoid common pitfalls and delays.

As the Michigan tax system continues to evolve, taxpayers can expect a more efficient, secure, and user-friendly refund process. With a combination of technological advancements, enhanced security measures, and a focus on improving the taxpayer experience, the Department is committed to ensuring that taxpayers receive their refunds promptly and without hassle.

What is the average processing time for a Michigan tax refund?

+The average processing time for a Michigan tax refund is approximately 45 days from the date the return is received. However, this timeline can vary based on factors like the complexity of the return and the time of year it was filed.

How can I check the status of my Michigan tax refund online?

+To check the status of your Michigan tax refund online, you can use the Michigan Department of Treasury’s refund status tool. You’ll need your Social Security Number, filing status, and the exact amount of your expected refund to access this tool.

What should I do if my Michigan tax refund is delayed?

+If your Michigan tax refund is delayed, you should first check the status of your refund using the online tool. If the status indicates an issue, review your return for errors and contact the Michigan Department of Treasury for further assistance. Provide any additional documentation requested promptly.

Can I choose the method of payment for my Michigan tax refund?

+Yes, the Michigan Department of Treasury offers several payment methods for tax refunds, including direct deposit, check by mail, and the Michigan Refund Tax Card. You can choose the method that best suits your preferences and needs when filing your tax return.